Industry

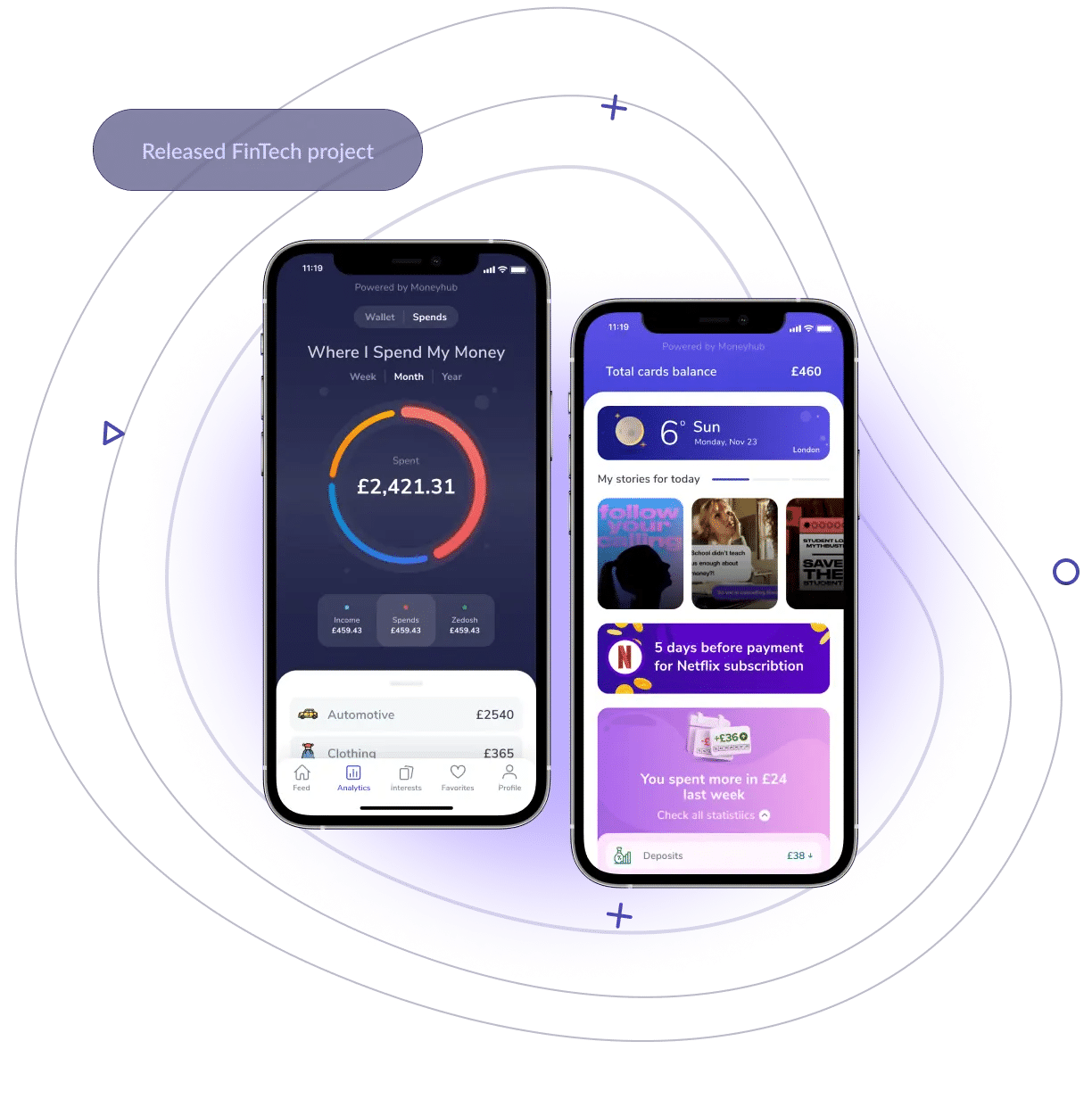

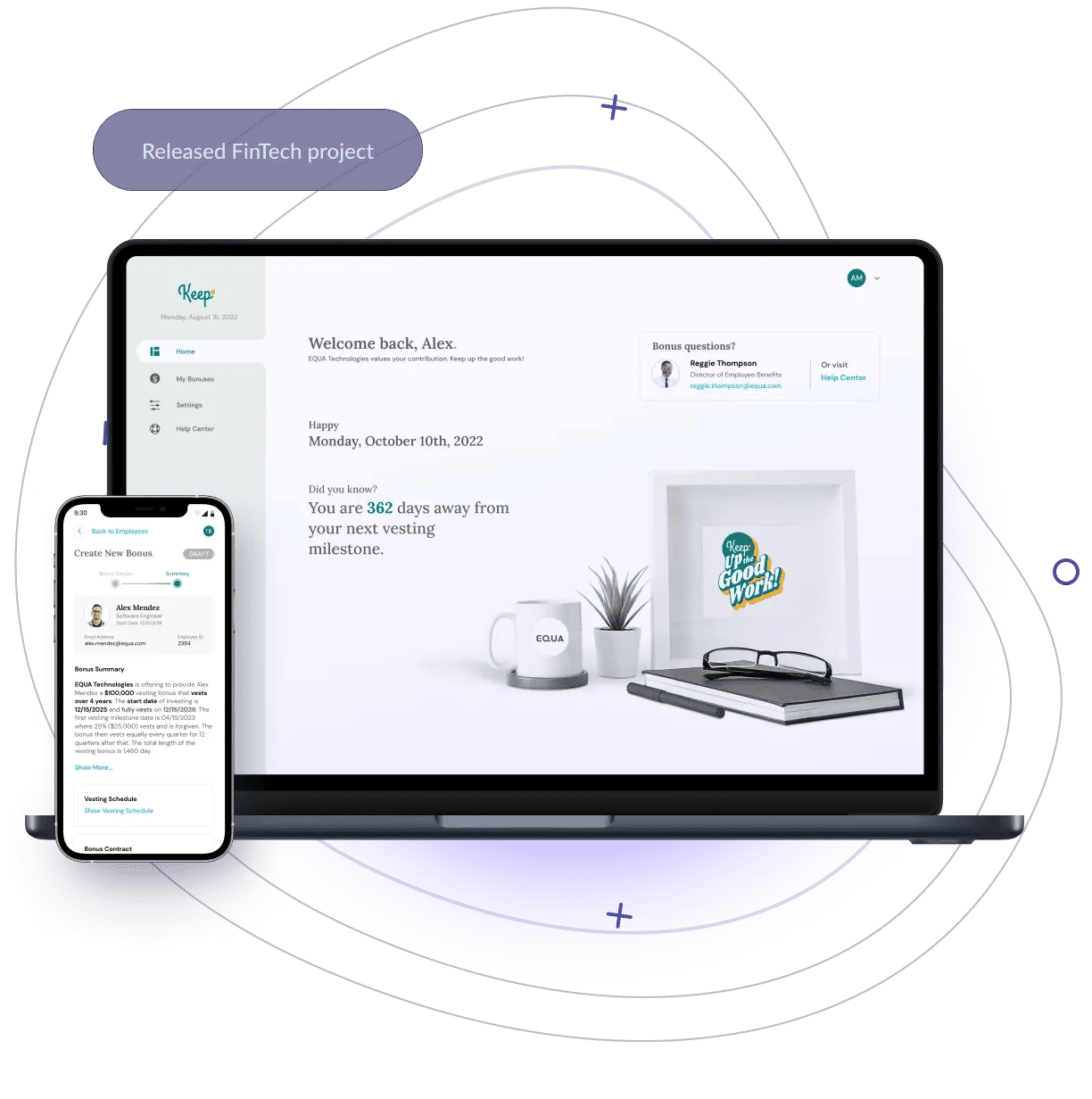

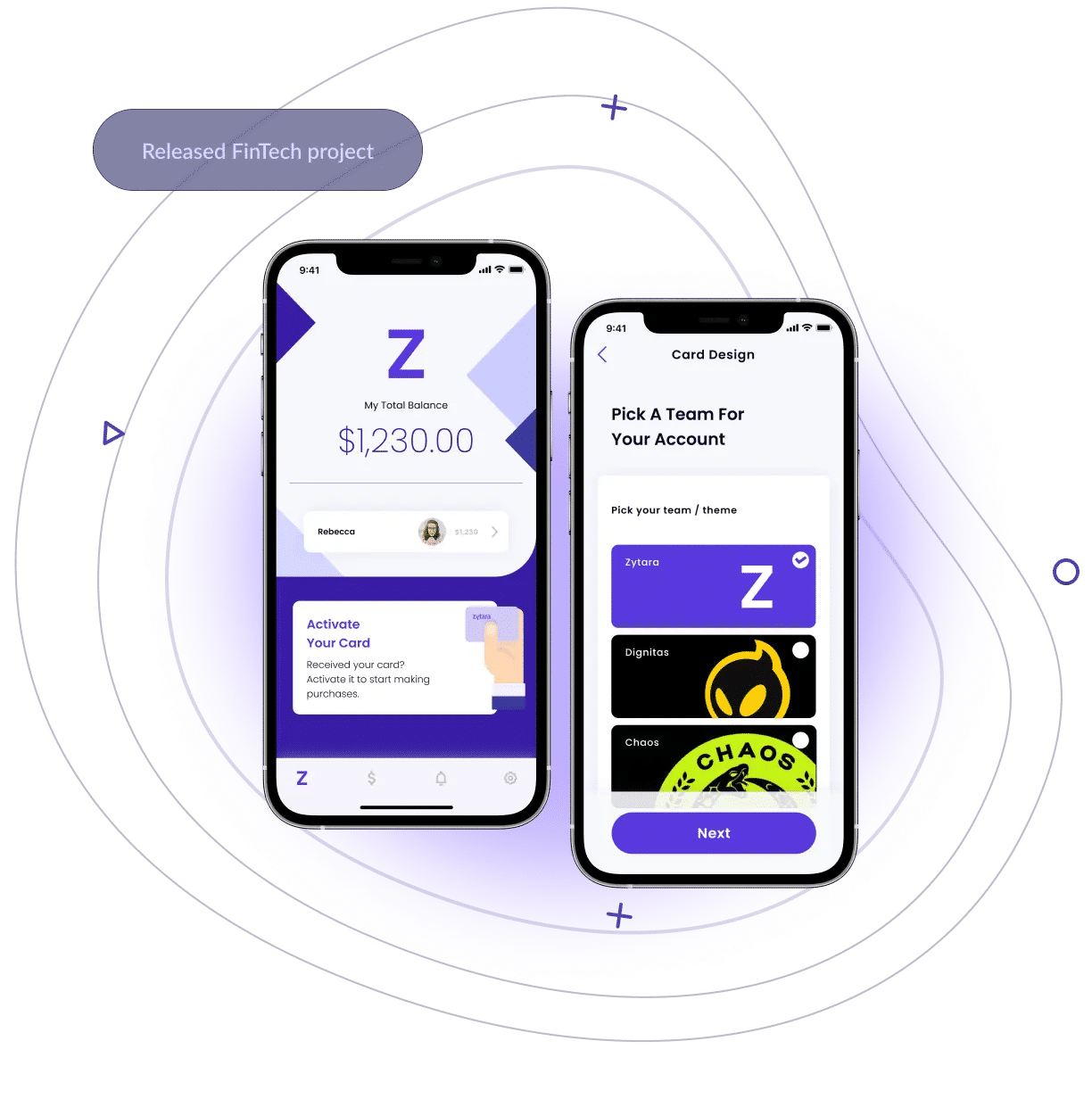

Fintech Software Development Services

Strengthened by an AWS partnership and its certified practices, Geniusee’s FinTech software development expertise is a powerful tech partner who’s here to create the best custom FinTech software for you! We also partner with some of the most proficient FinTech providers in the world: Galileo (banking as a service), Plaid (open banking), Finicity (open banking), and others to empower your services with trustworthy expertise.

Financial data management

Financial data management Fraud detection

Fraud detection Regulatory compliance

Regulatory compliance Data-driven management decisions

Data-driven management decisions Blockchain

Blockchain Financial platforms

Financial platforms Cloud computing financial services

Cloud computing financial services Predictive analytics

Predictive analytics