Business context

Zytara is a new bright star in the FinTech sky. The company’s creators came up with the revolutionary concept of a neobank for Generation Z and gamers. Geniusee has been working with Zytara since 2018, developing its mobile banking app. The Geniusee experts strengthened Zytara's team with mobile app development.

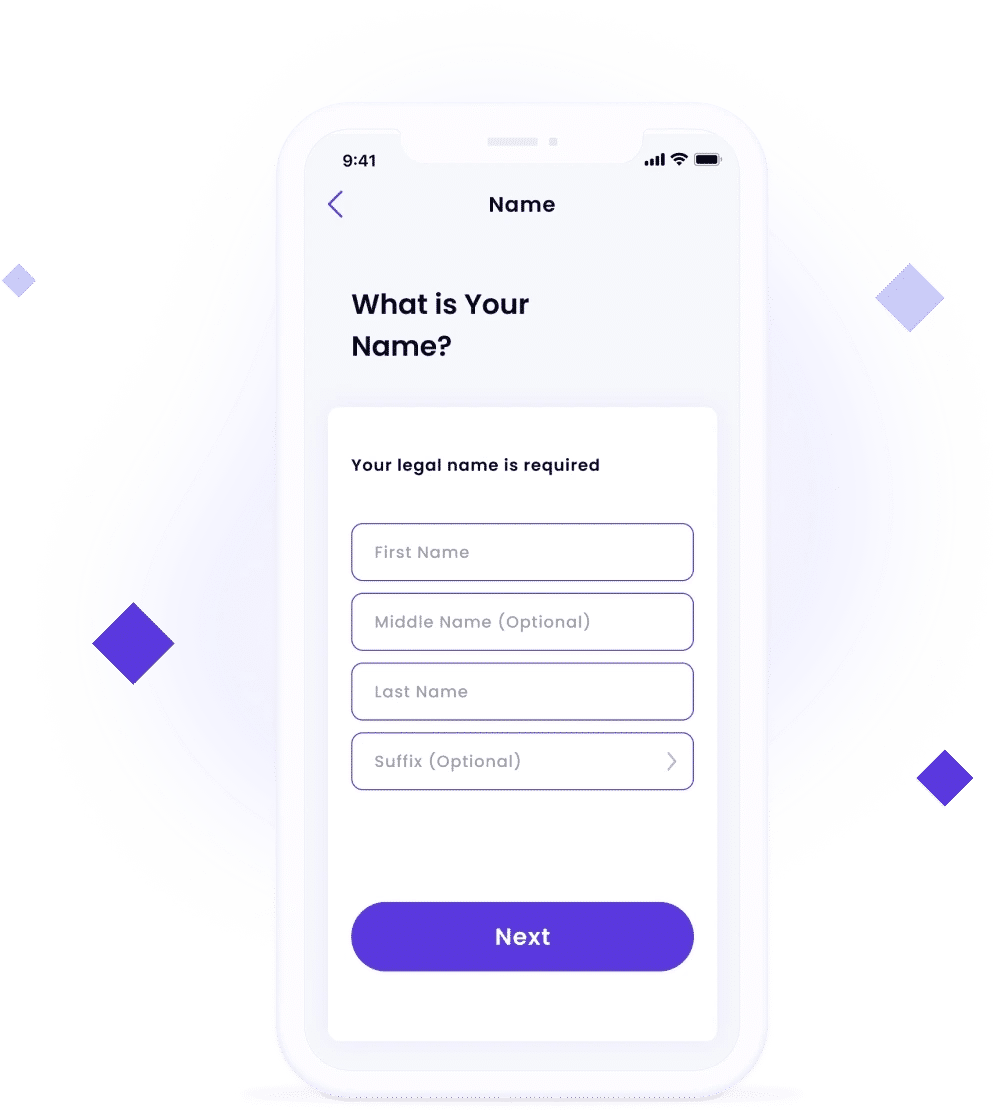

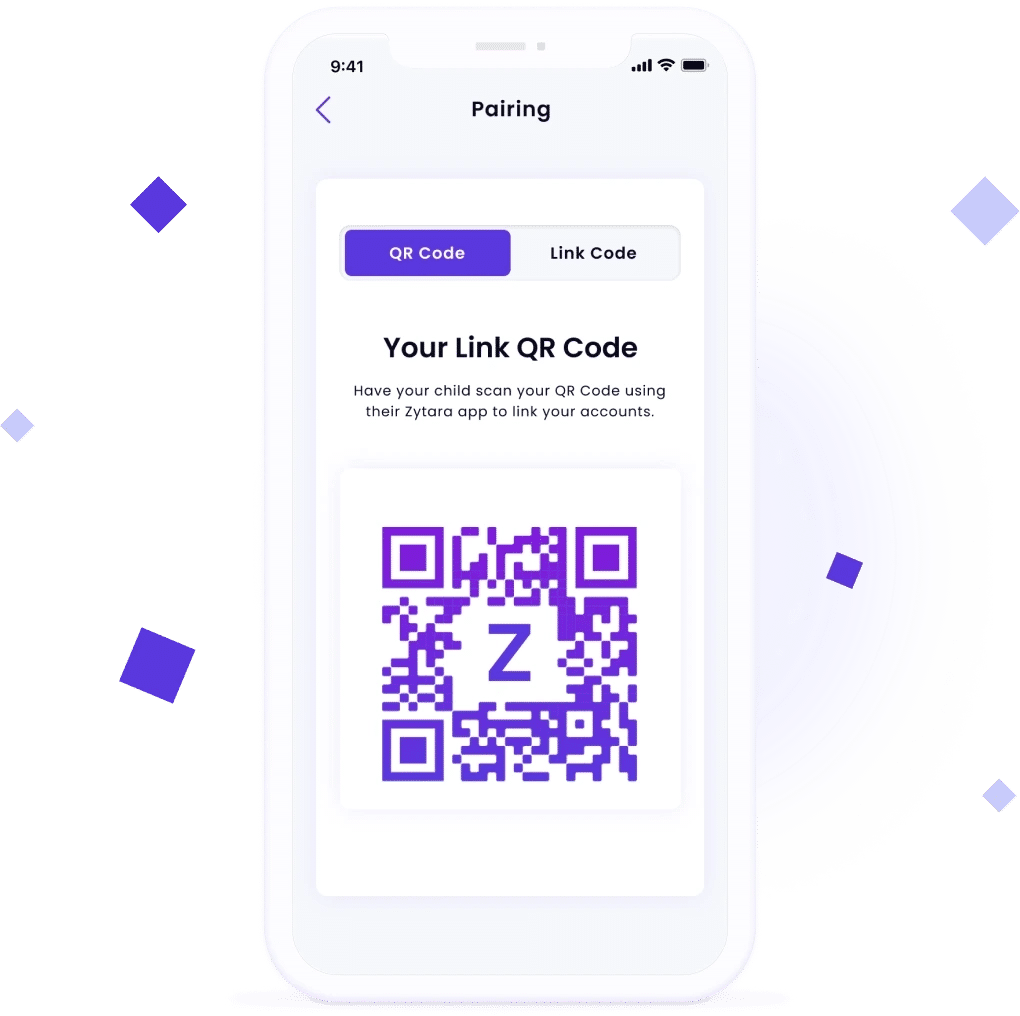

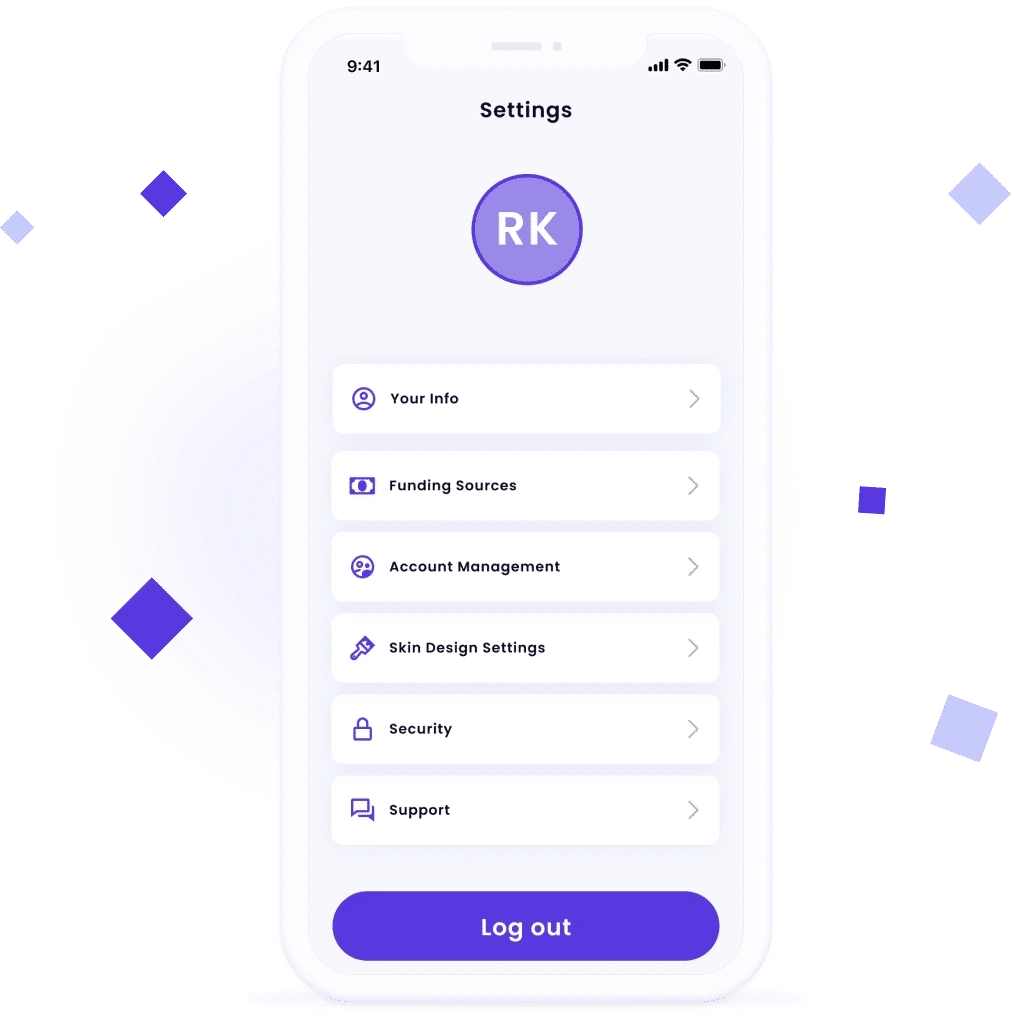

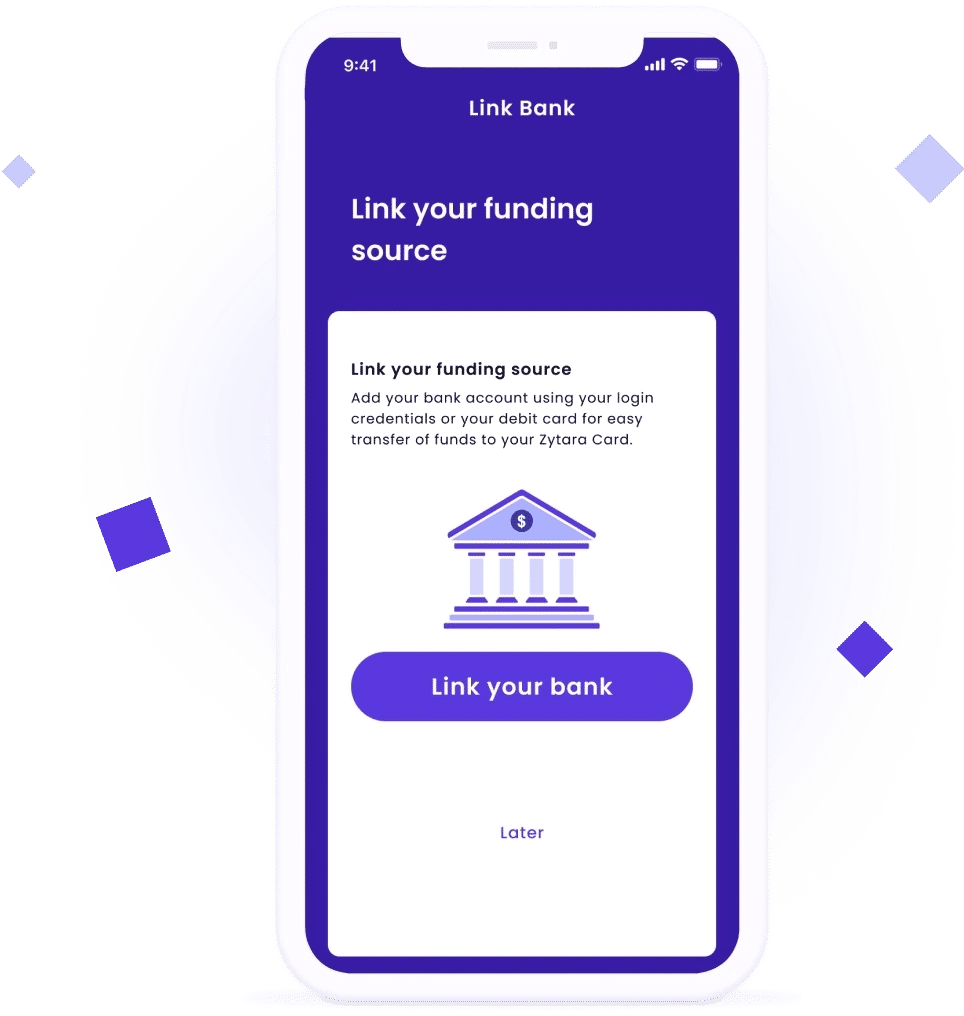

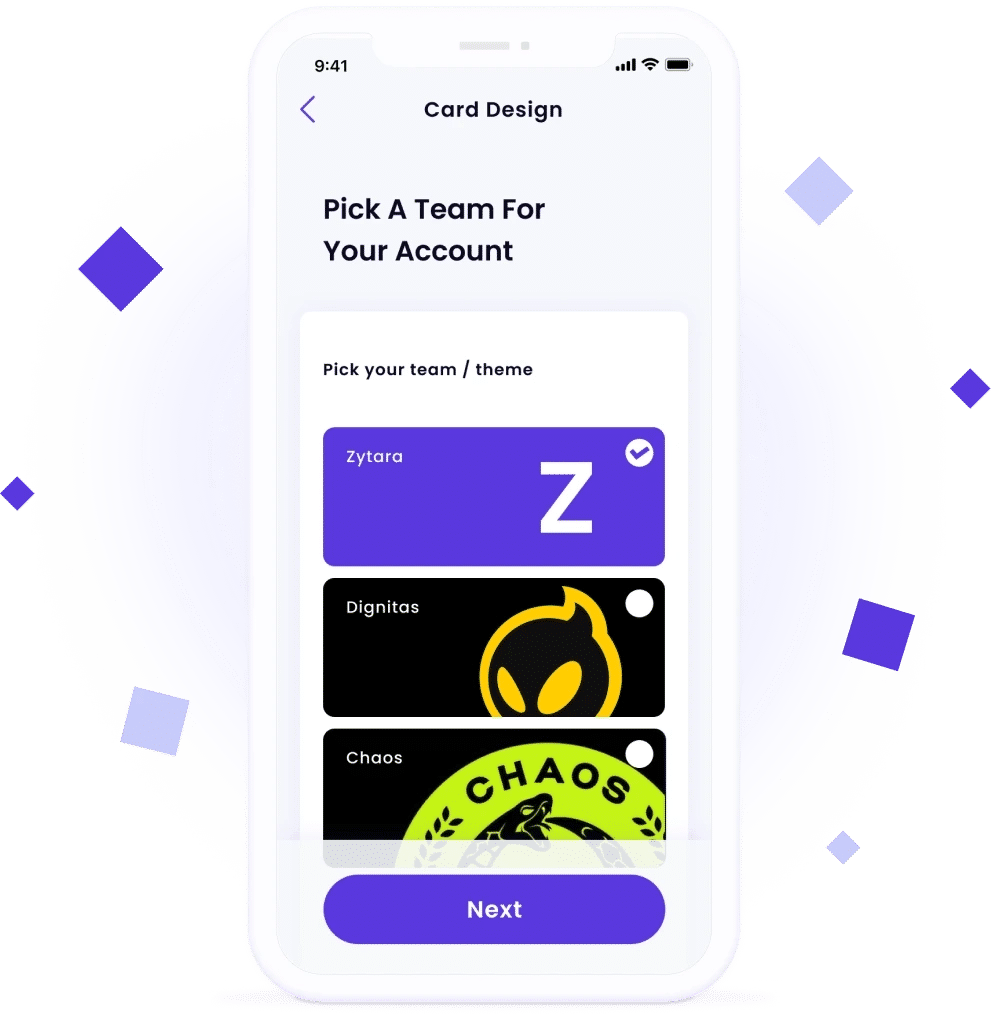

The challenge introduced to us was to create a financial application that allows users to not only send or receive money and check their balance, but also to personalize their card skins, such as with their favorite e-sports team logos. The concept implied financial education for Generation Z using gamification tools and teaching accountability to young people. It also needed to help parents manage spending limits, track transaction histories, send money to their kids, check their balances, bind savings accounts, and impose restrictions in one digital banking app.

Key challenges:

- Assure compliance with regulatory requirements regarding sharing the private information of minors and other restrictions

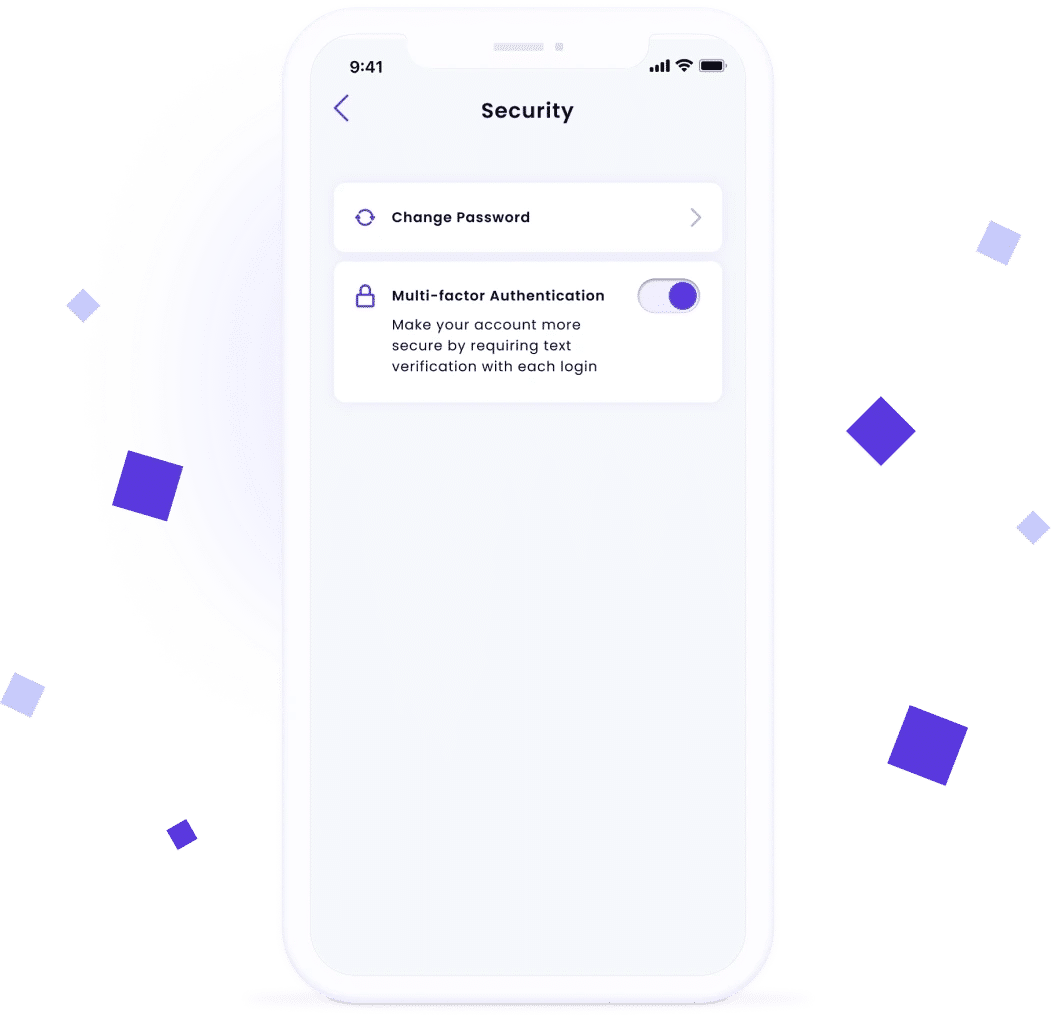

- Ensure security of online banking according to third-party integrations with banks based on penetration tests

- Organize smooth workflows and synchronization among teams from different countries and time zones

- Align cooperation with a designer from the client side and implement changes quickly