What if managing your money was as engaging as playing a game? Gamification in fintech is making this possible by using game-like features to improve how people save, spend, and invest. With the gamification market valued at $9.5 billion in 2022 and expected to nearly double by 2028, it’s clear that this approach is gaining attention.

Gamification works because it encourages users to take action through rewards, challenges, and goals. It can make tasks like saving for a big purchase or learning about investments more interactive. Instead of traditional methods, fintech apps are introducing features like progress trackers, badges, and even friendly competition to keep users motivated.

This approach also helps people improve their financial habits. For example, goal-setting tools with progress updates can make it easier to save. Educational features presented as challenges can help users understand complex financial concepts step by step.

In this article, we will look at how gamification shapes fintech, the strategies companies are using, and what this trend might mean for the future.

Gamification market and types of players

Trends in the development of the modern world require using cross-disciplinary and innovative approaches in business to achieve success. One such method can be leveraging gamification—the use of game methods in non-game processes. In education, gamification has shown significant potential to enhance the learning experience. By incorporating game elements such as rewards, achievements, and interactive challenges, educators can create a more engaging and motivating environment for students.

Gamification makes learning enjoyable and fosters a sense of competition and collaboration among students, leading to improved knowledge retention and academic performance. Furthermore, gamification can be customized to suit different subjects and learning styles, making it a versatile approach that caters to diverse educational needs.

Gamification offers a range of benefits in business administration. Companies can increase employee engagement and productivity by implementing gamified systems in educational content. Through the use of leaderboards, badges, and real-time feedback, employees are incentivized to complete tasks, meet goals, and strive for excellence.

Moreover, gamification can promote a culture of continuous improvement by encouraging employees to acquire new skills and knowledge. This not only benefits individual employees but also contributes to the overall growth and competitiveness of the organization. Businesses can create a more dynamic and stimulating work environment by leveraging gamification techniques.

HR departments leverage gamification techniques to enhance employee engagement, motivation, and performance. HR professionals can create a more interactive and enjoyable user engagement by introducing gamified elements such as challenges, competitions, and reward systems. Gamification in HR can be applied to various areas, including onboarding, training, performance management, and employee recognition. Through gamified training modules, employees can acquire new skills in a fun and immersive manner. Gamified performance management systems provide real-time feedback, set clear goals and targets, and recognize achievements. This not only boosts employee morale but also fosters a culture of continuous learning and growth within the organization.

On the topic

Everything you need to know in one guide by top Geniusee experts

Gamification in financial services has emerged as a powerful tool to engage users and enhance their financial experiences. By integrating game elements into financial applications and platforms, Fintech companies can make traditionally complex and mundane financial tasks more enjoyable and accessible.

Through features such as personalized goal tracking, virtual rewards, and interactive financial education, gamification encourages users to actively manage their finances, make informed decisions, and achieve their financial goals. Additionally, gamification has the potential to increase financial literacy and improve financial well-being by making financial concepts and products easier to understand and navigate.

By leveraging gamification principles, Fintech companies can revolutionize how people interact with and manage their money, leading to greater financial empowerment and improved financial outcomes.

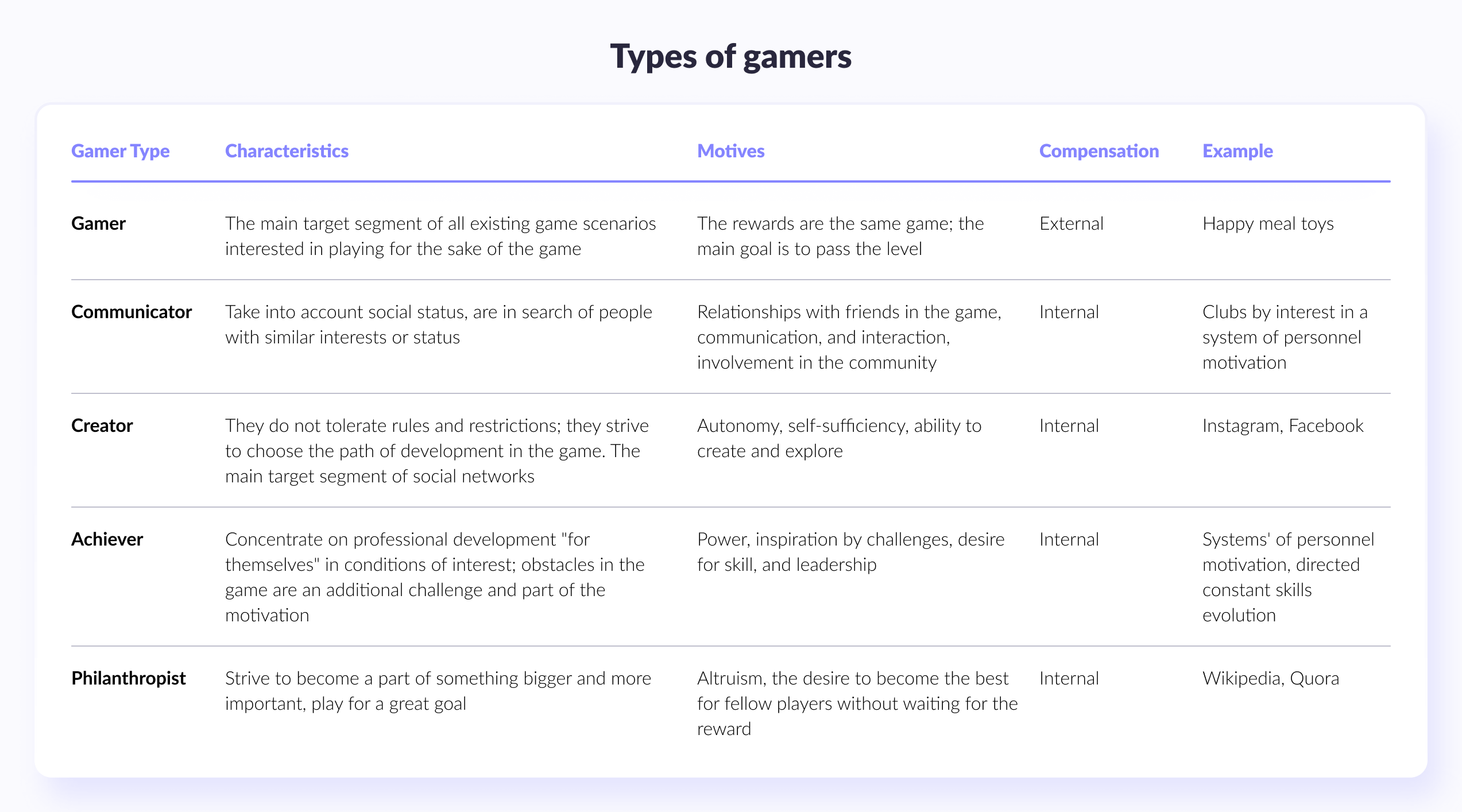

Gamification is used by companies of various levels: small companies and startups focus on gamifying the product, medium-sized companies attract consumers, and large companies adapt staff and improve their productivity through gamification. However, there are also mixed approaches. The types of players should be considered to better understand the process of attracting users through gamification.

Key features of a good game system

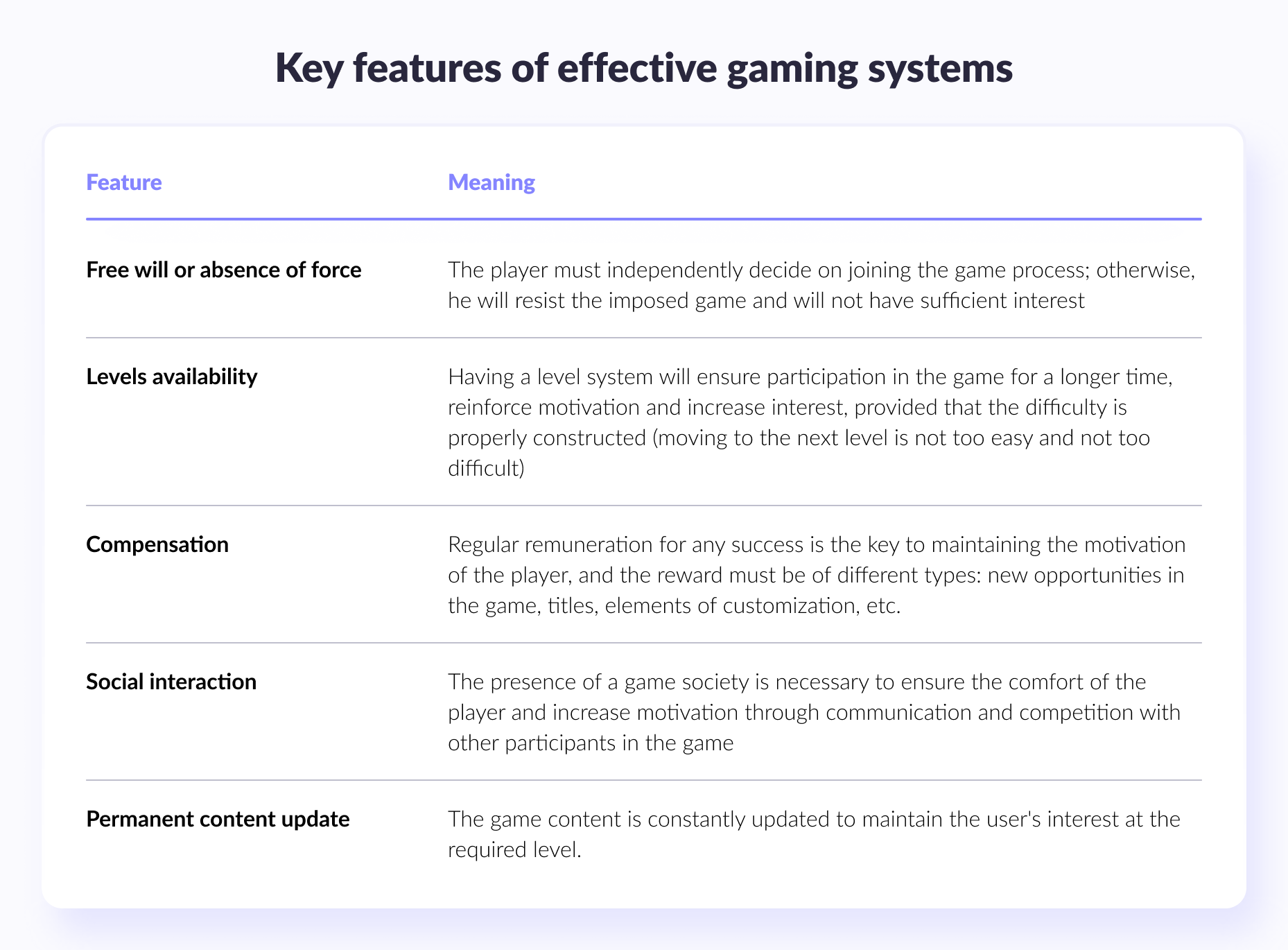

It is important to note that although the term "game" is used to refer to the process of interaction with a gamified system, gamification itself is not the creation of a game as such, and the game does not serve as a goal when introducing gamification elements into the work of organizing into a product. In this process, positive characteristics, elements, and mechanisms of the gameplay are transferred.

The main components of the gamified system, thanks to which the user is attracted and retained, are the competitive spirit, the presence of a system of accumulating points, and the possibility of receiving rewards, but to build an effective gaming system in business, it is also important to determine the key characteristics of efficiency.

Gamification is based on the application of methods that involve natural instincts, namely: competition, which further also leads to the attraction of higher-level needs according to pyramid A. Maslow: the desire for achievements (achievements), status, self-expression, selfish altruism, and problem-solving.

The basis of gamification is the actual solution of problems or the implementation of various game tasks for which the player receives rewards of different types and levels, depending on the complexity of the task and the prizes already received or the problems solved. Incentives in gamification are points, honors, levels, and indicators of progress. An important component of gamification is also storytelling.

Advantages and disadvantages of gamification

The motives for introducing gamification into business are:

- the ever-growing need of society for new impressions and experiences;

- the symbolization of many spheres of life;

- the improvement and cheapening of information technology;

- dynamic market changes associated with the transition to the online sphere.

Introducing gamification (external, aimed at product or marketing, and internal, aimed at company employees) increases the level of involvement and satisfaction and creates a sense of belonging. An especially effective use of gamification is when working with consumers of "Generation Z" and "millennials."

Among the shortcomings, it is worth highlighting the often short-term effect of gamification, the need to align the goals of gamification with the goals of the organization, and, sometimes, the somewhat superficial nature of gamification. The easiest way to integrate into the work of the organization is gamification aimed at personnel. Gamification of the product and gamification of marketing are more difficult to implement in the "non-game" spheres of entrepreneurship and require innovative approaches to product development and the marketing mix in general.

By the way: virtual assistance in digital banking

Take advantage of gamification and modern technologies to make your service even more comfortable for end customers and boost your company's expansion.

Fintech and opportunities for gamification

One of the areas where (according to traditional approaches) the most challenging thing is to implement elements of gamification is the financial services sector. That is why the field of Fintech is essential, where the introduction of gamification is much simpler and more appropriate. Fintech (or financial technologies) is our time's fastest-growing segment of financial products & services. First, this is ensured by the rapid digitalization of all spheres and industries. In addition, Fintech is one of the most innovative industries: technological development is accompanied by the latest approaches to the organizational and product components of the business. In fact, Fintech is a combination of financial services, financial activities, and information services.

Fintech has pierced through all areas of the financial industry:

- personal financial management (CreditKarma, Mint, BillGuard);

- payments (Stripe, Square, Wepay);

- loans (LendingClub, Kabbage, Prosper);

- stocks (CircleUp, Loyal3);

- money transfers (Azimo, Payoneer, Currencyfair);

- retail investing (Motif, Kapitall, Wealthfront);

- institutional investment (Addepar, SumZer);

- crowdfunding (Kickstarter, Indiegogo);

- online banking app (Cardlike, Simple, Moven, Atom);

- business means (Gusto, Xero, Zenpayroll);

- infrastructure (DemystData, Plaid, Mambu);

- security (Centrify, Riskifield, Signifyd, Feedzai);

- analytics and research (Seeking Alpha, Cosser, Xignite, Heckyl).

Obviously, finance gamification is not appropriate for use in all areas of the industry. Gamification in this area is used to increase the financial literacy of the population, provide advice on managing their own finances, and promote certain innovations, in particular, Internet banking etc. The most logical is the use of gamification in financial management, such as personal funds, online banking, and neobanks.

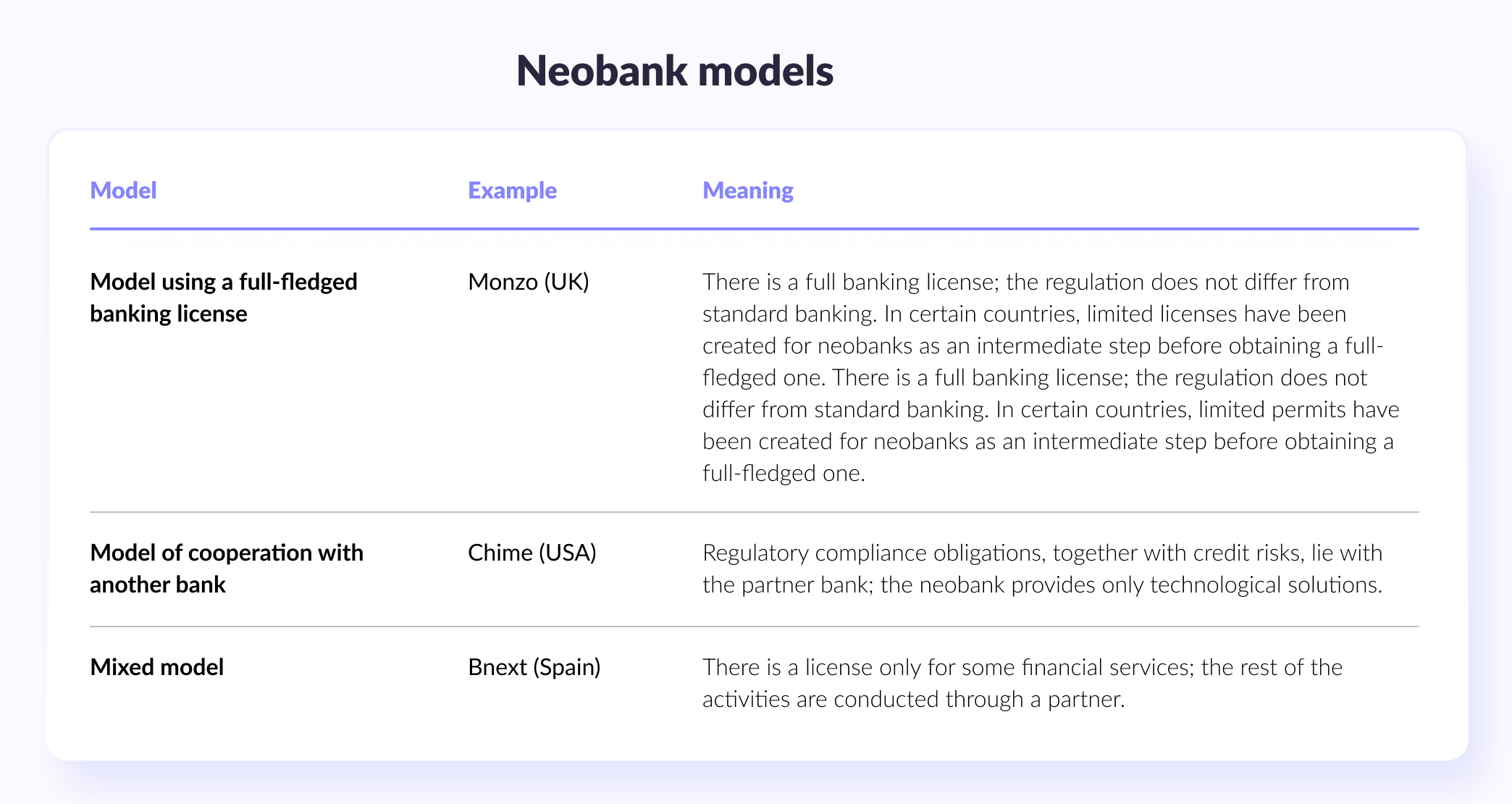

Neobank is a modern type of bank that operates exclusively online and without traditional physical branches while providing all banking services. According to research by Business Insider Intelligence, the cost of neobanks in 2024 will triple compared to 2018, and the number of users will be fourfold.

One reason for this growth is the innovative features that neobanks offer, including the use of gamification. A gamification is a powerful tool that enhances the customer experience by incorporating game-like elements into banking. It can make financial management more engaging, educational, and rewarding. Whether it’s through savings challenges, goal trackers, or reward-based spending systems, gamification aligns perfectly with the digital-first nature of neobanks.

Interestingly, gamification is not limited to one type of neobank. Whether the bank operates on a standalone model (a fully independent digital bank), a challenger model (competing with traditional banks), or a fintech partnership model (collaborating with established banks), gamification strategies can be effectively applied across the board

Use cases of gamification in Fintech

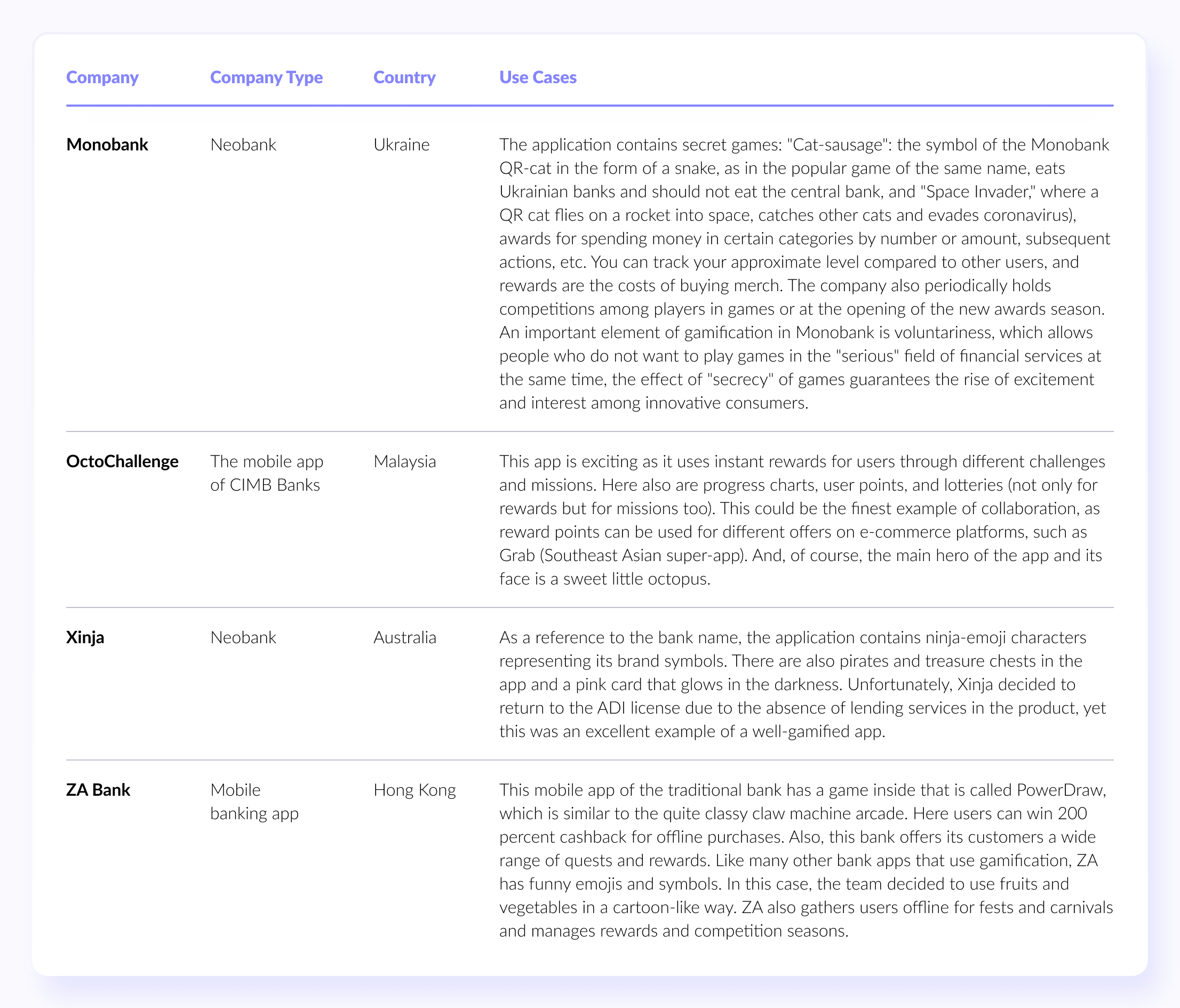

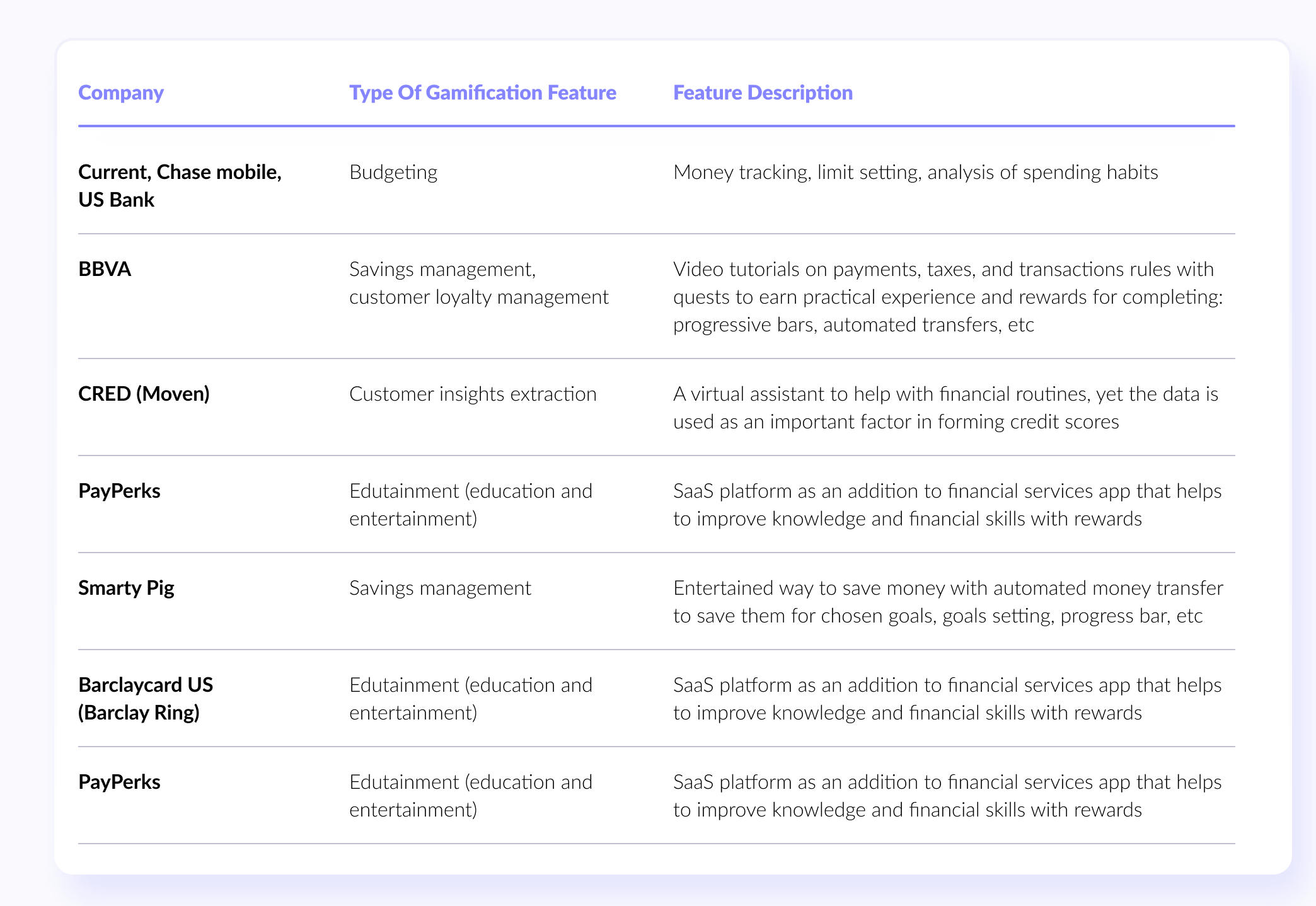

Let’s look at real Fintech gamification examples and neobanks that use gamification in their applications. Financial institutions all over the world leverage gamification in their apps and sometimes even business models to achieve greater results and attain a competitive advantage.

The most popular game features in Fintech

Yet, not all the neobanks implement that many gamification features into their Fintech apps and strategy itself. Let’s take a look at some other examples where we may notice only a slight usage of gamification. Nevertheless, even the shadow of fun and entertainment brings success and loyalty to the Fintech companies mentioned below.

Implying gamification in banking software, companies can benefit in several ways:

- to help individuals, meaning customers, achieve their financial goals (which brings more money to their bank accounts and is crucial for the financial institution, obviously)

- to achieve their own sales goals by attracting new customers, providing better customer experience and personalization

- to use it as a part of their strategy of corporate social responsibility, which means teaching their users how to spend money wisely, save them easily, etc.

Thank you for Subscription!

Practical tips

Let's consider a real example of a neobank that is using gamification. An important element of gamification in this bank is voluntariness, which allows people who do not want to play games in the "serious" field of financial services; at the same time, the effect of "secrecy" of games guarantees excitement and interest among innovative consumers. It is also worth considering the advantages and disadvantages of using gamification in the field of Fintech.

Among the advantages:

- increasing recognition;

- attracting new users;

- increasing interest in the company of potential users and existing users in the product;

- increasing customer loyalty;

- obtaining a competitive advantage;

- a characteristic feature of USP.

Among the disadvantages:

- the possible outflow of conservative customers for whom gamification of the "serious" sphere is unacceptable;

- the complexity of technical support and development of the gaming system itself, psychological analysis of consumers, etc.;

- the need for constantly updated content, levels, and development of new games.

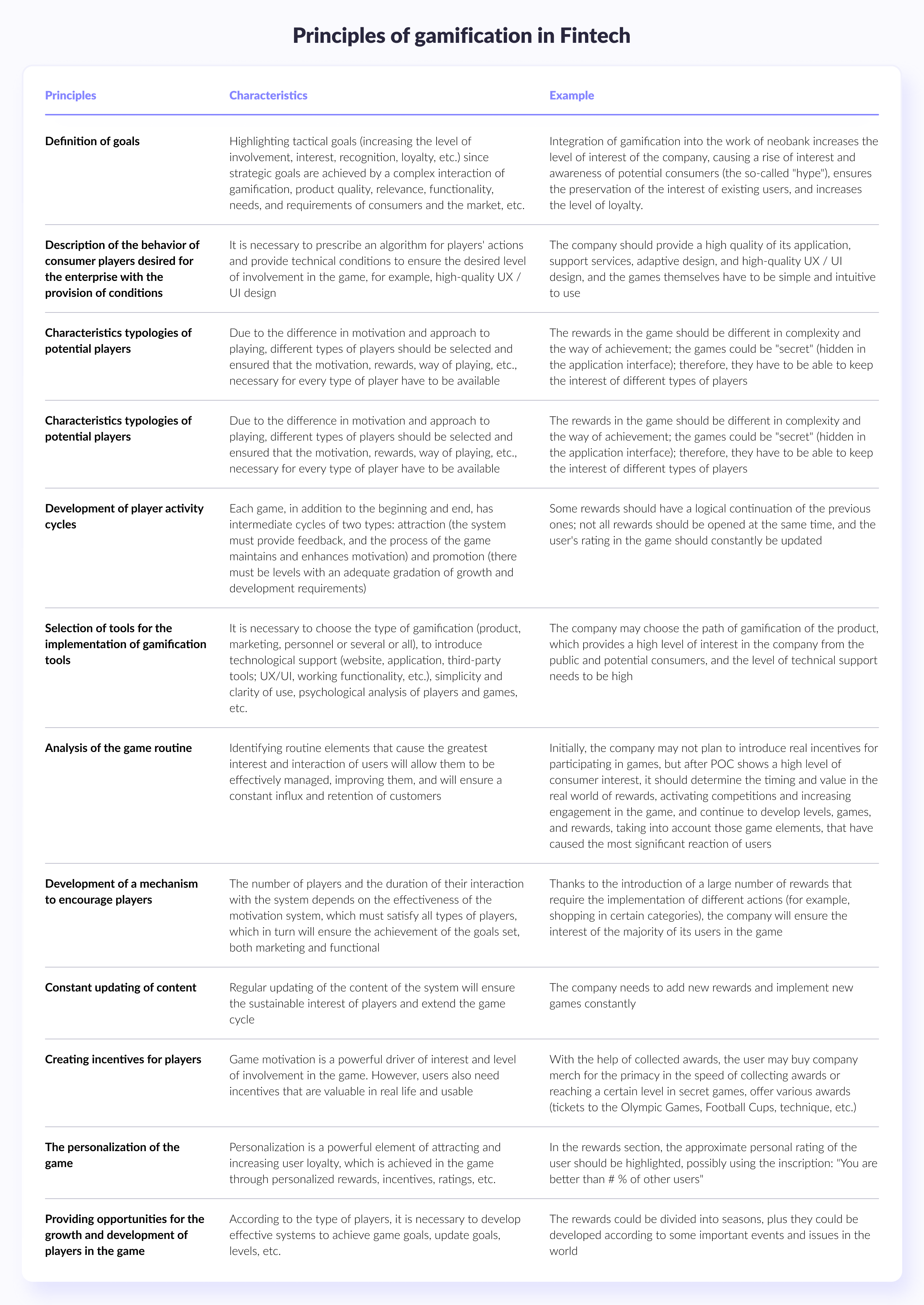

It is worth considering the basic principles of applying gamification to Fintech development, specifically neobanks, which are presented below.

Our experience

With more than seven years in Fintech development services, our team tailored many financial services and products, including neobanks. One of our works is Zytara.

Key challenges for us were implementing parental control as Zytara is designed to be used among others by the youngest representatives of Generation Z, meaning kids aged from 6 to 17, and tailoring the app in a way to engage and retain young people.

To be honest, Zytara is not the first time we have created parental control, yet, we are always serious about it as kids, their data, and financial behavior are top-priority in cybersecurity.

The real deal was to make it exciting. Of course, building a gamification strategy and deciding to use it is not on us, yet as we're not only building software but are also pretty experienced in Fintech consulting, we decided to talk to the Zytara team about it. The outcome of this talk was one of the really powerful insights for us: personalization strikes it! Game changer, no doubt.

We're not really about turning this article into an ad campaign, so if you’re interested in diving deeper into Gen Z neobank, read the case here.

A guide for creating a neobank

Get the best insights from our CTO’s article on Forbes: how to create a neobank, make it safe, flexible, and successful, and what are benefits of most known digital banks on the market

Conclusion

Developing a Fintech application is a complex and responsible task. If you want to add gamification, this will increase the degree of responsibility for the team.

With the right developers, experienced and attentive to detail, anything becomes achievable. And here's where the Geniusee team steps in to back you up! Understanding the potential pitfalls of gaming elements and adeptly transforming them into advantages — that's how we can truly make waves in the Fintech industry together.

Contact us, and let’s discuss your ideas!

Gamification in Fintech: FAQ

What is an example of gamification Fintech?

An example of gamification in finance is the use of investment apps that employ features like virtual trading competitions, progress bars, and badges to engage users in learning about investing while making it feel like a game. These apps often offer cashback rewards or incentives for achieving certain milestones, encouraging users to stay active and educated in managing their finances.

How does Fintech gamification benefit users?

Fintech gamification benefits users by making financial tasks more engaging and accessible. Through features like reward systems, progress tracking, and interactive challenges, gamification encourages users to actively manage their finances, make informed decisions, and achieve their financial goals with a sense of enjoyment and accomplishment.

What are Fintech's main gamification techniques?

The main gamification techniques for Fintech include rewards systems, progress tracking, and interactive challenges. Rewards systems incentivize users to engage with financial tasks by offering points, badges, or virtual rewards for completing actions like budgeting or saving. Progress bars allow users to visualize their financial journey, while interactive challenges add an element of fun and motivation to tasks such as setting and achieving savings goals.