The financial system has been booming lately, with more tech companies clambering to bring the financial sector into 2025. The financial sector must now handle an expanding web of complex laws, ensuring protection from legal consequences and developing consumer confidence to reach sustainable business success.

Fintech will undergo massive market expansion during the next few years. Analysis indicates that the global fintech market will expand more than threefold to $1,126 billion by 2032 while maintaining an annual compound growth rate of 16.2%. The market expansion is powered by technological innovations and rising consumer adoption of digital financial services, while substantial funding fuels this growth.

Of course, working within finance comes with a complex regulatory landscape. Staying compliant with these regulations is a tightrope for the tech community.

The main fintech regulatory challenges

For aspiring companies, investors, or developers, financial regulations may not be the most exciting challenge in fintech. Fintech software development is a rapidly evolving field that offers great opportunities. It’s essential to understand the core fintech legal issues to reap the rewards that fintech offers. The 3 key areas with regulatory issues are:

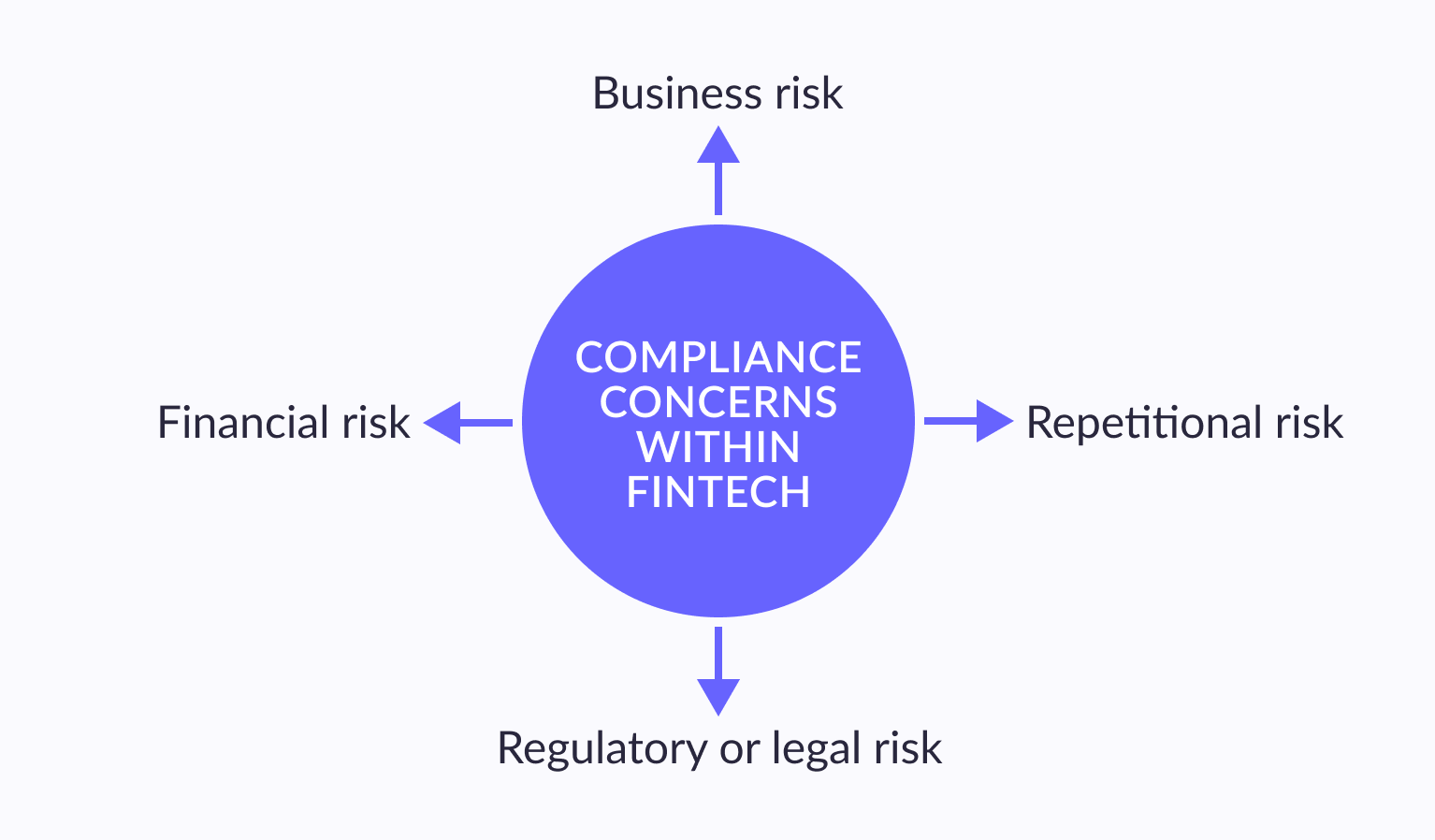

Data security. Consumer financial information protection is a core component of fintech regulations. Compliance bodies concerned with data privacy can sanction companies for not following proper risk management and meeting standards around consumer data.

Money laundering. Governments take money laundering seriously. They recognize that fintech could be used to avoid duties. As such, each territory has its anti-money laundering (AML) laws.

- Cyberattacks. Traditional banks and fintech startups are big targets for hackers and other cybercriminal activities. Financial regulations aim to mitigate these threats, some of which we’ll discuss below.

Therefore, safety measures against any data security breach and money laundering call for a thorough examination known as due diligence. A proper regulatory assessment along with system and process alignment of required standards enables fintech companies to prevent expensive compliance errors.

Regulatory framework for fintech businesses

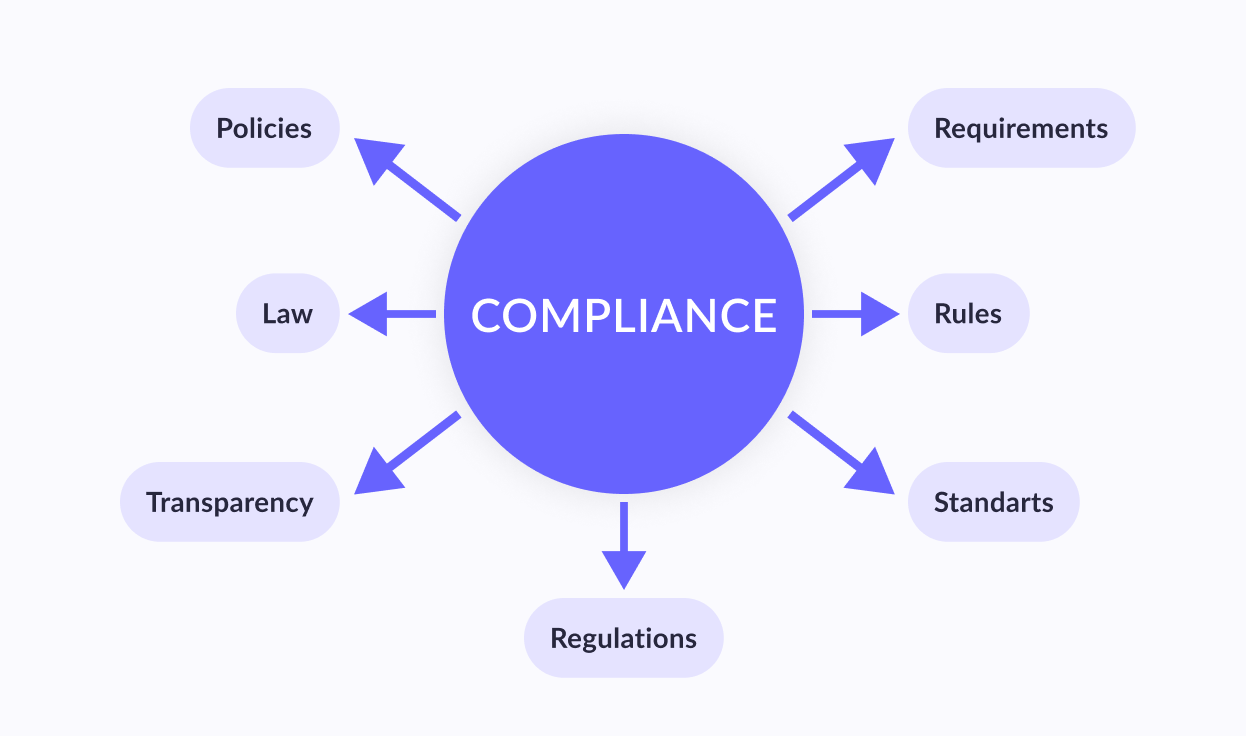

You may have already noticed one of the complexities around financial regulations. There is no single, overarching body that governs them. Each major jurisdiction has its own specific set of regulations, which means compliance standards can vary significantly depending on where the involved parties are located. While there is often some overlap between different compliance agencies and frameworks, the overall picture can initially seem like a tangled web of bureaucracy.

To help you understand the landscape, we have listed the major governing environment bodies in the key territories.

Fintech laws and regulations in the US

The Conference of State Bank Supervisors (CSBS), established in 1902, launched its Vision 2020 program to simplify fintech licensing standards and promote the U.S. market entries for financial entities. The organization facilitates simplified fintech firm approval procedures at the state government level.

The Consumer Financial Protection Bureau (CFPB) oversees financial firms, including fintech organizations, to protect consumer rights. As its primary mission, the organization shields consumers from illicit business conduct.

The Commodity Futures Trading Commission (CFTC) regulates the derivatives market. So if you are, for example, building an application related to trading commodity futures, options, swaps, or over-the-counter (OTC) derivatives in the U.S., you’ll need to comply with CFTC rules and regulations.

The U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) is a compliance authority primarily focused on combating money laundering and collecting and analyzing of financial intelligence. It covers various financial institutions, including banks, credit unions, money services businesses, insurance, casinos, etc.

The Office of the Comptroller of the Currency (OCC) is an independent bureau within the U.S. Department of the Treasury. It oversees federal savings associations, national banks, and foreign bank agencies. So, if you’re planning to launch an online banking app, you must engage with the OCC.

The Federal Deposit Insurance Corporation (FDIC) is a regulatory authority responsible for insuring deposits in banks and savings associations in the United States. In Fintech, the FDIC regulates and supervises fintech companies that offer banking services or partner with traditional banks to provide financial products and services.

The Financial Industry Regulatory Authority (FINRA) supervises securities-related financial services, including online brokerages and digital investment platforms. Through FINRA, investors receive fair market conditions and protections for their economic interests.

Securities and Exchange Commission (SEC) is a compliance body that controls fintech companies that provide digital securities, including asset management platforms and crowdfunding solutions. Through its structure, the system ensures that both parties understand everything and helps safeguard investors.

Federal Trade Commission (FTC) ensures that fintech companies fulfill consumer protection standards and prevents deceptive or competitive behavior against customers. It also monitors financial product advertising and sales.

Regulatory Sandboxes. State regulators and the Consumer Financial Protection Bureau (CFPB) offer governing sandbox testing spaces where fintech companies can test innovative products under simplified regulatory frameworks. These programs provide limited-time opportunities for product development and refinement prior to full commercial launch.

The Bank Secrecy Act (BSA) refers to a specific statute that stops money laundering. One of the main practical outcomes for financial institutions is that they must keep detailed records of transactions.

Anti-money laundering (AML) does not refer to a single financial institution but rather to a collection of financial statutes and regulations designed to minimize and deter money laundering in the U.S.

Governing agencies oversee fintech business models, ensuring compliance with regulations, promoting corporate transparency and integrity, and protecting consumers from fraud in the evolving fintech industry.

Complete FinTech guide

Dive into all industry insights from our leading experts

Fintech laws and regulations in the UK

Financial Conduct Authority. In the UK, the FCA is the core regulator for all financial services and markets. Unlike in the U.S., the UK does not have difficulty with state-level legislations. The FCA protects consumers, deters money laundering, and promotes fair competition among financial service providers.

Prudential Regulation Authority. PRA acts as a bank under the Bank of England framework to monitor the responsible financial activities of banks and insurers. The financial sector authority extends to fintech companies for AI governance, risk management, and requirements within its compliance scope.

Payment Systems Regulator. The PSR is focused solely on electronic payments in the UK. It ensures systems work well, promotes healthy competition, and safeguards fairness for consumers.

Financial regulation in Western Europe

The General Data Protection Regulation (GDPR) refers to European rules regarding data privacy and security. This is important for fintech and any organization holding personal data in Europe.

The European Union Directives and Financial Action. The European Union issues directives and collaborates with agencies such as the Financial Action Task Force (FATF) to fight cybercrime, including, but not limited to, money laundering.

The Revised Payment Service Directive (PSD2) strengthens the regulation of payment services across Europe, focusing on secure transactions via online and mobile devices. PSD2 facilitates fintech industry entry through its API support and new product innovation framework.

The European Banking Authority (EBA) ensures European banking sector standards while regulating AI integration systems. The regulation system concentrates on monitoring 3 main AI system risks: data bias, model risk, and the need for system transparency.

European Securities and Markets Authority (ESMA) regulates the securities markets in the EU and oversees fintech innovations such as digital investment platforms and AI-driven trading systems. ESMA's regulations aim to ensure investor protection and market integrity, addressing risks associated with artificial intelligence and machine learning in financial services.

Thank you for Subscription!

Licensing categories for finTech projects

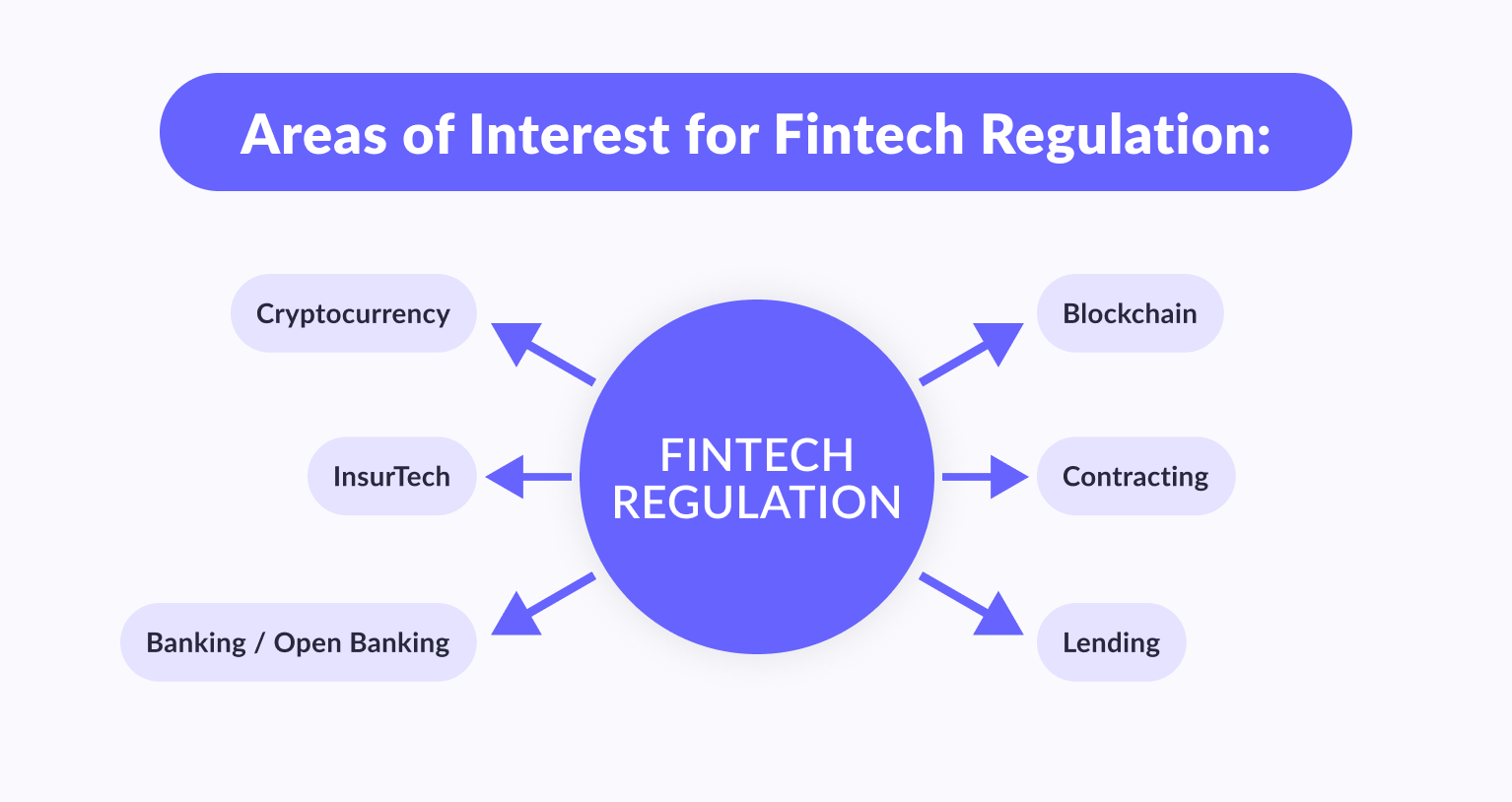

Before we examine specific licensing examples, let’s delineate some of fintech's core areas:

Digital banking. This is a movement driven by changing consumer expectations. Traditional banking institutions and outdated practices (e.g., queuing, checkbooks, in-branch appointments) are no longer practical. Mobile banking applications, virtual banks, and similar services are rapidly emerging — driven either by traditional banks adapting to digital trends or by newer, more agile financial service providers.

Payment. E-commerce propels fintech's growth in the payment sector. Speed, cybersecurity, and ease of online payments are top priorities for consumers and, as a result, for fintech companies and financial institutions alike.

Trading and crypto. Financial products and services are constantly making the world of stock and crypto trading more accessible. What was once limited to the wealthy and financially or tech-savvy individuals is now available to everyday users with minimal capital or expertise.

Insurance. Insurtech is the recently coined term for tech companies and applications working in the insurance space. There is a huge scope for growth here, driven by consumer demand for greater choice, flexibility, and convenience.

- Online lending. Credit scores, microlending, and budgeting platforms all fall under this category. They make up hundreds of applications currently on the market that are digitizing and simplifying borrowing.

Banking license

When it comes to regulating FinTech, companies face a familiar challenge: compliance requirements vary significantly across jurisdictions.

For example, in the U.S., state bank supervisors play a key role in the governing process. However, some principles remain consistent across regions:

Only a company with a banking license can legally refer to themselves as banks. With that designation come specific rights that regular companies do not have.

Like a bank, you can hold customers’ funds, invest them on their behalf, and offer additional financial services.

Banking license types can be complex. Still, as a fintech company with a banking license, you have the potential to disrupt traditional financial institutions, many of which are working to keep pace with digital-native competitors.

Even conservative banks are undergoing digital transformations, but smaller, more agile banks, either newly established or already in operation, are luring customers with the benefits of their digital-first approach.

Payment systems

As we have seen, there is a lot of movement in the available tech-based payment systems. In the UK and Europe, there are dedicated organizations that can guide you around payment system licensing. In the U.S., this is ultimately covered by the CSBS.

So, if you want to expand consumers’ ability to shop from the comfort of their homes, pay their bills via smartphones, and access other digital financial services, you’ll need to navigate some specific licensing requirements. However, the rewards can be substantial, as this is a popular development area; you just need to follow consumer protection legislations.

Read more: Core open APIs for banking & payments.

A few tips

How to choose an online payment system that will fit your project

Choose the best payment system once and forever. Here are insights from the Geniusee team.

Let's seeLicensing of stablecoins

As stablecoin is often pegged to a commodity or currency, it is more likely to meet governing requirements for new fintech solutions. Blockchain, in general, continues to be a rich ground for development. To adress this evolving space, the U.S. government created the Stablecoin Trust Act to establish clear guidelines around which assets can be legally tied to crypto.

Success story: Zytara – a gamified digital banking app for GenZ

Zytara operates as a neobank specifically designed for members of Generation Z and gamers who need financial services combined with gaming elements. Zytara has started its development of a blockchain-based banking app with Geniusee since 2018, bringing together money transfers and savings features with options for customized card skins combined with a branded merchandise shop and parent control functions. Through its interface, users can handle digital assets while they perform NFT lifecycle operations, which integrate educational and financial content into an interactive game-based system.

Challenges

The software team worked to satisfy all necessary data privacy standards to protect minor accounts and bank-level security KYC requirements.

The company performed penetration tests to achieve bank integration protection standards.

We managed communication and workflow between teams across different time zones.

The team functioned as part of the client’s design team, which needs to adapt rapidly to design modifications.

Solution

The system lets parents control their child’s spending by establishing payment thresholds and viewing financial records and account activity.

The gamification aspect allows users to personalize their card appearances and obtain unique merchandise from professional e-sports teams and musicians.

Secure handling of digital assets and NFT lifecycles.

Outcome

Zytara rapidly assembled a large Gen Z audience by delivering educational finance material with entertaining content. The app became a top choice in digital banking because of its advanced security measures, an intuitive user interface that made a great customer experience, and addictive gameplay elements.

Are you building a Neobank or trying to implement the right payment system? Geniusee can assist you!

Geniusee Fintech Software Development Services are designed to give any prospective аinеech company the technical capabilities to realize its potential. This isn’t just about code; this is about bringing together a diverse yet highly connected set of skills and experiences to deliver a peerless and compliant result. These services include:

Financial data management

Data-driven management decisions

Identity fraud detection

Financial platforms

Predictive analytics

Digital banking (wallet)

With Geniusee at your back, you’ll have the technical clout to deliver your vision confidently.

Summary

Fintech requires more than technical advancement since it demands accountability from the perspective of responsible service delivery. Every company needs to comprehend the legal requirements that apply to its operations within different geographical areas. Ignoring these regulations will lead companies to encounter expensive delays, face legal risks, and damage their reputations. Compliance is an essential requirement for growth and danger reduction.

At Geniusee we create fintech solutions that follow all applicable country regulations. If you need help or would like to learn more about building a Neobank or implementing a payment system, contact Geniusee today.