Visibly or not, recent global events have disrupted nearly every industry and transformed traditional business practices for organizations. The banking sector is no exception to this shift. Banks are transforming digitally by shifting to new business models and introducing fully digital banking services to keep up with the trends in 2025.

Yet, this digital transformation does not come without its challenges. Most traditional banks have to live with legacy systems that restrict their innovating, integrating modern technologies, and meeting the rising expectations of digitally savvy customers. This now becomes an urgent call for banks to adopt agile, secure, scalable solutions to stay competitive.

In this article, we'll review the latest online banking trends you should expect from the financial services industry and which trends you should consider incorporating into your digital products, such as banking apps, etc.

What are digital banking trends?

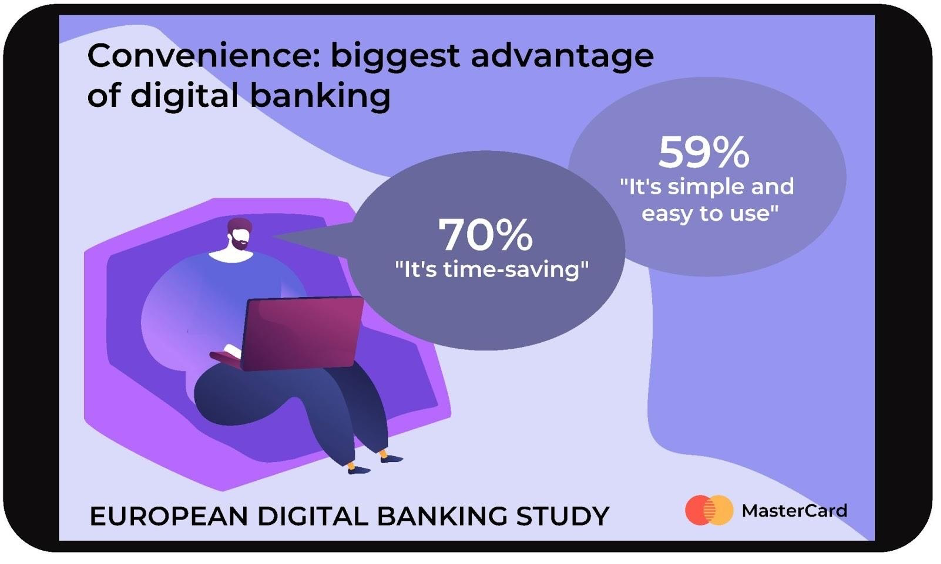

Did you know that over half of adult Americans access digital banking services via laptops and PCs? They are no surprise; after all, they provide mobility, control, and convenience over driving to a bank and standing in line. Increasingly, with banks adopting secure technologies and customers focussed on the digital age and demand for online and mobile banking, banks are embracing automation.

The answer to bank automation might lie in AI and cloud computing. These technologies can help transform digital banking, branchless banking, digital account opening facilities, and so on, digitizing the usual bank services and creating new ones.

For example, in the wake of the Covid-19 pandemic, many businesses had to steady cash flow to fight the aftermath. With the help of AI and digital transformation, FinTech companies can use banking software development to simplify acquiring funds to pay their employees' wages on time.

However, physical banking isn’t dead. Many customers still require a combination of physical and digital services. The Phygital Services and Alternate Delivery Channels (ADC) concept fills this gap. An example of the former is a specialized kiosk where customers can perform their routine tasks quickly and efficiently using digital services and digital eWallet payments in a specific physical space.

All in all, clients and businesses are becoming more dependent on digital banking services and the recent digital banking trends to look at. The general direction of digital transformation is to:

- Provide financial service with ease and authority.

- Facilitate the use of mobile banking on the go and accept real-time mobile payments from other parts of the world with just a click.

- Reduce time and resources used for financial transactions.

- Operate globally and increase their acceptability, resulting in more significant business growth.

More on the topic

How to create a neobank?

This story is based on your real experience. Do you want to know the real case of neobank development?

Tell meTraditional banking vs. digital banking comparison

Online bank, known as e-bank, is catching on as a way to create and manage accounts from internet-enabled mobile phones, tablets, and laptops. These help the customer to have flexibility and control of their finances at any time and place. E-banks, often insured by FDIC, offer the benefit of higher savings interest rates, lower loan rates, and no monthly fee or minimum balance requirement — that traditional banks don’t often provide.

E-banks use technology and automation to reduce the need for in-person visits and save customers time and money. They are much easier to deal with better services like better interest rates and low-cost loans and remove common frustrations like waiting in line or dealing with bad customer service from physical branches.

Differences between digital banks and traditional banks

Accessibility

Any digital bank offers online banking, which means users can manage their finances in their commonly used digital channels anytime. Moreover, they are always open. While physical banks have limited hours of operation or may be closed on certain holidays unless they are in malls that stay open until nightfall, online banks never close. Online banks also usually offer 24/7 customer experience support by phone and online chat.

Service fees

Internet banks don't require monthly service fees or minimum balances from customers, which can save consumers money over time. They are secure, have an easy-to-use website, and do not require hidden fees. Online banks do not charge late fees or require a minimum balance, so they are a better fit for consumers who need to plan their money.

Assistance in making a financial decision

Digital banks promote financial wellness by helping customers make responsible financial decisions for themselves and their families through features such as daily balance alerts that let you know when your account balance is getting low or online bill payment that makes managing your finances convenient. Virtual banks even provide graphical statements or alerts that indicate when a payment is credited to an account.

High-Interest rates

Online banks also offer higher interest rates on savings accounts, which is another advantage over conventional banks. They also offer lower interest rates on loans for people with good credit. Digital banks can help you save more money over time and earn interest, so they grow faster than traditional banks.

Technological advantages

Online banks are keeping up with the latest technological advances that traditional banks simply cannot compete with when it comes to customer service and convenience. They do not have a physical bank location, which means digital banking is great for people who are constantly on the go or don't enjoy human contact.

Seсurity

With advanced encryption technologies, virtual banks can safely deposit prudent data. They are readily accessible from any device and provide convenience alongside greater security than traditional offices. Like conventional banks, they come FDIC-insured and have features like two-factor authentication and activity alerts. Virtual banks are also much easier to get funds and payment options that aren't present at traditional banks.

Do you know?

How To Implement Zero Trust Security: Practical Steps

Treat your system as it has already been compromised to implement more secured system.

Read the full guideEase of transactions

Digital banking is even available through mobile apps, so you can check balances, transfer money between accounts, or pay bills wherever you are, as long as you have your phone. They also offer video teller services where customers can chat with their bank in real time as if they were talking to someone in person, except that the conversation is via a webcam.

Support service

Customer service plays a big role, at least from the customer's point of view. Online banks can offer better customer service than traditional banks because their customers can communicate using bank websites, mobile apps, and social media. Online banking provides more ways to contact support than legacy banks, which only provide one way to contact their customer service department.

Fast payments

Traditional banks can take three days or more to transfer money from one account to another; Internet banks have a much faster transfer system that transfers money instantly. Digital platform users can transfer to another account in just one day.

Online banks offer more ways to deposit and withdraw money than traditional banks. Their users also don't have to wait in long lines like traditional financial institutions.

Statistics on digital banking

Let's look at the most interesting statistics of online banks.

The digital bank market's net interest income worldwide is estimated at US$1.50tn by 2024. (Statista)

Net Interest Income is forecast to experience an annual growth rate (CAGR 2024-2029) of 6.86%, making its market volume reach US$2.09tn in 2029. (Statista)

The sheer growth potential represented by CBDCs is evidenced by the fact that by 2030, CBDCs are projected to facilitate $213 billion worth of transactions. (Juniper)

Almost 59% of people use mobile phones to manage their bank accounts. (Nuke)

78% of U.S. adults prefer mobile apps or websites over branch visits. (Forbes)

Top digital banking innovation ideas for your business

The latest digital banking trends for 2024 in the banking sector can help many banks improve and successfully serve their customers' needs.

Let's discuss some of the current digital trends in financial services.

1. Radical transparency and open banking

According to Raconteur, trust is the second most important factor when choosing financial products. Banks must prioritize trust by embracing radical transparency or open banking to stay competitive. This idea fosters honesty, clear communication, and accountability, meeting growing customer expectations.

For example, Monzo, a UK-based app-only bank launched in 2015, now serves over five million users. Monzo's success shows how transparency can help new financial organizations capture market share from traditional banks, reshaping the industry.

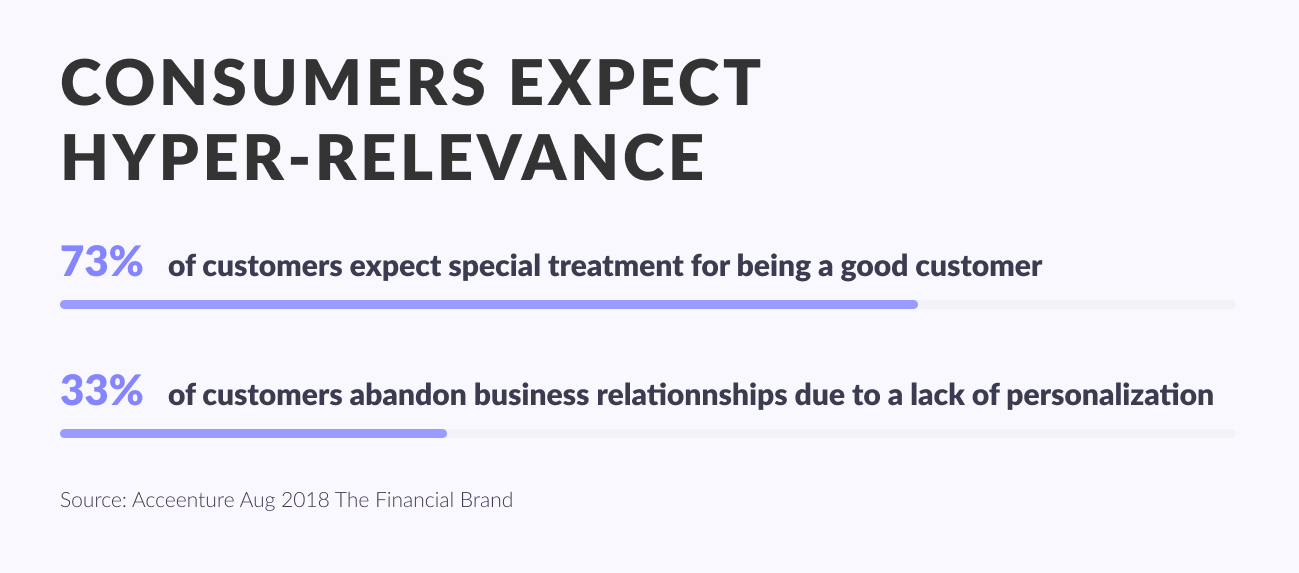

2. Data as a predictable personalization tool

The big data, AI, and ML empower financial marketers to deliver personal banking experience beyond names. This is about knowing the customer preferences and catering banking products to an individual need. According to Accenture, 74% of consumers find detailed 'living profiles' useful to create personalized banking solutions. Personalized marketing is a must for a great customer experience, and customers want to be recognized quickly for sharing data, but traditional banks have not harnessed this yet.

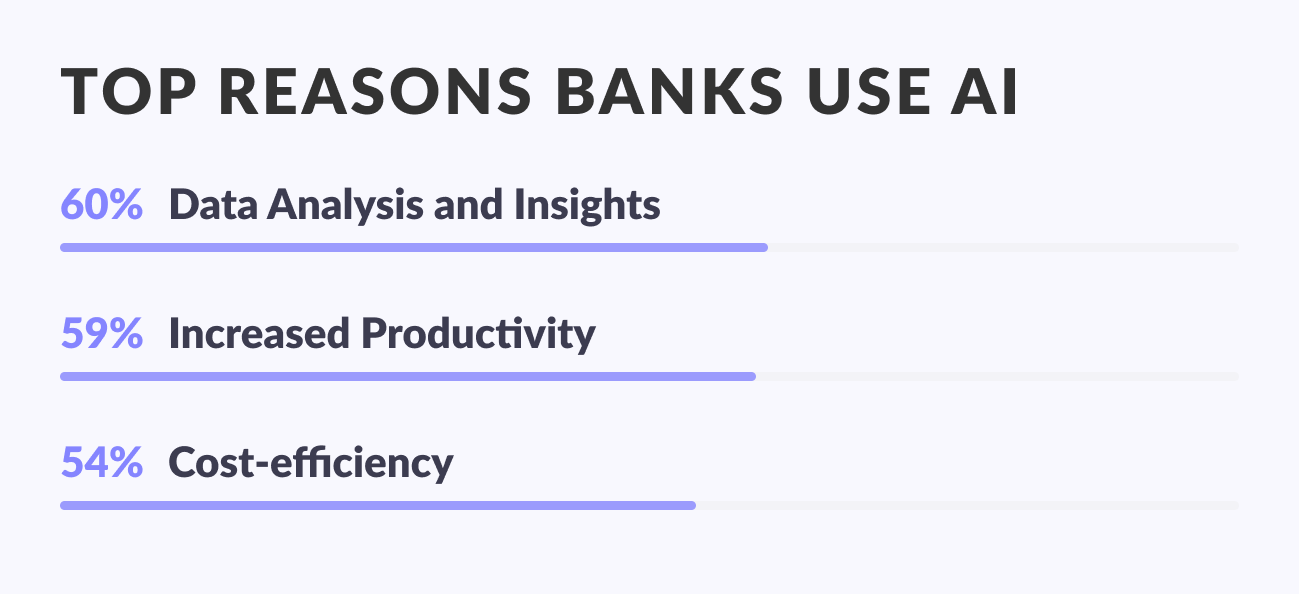

3. AI providing more targeted services

The digital banking trend of 2024 suggests using real-time AI-based bots to gather information about customer preferences. Financial marketers can leverage personal data and advanced analytics to provide predictable personalization and delight customers.

With the help of artificial intelligence and ML, a bank can:

- Understand the needs of their customers more quickly in real-time.

- Identify and provide data-backed solutions for these problems.

- Perform faster analyses to become more efficient and productive.

- Develop key strategies for their business backed by valuable customer data.

4. Cloud computing digital transformation

There has been a massive growth in the use of cloud computing in digital banking innovation trends. Cloud computing is a concept in which computing services such as software, data warehouses, and digital networking tools are readily available on the Internet.

We got a massive shift towards cloud computing in the finance sector in 2022 because it provided banks with such benefits as:

- Cost efficiency

- Global scalability

- Increased productivity

- Speed

- Adequate security

- Reliability

- Convenience

Financial institutions can mitigate the risk of losing data in case of any physical disaster or calamity. In addition to that, cloud computing helps banks eradicate massive data silos. It also eliminates the need for physical servers, systems, and people to manage them.

5. Automation using time and money efficiently

Even today, many FinTech startups and banks rely on manual data work, keeping upper management focused on data work rather than strategy. Automation can transform internal processes:

- Enhanced decision-making: This will help managers shift priorities from creating and reviewing reports to planning and strategy.

- Improved productivity: Manual reports make way for time better used elsewhere.

Cost and efficiency benefits: Automation cuts costs, speeds delivery time, and improves productivity.

Advanced tools:

Unlike data entry tasks, Optical Character Recognition (OCR) eliminates them.

Through Robotic Process Automation (RPA), your workflows are error-free.

They are moving banks’ development focus from innovation toward reshaping the financial industry's future.

6. No downtime — reliability is key

With the rise of digital banking users, a bank cannot afford faulty server downtime. Even a few minutes can destroy the reputation and goodwill they created over decades. For example, the State Bank of India's system outage resulted in significant revenue losses. More than 16,000 financial transactions occur on the digital banking platform every hour, so every minute counts.

These technical glitches have raised many concerns about the reputation and credibility of the institution. Thus, banks need to invest considerable time and money to ensure that their systems are always functioning error-free.

7. Security and privacy

Banks and theft have a parallel relationship. With newer online banking products and services, customers are now more exposed to the threat of losing money. Cybersecurity is now becoming a major consumer demand for any digital bank.

According to a recent survey by CSIweb:

- 58% of people will stop using a financial institution's services if they have faced a privacy breach.

- 28% of bank customers say that their bank accounts have been exposed to cyber-attacks at least once in a lifetime.

To ensure security and privacy, banks need to:

- Invest in security systems to avoid the risks of cyberattacks.

- Perform detailed and ongoing security audits of a bank’s system to mitigate its weaknesses and flaws.

- Protect their customers from phishing, through which anyone can steal money from customers' accounts.

- Educate customers about cybersecurity and how they can safeguard themselves from any such attacks.

8. Speed and reactivity

Every bank needs to increase the speed of its bureaucratic working systems. Speed is something that can provide a competitive edge to any bank. Businesses now need to make decisions more quickly, requiring a trustworthy and quick banking partner to channel their funds more efficiently and rapidly.

According to a survey by Mckinsey, 59% of the banks lack the ability to have speedy systems due to a lack of cross-functional collaboration.

9. Usability and intuitive design

User-friendly and intuitive application programming interfaces are now a vital service requirement. Tailored mobile retail banking super apps are more popular than limited functionality tools. Customers prefer graphs, infographics, and interactive modules to the typical Excel sheets. According to the future trends in mobile banking, we can expect newer features and functionality from banking apps in 2025.

10. Importance of visualization as a global trend

The current generation is more appreciative of visualization in their day-to-day routine. User experience will now play a vital role in any financial institution's competitive edge. Online banking needs to create visually appealing systems to retain their customers' attention and focus.

In the future of banking trends, we can expect the introduction of more visualized, attractive, and trendy mobile apps. Banks will now invest thoroughly in creating innovative mobile banking apps, as customers need enhanced user experiences and functionality.

How to create a user-friendly interface

You might be interested

What Is Embedded Finance And How Is It Revolutionizing Financial Services?

A classic business case is integrating conventional payment services into non-banking companies, benefiting significantly, as, for example, the alliance of the Mexican BBVA and Uber.

Find out now11. Cryptocurrency and blockchain

Cryptocurrency and blockchain will continue to play a key role in digital banking in 2024. By mid-2023, 8,832 active digital currencies were on the global cryptocurrency market. The Economic Times claims blockchain technology saves financial institutions up to $12 billion annually thanks to its security and transparency.

Central Bank Digital Currencies (CBDCs) are materializing, allowing for central bank monetary control, while decentralized finance (DeFi) platforms rapidly progress in lending, borrowing, and investing. Smart contracts automate processes like loan origination and compliance, video hosting, token premiums, and more — ultimately streamlining your financial service. Transforming digital assets into NFTs is revolutionizing digital ownership and asset trading.

As digital banking future trends continue evolving, cryptocurrency and blockchain integration are poised to redefine financial services, offering new levels of efficiency, transparency, and accessibility to users worldwide.

12. Banking-as-a-service

Modern banks are like grocery stores— they sell loans, debit cards, mutual funds, and other products. Traditionally, banks helped businesses by offering credit at appliance stores. Banking as a Service (BaaS) has allowed large companies and fintech startups to deliver digital banking products to users. Today, large companies and fintech startups want to offer digital banking products directly to users.

According to the BaaS market in 2022, it is estimated at $390 billion and is expected to grow at a CAGR of 78.4% to reach 1.56 trillion in 2027. Due to increasing living costs, BaaS-based services are expected to overtake in five years, according to European leaders who are betting that the services will be able to be offered for a more competitive price. Additionally, using BaaS allows businesses to have a significant competitive edge in customer experience and engagement.

13. Mobile banking

Based on the ''What is Financial Wellness?'' report 2023 45% of consumers are performing finance-related tasks on a mobile app at least once per day. Another research shows that 72% of US consumers prefer to manage all their finances online or through a mobile app.

Mobile banking is a technology that allows a client to access all of their bank accounts and manage them independently using a special application. In essence, it is a form of Internet banking adapted for mobile devices. The service is provided by banks free of charge.

By offering a mobile banking app for customers, you can significantly benefit by enhancing customer convenience and customer loyalty. It allows the bank to create a seamless and personalized user experience and collect valuable data on customer behavior. You can use this information to improve services and create targeted marketing strategies.

Additionally, mobile banking can reduce operational costs by shifting routine transactions and inquiries to digital platforms, thus decreasing the need for in-branch services.

14. Generative AI

Today, in the digital age, online banks mainly deal with Narrow AI technology, which focuses mainly on highly specialized applied tasks. For example, in chatbots and voice assistants, AI helps to close large blocks of communication with clients, but the solutions are not always optimally trained and configured.

Gen AI digital banking trends can become the basis for creating next-generation financial services. So, leading online banking players have already begun to use this technology for a wider range of tasks.

According to a McKinsey report, the most common areas of AI applications include:

fraud prevention & security concerns elimination;

automating code development;

summarizing regulatory reports;

predicting ATM & bank branch loads;

processing and entering customer data;

making decisions on credit applications;

and much more.

Expect a thriving digital banking industry future

With many digital banking technology trends just around the corner or fully in FinTech development, it's possible to spot some industry favorites. Here’s what you can expect in the years to come:

AI will keep on growing

Banking Continues to be Transform by AI for Better Security and Real-time Personalized Solutions. For example, the potential of AI in banking is just given by Erste Bank’s AI-driven digital platform, George. George is AI-driven, serving over 6 million European users and giving Erste Bank a competitive edge.

Cybersecurity will become more critical

With the evolution of digital banking, a need for more and more cybersecurity appears. Due to rising data privacy concerns, banks must build these advanced systems to protect data from being exposed to fraud and data breaches.

Customer service – a compassionate presence

Virtual customer support is a necessity as branchless banking is getting more popular. Chatbots powered by AI solve issues instantly, improve efficiency by 33%, and improve interactions via mobile apps..

Complete FinTech guide

Dive into all industry insights from our leading experts

Conclusion

In summary, with the continuous and radical changes in digital technology, banks are also transforming themselves by taking advantage of new technologies. Covid-19 has disrupted every industry globally and forced enterprises to change their existing way of doing business. People and businesses rely more on digital banking in their basic banking activities.

We can expect significant banking industry trends to reshape the digital banking landscape. Banks will use advanced technologies such as AI, cloud computing, and machine learning to gain a competitive edge. The policies and standards of banks will become much more open and customized. Banks will introduce tailored products to cater to the new needs of their customers. Banks will need to act on new-age digital customer service and support quickly. Visualization, privacy, and cybersecurity will be more critical in the upcoming months.

Feel free to call us if you consider implementing digital banking solutions or establishing an online bank. At Geniusee, we facilitate companies by providing essential services to gain a competitive edge by utilizing these trends.

Trends in digital banking FAQ

What is digital banking?

Digital banking is an online software solution that allows you to manage your bank account over the Internet, without having to visit a physical bank. With digital banking, customers can check their account balance, make transfers, deposit checks, pay bills, set up financial goals, and perform many other operations using a computer or mobile device.

What are the technology trends in the banking industry?

The banking sector is currently seeing such technology trends as the use of AI to automate processes and prevent fraud, the introduction of blockchain technologies to improve security, the development of online banks and mobile applications, and the use of big data to personalize services.