Modern cloud computing has completely changed the course of the world with its new, serverless architecture.

This serverless model has become the perfect host for modern microservices applications due to the numerous benefits it offers—which include reduced costs, high scalability, and an exceptional level of performance.

Like other industries, fintech has also jumped on the serverless architecture bandwagon and is enjoying everything it has to offer.

But what does a serverless application look like, and is it worth building serverless architecture in a fintech app? Let’s find out.

Serverless Architecture for Fintech Startups

Serverless architecture has recently started attracting attention in the IT industry. As a result, some of the most well-known companies are now shifting to this model for all their technical needs. So much so, companies that already have fully-established servers are now creating new services or are completely redesigning the older ones to utilize its features.

For fintech startups operating on a smaller scale, the serverless model is a savior. It helps them cut infrastructure costs and allows new services to be launched faster and more secure. Besides, there aren’t any unnecessary storage or processing costs because they only need to pay for what they use.

This article will examine practical applications of serverless architecture in fintech startups to help you understand why using distributed applications is the right choice for your next project.

What Is Serverless Architecture?

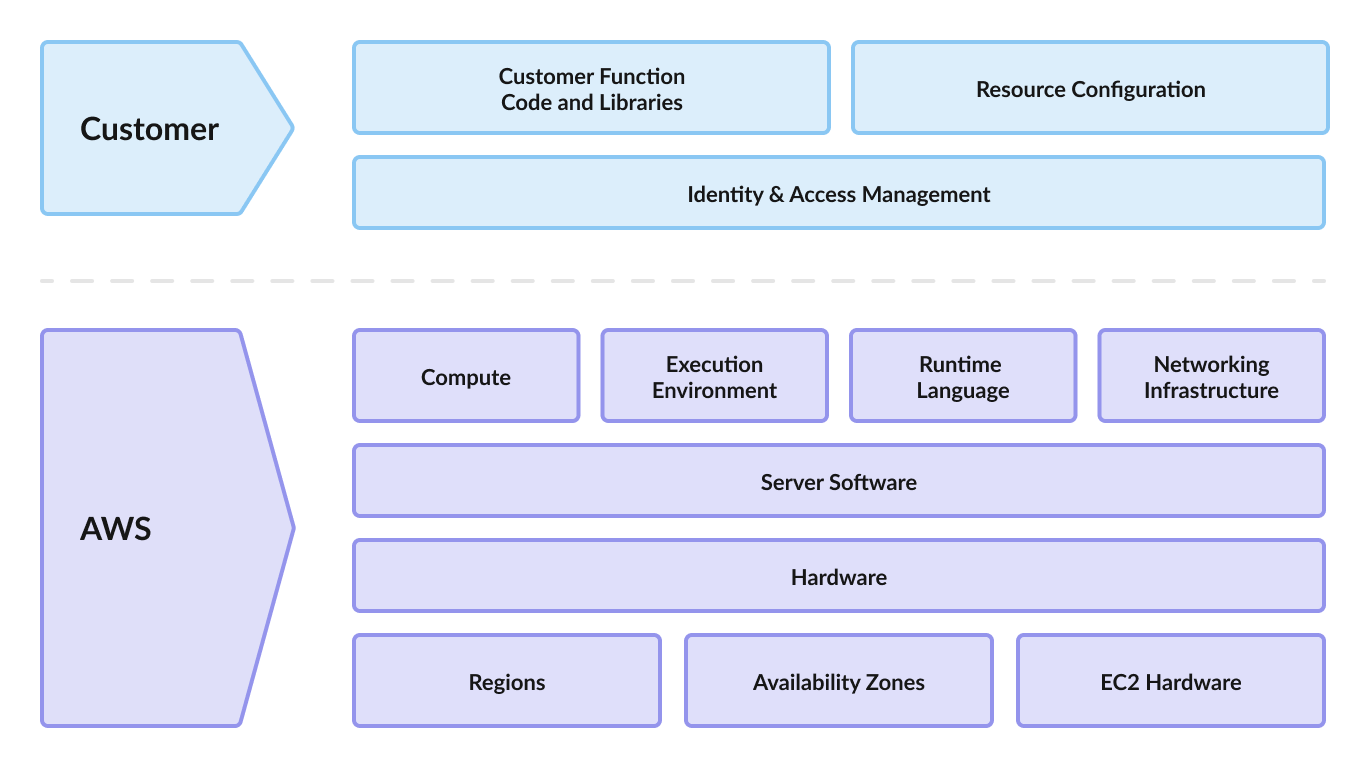

Serverless architecture refers to the creation, publishing, and maintenance of applications without having to manage the basic infrastructure behind them.

The application does run on a server, but the server space is maintained by the cloud providers. This way, the company does not have to put resources into managing the server and can focus solely on its core service offering.

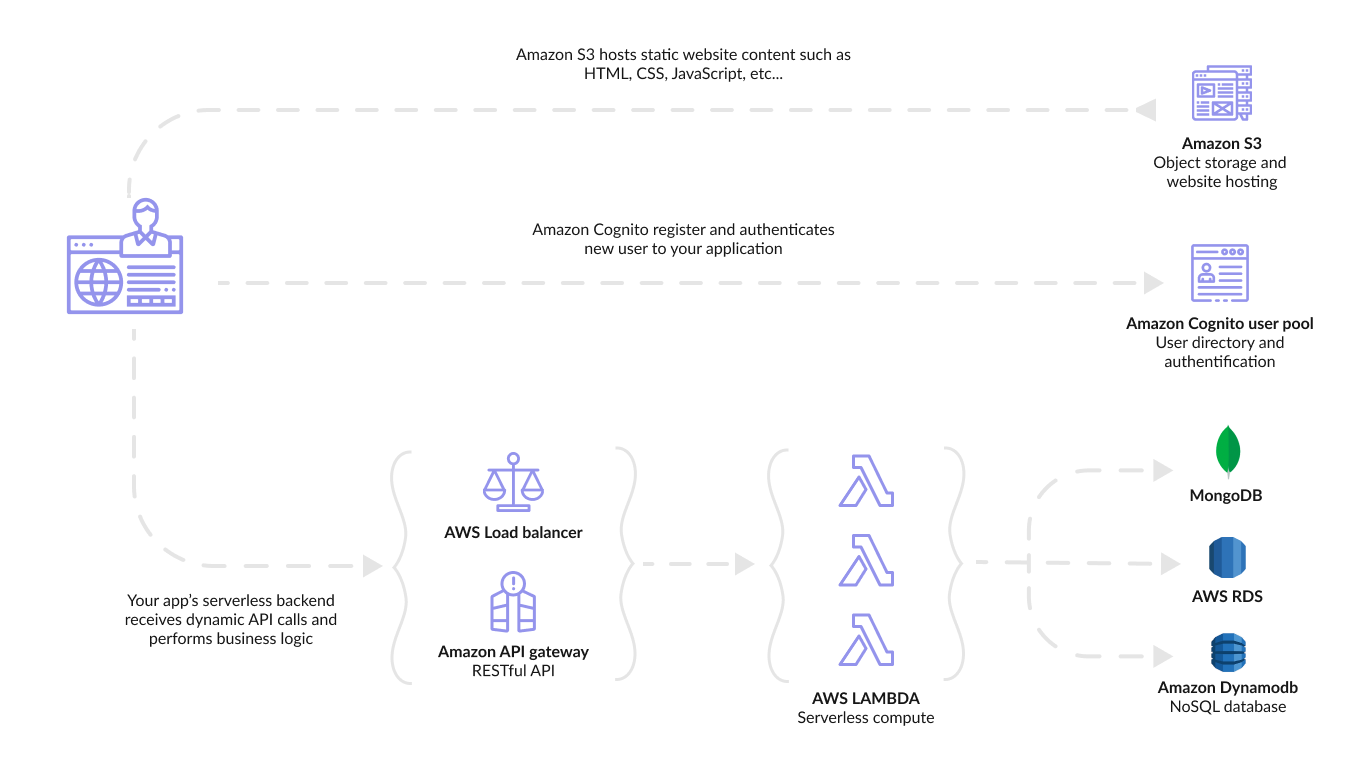

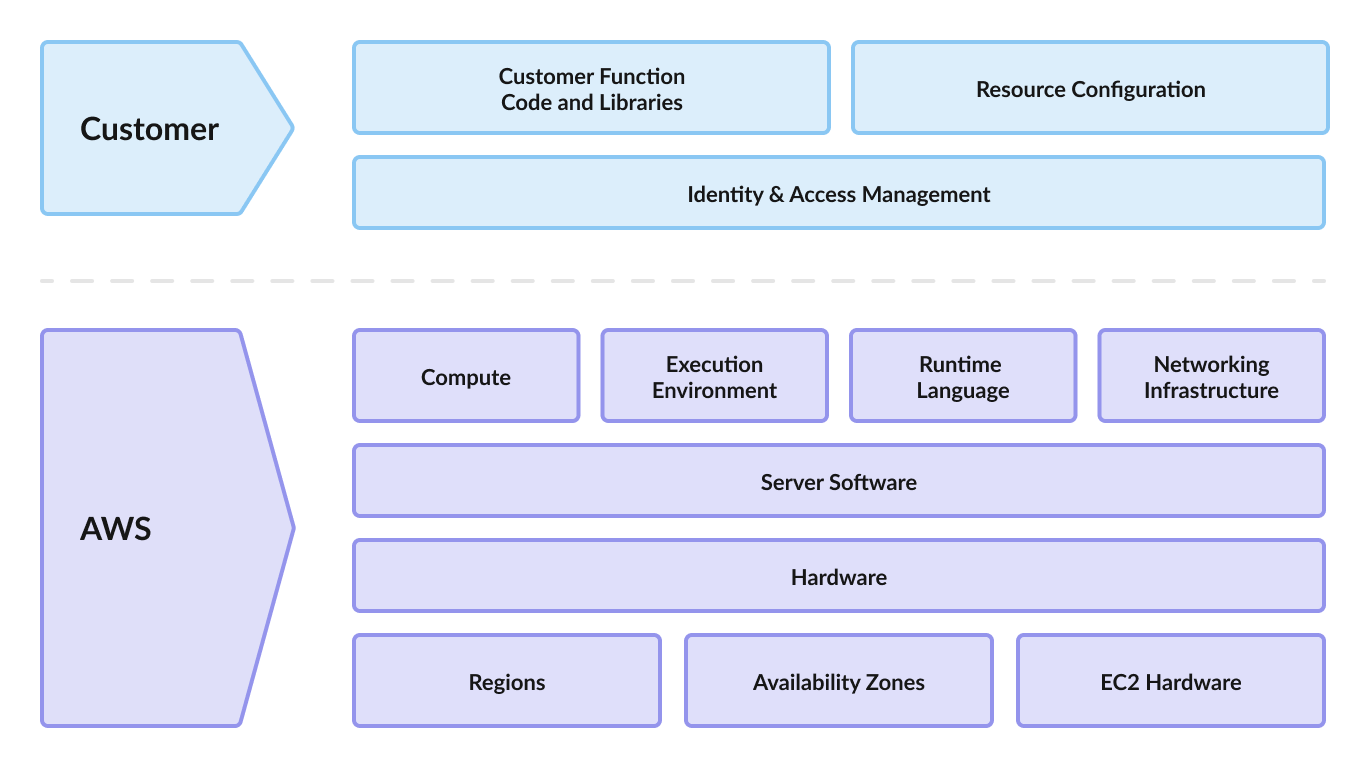

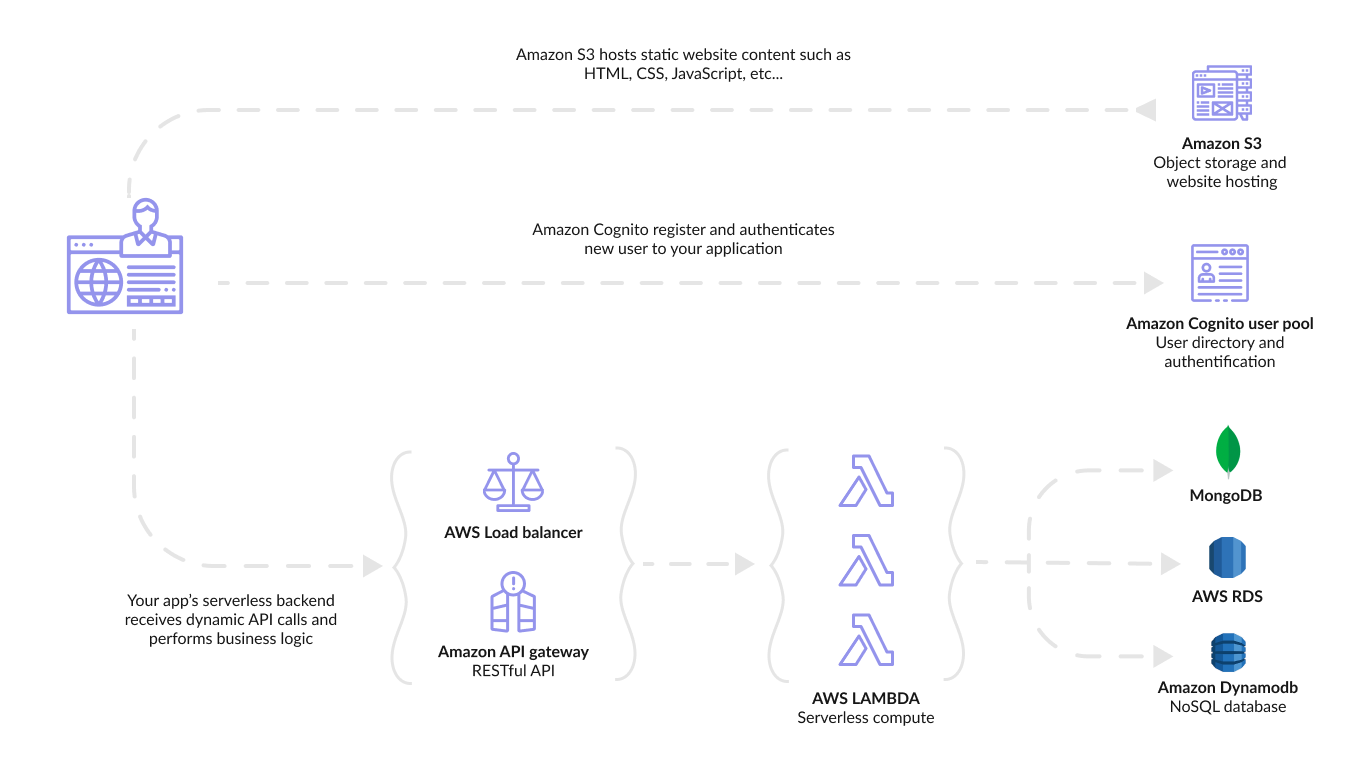

The main difference between a conventional and serverless architecture for apps is that in a serverless model, the backend environment is outsourced and managed by the cloud. The developers are only responsible for building backend functions that respond to client triggers and perform their intended functions.

Applications built using this serverless model are very lightweight and dependable. The hardware and data processing side is outsourced, so the company entirely focuses on its main functionality and user experience.

Why Is Serverless Important for Fintech Startups?

Serverless computing is a brilliant opportunity for fintech startups as it takes many burdens off of their shoulders. It helps:

-

Not to waste time and money on infrastructure management and support

Apps designed this way are up and running in a much shorter time with almost zero engineering overhead for managing the infrastructure. All you pay for is what you consume—not a penny more.

-

Launch new services faster and implement security best practices easily

The banking and finance clientele usually expect immediate solutions to their problems that are readily available 24/7. There is always constant pressure to keep up with security risks and compliance regulations to prevent breaches. In such a situation, serverless fits like a glove and acts as a one-stop solution for these demands.

-

Pay only for what you use

Another element that makes serverless ideal for fintech is its on-demand-only costing model. Financial companies usually have a variable workload depending on what client they are working with and what services are being rendered. The serverless model only charges you for the load you put on it, and the chargeback is nil for the services you do not need.

This cost-efficient model is beneficial for startups with low budgets who can’t afford additional server maintenance and infrastructure costs.

Serverless architecture continues to be used in fintech applications as these startups grow and build their place in the market. Since some of the highest-valued startups are fintechs, such as Stripe, valued at $95 billion, and Klarna, valued at $31 billion, the massive influx towards serverless is inevitable.

Benefits of Serverless Architecture for Fintech Startups

Serverless architecture is usually very slim, and unlike traditional server infrastructure, it only charges you when a user request is processed, or a similar event occurs. Besides reducing costs, this approach also simplifies the support and maintenance of the infrastructure, which allows you to develop the same projects with a much smaller in-house team.

Here are some of the most critical benefits serverless architecture offers fintech startups.

Lower Costs

One of the most obvious benefits of shifting to a serverless model is its low costs. This is particularly helpful in the fintech space because it minimizes operational costs from the ‘always on’ processes with heavy runtimes. Such processes usually utilize a lot of memory and require large servers, as the operational requirements are very weighty.

To understand what this means for cost-saving, let’s have a quick look at how traditional methods are priced compared to the serverless model. The conventional method of hosting requires the purchase of powerful CPUs and the maintenance of expensive memory. If we move one step ahead, the conventional cloud method will charge you either monthly or annually for the same, so you don’t have to pay the full purchase costs of these resources.

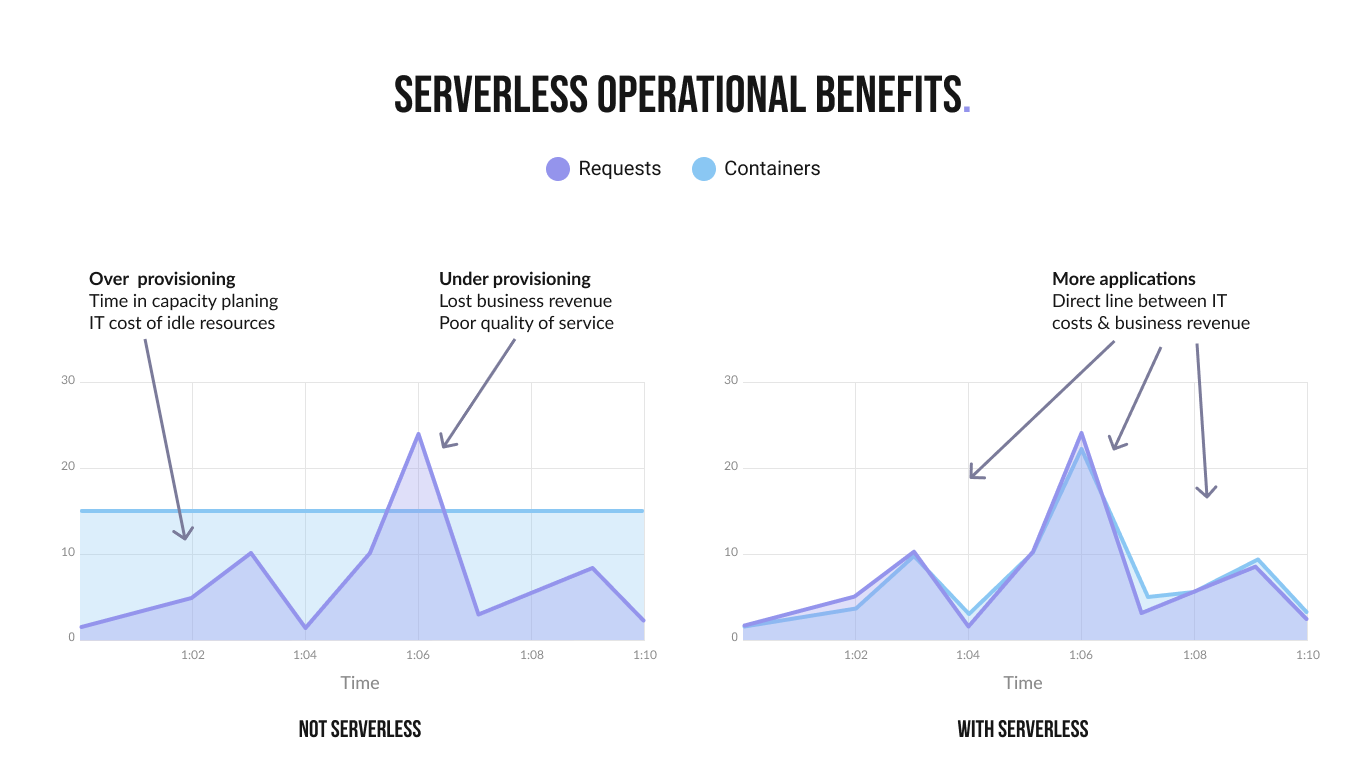

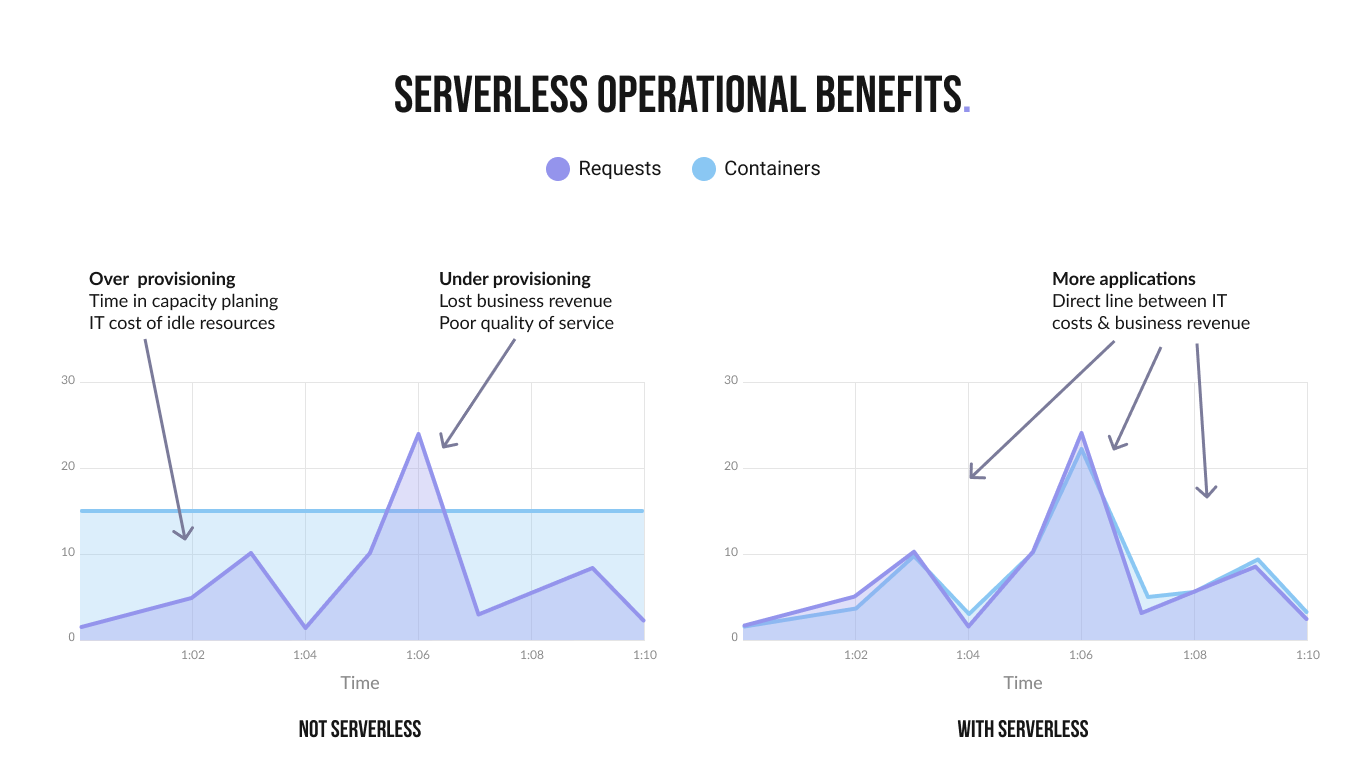

The serverless model frees you from these constraints and charges you only at runtime, when a certain function is performed, and not for the total working time of the server. This way, there are no over-provisioning or under-provisioning problems, and your total charge is much lower than before.

Additionally, since most cloud services offer free tiers, the expenses are cut down further, especially at the primary stages of development, and as things start getting heavier, you are charged accordingly.

Maintenance and Scalability

All server applications have scalability limitations, but with the serverless model, there are none. Increasing the number of users on a server requires investing in more and rebuilding the backbone of your application. Unless you upgrade your technological basis, you can’t scale at all, let alone scale at a fast pace. This is exactly why newer fintech startups who prioritize a stable and traffic-resistant system prefer to use serverless development.

Besides the stability factor, serverless development offers excellent ease of configuration and stability. The deployment and maintenance are equally fast since all changes to the code are deployed automatically. Fintech startups can launch or revamp their products easily without having to worry about the system crashing.

This also increases flexibility and allows these startups to introduce newer services faster, helping them scale at a fast pace.

Security

Since the primary issue fintech startups have is money, there are many security issues they have to deal with daily. This includes virus and malware attacks, phishing attempts, server hacks, and more. Thus, they need to have an underlying system that is resistant to such attacks and complies with all security standards.

Serverless architecture in fintech software development, by principle, is very lightweight and should have minimal contact with other services for supplying its functionality. This approach limits the movement of sensitive information and shelters the system from external parties actively looking to exploit such channels. Security compromises are greatly reduced, and the information within the startup remains secured.

Moreover, most cloud providers supply additional services and functions, such as WAF and AWS Audit Manager or Trusted Advisor. These services help add another protective layer and save the server from external threats. They also check whether your AWS environment and activities are operating as needed, make necessary suggestions, and amend the system performance.

How Serverless Can Benefit Financial Services

The fintech startup space is based on introducing technological innovation to conventional financial services. To introduce this tech innovation, you need to keep up with what is happening in the cloud space. The fintech industry often requires that immediate and always-on solutions be provided; there is no other development model that fits these specifications better than serverless.

Let’s look at the advantages closer:

-

Companies operating in the banking and finance sector must guarantee business continuity and use multiple providers so that they have a system to fall back on in case part of it goes down. Such risk and compliance regulations make them distribute their workload and services in multiple places. The serverless model is great since it is already based on the same model, and the banks no longer have to look for backups.

-

Cost-efficiency and security are also undeniable factors that could greatly benefit financial services. Both stem from the lightweight structure of the serverless models and its flexibility to adapt to changes made to the products. The whole system is very event-driven and maximizes on-demand-only costs, so when services are not required, there is no charge.

-

The scalability element of serverless is also very relevant to the financial services industry since most solutions are variable. A simple example is the risk and repricing calculations that are very temporary but recurring for each client. This already variable calculation gets even more volatile when the sphere includes more than one client.

In such a case, using a serverless model becomes an absolute necessity since you may not be able to afford the marginal server costs that would come with the increasing workload from each client.

Our expertise

As an AWS partner, our team specializes in serverless solutions for startups operating in the fintech industry. Our focus is on creating highly scalable and secure systems that these startups can leverage to improve their service offerings. Our expertise lies in developing serverless AWS architecture through different tools and frameworks, such as the native serverless framework, Laravel Vapor AWS SAM, and a few more.

Let’s review two of our most successful examples of serverless architecture for fintech startups:

- 01

Zedosh is a new digital advertising platform that financially empowers Gen Z. We designed the app’s serverless architecture and built the system from scratch using our in-house talent. The main goal was to create a payment system that is completely secure and easy to use. Plus, the level of security that needed to be ensured was very high, with the same encryption and physical security as the banks.

The initial MVP version was developed and optimized for customer experience in the first two months. One of the main challenges we faced was integrating third-party financial data providers such as Moneyhub; this was successfully done thanks to our skilled developers. The end product we delivered was the working application that is still running on a serverless model.

- 02

Finance Unlocked is the world’s first comprehensive, on-demand, video-delivered learning platform built specifically for finance professionals. This platform isn’t explicitly operating in the fintech industry, but there is a significant overlap since the target audience is finance professionals.

This platform was also built using a serverless model, and underlying systems were set to track real-time analytics to check their learning progress and prove ROI. Finance Unlocked is currently helping brilliant finance professionals improve their skill sets and add significant value to their firms.

Conclusion

Serverless architecture can completely transform how firms consume IT resources and is currently doing so with wide applications in almost all industries. The fintech industry is particularly an interesting use case since it can benefit from its high cost-efficiency, huge scalability potential, and pivoting-friendliness.

As we move towards the future, harnessing the benefits of serverless for such startups will lead to the proliferation of more powerful, functional, and innovative projects. However, since the concept is still relatively new, firms almost always need professional services to understand its application in their line of work.

If you are in a similar situation and wonder how to implement serverless architecture in a fintech startup, it is best to hire a top-notch team to help you do so. Geniusee is a great choice for creating serverless platforms, especially for the fintech industry.