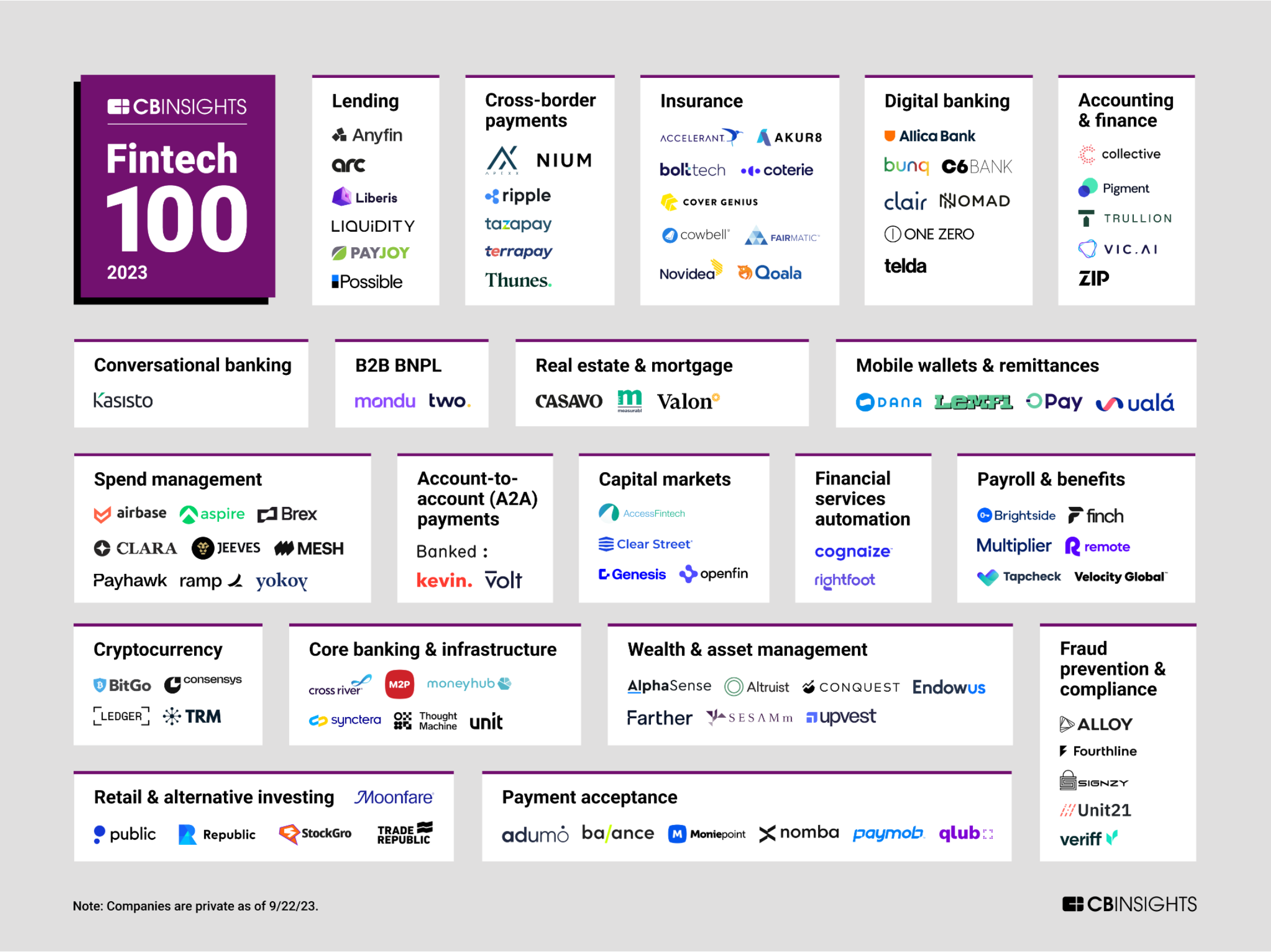

We're thrilled to unveil the winners of CB Insights' prestigious FinTech 100, the annual celebration of the world's 100 most promising private FinTech companies. In this year's cohort, these visionaries are spearheading groundbreaking innovations in A2A payments, spend management automation, embedded finance, and beyond.

This marks the sixth edition of the FinTech 100, formerly known as the FinTech 250, and it's our pleasure to get this elite list and share it with you. Notably, three-quarters of this year's winners fall under the B2B FinTech umbrella, spanning business spend management platforms, cross-border payment wizards, real-time payment pioneers, and core banking maestros.

But that's not all! Among our winners, we've got 24 trailblazing B2C champions. These include challenger banks, mobile wallet wizards, and retail investing marvels, all making waves in the ever-evolving landscape.

Wondering how CB Insights picked these stars from the FinTech galaxy? Their dedicated research team had quite the task, sifting through over 19,000 companies, including applicants and nominees. They relied on a treasure trove of CB Insights datasets, covering equity funding, investor profiles, business connections, R&D activity, news sentiment analysis, competitive landscapes, proprietary Mosaic scores, and Yardstiq transcripts. Thousands of Analyst Briefings from applicants also played a pivotal role in the selection process.

Now, let's dive into some captivating highlights from our FinTech 100 Cohort in 2023:

Overall funding and valuation trends: The funding and valuation trends in the FinTech industry this year are quite diverse, with a range of companies at various stages of growth. From fledgling startups to well-established players, they have collectively secured an impressive $22 billion in equity funding through an astounding 381 deals since 2019 (as of 9/22/23). Among these companies, 31 unicorns have emerged, solidifying their position as privately-held entities valued at over $1 billion.

Early-stage innovation: When it comes to early-stage innovation, the 2023 cohort showcases twenty pioneering companies that are making waves in the industry. They specialize in areas such as B2B BNPL, A2A payments, and mobile wallets. These innovators, including Mondu, Two, Banked, Kevin, DANA, and LemFi, are reshaping the FinTech landscape with their forward-thinking solutions.

Most represented categories: Our FinTech stars are grouped into 20 distinct categories. Among them, "spend management" and "insurance" share the spotlight, each with nine outstanding companies. The spend management category is led by prominent players like Brex and Ramp, who have introduced generative AI features this year. It's also worth noting two newcomers from non-US markets: Aspire from Singapore and Clara from Mexico.

Global reach: These winners proudly represent 24 different countries worldwide. The United States remains a FinTech powerhouse with 43% of the selected companies headquartered there, although this figure is down from 53% last year. The UK follows with 12 winners, while Singapore boasts seven impressive FinTech champions.

Thank you for Subscription!

Novel applications: Innovation abounds in our cohort, with two companies developing large language models tailored specifically for financial services: Kasisto, a conversational AI provider, and Cognaize, a financial document processing platform. In the wealth and asset management category, AlphaSense and SESAMm have harnessed generative AI to enhance their market intelligence platforms, enabling document summarization and extraction.

Within the realm of core banking and infrastructure, embedded finance platforms are making waves in the United States. Leaders like Unit and the early-stage star Synctera are rapidly gaining ground.

Brex: A Disruptive Fintech Company

Brex is a fintech company that is revolutionizing the way businesses manage their finances. Founded in 2017, Brex offers corporate credit cards specifically designed for startups and emerging businesses. What sets Brex apart from traditional banks is its unique underwriting process that evaluates a company's financial health based on its cash balance, rather than relying solely on credit scores. This innovative approach has allowed Brex to provide credit card services to businesses that would typically struggle to obtain credit.

With its seamless integration with popular accounting software platforms like QuickBooks and Xero, Brex simplifies expense tracking and financial management for businesses. The company has also partnered with major players in the industry, such as Visa, to offer additional benefits and rewards to its customers. Brex's disruptive business model and commitment to supporting startups have made it a prominent player in the fintech industry.

Cross River: Revolutionizing Banking Services

Cross River is an innovative fintech company that is revolutionizing banking services. As a provider of banking-as-a-service (BaaS), Cross River partners with fintech startups and companies to offer them access to banking infrastructure. By leveraging Cross River's platform, these fintech companies can focus on developing their core products and services without the need for a traditional banking license.

What sets Cross River apart is its commitment to compliance and risk management. The company ensures that its partners meet regulatory requirements and provides them with the necessary tools and support to navigate the complex world of banking regulations. Cross River's BaaS model has enabled numerous fintech companies to enter the market quickly and efficiently, accelerating innovation in the industry.

Trade Republic: Making Investing Accessible

Trade Republic is a fintech company that is making investing accessible to a wider audience. Traditional investing platforms often come with high fees and complex processes, making it difficult for many individuals to start investing. Trade Republic aims to change that by offering a user-friendly and low-cost mobile app that allows users to invest in a wide range of stocks and ETFs.

One of the key features of Trade Republic is its fractional investing option. This means that users can invest in fractions of shares, making it possible to start investing with even small amounts of money. The company also offers commission-free trading, eliminating one of the major barriers to entry for many potential investors. Trade Republic's user-centric approach and commitment to making investing more accessible have earned them a spot on CB Insights' Fintech 100 list.

C6 Bank: Transforming the Brazilian Banking Industry

C6 Bank is a Brazilian fintech company that is transforming the banking industry in Brazil. With a focus on providing digital banking services, C6 Bank offers a range of products, including savings accounts, credit cards, and investments. What sets C6 Bank apart is its customer-centric approach and commitment to innovation.

C6 Bank's digital-first approach allows customers to access their accounts and manage their finances through a user-friendly mobile app. The company also offers personalized financial recommendations based on users' spending patterns and goals. C6 Bank has quickly gained popularity in Brazil and has become one of the leading fintech companies in the country, challenging traditional banks and driving innovation in the industry.

Casavo: Innovating the Real Estate Market

Casavo is a fintech company that is revolutionizing the real estate market. Buying and selling property can be a complex and time-consuming process, but Casavo aims to simplify it by providing an instant home buying service. Casavo purchases properties directly from sellers, offering them a fast and hassle-free way to sell their homes.

By leveraging data analysis and technology, Casavo is able to make instant offers on properties, eliminating the need for sellers to go through the traditional listing and negotiation process. This innovative approach has not only made selling homes easier for homeowners but also provides investors with an opportunity to diversify their portfolios. Casavo's disruptive business model has earned them a place on CB Insights' Fintech 100 list.

In the ever-evolving world of finance, innovation is key. Companies that are able to disrupt traditional banking and financial services have the potential to revolutionize the industry. One such company that stands out among the rest is CB Insights. With their annual Fintech 100 list, CB Insights showcases the top players in the fintech industry and highlights the companies that are shaping the future of finance.

So, there you have it! A sneak peek into the dynamic world of FinTech through the lens of our FinTech 100.

Stay tuned for more FinTech adventures, and remember, the FinTech world is always evolving, offering endless opportunities for those ready to seize them. Cheers to innovation, collaboration, and the boundless potential of FinTech!