Embedded finance and banking as a service (BaaS) are two emerging trend that is revolutionizing the financial services industry. It is a model that integrates financial services into non-financial products and services, providing consumers with a seamless and convenient way to manage their finances. With embedded finance, consumers can access financial services such as loans, insurance, and investments without having to leave the platform or application they are already using. In this article, we will discuss the concept of embedded finance, how it functions, the various forms it can take, and what the future may hold for this emerging field.

In This Article:

What is embedded finance?

Let's start with the embedded finance definition. Experts define embedded finance as a new trend in modern financial technologies that integrates loans, insurance, debit cards, and investment instruments with almost any non-financial product. It is essential for e-commerce, where the profit and loyalty of the consumer depend on the transaction speed. Why force a client to go to the bank for a loan — fill out a questionnaire, undergo an assessment, and wait for approval — when you can add the option "on credit" or "in installments" to the store's website and help him complete a purchase in 2 clicks?

Today, the financial sector is rapidly evolving under the influence of several factors, including competition from new players, commodity payments, government regulation, and new customer expectations. The recent technological and business reality is constantly emerging, to which it is necessary to be able to quickly adapt — not only for banks but also for FinTech companies. Gone are when FinTech had a monopoly to disrupt the global payments industry. Today, there is confusion: banks are buying up startups and actively developing their digital services, while FinTech seeks to obtain a banking services license and, with its help, independence in decisions, as well as commission income.

Both traditional banks and FinTech companies are facing the challenging problem of expanding their market presence in an environment that is crowded with numerous quality offers. This has resulted in a decline in commission income, partly due to regulatory actions. FinTech startups, in particular, struggle with the challenge of attracting new customers to their brand as the cost of acquisition is significantly high in the face of intense competition from established banks that already offer similar services. One of the few opportunities for these companies is to quickly create specialized products for narrow niches with minimal investment. Meanwhile, the rapid growth of the FinTech sector highlights the banks' inability to quickly adapt to market changes and enter these specialized niches on their own.

In addition to banks, there are many brands on the market with a strong reputation that could provide financial services at a significantly lower cost of attracting new customers. At the same time, they lack the infrastructure and expertise in payments. Moreover, not all companies are determined to develop such services internally, receiving them by subscription via the API. By leveraging embedded finance and BaaS, brands can focus on product development while banks and FinTech gain a new untapped market. Moving to a product and service model and working effectively through partners seems the new normal.

Expand your expertise

Core Open APIs For Banking and Payments

Understanding embedded finance solutions as a change in providing services are more correct, not the emergence of another type. Such processes are typical for the payment industry. For example, in the card industry, contactless EMV payments have steadily replaced contact bank cards and soon will, in turn, be replaced by a tokenized form in a mobile phone. It is essential to understand the underlying driving forces that will lead to the new phase shift.

Embedded finance — how it works?

Simply put, embedded finance services allow any business to manage and market innovative financial services. Every company can now seamlessly integrate creative forms of banking products such as payment, debit, credit, insurance, or even investment into end-user experiences. A straightforward example is paying for a ride with Uber. You will not receive your credit card at the end of the journey. Uber's product designers have made payments built into your app, while the driver gets the right amount at the end of the ride.

Payment facilitation companies such as Stripe and Square have increased over the past decade, bringing these opportunities to digital businesses. They are now worth $36 billion and $57 billion, respectively, expanding their capabilities in other areas.

The complexity increases as you move from payments to debit, credit, insurance, and investment. But if you are a marketer or brand in any sector, you want your offerings to customers to be as attractive as possible. Today, customers have to interact with their banks to get debit and credit cards, sofa, car, or home loans, and there are many disputes between the customer, the bank, and the seller. Below we will look at several options tailored to the needs of individual clients. Klarna has grown into a $5.5 billion company, enabling brands to offer innovative lending customized financial solutions at the time of purchase, such as through installment payments.

Lambda School offers online training for potential programmers. It provides various payment options, including an income-sharing agreement that charges students a portion of their future income rather than an upfront tuition fee. The student contacts the school directly about this and other proposed payment options rather than seeking a bank loan. It can be attractive to everyone.

The integration of the financial services industry is also overgrowing. For example, you can provide your car-sharing service with automatic mobility insurance or give your new camera protection against theft and damage right out of the box for the total cost. Some of this is happening today. British Airways offers travel insurance on its website when you purchase your flight. But so far, these embedded finance offering for brands and sellers has not been quick or cost-effective. They are generally generic and managed by the insurer rather than customized by the brand in real-time.

Ultimately, the financial industry will fade into the background of the solution offered to the client. British Gas has already stopped selling "boiler insurance." It now provides "remote boiler maintenance" (thanks to IoT-optimized underwriting), a much more attractive proposition.

Embedded finance — as opposed to resale financial services — is attractive to digital brands and merchants because it creates new revenue opportunities at meager marginal costs (the brand already has a customer base). It provides new customer relationships that drive loyalty and repeat online transactions and allows sellers to understand relationships' economics better.

It could potentially allow them to double their revenue per customer by two to five times for software companies. For example, Shopify, a B2B e-commerce platform, currently makes over $500 million a year from the financial department for its sellers (growing at around 50% per year). The underwriting cost is much lower as Shopify already has vast data about its users. For many software and platform companies, financial services will become an increasingly profitable addition to their core business.

Examples of Embedded Finance

Installment payment services (BNPL) are seamless lending that integrates especially well with large online stores and marketplaces — OZON, Shopify, Amazon, and Walmart. Clear business history and the ability to work in isolation make these services attractive to embed in a service model. Again, according to a Solarisbank report, 42% of people surveyed in Germany have used Klarna, one of the largest BNPL services, at least once in the past 12 months. There is a difference from 95% for PayPal, but the penetration rate is very high even in conservative European markets.

The offer of KYC services in the form of an embedded service, although not directly a financial service, is, however, a part of the necessary infrastructure, without which it will be impossible for non-banks to provide financial solutions. By the way, there are quite a lot of companies in the embed finance market that provide this type of service, which can be partly explained by the rapid development of alternative finance in blockchain ecosystems, which are forced to use KYC under pressure from regulators.

The video game economy is another large segment in which financial products can be applied. For quite a long time, almost the only option for economic interaction was selling a game account on unofficial sites. However, the leverage of embedded finance as blockchain technologies and smart contracts led to the emergence of the GameFi direction. The in-game currency is traded on crypto exchanges, as are in-game items in NFT form. The potential of this area is enormous. For example, the token capitalization of one of the first Axie Infinity games is currently more than $8 billion.

In addition to the full set of DeFi financial tools, it remains possible to work with traditional financial instruments, allowing you to make online purchases on an installment plan or on credit.

BaaS platforms are in great demand among neo banks, for which it is extremely important to be able to focus on the product without being distracted by building the payment infrastructure, which they can get through the API. A prime example is the ClearBank-OakNorth alliance or the Solarisbank-Tomorrow collaboration. Large banks can launch niche neobanks based on BaaS solutions, accelerating time to market, reducing transaction costs, risks, and embedded investments in infrastructure. For example, Crédit Agricole did this with a digital bank for freelancers Blank and BN Amro with the Moneyou neobank.

By the way...

Building a neobank: a complete guide

Here's a real cases on how to build a neobank based on our experience

Read the full guideBenefits of Embedded Finance

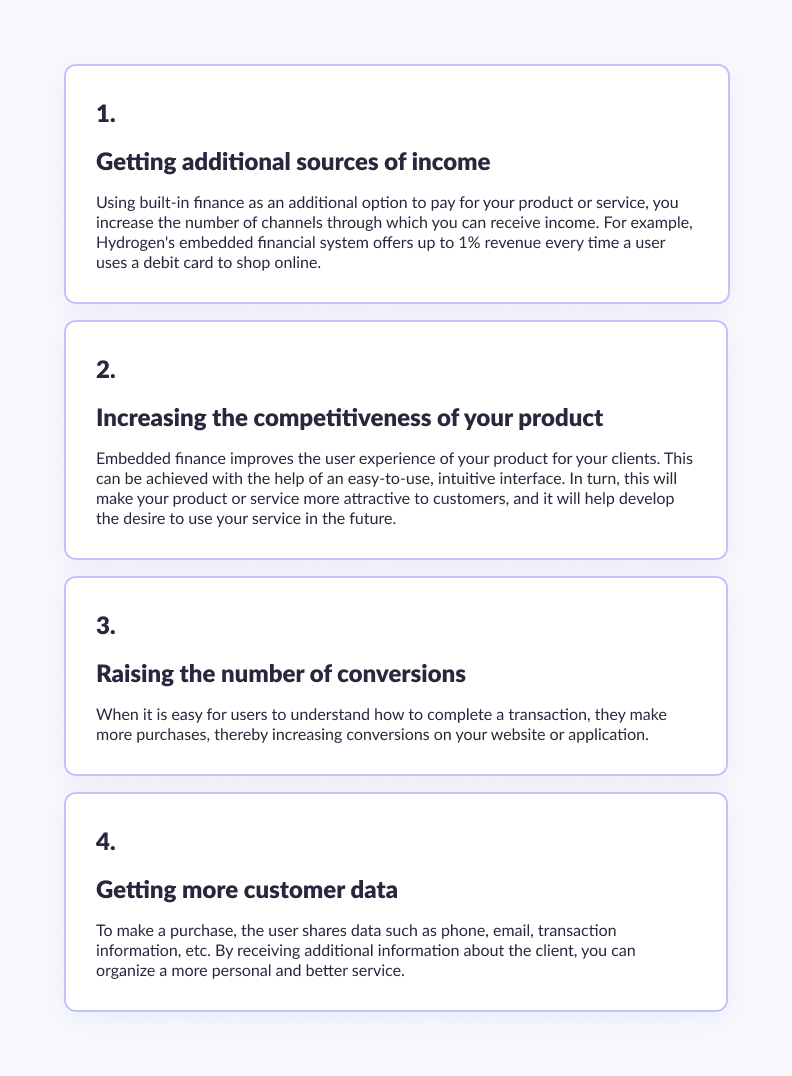

Of course, embedded finance has a number of benefits for both users and businesses. But today, we will dwell on the benefits for business in more detail.

1. Getting additional sources of income

Using built-in finance as an additional option to pay for your product or service, you increase the number of channels through which you can receive income. For example, Hydrogen's embedded financial system offers up to 1% revenue every time a user uses a debit card to shop online.

2. Increasing the competitiveness of your product

Embedded finance improves the user experience of your product for your clients. This can be achieved with the help of an easy-to-use, intuitive interface. In turn, this will make your product or service more attractive to customers, and it will help develop the desire to use your service in the future.

3. Raising the number of conversions

When it is easy for users to understand how to complete a transaction, they make more purchases, thereby increasing conversions on your website or application.

4. Getting more customer data

To make a purchase, the user shares data such as phone, email, transaction information, etc. By receiving additional information about the client, you can organize a more personal and better service.

Types of Embedded Finance

There are several types of embedded finance. Let's take a deeper look at this question.

1. Buy Now Pay Later (BNPL)

Definition

Buy Now Pay Later (BNPL) is a payment option that allows customers to buy products or services and pay for them over time through a series of interest-free or low-interest installments. BNPL is typically offered by third-party companies that partner with retailers and eCommerce platforms to provide financing options to customers.

Examples

Some popular BNPL companies include Afterpay, Klarna, Affirm, and PayPal Credit. These companies partner with a variety of retailers, from small businesses to large eCommerce platforms, to offer BNPL as a payment option at checkout. Customers who choose to use BNPL typically make an initial payment, followed by a series of payments over several weeks or months until the total cost of the purchase is paid off.

Benefits for Business Owners

BNPL can offer several benefits for business owners. First, it can help increase sales by making it easier and more affordable for customers to make purchases. Second, it can help attract younger customers who are interested in alternative payment options. Third, BNPL companies typically handle the financing and risk assessment, which can help reduce the burden on the retailer's finance department and increase customer acquisition.

Benefits for Users

BNPL can also offer benefits for customers. First, it can provide a more flexible payment acceptance option for customers who may not have the funds to make a large purchase upfront. Second, BNPL companies often offer interest-free or low-interest financing options, which can be more affordable than traditional credit cards or personal loans. Third, BNPL can help customers build credit by making regular payments on time.

Challenges

However, BNPL can also present some challenges. First, some customers may be tempted to overspend or take on debt that they cannot afford to repay. Second, late or missed payments can result in fees and damage to the customer's credit score. Third, there is the potential for customers to become reliant on BNPL financing, which can lead to financial instability in the long run.

2. Embedded Insurance

Definition

Embedded Insurance is a type of insurance that is integrated into the purchase process of a non-insurance product or service. This means that insurance coverage is automatically included in the purchase of another product or service, such as a car, a phone, or a vacation package.

Examples

There are many examples of Embedded Insurance in various industries. For example, when you buy a car, you can often choose to include insurance coverage with your purchase. This is a form of Embedded Insurance. Similarly, when you book a vacation package, you may be offered the option to include travel insurance with your purchase.

Benefits for Business Owners

Firstly, it provides an additional revenue stream, which can be a significant source of income for businesses. Secondly, it can increase customer loyalty as customers appreciate the convenience of having insurance coverage automatically included in their purchases. Thirdly, offering Embedded Insurance can give businesses a competitive advantage by differentiating them from competitors who do not offer similar coverage.

Benefits for Users

Embedded insurance is convenient, as users do not need to go through the separate process of purchasing insurance coverage, which can be time-consuming and confusing. Moreover, it provides peace of mind, as users can feel secure knowing that they have insurance coverage for their purchase without needing to worry about finding coverage separately.

Challenges

The biggest challenge is a high level of regulation, and there may be regulatory challenges to offering Embedded Insurance in certain markets. Also, users may not have as many options for insurance coverage when it is embedded in a product or service, which could lead to coverage that is not as comprehensive as it could be.

Thank you for Subscription!

3. Embedded Investing

Definition

Embedded Investing is an integration of financial investment opportunities into non-investment products or services. This implies that customers can invest in assets or securities without having to go through a separate investment process.

Examples

When you make a purchase using a credit or debit card or digital wallet with a cashback function, you may be able to invest the cash-back rewards in a variety of assets. Another example is the integration of investment opportunities into online shopping platforms, where customers can invest in the stocks of the companies whose products they are purchasing.

Benefits for Business Owners

It provides an additional revenue stream, which can be a significant source of income for businesses. It can also increase customer loyalty as customers appreciate the convenience of having investment opportunities integrated into the products or services they are already using. Additionally, it can help businesses differentiate themselves from competitors by offering unique and innovative investment options.

Benefits for Users

First of all, it is convenient, as users do not need to go through a separate investment process to access investment opportunities. In addition, it provides a low barrier to entry for novice investors who may be intimidated by traditional investment platforms. It can potentially lead to higher investment returns as well.

Challenges

Unfortunately, it can be difficult to provide investment options that are appropriate for all customers, as different customers have different investment goals and risk tolerances. Considering the fact that investment opportunities are integrated into non-investment products or services, there may be a lack of transparency regarding the risks and fees associated with the investment options. Finally, there may be challenges related to customer data privacy and security, as the integration of investment opportunities may require access to sensitive customer information.

Your way through FinTech

Everything you need to know about FinTech collected in one guide presented by top Geniusee experts

4. Embedded Payments

Definition

Embedded payments refer to the integration of payment processing capabilities into third-party platforms or applications. This means that businesses can accept payments within their own software or app without requiring customers to leave the platform to complete the transaction.

Examples

There are several companies that have already used the advantages of embedded payments. As an example, we can consider PayPal Checkout, Stripe Connect, and Square's APIs. These platforms allow businesses to integrate payment processing into their websites or apps, enabling customers to conduct transactions seamlessly without leaving the platform.

Benefits for business owners

Embedded payments can streamline the checkout process and improve the overall user experience, leading to higher conversion rates and increased revenue streams. Additionally, it allows businesses to maintain brand consistency and control over the customer experience. Finally, integrated payments reduce the administrative burden on businesses as payments and order data are automatically processed and recorded.

Benefits for users

This technology simplifies the checkout process by reducing the number of steps required to complete a transaction, which can improve the overall user experience. Moreover, integrated payments may offer additional security measures such as two-factor authentication or biometric authentication to protect sensitive financial information.

Challenges

The main challenge of embedded payments is the potential for security vulnerabilities, which can put both businesses and end customers at risk. Also, integrating payment processing can be complex and time-consuming for businesses, requiring expertise in both technology and finance. Finally, businesses must comply with various regulatory requirements around payment processing, which can add complexity and cost to the integration process.

More on the topic

AI in Fintech: How to stand out from the competition?

With increasing levels of process automation and digital transformation of financial services, the use cases of AI and machine learning in the finance industry are everywhere, from secured digital transactions to personalized financial advice.

Read moreUse Cases Of Embedded Finance

A classic business model is integrating conventional payment services into non-banking companies, for example, the alliance of the Mexican BBVA and Uber. Due to the extended functionality of the merchant application, drivers can receive payments within a few minutes, as well as get direct access to loans, discounts, and cashback at a gas station.

Moreover, such embedded services can be not only from the acquiring side but also from the emission side. For example, watchmaker Swatch provides the ability to issue tokenized payment cards on a number of its watches through SwatchPay. Amazon and Apple offer their own credit cards.

How is it revolutionizing financial services?

When planning the implementation of promising innovations for traditional financial institutions, it is essential to understand whether this solution is a bold experiment or a necessary part of the service that competitors will offer in two or three years. In both cases, an error can lead to losses, and it is not yet known in which version they will be greater.

Embedded financial services refer to non financial companies that have value propositions that expand significantly or even transform with embedded-related financial products and services.

The experience of global companies in various verticals, from search engines (Google with Google Bank) to on-call services (Grab with GrabPay) to marketplaces (Amazon Pay), shows that embedded finance providers have an advantage in offering financial services through distribution, data, and resources.

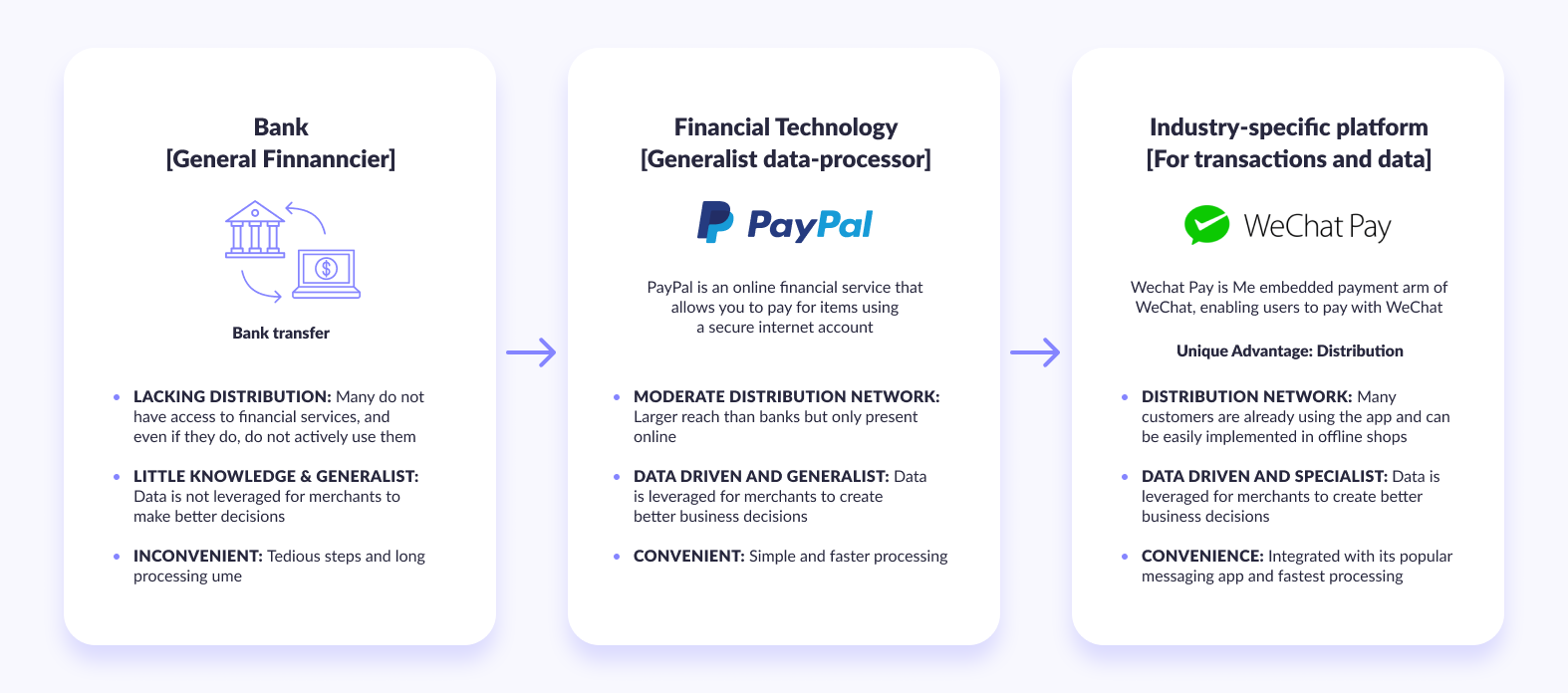

At a high level, we see a three-step evolution in financial services.

- First, it came from banks and other financial institutions, universal financial institutions. For example, bank transfers as a means of transferring money from one organization to another.

- Second, the Great Bank Separation led to the emergence of many first-wave FinTech companies that focused on using technology to provide financial services outside/on top of the traditional banks’ process. For example, Paypal for online payment.

- Third, the great democratization of financial services has led to certain financial transactions (potentially segmented by customer or industry type) that are better served or distributed by specific petro-technical platforms. For example, WeChat Pay for p2p payment transfers.

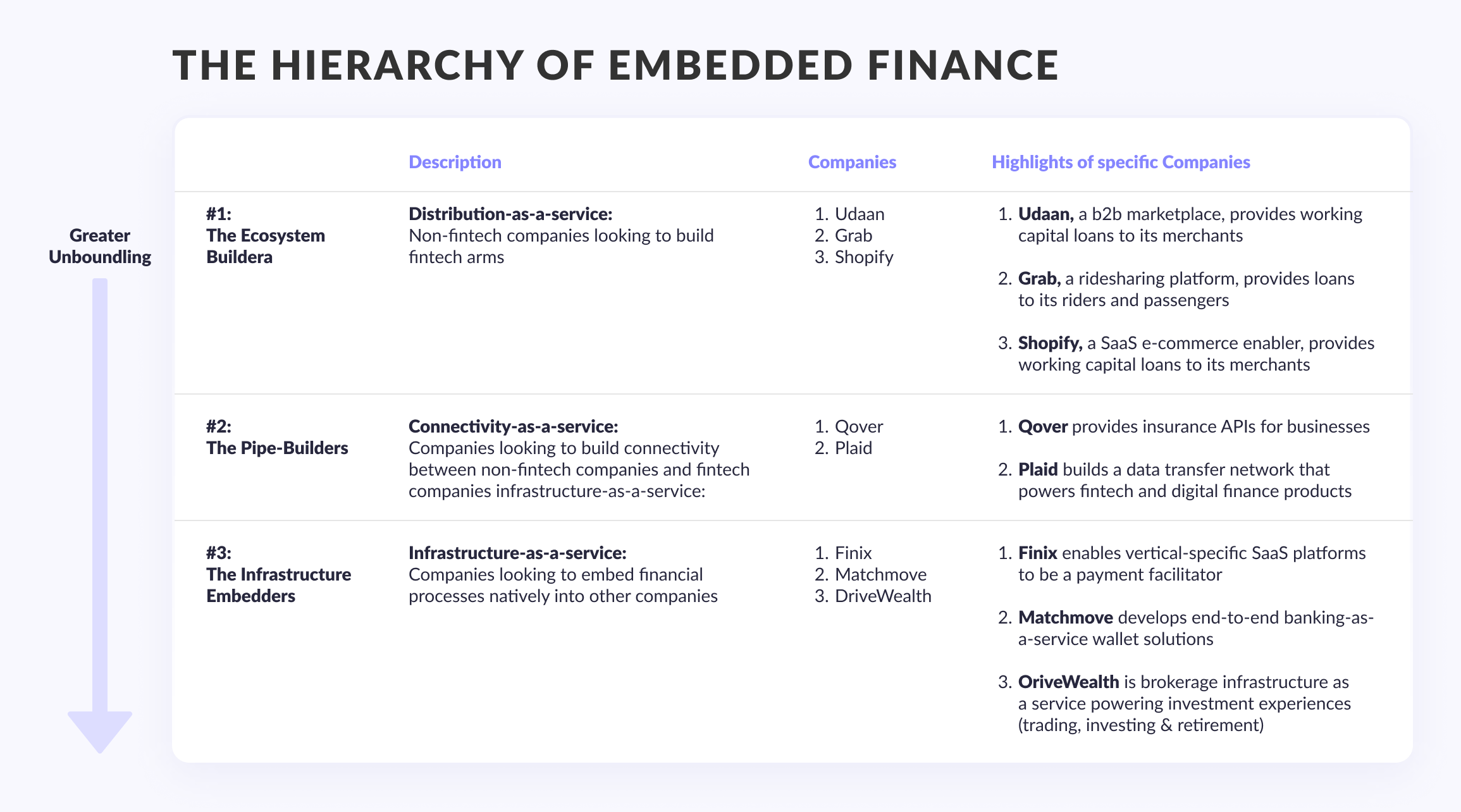

It is important to note that by conducting a global scan of the embedded finance industry, we see that startups are taking advantage of an even greater separation of the various stages of the financial value chain. Overall, we see three main ecosystem stages that correlate with the complexity of the embedded finance ecosystem.

The first phase focuses on distributing financial services through the existing platform. We see that this is more common in Asia, where distribution and education remain the central issue. These companies are looking to focus on building an ecosystem of services that seek to integrate deeply into the value chain within their specific vertical. The Shopify mentioned above, Udaan, Grab, and others in this space.

The second phase aims to provide communication between FinTech and non-FinTech companies. It is an acknowledgment that financial services are complicated to manage correctly (especially for companies without institutional knowledge and capital investment). The catalysts for this are twofold: regulators insist that products and services remain in the hands of banks, and banks want to engage in advanced financial technology. By focusing on connectivity, these companies optimize the distribution of financial services. Companies in this area include Flexmoney, Plaid, Instacred, etc.

The third stage aims to integrate financial processes through the existing platform. As platform ecosystems grow more significant with more payment/transaction flows on the forum, reliance on external financial processes (payment processing, facilitation, etc.) becomes more prominent. While it may not make economic sense to build and maintain such platforms in-house, startups provide an opportunity for B2B companies to embed white-label finance from the outset into their digital ecosystems. Companies in this space include Finix, Matchmove, and DriveWealth, which are focused on allowing existing ecosystem players (like Shopify) to offer their white-label financial stack. For example, Finix will enable digital platforms to have their network to facilitate payments. It will allow such e-commerce tools (like Udaan) to have their internal payment stack. They can then start charging a variable rate, negotiating with appropriate partners, etc., emphasizing infrastructure as a service. They are building more robust proprietary financial ecosystems.

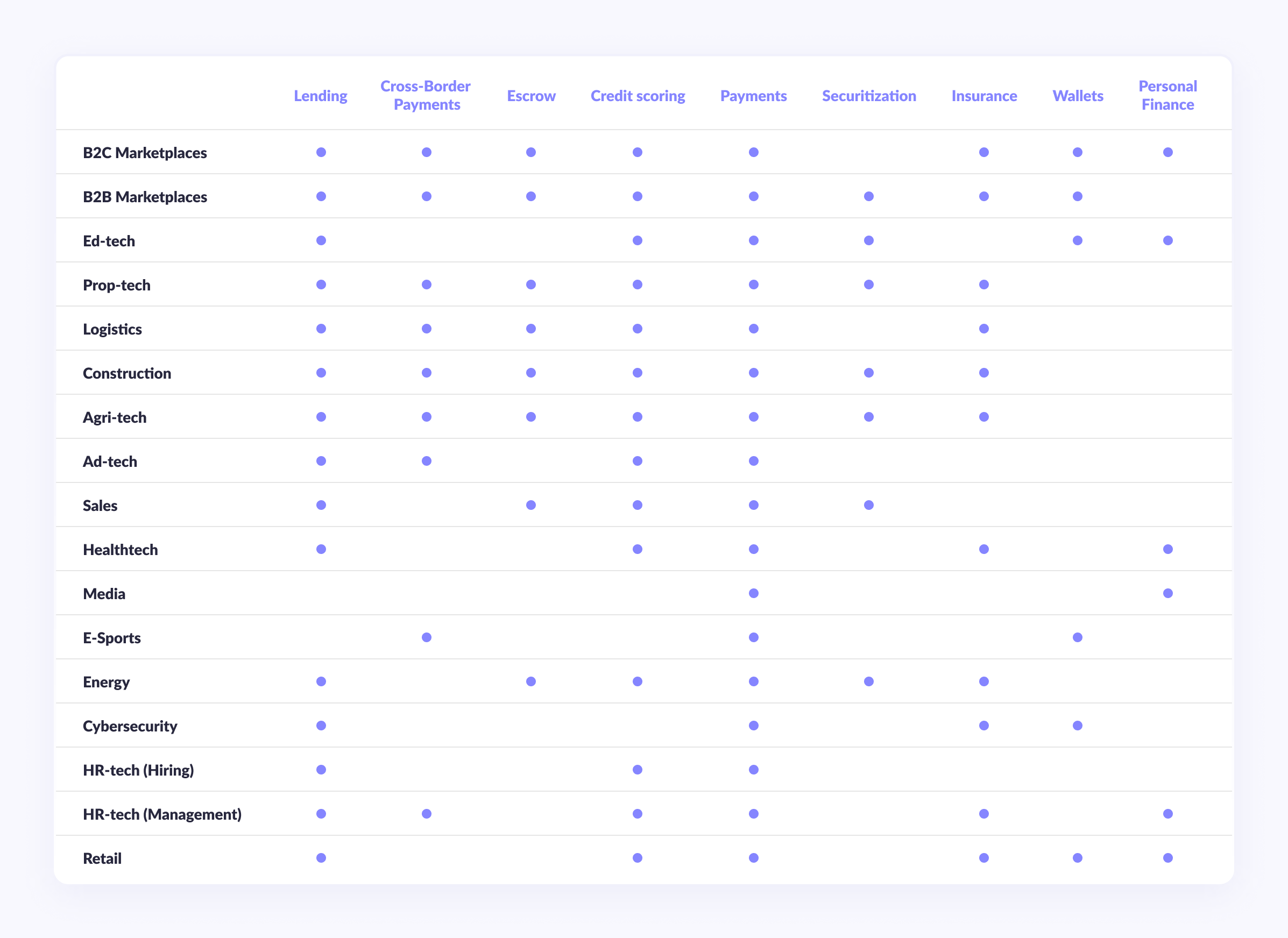

Below you can see a high-level map of what the potential opportunities in various industry verticals might look like.

The opportunities to offer embedded finance are exciting as fundamental levels of digitalization occur in traditional industries. It allows companies traditionally unrelated to financial technology to build financial services. As embedded finance companies continue to separate financial processes, the hierarchy of separation that we see will be repeated in ecosystems worldwide.

By learning from what is happening around the world in the US, India, China, and other ecosystems, we see the future of embedded finance platforms.

Trends in the Embedded Finance

At the moment, there are several significant trends for BaaS and embedded banking that are critically important for banks to track to keep up.

1. All in one

Human attention is the critical currency of the 21st century. Much of this attention is channeled through a smartphone that has hundreds of mobile apps installed, including social media. Because it is tough to keep in mind the laws and structure of each service, people naturally gravitate towards ecosystems of different, equally organized products that third-party partner companies can provide.

2. Natural demand

FinTech organizations have created a robust global demand for payment services that consumers expect from extensive technology and other non-banking companies. According to a study by Solarisbank, 61% of respondents are willing to use provided by brands they trust. Moreover, such companies cannot cope with this request on their own due to complex regulatory restrictions and the lack of the necessary expertise. BaaS presented as a boxed solution ideally addresses this market demand.

3. Open API

Currently, the Open API reflects two trends. First, this is the transition to the Web 3.0 paradigm, within which each person owns all their data and can quickly revoke access to them from third parties. Secondly, central banks have a regulation that introduces directives like PSD2 to stimulate the development of quality services and competition.

At the same time, PSD2 quite clearly divides market participants into account operators and financial providers. Having lost the exclusive right to be the sole service provider for its client base, the bank can sell payment expertise and infrastructure to those who will try to take advantage of technological and market changes.

4. Technological changes

The move from mono-core architecture to microservices and containers made it technically easier to create dedicated services. By gradually bringing all their IT systems to a set of dedicated services and APIs, the same banks will find it easier to perceive the idea of providing their services in the form of White Label embedded financial products to other companies.

Accordingly, companies looking for an opportunity to integrate embedded finance products into their ecosystem are now beginning to perceive payment services as a set of modules assembled by other companies as well. In turn, the issuance of loans, embedded payments, and deposits are, for them, nothing more than an extension of the existing product line, an extension of the user experience. It becomes easier for most banks to make decisions about launching technically accessible and ideologically understandable projects.

Thus, technological, regulatory, and economic changes converge at one point, unexpectedly tightly correlated with the demand from end-users. They, in turn, expect a simplification of the user experience when interacting with financial products and are also less and less of the opinion that financial services should be provided exclusively by banks.

Do you know?

Top digital trends that reshaped the financial world

All challenges of modern world influence financial world and reshape its landscape. Find out how

I want to knowInstead of conclusion

Embedding financial services allows you to integrate payments, debit cards, loans, insurance, and even investment instruments into almost any non-financial product. For example, you can get embedded lending directly on the digital platforms of an online point of sale or a supplier company without filling out questionnaires. And users can transfer money through applications that, it would seem, have nothing to do with finance. This approach will increase the profits of banks and FinTech, as it will allow them to compete with players who are trying to drive customers into their embedded banking applications.

Order FinTech software development and implement all the benefits of embedded finances in your business.