Loan origination software (LOS) accelerates the loan process by 70% while trimming operational costs by 30% and managing regulatory compliance with no additional staff. Only an expandable and adaptable LOS can effectively manage the full loan lifecycle and boost customer engagement when commercial loans become intricate.

The loan origination software market is projected to reach over $11.44 billion by 2032, while maintaining a 10.73% Compound Annual Growth Rate from 2024 to 2032. Currently, 72% of banking customers handle their finances online. The rising commercial lending competition requires financial institutions to use AI-powered flexible LOS to acquire a strategic advantage.

The following article shows how LOS drives faster loan handling while minimizing risks and delivering better service outcomes.

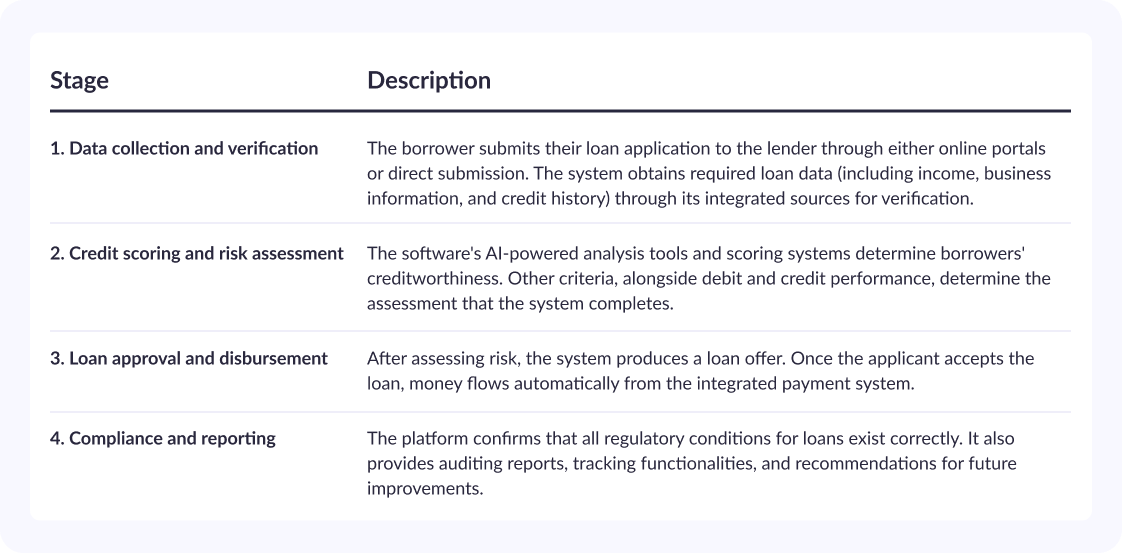

How loan origination software works

LOS simplifies loan operations, delivers instant decisions instead of weekly waits, and reduces errors to around 90%. At the same time, regular loan origination proceeds through these stages:

LOS speeds up lending processes and enhances precision by automating primary operations, supporting better lending choices, and reducing business expenses.

LOS essential elements that operate in platforms

Currently, LOS contains several essential components that make the commercial lending process more efficient, accurate, and compliant. Key components of today's LOS and their measurable business benefits:

1. Application management

Database automation reduces application processing time by 80% and eliminates data input errors, improving conversion rates by up to 25%.

Tiimely Home is an Australian platform-based fintech company that offers automated digital home loan services for retail borrowers. Their platform generates virtual credit cards within 20 minutes and approves new applications in less than 1 minute to speed up all operations in the loan application sequence.

2. Automated decisions

Decision-making algorithms enable instant loan approvals, eliminating the delays associated with traditional day-long review processing. The system undergoes regular assessments for non-biased characteristics to meet anti-discrimination requirements.

Fair lending practices are supported by models that undergo regular audits, are trained on diverse datasets, and comply with anti-discrimination laws.

By using straight-through processing (STP), JPMorgan automated its loan data transmission process, resulting in fewer errors, faster operations, and reduced loan handling delays.

3. Document management

A centralized storage system maintains secure access to all documents during audits because it provides real-time tracking, versioning, and access control features.

Advanced document processing:

Loan origination systems are more than simple loan storage and include Document AI tools. They allow documents to be processed automatically, classified, and data extracted from sources such as tax forms, pay stubs, or IDs, improving processing speed and data accuracy without manual work.

Organizations save time on audits, have more accurate loan files, consume less administrative effort, and can maintain high data security.

By implementing its loan origination system, LendFoundry developed an automated hard money lending origination system, which provided flexible workflows. Secure document management capabilities within the system made it possible to store and retrieve loan documents efficiently, reducing compliance process durations.

4. Compliance monitoring

The automated monitoring system protects lending practices from non-compliance with local and international lending regulations.

Planning compliance reviews decreases the likelihood of receiving penalties from authorities.

Thank you for Subscription!

Benefits of loan origination software

1. Intelligent risk management

The system calculates risks in mortgage applications using AI-driven scoring and documented mortgage data from the past. It evaluates current market activity and borrower characteristics to predict high-risk applicants, which leads to recommended modifications of loan terms and interest rate adjustments.

Risk assessment models get better through constant updates using new data from the system.

Financial distress signals and inconsistent information appear on LOS platforms at the start of the process.

The combination of financial institutions' tools helps decrease default rates and enhance portfolio performance.

2. Personalized lending offers

Modern loan origination platforms analyze borrower income data, credit history, and payment behavior to craft unique loan offers with individualized rates and payment terms. Such customization impacts a higher approval rate and better customer loyalty. AI algorithms identify real-time patterns based on user behaviour that drive term optimization processes.

The system generates specific recommendations for the loan amount, interest rates, and repayment durations.

The system enables lenders to focus their promotional deals on particular customer types.

Better customization methods help customers stay with your company and encourage them to return for additional transactions.

However, explainability is critical. Despite using these models, lenders must verify that they make justifiable decisions while meeting fair lending requirements. Visually similar systems to ChatGPT need proper governance because they require bias elimination steps and transparent processes.

3. Easy integration with third-party systems

The modern LOS permits step-by-step data flow with external services, including Experian, Equifax, and TransUnion (credit bureaus), Plaid or Yodlee (banking APIs), Stripe or PayPal (payment processors), and Jumio or Onfido (identity verification). The automated data sharing system replaces traditional manual data input methods.

Instant credit score checks and identity verification procedures speed up the approval process.

APIs manage secure, real-time, cross-platform transmission of precise information.

The connection between regulatory and document verification tools simplifies compliance documentation systems and KYC/AML workflows.

4. Data-driven decision-making

This data enables lenders to revise their loan policies through better underwriting models and helps them identify fresh business prospects.

Predictive analytics produces forecasts regarding borrower default rates while showing how borrowers repay their loans.

By analyzing identified risk grades, you can use AI insights to modify their interest rates and loan terms.

Financial institutions achieve better lending strategy performance through real-time tracking of their operations.

5. Adaptability to regulatory changes

Financial regulations change frequently, so non-compliant activity can result in severe fines and damage your reputation. Commercial loan origination systems incorporate built-in functions that automatically update lending laws at both national and international levels.

Since the system includes built-in regulatory checks, all loans follow jurisdictional requirements.

The system creates extensive audit records, which simplify regulatory reporting processes.

The automation of regulatory compliance updates eliminates the requirement for manual labor.

6. Enhanced fraud detection

Today, loan origination platforms utilize AI algorithms and machine learning to stop and identify fraudulent activities among borrowers through user behavior and financial transactions analysis. These systems analyze abnormal patterns to recognize potential risks, which saves you from big losses while safeguarding your assets.

The system analyzes borrower information across different database records through AI to spot irregularities, which helps minimize fraud opportunities.

The system embeds real-time monitoring capabilities, which enable it to identify atypical behavioral patterns when processing loan applications, thus allowing quick fraud detection.

Through TigerGraph and similar tools, you can identify invisible fraud networks by tracing relationships between debtors, their transactions, and other available data elements.

7. Faster time-to-market for new products

Using configurable loan origination platforms allows lenders to deploy new loan products at lower development costs and faster creation speeds. Organizations in the lending industry can modify product specifications, interest rates, and qualifying criteria based on current market conditions.

The modular systems design enables organizations to adapt rapidly to changing market situations.

New products can reach the market more swiftly because of minimized development periods.

The scale capability enables businesses to add new products without affecting the operation of existing services.

8. Increased operational efficiency

LOS automates manual processes such as data collection, document handling, and risk assessment, thereby saving time on loan processing and decreasing operational costs. Lenders can then fulfill the increased loan volumes without employing additional staff.

It helps in shortening the approval time from days to hours through automated workflows.

A reduction in manual processing means fewer staffing costs.

It helps streamline operations and improves overall business agility and customer satisfaction.

More from our blog

Integrated banking system: strategies, challenges

Learn best practices for core banking integration and open banking transformation today.

Read more9. Improved customer experience

A platform automates the loan's conversion and movement between the loan cycle's phases. It helps speed up the loan origination process to reduce waiting times and provide borrowers with instant decisions. Higher customer satisfaction translates into a smoother experience, which translates into higher customer satisfaction and, therefore, stronger client relationships.

Borrowers can also use self-service portals to track application status in real-time.

Borrower trust and confidence increase with fast decisions.

A good lending experience increases the likelihood of repeat business and long-term customer retention.

10. Lower costs and higher profit margins

Automation reduces labor costs and lessens errors with proper resource allocation, which increases profitability. An increase in the capacity for larger loan volumes will decrease the bottom line for lenders.

Fewer reworks and processing delays lead to greater operational efficiency.

Profit margins increase as the costs go down.

Reducing the risk of damaging disputes and defaults brings loan accuracy to its peak level.

Challenges in commercial loan origination

Even though LOS offers many benefits, incorporating and using it presents challenges. Lenders must identify these potential hurdles and prepare their systems as well as possible.

1. Regulatory compliance

The environment in which we can lend contracts constantly evolves at all levels as new requirements grow. This creates a lot of complexity for financial institutions because banks are mandated by laws such as GDPR and anti-money laundering regulations.

Because of regulatory changes, the loan processing procedures, risk model, and customer verification protocol need to be immediately updated.

LOS that can receive automated updates will quickly adapt to changes in the operating environment and legal and regulatory requirements without significant disruption.

Nevertheless, staying current with regulatory changes and the system's capacity to adapt ad hoc to real time is necessary.

2. Data security & privacy

LOS processes a large amount of data containing customers' financial records, personal information, and credit history. Given the daily rising cyber threats, security for such data is of significant concern to lenders and borrowers.

Legal consequences, reputational damages, and loss of customer trust are harmful side effects of a data breach.

For modern loan origination platforms, end-to-end encryption, multifactor authentication, and secure access protocols are the core requirements for protecting sensitive data across its life cycle.

Strong cybersecurity measures and regular audits are essential to protect data privacy and comply with the GDPR or other regulatory standards.

3. Integration with legacy systems

Legacy systems built for a modern digital world, which many financial institutions still use, are a reality. Integrating LOS with these older systems can be challenging.

Other reasons could include outdated technology in legacy systems that is difficult to update with new lending software.

The new LOS will enable APIs and have a scalable, flexible platform architecture that allows it to integrate with existing systems easily without disruption.

Such integration can require a significant upfront investment in resources and time. Still, integration enables this work, leads to workflow efficiency, and unlocks the full potential of the loan origination platform.

4. Change management and user adoption

Despite the best technology, transitioning to a new loan origination system is subject to employees’ resistance to changing away from legacy processes. This can be time-consuming and expensive, as staff need training, you must update procedures, and all stakeholders must know how to use the new system.

Delays in full adoption of the software and lower effectiveness may result from resistance to change.

This necessitated financial institutions to invest in comprehensive training programs led by the organizer, good user support, and easy adoption throughout the organization.

By clearly communicating the new system's benefits, buy-in can be factored in to help facilitate the transition.

5. Cost of implementation

While implementing, customizing, and integrating LOS with other systems can be expensive in the long term. This is a barrier to adoption for smaller lenders or those with limited resources.

Commercial lending software purchase costs, staff training, and possibly updating the existing infrastructure to support the new system.

Cloud-based solutions may be cheaper to enter and less expensive to scale, as little or no capital is typically required upfront to initiate service.

However, lenders should consider the total cost of owning the system, including maintenance, updates, and any additional features or customizations they may require.

Conclusion

Your business needs the correct LOS to succeed in a competitive commercial lending market. It is a strategic investment. With loan origination software, you can optimize operational management, create smarter choices, and improve customer satisfaction with decreased operational risks.

Picking a commercial lending solution that meets all requirements of proven performance, customization, compliance, and security performance will 100% lead your business toward success. This approach allows your operations to maintain efficiency, scalability, and resilience to market evolution.

Moreover, selecting the proper loan origination system can help develop customer relationships and achieve long-term organizational success. Contact us so our software platform can help your business lending achieve maximum performance!

FAQs

How does loan origination software improve compliance?

LOS improves compliance for financial institutions by automatically updating regulations. It tracks commercial lending laws nationally and internationally, reducing the risk of fines and ensuring consistent operations with current legal requirements.

Can loan origination software integrate with existing systems?

Modern loan origination software effortlessly connects with older systems using APIs. It shares data efficiently with existing tools like CRM and accounting programs. This flexibility lets your business use new and old technologies, benefiting from past and current solutions.

Is loan origination software secure?

Modern LOS prioritizes security using encrypted data, multi-factor authentication (MFA), and secure data storage to protect sensitive customer information. Your institution’s data is protected by regular security updates that combine data redundancy solutions with strict access controls to meet GDPR and PCI DSS regulatory standards.