Regulatory pressure is increasing, expectations are growing, and compliance teams are under stress as never before. AML, KYC checks, data privacy, and capital rules require precision, speed, and cost-effectiveness. With rising complexity, automation is no longer optional but the only way to stay compliant and audit-ready.

The worldwide RegTech market is expanding rapidly. Between 2025 and 2033, according to research, the sector will reach $83.8 billion with an annual growth rate of 18%. VC funding continues to pour into RegTech startups, fueling rapid product innovation. Over half of central banks use regulatory and supervisory technology tools to enhance data collection, validation, and analysis, highlighting their growing importance for regulators.

Behind the market numbers lies the real story: how RegTech platforms use AI, automation, and data integration to transform compliance. Let’s look closer at how these solutions work in practice.

Key takeaways

Better ways to comply. AI automates AML/KYC checks and improves audit reporting.

Technology powers compliance. Blockchain, RAG models, and ML not only provide real-time tracking but also automate processes.

Cost and efficiency: RegTech will help save money and mitigate the risks associated with regulation, while improving the cash business.

Adoption across the industry: Banks, fintechs, insurers, and central banks are adopting RegTech as an effective risk management approach.

How RegTech works: Technology behind the transformation

Use of ML, Blockchain, and AI

RegTech platforms use advanced analytics and distributed ledger technologies to turn raw data into actionable compliance insights. Analyzing AI patterns within immutable transaction records enables firms to efficiently monitor regulatory compliance.

Real-time anomaly detection: ML models continuously evaluate transaction flows and client behaviour to detect money laundering, fraud, or insider trading risks. Tools like TigerGraph improve this process by uncovering hidden relationships between individuals and accounts and suggesting fraudulent networks or coordinated actions.

Automated text analytics: RAG systems retrieve regulatory text and produce structured summaries of updates. This allows users to access new regulations quickly and integrate them into internal policy processes.

Transparent audit trail: Blockchain offers a secure record of all compliance events, making external audits and internal checks easier.

Regulatory monitoring, reporting, and compliance automation

AI transforms processes that used to take weeks into real-time operations. These technologies make compliance more precise and straightforward to execute, such as RAG, anomaly detection, and connected reporting tools.

Rule ingestion: APIs automatically make updates from world regulators and translate them into a machine-readable format, either XBRL or JSON.

RAG interpretation: RAG models find historical data, summarize new laws, mark major changes, and link these to your internal controls.

Automated rule mapping: New rules are separated into categories (e.g., AML, ESG). They relate to corresponding policies, procedures, and other control measures implemented in your organization.

Data integration: Connectors are embedded within the system that enable real-time data synchronization with the main systems, allowing for continuous compliance checks.

Anomaly detection: ML models utilize transaction and communication monitoring to identify the risk of fraud, market abuse, or insider trading.

Instant reporting: Creates audit-ready reports under SEC, FCA, etc., which are 100% pre-filled and regulator-compliant.

Dashboards and audit trails: Compliance teams can monitor everything and assess their readiness with interactive dashboards and immutable logs.

Standardizing regulatory processes with low-cost technology solutions

Standardized regulatory processes with cost-effective technological solutions deliver services through cloud-native and SaaS platforms. Both reduce costs while speeding up time-to-value calculation.

Modular compliance APIs: including KYC/KYB checks, risk scoring, document verification, and policy management, offer plug-and-play flexibility and scalability. These APIs also include anomaly detection. They ingest real-time data into ML models that flag suspicious behaviors, fraud patterns, or regulatory breaches. This is beneficial for both onboarding and continuous monitoring.

SaaS scalability: Subscription-based licensing removes hardware investments and adjusts capacity dynamically.

Unified data schema: A single source of truth for compliance data ensures consistent policy application across business lines and jurisdictions.

Low TCO: Standardized processes and delivery cycles significantly reduce maintenance overhead.

Summary

RegTech empowers compliance teams to work more efficiently and proactively. As companies eliminate manual tasks and cut costs, they use AI to identify problems, track rules, and provide real-time reports. This means they are always prepared for audits, no matter how often regulations change.

Need a consultation?

Fintech software development services

Let’s explore how your product can grow with the right technology. Discuss your FinTech goals with our experts.

Read moreWhat are the key functions and categories of RegTech?

Implementing a clear organizational structure for RegTech solutions can help you discover the most suitable compliance tools. Financial institutions improve compliance results by organizing their solutions into these 4 categories. This approach allows them to integrate tailored solutions into existing systems

Regulatory intelligence

Tools for regulatory intelligence track worldwide rules through an aggregation process, which includes a new guideline interpretation phase.

Automated rule mapping: Platforms ingest PDF, XML, or RSS feeds from authorities. They use Generative AI to tag each new clause by risk type (e.g., AML, data privacy).

Alerting and forecasting: Compliance teams receive prioritized notifications when a pending regulation (like Basel IV or MiCA) will impact their operations.

Example: A bank can use an intelligence dashboard that flags upcoming KYC enhancements 6 months before enforcement, giving legal and IT teams time to update workflows.

Regulatory reporting

Automation within filing processes minimizes manual effort and reduces error rates.

Data orchestration: Connectors extract required fields (trades, balances, customer profiles) from core systems.

Template-driven output: Reports auto-format to XBRL, JSON, or proprietary layouts regulators demand (SEC EDGAR, EBA COREP).

Example: A financial services firm can reduce its quarterly credit-risk report preparation time from 3 weeks to 3 days by switching to an automated reporting engine.

Compliance process management

This category standardizes the execution of compliance tasks that automatically generate official audit records.

Workflow execution: Based on rule logic, case-management modules assign tasks (e.g., KYC approval, transaction review) to the right users.

Document validation: OCR and AI verify IDs, utility bills, or corporate filings against regulatory requirements.

Example: A neobank can integrate a KYC API that completes end-to-end identity verification in under 2 minutes, with full audit history stored in the platform.

Regulatory risk & data management

Regulatory tools integrate 2 functions by analyzing data while enforcing governance features to control compliance threats.

Risk scoring engines: Combine customer profiles, transaction patterns, and external watchlists into dynamic risk ratings.

Centralized data models: Unified repositories guarantee that every compliance function works from the same verified dataset.

Example: An asset manager can deploy a real-time dashboard to recalculate counterparty exposure, alerting traders when limits approach regulatory thresholds.

Summary

The 4 major categories of RegTech are: regulatory intelligence, reporting solutions, compliance process management, and risk & data management solutions. All categories automate tasks to enhance the speed, accuracy, and predictability of compliance operations.

What are the benefits of regulatory technology?

Adopting RegTech solutions improves efficiency and a strategic edge in managing complex regulation. Here’s a brief table summarizing the key benefits of RegTech for financial institutions:

Benefit | Key features |

Automating regulatory obligations |

|

Reducing regulatory risk |

|

Simplifying regulatory processes |

|

Staying ahead of regulatory changes |

|

Enhancing cost-efficiency |

|

How does RegTech work in the financial sector?

You can use RegTech tools to manage compliance operations. They coordinate all stages of compliance, from rule collection and data analysis to monitoring until reporting requirements are met. APIs retrieve regulatory updates worldwide and turn them into operational actions.

Core banking systems and trade platforms connect through data connectors with reporting engines, which reduces the need for manual data comparison. Advanced platforms combine NLP and sentiment analysis to monitor communication channels, market abuse, and insider trading across emails and chats.

Blockchain and context-aware decision platforms allow developers to maintain tamper-proof audit trails showing all compliance actions. Let’s take a look at some real-life examples.

AI crime detection

Google's dynamic risk assessment system and ML models process over one billion monthly transactions. The new AI system, piloted in 2021, found financial crimes twice to four times greater than traditional systems. It also shows better accuracy than previous detection programs.

Regulatory intelligence dashboard

Revolut built a cloud-native RegTech system that allows the company to absorb global regulatory rules. At the same time, they can map them against internal and automated KYC procedures. Revolut achieved fast user onboarding through its system integration, protecting its presence in European markets.

AI-driven compliance

ING made a multi-million-dollar investment in 2019 to deploy Ascent AI-powered compliance capabilities. The NLP technology provides automatic regulatory requirements and control mechanism connections while shortening manual policy-linking times by more than 60%.

Global tax reporting

Standard Chartered Bank implemented FiTAX by BearingPoint RegTech to achieve CRS, FATCA, and QI reporting across 130 jurisdictions worldwide. This reduced report preparation time and improved accuracy in tax reporting.

AI transaction monitoring

Citi implemented AI abilities in its transaction-monitoring system. This allows for instant risk scoring and improved alert management protocols. Citi maintains effective compliance oversight while avoiding excessive employee growth.

Key takeaway

RegTech automates financial compliance, thereby lowering manual input. It increases precision and speeds up response to regulatory changes by utilizing AI, APIs, and blockchain-supported audit trails.

Thank you for Subscription!

RegTech applications across different regulatory regimes

These regulatory tools are broadly applicable across different regulatory frameworks. Examples include:

GDPR (EU): PrivacyTech solutions include automated systems for managing consent documents and performing data inventory to fulfill privacy protection requirements.

MiFID II (EU): Trade surveillance tools provide transparency for operations by monitoring pre- and post-trade reporting activities.

FINRA (US): The American financial sector uses RegTech solutions to run surveillance systems, track market abuse rules, and store communications records.

MAS (Singapore): Financial organizations implement RegTech solutions to build anti-fraud and digital ID authentication systems that adhere to MAS's TRM framework.

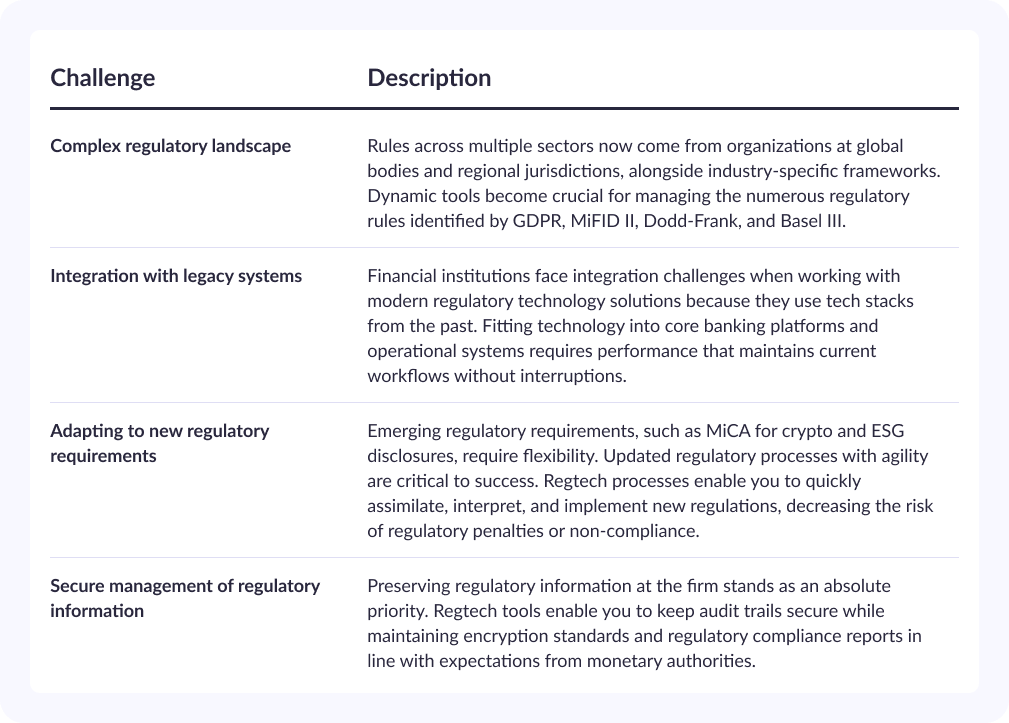

Challenges and considerations in implementing RegTech

While RegTech offers significant benefits, firms often struggle with change management, system integration, and compliance with complex regulations.

What is the future of RegTech? Trends and opportunities

Modern compliance requires RegTech as a vital foundation because regulators demand more oversight. Companies face increasing data challenges alongside higher accountability standards. The future of RegTech holds several developments:

Regulatory bodies and regulatory authorities' roles

Regulatory bodies like the Financial Conduct Authority (FCA), SEC, and EBA now engage with the RegTech ecosystem rather than functioning solely as traditional overseers. Through their partnerships with RegTech companies, regulators are now developing technology-based solutions that integrate into their supervisory systems.

Key developments:

Regulatory sandboxes allow regulatory bodies to test new compliance technology in real time.

Authorities want regulatory documents that machines can easily read, which improves their ability to automate processing and interpretation.

When different jurisdictions harmonize their regulations, RegTech tools can help ensure compliance on a global scale.

Growing adoption of technology solutions in finance

RegTech adoption has surged into the financial services sector to become its primary focus. The financial industry, including banks, asset managers, insurers, and fintechs, uses regulatory technology to reduce costs and improve regulatory compliance. Areas needing extensive real-time monitoring and reporting benefit most from RegTech applications.

Key trends:

Enterprises are moving away from manual audits to AI-powered surveillance and alert systems.

The implementation of ML generates predictive risk models.

Blockchain technology, together with digital identity systems, allows the creation of transaction records that cannot be changed.

You can perform automatic KYC processing alongside transaction monitoring through RegTech while saving resources and preventing human mistakes. Technology increases regulatory compliance management capabilities.

How are RegTech firms reshaping the financial industry?

RegTech companies are shifting from solution providers toward ecosystem developers. These firms transform risk management and compliance approaches through platforms. They connect regulatory information with real-time data and workflow automation systems.

Future implications of this development include:

Modular API-driven RegTech systems integrate with existing legacy systems.

Interactive dashboards for compliance officers to manage their work while generating personalized alert systems.

Proactivity in compliance management instead of traditional methods.

Financial technology operations will increasingly incorporate regulations via strategic partnerships through this model transition of RegTech.

Key takeaway

RegTech involves regulators integrating more closely with AI solutions. It fuels real-time compliance, machine-readable rules, and predictive risk systems. RegTech is important because companies are shifting from being reactive to proactive in their checks.

How Geniusee builds RegTech solutions

Your selection of a technology partner in the RegTech sector is critical for implementation success. Geniusee uses its deep domain knowledge to develop advanced technical RegTech solutions that support scalability as your business requirements expand.

Our team has deep expertise in financial regulation and proven engineering methods to meet compliance requirements. We employ digital banking apps along with AI-based regulatory monitoring instruments.

We offer:

End-to-end product development services for both growing startups and established firms.

Domain experts specializing in automated compliance processes and intelligence for regulations and reporting.

Developing customized connections to current system infrastructures shortens the time-to-value.

Automation and management assistance

Geniusee supports financial institutions, including banks and regulatory bodies, by providing technology solutions that optimize their regulatory processes through automated practices. We guide regulatory adaptation while reducing operational risks and enhancing resilience.

Our RegTech development capabilities include:

A solution to maintain regulatory compliance throughout different jurisdictions.

An AI system coupled with ML analyzes regulatory texts to produce obligations automatically.

Bringing together all your firm’s regulatory data to make it actionable.

Innovation, compliance, and low-risk development

At Geniusee, engineering expertise complements solutions focused on low-risk development, agile delivery, and priority compliance readiness. Building RegTech tools requires more than just coding. We focus on developing trustworthy systems that provide secure solutions that adjust to future requirements.

What sets us apart:

Every RegTech initiative at Geniusee includes dedicated engineers with compliance expertise and legaltech consultants.

Proof of successful regulation-compliant work with fintech clients.

Security design principles integrated into architecture protect sensitive data and regulatory compliance.

If you aim to create your RegTech solution, contact Geniusee for help. We support clients who want to enhance their compliance stack through solutions that improve compliance while reducing the regulatory burden.

FAQs about RegTech

What is RegTech in simple terms?

Regulatory technology allows companies to automate their regulatory compliance through AI and ML systems. RegTech enables businesses to follow regulations better by combining automated reporting with efficient risk management systems.

What functions enable RegTech to serve financial institutions?

You can rely on RegTech to speed up regulatory responses by streamlining processes through automated tasks, thereby decreasing operating errors. The system reduces operational expenses while delivering precise results with simpler regulatory management operations in complicated and constantly evolving legal frameworks.

Is RegTech only for banks?

No. RegTech solutions benefit organizations outside the banking sector. It helps financial institutions, fintech, and insurance companies streamline and improve their compliance processes.