As of 2025, real-time payment systems have turned instant settlement from a perk to the global default. Transfers now clear in seconds through P2P super apps, government-run networks like PIX and UPI, and new cross-border links that connect national rails.

Key points:

3 areas of change: P2P super-apps, national instant payment systems, and cross-border RTP connections.

User expectations: every transfer—personal, business, or government—should be instant.

Business impact: faster settlement reduces costs, improves cash flow, and keeps customers coming back.

Proof in numbers: PIX (Brazil, 140M+ users), UPI (India, 18B+ monthly transactions), FedNow (U.S.), BIS Nexus cross-border network.

Cost of inaction: customers choose faster, easier ways to move their money.

Zero. That is the percentage of customers willing to wait for their money to be sent or received.

Whether it’s friends splitting a pizza in a super app or a government treasury team pushing salaries across borders, everyone expects instant results. Why? Because real-time payment (RTP) infrastructure speeds up fund settlement to seconds rather than days. And the process is ongoing globally.

For FinTech founders, banking strategists, and anyone launching a payment-enabled product, the signal is unmistakable: align with these rails or watch customers migrate to providers that already implement RTP networks.

Learn about major areas where RTP drastically changes customer habits and how to keep your digital product in play.

Thank you for Subscription!

3 levels of real-time payment shift

P2P level: the rise of mobile super apps

The first and most visible shift is happening in peer-to-peer payments (P2P). On global markets, instant transfers are now a basic expectation. Any banking or payment app that lacks them is seen as outdated.

This P2P payment system sets the stage for something bigger: the rise of mobile super apps that open many more opportunities for instant money delivery and a better choice of payment methods.

What is a super app?

A super app is a single mobile app that wraps many everyday services like messaging, shopping, or calling a taxi around an embedded wallet and real-time payments. By contrast, a multi-service app without an integrated wallet is not a super app (yet).

Payments are the anchor. Successful Asian super apps like WeChat or Alipay build around digital payments and offline QR acceptance, then layer services like mobility, shopping, and government tooling.

Advantages of super apps

For users | For businesses |

|

|

Now let’s have a look at the top world examples that best illustrate the point.

Apps payment use cases

Uber — what started as an app to call a taxi, gradually became a one-stop shop for multiple services, including instant payment. Rides came first; then Uber Eats let the same card on file pay for dinner. Fast-forward to 2025, and that single wallet now covers groceries, liquor, same-day parcels, and much more. Result: more than 30 million people pay for the Uber One subscription.

Uber’s in-app wallet offering real-time payments is already verified and cleared for security checks. So every new service can plug straight into it. One account, one wallet, many everyday tasks: the loop keeps users inside the app and makes Uber a textbook Western super app.

Glovo — a delivery giant that now operates in 23 countries and blew past 1 billion orders in early 2025, may resemble a super app, but it is not.

What’s missing is a proprietary wallet and an open mini-app marketplace. Today, Glovo still relies on card rails and third-party wallets at checkout. And merchants integrate through Glovo’s own seller tools rather than plug-and-play mini-programs.That’s why Glovo remains a formidable multi-vertical delivery app but not a super app.

DoorDash sits in the same bucket. It dominates on-demand delivery in the U.S. and, via Wolt, operates across Europe, offering food, groceries, alcohol, retail, package returns, and white-label logistics for brands.

But it still routes consumer checkout over cards and third-party wallets, and it doesn’t run an open mini-app marketplace. The subscription (DashPass) deepens engagement, and there’s a wallet for couriers’ earnings (DasherDirect), yet there’s no general-purpose in-app wallet for users that ties multiple services together. Net, a powerful multi-category delivery platform, not a super app.

National level: government-built instant payment landscape

A government RTP system is a national money network run by the central bank. Transfers clear in a few seconds, so it works like a public “money highway.” Financial institutions, banking apps, and digital wallets plug in as users; people and shops see it as a faster, cheaper option than cash or cards.

The central bank keeps fees tiny (or forces big banks to join) and adds tools like phone number handles and QR codes. It also sends governmental payouts such as tax refunds and welfare through its own real-time payment system.

Citizens notice that their benefits arrive instantly; merchants notice they pay almost nothing to accept the transfer. Cash starts to fade, and the instant rail becomes the normal way to pay.

Benefits of real-time payment government rails

For users | For businesses |

|

|

And here are the examples that showcase the efficiency of a governmental payment infrastructure.

Government-built RTP use cases

Pix (Brazil) – launched by their central bank in November 2020, Pix turned from a low-cost P2P tool into Brazil’s default pay method in less than five years. By mid-2025, it was moving about R$2.2 trillion every month and capturing everything from street-vendor QR sales to payroll and welfare disbursements. Merchants like Pix because fees are capped at fractions of a cent; consumers like the 24/7 speed and the ability to pay via phone number or static QR. Today, more than 140 million Brazilians—almost the entire adult population—have used Pix at least once.

UPI (India) – Unified Payments Interface (UPI) is the world’s largest real-time rail. In June 2025 alone, it handled 18.4 billion transactions worth ₹ 24 lakh crore (≈ USD $2.9 trillion). The hook is simplicity: pay by scanning any UPI QR or just typing a phone-style handle. New layers keep arriving: autopay for recurring debits, biometric log-ins that drop the PIN step, and cross-border links to Singapore’s PayNow. More than 680 banks and FinTech apps use it, as well as the government, for welfare distribution and better cash flow monitoring.

FedNow (United States) – The Federal Reserve switched on FedNow in July 2023 with only 35 pilot banks. By April 2025, the network had 1,300+ participating institutions across all 50 states, most of them community banks and credit unions. Early volumes are modest compared with Pix or UPI. But momentum is clear: treasury-management platforms and payroll providers now use FedNow to push wages and insurance payouts in seconds, even on weekends. Needless to say, this way of payment in the U.S. definitely increases customer satisfaction.

Cross-border level: interlinking of national real-time payment rails

When two or more countries link their domestic immediate payment systems, a phone number in Mumbai can send money to a QR code in Singapore within seconds, with the currency conversion handled on the spot. The local rails stay unchanged, but a shared cross-border switch and common message format make them function as a single network.

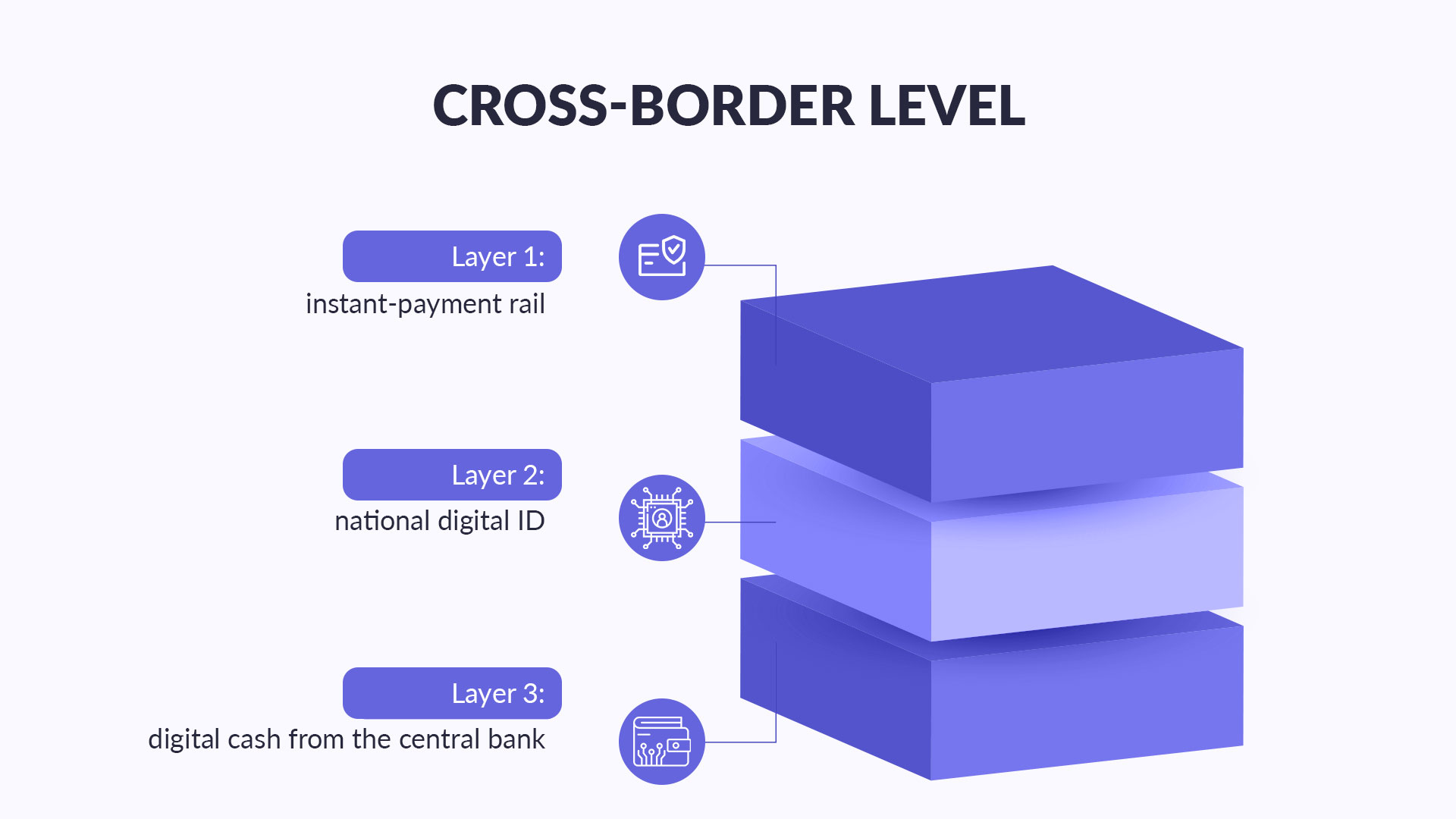

How governments are linking the pieces together:

Layer 1: instant-payment rail

Each country first runs its own 24/7 RTP network.

Layer 2: national digital ID

The customer’s pay handle—usually a phone number or email—is linked to their official ID (Aadhaar in India, Singpass in Singapore, and soon the EU’s Digital Identity Wallet). Because that link is already checked, payments instantly move with your identity attached, so the system knows who is sending the money.

Layer 3: digital cash from the central bank

Countries are testing central bank digital currencies (CBDCs) or “tokenised” versions of ordinary deposits. Because these tokens travel over the same instant payment rails, the money can move automatically if such a rule is set by a user: rent pays itself on the due date, or a supplier gets paid the second customs clears the shipment.

Even the often slow, paperwork-heavy European Union is moving. The EUDI wallet pilots running through 2025 will let any EU resident pay, sign, and prove age or qualifications in one app.

Advantages of cross-border instant payments

Linked RTP rails let a phone-handled payment jump between national switches in seconds, round the clock, with currency exchange done in flight. No waiting, no mystery fees, and no “three-to-five business days” disclaimer. The transfer clears instantly. Businesses get just-in-time liquidity; users enjoy affordable remittances wherever they are. Payment processes happen in the blink of an eye.

And here we come to the solutions that prove the point.

International instant payment use cases

Cross-border instant payment systems cut the costs and delays of moving money across countries. They matter to diaspora communities sending small, frequent amounts home, and to merchants and marketplaces that sell abroad and want instant, final settlement to improve cash flow. For exporters and suppliers, they enable just-in-time payments and simpler reconciliation—leading to faster order cycles and healthier margins. Here are real-world use cases that back this up.

From Bangkok to São Paulo in seconds. A Bank of Thailand account that uses PromptPay can soon make payments to a São Paulo shop that shows a Pix QR. Project Nexus, run by the BIS (which is owned by 63 central banks), links the two domestic rails through a shared switch. The sender types a Thai phone number or scans a Thai QR. The service maps that ID to a Brazilian Pix proxy, converts the currency on the spot, and lands the funds in about a minute at fees close to a local card swipe.

Digital rupees push India further toward cash-lite. India’s retail e-rupee pilot lets invited users pay any standard UPI QR code with central bank money held in a smartphone wallet. For example, a fruit vendor can display the same black-and-white square she already uses for UPI, and customers choose “Pay with Digital Rupee” instead of a debit pull. The payment settles instantly, no card rails, no interchange. It removes friction for small merchants and gives regulators real-time visibility of money flows.

More from our blog

Why does every business need AI agents now?

Use AI agents to automate workflows, boost ROI, and cut costs — see how AI empowers smarter, faster business decisions.

Read moreThe winners and the losers of global real-time payment transformation

The first winners are definitely the users. Instant rails make everyday money tasks painless. A few taps send and receive payments, pay a bill, or settle a checkout QR, and the balance updates before they lock the screen.

Super apps that embed RTP also win. Each new service—rides, food, loans—plugs into the same wallet, so active users and total volume keep climbing. According to Gartner, the outlook for super apps adoption is very positive, too.

Banks and FinTechs that connect early to the instant rails stay in the game. Their clients no longer drift to competitors just to get a faster payment option. Revenue stays with the bank, and the data stream feeding credit and marketing models only grows.

The only losers are those who ignore the shift. If you still make customers wait hours or days for funds to clear, they will move their money to a service that can settle now, at any time, from any place.

How the shift in RTP and banking affects digital products

Real-time payments have rewired the whole FinTech industry. Customers now expect every payout, top-up, or refund to arrive the moment they tap “send.” And they judge a product’s value by its ability to make real-time transactions.

FinTechs that plug into RTP rails keep those customers and the revenues inside their own ecosystem. Those who ignore the changes will start seeing a decline in their balance sheet soon.

Specialist development teams translate the new rail’s rulebook into working code. They build the API bridge to RTPs and then wrap it with the safeguards regulators expect (like automated KYC checks).

The result is an “out-of-the-box” module that settles funds in seconds and ensures that every transaction is automatically logged with the who, when, and how, satisfying regulators and internal auditors. Also, since complicated things like compliance checks or security controls are pre-built, the product can go live sooner without cutting corners on risk or regulation.

How to make RTP work for your product

Design for instant settlement first.

Replace overnight batches with an always‑on payment layer that connects (via APIs) to your market’s real‑time rails—PIX, UPI, FedNow—so transfers clear in seconds with KYC/AML and ledger logging built into the flow.

From there, hide rail specifics behind a service boundary so product teams can ship features without touching payments.

An experienced integration team can translate scheme rulebooks and certification into code, while your own team focuses on the user experience that keeps transactions—and users—inside your product.

Real-time payment rails have reset the global standard: what once took days now clears in seconds, and that shift will not reverse. Super apps, state-run systems, and emerging cross-border links all deliver the same promise: money moves instantly, with security and compliance already built in. Customers got used to that speed, and now they expect it from every brand.

Meeting that expectation means redesigning products around instant settlement, not yesterday’s overnight batches. A development partner versed in real-time rails and regulatory demands can lift much of the technical and compliance load, letting your own team focus on the features that truly differentiate your product.

Let’s discuss how real-time payments can enhance your product! Connect with our FinTech team to map the next steps.