The financial sector faces continuous threats from fraudsters ready to exploit or game the system. From cybersecurity threats to riding through market fluctuations, the fintech industry goes through a lot. The industry deals with numerous sensitive financial data that must be protected at all costs.

It makes sense to take stringent measures. And, of course, it wouldn’t have been possible without the intervention of technology. That’s where AI in financial risk management comes in. Banks have already started to embrace this change, and it is expected that they’ll be spending $84.99 billion on generative AI by 2030, with a CAGR of 55.55%.

Fintech AI risk management helps companies handle cyber attacks, ride through the ups and downs of financial markets, leverage data science to make calculated decisions and manage regulatory risks.

Read this article to learn how AI systems will help you mitigate risks for your fintech organization.

The importance of risk management in fintech

Managing risks in the financial industry is vital. Fraud techniques are now advanced and use AI-powered financial technology. Each one carries potential threats. They include managing sensitive financial information and degrading compliance risk with regulations.

But why is fintech AI risk management so important?

Customers’ trust in fintech companies is their backbone, and without it, they cannot operate. Without accurate risk management, incidents can occur. These include data breaches, regulatory violations, fraud, and anti-money laundering, which raises consumer risk.

Proactively finding and reducing risks helps data protection for customers and can streamline operations in the long run.

Here’s a glance at common types of risk:

Fraud: Cybercriminals target fintech companies due to the volume of financial transactions.

Regulatory authorities compliance: Navigating ever-evolving legal frameworks is tricky.

Enhance security: Protecting sensitive information is paramount in building customer confidence.

With the evolution of advanced technology, risks are also evolving. AI tools bring new opportunities and risks for secure fintech companies.

Traditional vs. AI-driven risk management

Traditional and AI-driven risk management have their different advantages and disadvantages. Let’s quickly compare both methods.

Aspect/factor | Traditional risk management | AI-driven risk management |

Data processing | Relies on past inaccurate data | Easy data processing no matter the size |

Accuracy | Limited when market conditions shift | Advanced pattern recognition |

Efficiency | Slow decision-making | Real-time analysis |

Predictive capabilities | Risk detection gaps | Accurate risk prediction |

Adaptability | Inflexible adaptation | Adaptive learning |

Interpretability | Simple interpretation | Explainable AI by accurate training given |

Cost and implementation | Higher manual oversight | Cost efficiency |

In fintech companies, traditional risk management gives vague data and implementation, which should not be the case as it is one of the most important data sets. However, significant limitations occur when there is a major market shift. The fintech sector has customer relationships that can suffer if they don’t take precautions for potential risks.

AI-driven risk management has minimal human intervention and offers substantial results for improvements with accuracy, efficiency, and predictive capabilities to avoid potential risks. With machine learning and natural language processing methods, AI can easily process vast datasets, including unstructured sources like activating agile and informed decision-making.

With these innovations, businesses that embrace AI-driven risk management gain a competitive advantage through more precise risk assessment and faster responses to emerging threats, keeping them ahead in the dynamic financial services landscape.

AI technologies transforming risk management in fintech

The financial services sector is undergoing a major shift post-integration of AI technologies. It identifies multiple things at a time, such as fraud detection, accurate analytics, predicting risks, and much more.

Let’s explore AI technologies and their application in fintech companies.

The fintech Industry is revolutionizing post-AI integration. Implementing risk management strategies and predictive formulas helps navigate upcoming risks in minutes, and fintech risk management can be seamlessly managed

AI technologies | Application | Benefit | Example |

Machine learning | Accurate fraud detection | Self-learning accuracy shown | Blocks frauds automatically |

| Natural language processing | On-point compliance monitoring | Automated data compliance | Trading prevention |

| Predictive accuracy for risk-detecting | Advanced risk prediction | On-point data insights | On-time risk analysis and assessment |

Implementing AI for risk management in fintech

Let’s go through the essential steps for implementing AI for risk management in the financial industry.

Third-party risk management identification: It is important to analyze third-party risk management and its processes. Using key risk indicators, fintech firms can make informed decisions and later engage stakeholders.

Define risk assessment goals: Fintech companies should get accurate results for risk assessment, and AI helps generate the best. Not only does it give accurate results, but it also decreases manual efforts.

Data collection process: Collect accurate and needed data for the company. AI helps in the data-collecting process, where it will navigate to discard unwanted data.

Selection of AI models: Choose AI algorithms that align with your business. It should be trained well to identify the patterns and create predictive models.

AI integration for risk management processes: AI insights in risk assessments and decision-making are the wisest choice, as they can handle risk tolerance and suggest preventive measures.

Analyze and monitor the process: Evaluation of the AI model’s performance is mandatory. It should be updated with the latest data privacy protocols to ensure the outcome of the updated results.

Thank you for Subscription!

Challenges and considerations in adopting AI for risk management

AI has become the most important part of the fintech industry for risk management, and it has multiple challenges to overcome. Since AI-driven solutions help reduce financial losses, they should always be accurate and able to detect fraud.

Let’s learn the key considerations in adopting AI:

Data quality and availability: Data quality as an outcome shows how a particular model is trained. Inaccurate data clearly shows poor training of the AI model.

Ethical considerations and bias: AI unintentionally introduces biases that lead to unfair decisions. It is key to ethical AI in financial risk management. It will promote fairness and unbiased outcomes.

Regulatory compliance: AI models should be trained to consider financial regulations for the best outcomes. Transparency in the business helps to avoid unwanted risks and fraud.

Real-world case studies of AI-driven risk management in fintech

Artificial intelligence has changed risk management in a good way for fintech services. It has become easier to provide real-time insights with greater accuracy. Overall, AI enhances accurate credit scoring by reviewing data and improving loan approval proposals.

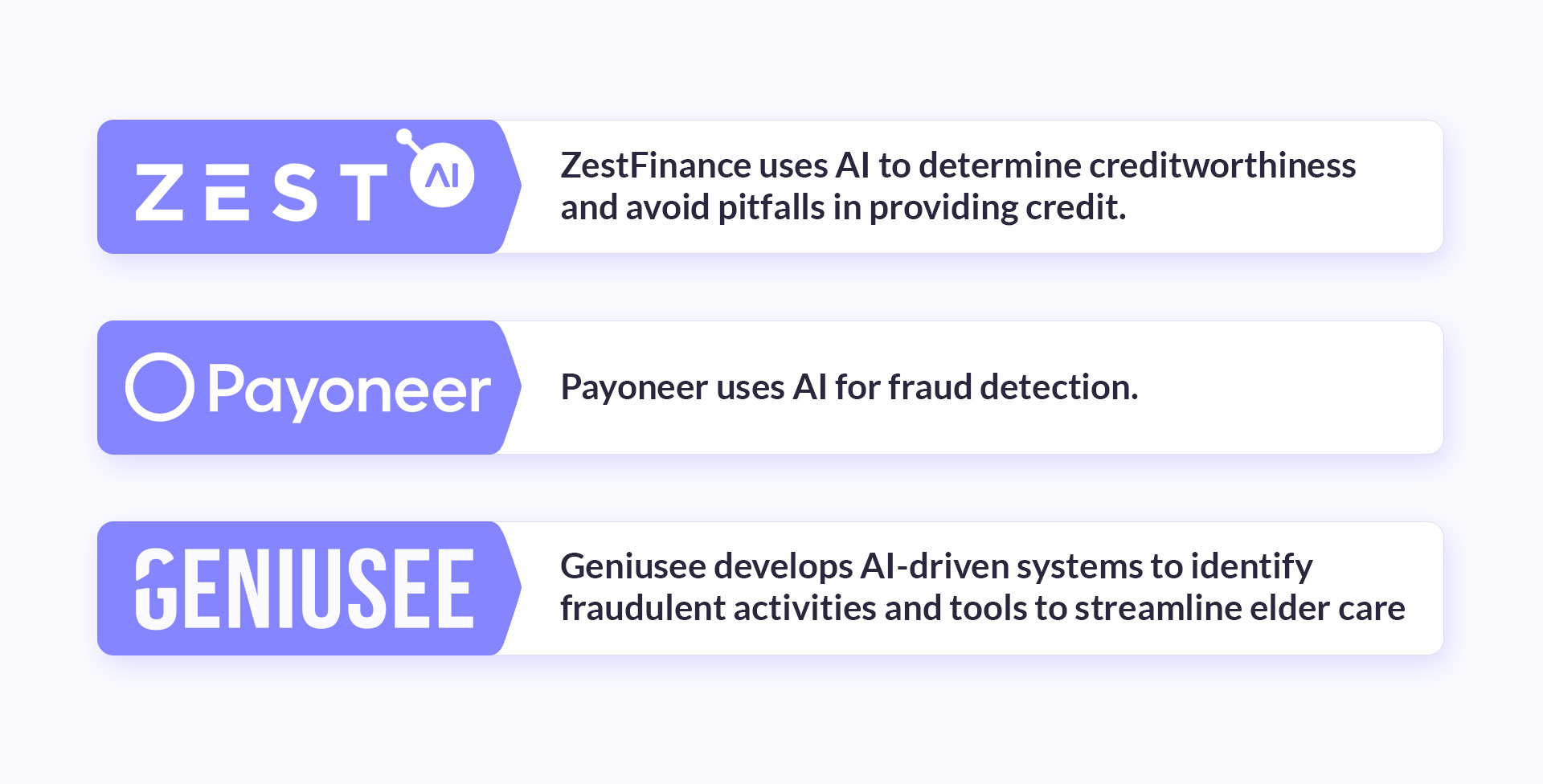

There are several success stories showcasing artificial intelligence in action. Take, for example, ZestFinance, which uses artificial intelligence (AI) to determine creditworthiness and avoid pitfalls in providing credit. Traditional credit scoring models often excluded thin-file borrowers, leading to missed opportunities. The result of implementing AI? The company reduced default rates and approved more loans, increasing credit access for underserved populations and reducing operational costs.

Another example is Payoneer, which uses AI for fraud detection. Due to the many global transactions the company manages, it faces numerous fraudulent activities. Payoneer used machine learning models to identify suspicious activities in real time. The result was their fraud detection rates improved, reducing losses and making transactions safer for users worldwide.

Artificial intelligence in the fintech industry accurately detects fraud. You can easily prevent fraud before it happens. Fintech companies should follow a few best practices, and it’ll be like having several virtual assistants at your bay. For example, real-time monitoring helped Payoneer detect fraud.

But remember, AI models need to be consistently trained and updated. This will ensure these language models stay helpful to the financial institutions they serve.

More from our blog

Neobanks: Disrupting the banking landscape

Uncover how neobanks are redefining finance with advanced technology, affordable solutions, and modern ease.

Read moreFuture trends and innovations in AI for fintech risk management

The future of AI in risk management is evolving. Emerging trends in tech, like explainable artificial intelligence, will make AI more transparent. They will help fintech firms meet regulations and build trust in their automated decisions. AI-powered solutions for predictive analytics will also advance.

In a nutshell, it makes sense to include artificial intelligence as a part of your investment strategy, so your business can navigate modern-day problems. But be cautious!

You can get help from a reliable partner to embrace AI in your fintech business. At Geniusee, we have experience and expertise in developing AI-driven systems. Recently, we developed an AI-powered fraud detection and elder care management platform to identify fraudulent activities and offer collaborative tools to streamline elder care management.

Conclusion

So, now you have a clear picture of how fintech AI risk management can be useful to your financial institution. There are many benefits, from fraud detection, enforcing security, and ensuring regulatory compliance to leveraging data science to give accurate financial advice and make an informed decision.

But here’s the interesting part: artificial intelligence not only mitigates the risks but also streamlines operations, ultimately fostering trust among customers. Therefore, for financial services firms aiming to stay competitive in this rapidly changing sector, embracing AI-driven fintech risk management is no longer optional—it's imperative.