Having strong online payment systems in place is helpful not only to you but also to your clients. In most cases, late payments happen due to misunderstandings with your invoices or trouble with the payment system. When you make the payment process hassle-free, clients pay invoices on time, and as a result, your cash flow cycle gets healthier.

With more than a dozen payment solutions on the market, choosing one can be difficult, especially when you aren’t familiar with the technical side of things.

To help you, we have put together this guide on how you can choose the best online payment system for your business. We’ve also compared a few of the most popular ones on their basic features, ease-of-access, and the value they provide. Intrigued? Read on!

Criteria for Choosing the Best Online Payment System

The most important thing to consider while selecting an online payment gateway is how well it suits your specific business needs. Here are a few questions you can ask when you start looking for one.

What do you expect from the payment platform?

You can start by listing all your requirements and then see which ones can be realistically fulfilled by an online payment solution. Most of them provide the following to users:

-

Ease-of-access and user-friendliness

When you’re trying to make things easier for your clients, you can’t afford to have a steep learning curve. Everything needs to be plain and simple — easily understandable by people who aren’t tech-savvy.

-

External integrations

Having your payment gateway automatically communicate with your CRM and other business software is essential. This reduces manual involvement and hence reduces the margin for error.

-

Support for multiple payment types

Scaling your business globally requires you to be able to process multiple card types and multiple currencies. And if your payment solution can’t handle that, you may not be able to scale quickly.

-

Reporting and analytics

Having analytics in place helps you understand the trends and patterns in your cash flow so you can better track any anomalies in the cycle. This also makes reporting payment updates to senior management or any external authorities easier.

-

Good customer support

No matter how good your payment solution is, you may still run into problems with it. That is why you will need efficient customer support to get you back on your feet with minimal downtime.

What type of transactions do you need to process?

An ideal payment system should be able to process all kinds of transactions. You need to ensure the one you are getting doesn’t miss an essential type that you may need.

Some common online transactions that your payment solution must be able to handle include:

-

Debit/credit cards

-

Internet banking

-

Mobile wallets

-

Digital payments apps

-

Unified Payments Interface (UPI)

How are the online payment systems priced?

Most payment systems charge you per transaction, and some even have an upper limit for the maximum amount you can transact per day or month. Each transaction has a certain fixed cost along with a percentage cost of the total amount transacted.

When picking one for your business, you must reach a good compromise between the fixed price and percentage charge so that you can transact large and small sums at decent rates.

Paypal, one of the most popular payment solutions worldwide, charges somewhere between 1.9% and 3.5% per transaction and a fixed fee of under 50 cents. The exact amount depends on the PayPal product you’re using, but for most of them, a $100 transaction will cost you between $2 and $3.99.

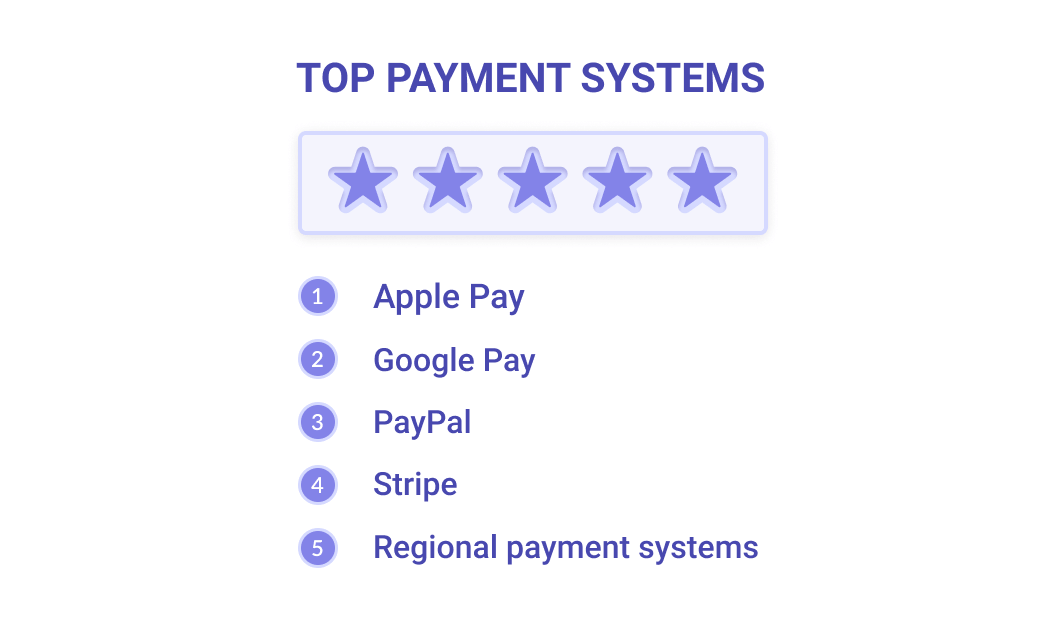

Top Payment Systems Reviewed

This list will help you understand some of the most popular online payment gateways to decide which one suits you best.

1. Apple Pay

Apple Pay is a relatively new platform, but since it was developed by Apple, it has a lot to offer. It connects directly to your credit and debit card and lets you pay with Touch ID, which allows you to use your fingerprint instead of a card or cash.

If you’re already a part of the Apple ecosystem, you can also use iMessage to directly send payments to your friends, family, or any business stakeholders. One limit to Apple Pay is that you can only send or receive a maximum of $10,000 within seven days. Apple does not charge any fees to use Apple Pay.

2. Google Pay

Google Pay brings together all the ways you can pay with Google. You can use it to tap and make purchases with your phone, buy items online, and send money to other users. Since most users already have a Google account, it is very convenient to use Google Pay for daily transactions.

The maximum amount you can hold in your Google Pay account at any time is $25,000. Transactions and payouts are also limited to a maximum of $5,000 and $20,000 per week, respectively. Google doesn’t charge merchants fees for using Google Pay.

3. PayPal

PayPal is known by millions and doesn’t require an introduction. It is one of the most widely used payment providers across the globe.

Since PayPal is an old player in the fintech market, it is supported by all platforms and businesses. It allows you to pay, send, and accept payments through an email address without revealing your financial details.

If you have a verified PayPal account, you can send up to $60,000 per transaction. There are no overall limits per week or month on the money transferred. PayPal is free to use for donations or purchases or any other commercial transaction unless it involves a currency conversion.

4. Stripe

Stripe is a suite of payment APIs that powers commerce for online businesses of all sizes. By bypassing the traditional signup process, Stripe acts as a merchant account for its providers, handling all PCI compliance and merchant approvals. Since the API is extremely flexible, you can tailor the platform to meet your specific needs. You can use it to collect payments, process invoices, and pay out funds instantly.

The minimum amount for processing a transaction through Stripe is $0.50, and the maximum amount for a single charge is $999,999.99. The pricing includes a flat rate along with a transaction based-fee that you can check out on their website. There are no monthly or annual charges associated with Stripe.

5. Regional payment systems

The Regional Payment and Settlement System (REPSS) is a Multilateral Netting System that provides end-day settlement in a single currency. It allows regional trade transactions to take place in local currencies instead of dollars and euros. This reduces the collateral requirements, as central banks of the regions are directly involved in the system.

With REPSS, trade is mainly amongst member banks, which include the following:

-

Bank of Zambia

-

Reserve Bank of Malawi

-

Central Bank of Swaziland

-

Bank of Uganda

-

National Bank of Rwanda

-

Bank of Mauritius

-

Central Bank of Kenya

-

Banque Central du Congo

-

Central Bank of Egypt

Payment Solutions for Mobile Devices

With ‘mobile-first’ transformations taking up the tech-space like a storm, mobile payments are also growing exponentially. The global mobile wallet market size is expected to cross $9 billion by 2025. This large growth is partly due to the convenience mobile commerce has brought to all industries. The rest is because of how easy it is to move cash around with a few taps of a screen, allowing businesses to instantly update their cash flow template with real-time transaction data for better financial visibility.

How do mobile payments work?

Mobile payments work in several ways. If you use a mobile wallet, they can be as complex as manually adding the financial details of the person you are supposed to pay or as simple as waving your phone over an NFC-enabled payments terminal. Merchants do this by installing an mPOS system, along with a card-reading device that detects the wave of your phone. Encrypted payment information is passed on to this reader through radio-frequency identification (RFID), and the payment moves from one wallet to another.

Major players in the mobile payment solutions industry

Some of the most popular mobile payment providers include Visa Checkout, MasterPass, Google Wallet, and Maestro. All of these are cost-effective solutions for contactless payments and let users perform transactions that are completely secure and encrypted throughout their transit.

Main Benefits and Drawbacks of Online Payment Services

Here are a few pros and cons of online payment services according to the applications they serve.

-

The Business POV

A rise in the usage of e-payments means more convenience for buyers, and hence, they can purchase more. Thus, businesses can sell more to the same buyer pool and generate more revenue.

On the other hand, this reliance on technology has also made business data prone to breaches and leakages. Online solutions are always vulnerable to cyberattacks, and in case one occurs, businesses can lose millions of dollars in the blink of an eye.

-

Hardware Integrations

While the use of hardware, such as NFC terminals, has made physical checkouts much easier, they have also allowed players such as Apple to monopolize the space. The devices Apple Pay uses can only be installed, provisioned, and managed by Apple’s own TSM. These devices don’t work with any other payment solution, and hence, no other platform can be used in place of Apple Pay.

-

Ease-of-Access

In the case of Apple and Google’s payment platforms, customers can connect the accounts they are already using, such as a Gmail ID, and enjoy the service right away. For other solutions, such as PayPal and Stripe, the necessity to subscribe and reconnect all cards is too much of a hassle. Therefore, while these payment methods might be useful for some customers, they may not be as convenient for others.

-

Change in Consumer Behavior

Cashless payments have improved the speed at which transactions occur, but they have also affected consumer behavior as a whole. Impulse purchases are on the rise, and all marketing and advertising campaigns are now based on creating a sense of urgency to make people buy ASAP. This hasn’t had any major impact on economies as of yet, but if things keep going this way, there could be a serious shift in the type of commodities included in an average market basket.

Conclusion

When choosing an online payment solution for your e-commerce business, the number of options you have is countless. And since all of them provide the same features more-or-less, all it comes down to is what kind of app you are developing, the type of transactions you want to process, and the region you are based in.

We hope this guide on how to choose a payment solution will help you make the right choice. If you are still confused about where to start, do not hesitate to reach out to us for help. The experts at Geniusee are always ready to help you and make your product a success!