With around 60% of respondents using BNPL financial services during the pandemic, it has turned into the biggest trend in the e-commerce sector. In fact, according to C+R Research, it has surpassed the use of credit and debit cards by more than half.

While the pandemic itself was responsible for decreased use of credit cards, notably in the United States, BNPL not only made it more convenient to make purchases but also increased overall sales. As a result, in 2022, the total number of BNPL users is estimated to reach 59.3 million.

But such a beneficial service isn't an easy fit on both sides. How much effort is required to make the service possible? How does it ensure the security and safety of purchases? What steps does it take to implement and develop such a service? This article will answer all these questions and more. Let’s find out together with the paper written by our CTO Nazar Hazdun, published on Forbes Technology Council, further expanded with some more details and examples on the topic.

In this article:

What Is BNPL?

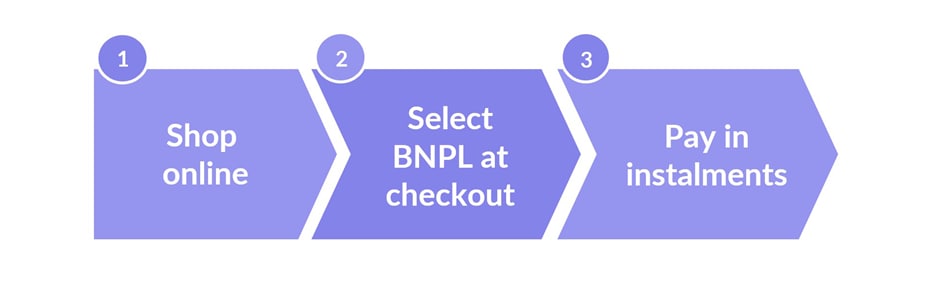

Buy Now Pay Later (BNPL) is a service for purchasing items in interest-free installment options. The payments are usually set for every few weeks or monthly installments, allowing customers to not have to pay for their purchases immediately. It is also widely known as a point of sale (POS) installment loan.

This type of service is mainly popular for online shopping. Clothing, appliances, electronics, and furniture are the most common items purchased through a BNPL service, with electronics taking the lead.

What Are the Types of BNPL Solutions?

There are mainly three types of BNPL solutions used by FinTech solutions software development companies:

- Direct providers. Direct providers are the best when it comes to benefiting from the development of the industry. They provide Buy Now Pay Later products through point-of-sale financing. In addition, these BNPL providers are also the focal point of the rise in such services in the United States. Affirm, Klarna, and Afterpay are a few examples.

- Retroactive providers. Customers can receive financing options through retroactive financing providers, which they can use for every purchase made through credit cards. Issuers and such BNPL providers offer an adjustable payment solution to customers after making the purchase. Chase and American Express are well-known retroactive providers.

- Facilitators. Facilitators form merchant relationships with direct providers to capitalize on the current interest structures. They are distinguished payment companies that profit off of the BNPL ecosystem. Shopify, Stripe, and Mastercard are examples of such companies.

Now, you might have questions about how BNPL actually works. Let’s find this out in the next section.

Do you know?

What’s The Difference between FinTech and RegTech?

Both new technologies are a huge point of interest to the financial and banking industries, but do you know the difference?

Expand your expertiseHow Does BNPL Work?

Although purchasing items using the BNPL method involves paying in installments, the buyer first makes a down payment of about 25% at checkout. The remainder is then divided into scheduled installments.

If customers fail to pay on time, their credit scores can be damaged. Most commonly, BNPL works through two to four spaced-out payment installments, but the customer can also choose the option to pay later in full after 30 days.

The retailer has to pay around 2% to 6% of the commission fee, along with a fixed fee, to the provider for all BNPL transactions.

What Are the Advantages of Using BNPL in Businesses?

It is not just the customers highly benefitting from BNPL solutions but merchants and businesses as well. Following are some of the advantages businesses have in using BNPL:

- Convenience and sales. As it is much easier to purchase items without immediate payment, customers fill their shopping carts and go through the ordering process quickly. This convenience also reduces cart abandonment.

- Generating higher revenue. Having the BNPL options for split payments incentivizes customers to make large purchases without worrying about the money. A survey by C+R Research found that around 59% of people made unnecessary purchases they couldn't otherwise afford in 2021.

- Gaining customer loyalty. With more control and flexibility over spending money and purchasing items they want, most BNPL services are a hit among customers. Consequently, they help enhance the customer experience and retention through positive purchases.

- Higher conversion rates. According to the Similarweb Buy Now, Pay Later Report from October 2020, when retailers provided BNPL service options, they saw an average increase of 2.1% in conversion rates.

- Selling high-value products. BNPL is widely popular among customers for buying high-end and expensive items without impacting their credit limits. In fact, 44.9% of people use BNPL solutions to buy products beyond their available credit or budget. So retailers have seen increased purchases of higher-value items through BNPL.

Can you imagine which companies provided successful BNPL solutions to their consumers in the last few years? Why not check out some of the prominent examples?

Successful Examples of BNPL Solutions

The following are some of the best BNPL apps as of 2022 based on purchase sizes, flexibility, and overall uses and benefits.

1. Apple Pay

In their iOS 16 announcement, Apple revealed the addition of Apple Pay Later. It is a feature you can choose in the Wallet app to pay in installments before making purchases. It allows you to make BNPL payment plans in four installments for over six weeks with no additional costs.

As a fraud prevention tool, Apple is choosing to forgo a bank partner and instead use the history of their users' Apple IDs. It is convenient to keep track and schedule payments using the Wallet app.

2. Klarna

Klarna is among the best BNPL integrated shopping apps, offering a maximum of 36 months of financing. The virtual card numbers of the Klarna app work for all in-store and online merchants that accept credit cards.

It asks for no fees or interest rates upon making timely payments, excluding any late fee, and utilizes smart credit limits. Besides that, Klarna offers one-time card numbers for added security. You can also earn rewards through their Vibe loyalty program.

Complete FinTech guide

Dive into all industry insights from our leading experts

3. Sezzle

Sezzle has the most flexible payment options among the BNPL apps. It offers customers an additional two weeks by rescheduling installment payments. The purchases include no interest or extra fees, and your first schedule for each order using the app will be free. However, a 25% down payment is required during purchase.

4. PayPal Pay in 4

When it comes to making small purchases, PayPal Pay in 4 is considered the best among the BNPL apps. It allows transactions starting from 30 USD all the way to 1500 USD with no interest. The PayPal Pay in 4 service is also available at countless online merchants. For security, every order in your purchase journey using the PayPal Pay in 4 app needs an approval decision.

5. Affirm

Affirm is an app that lets you make purchases both in-store and online with no overall fees, including late fees. In the case of transactions with interest charges, the app imposes simple interest, which ensures no mixing or increasing of your interest charges. You can also choose to schedule BNPL payment options to never miss installment due dates. Purchases can be made for up to $17,500.

The following section is on the steps to develop a successful BNPL solution like the above examples.

Useful tips

Get The Right Tech Partner

Make sure you ask your managers the right questions and also provide the right answers to choose the best outsourcing technical vendor ever.

Let's seeWhat Are the Steps for Developing a BNPL Solution?

The Financial Brand estimated a 20.7% increase in BNPL solutions from 2021 to 2028. Meanwhile, in 2025, the worldwide transaction volume through BNPL card-linked installment offerings could reach 680 billion USD.

With such trends and marketability factors, the question arises of how you can be a part of it. If any of the successful apps mentioned or the concept of BNPL has inspired you to develop your own, here are the key steps you should consider:

Hiring a Team

Hiring a team of professionals can not only give you a head start in the right direction without risks but also save expenses and additional fees. It will also enrich your team with newer practical knowledge and expert experience.

Deciding on the Features

All BNPL products need to implement a few must-have features as proper financial apps. First are the loaning options with a few weeks to months of repayable limits. The loaning and approval process should also be quick enough for the customer to not be affected inconveniently.

You should further consider a loan cap for customers and the frequency of repayments in weeks or months. The entire process should be digital.

Selecting a Tech Stack

The tech stack will determine the future developments of your company, so having a clear goal and idea of how you want your company to be seen is an essential step for developing a Buy Now Pay Later solution.

Establishing the Proper Success Metrics

Through the establishment of your success metrics, you can learn the pertinent data required for measuring your success and execute any possible improvements. Estimating the total sales revenue, the number of users, and the average order value (AOV) are measures taken by some developers.

Conclusion

With the rise of BNPL apps, customers have fully embraced the service and are not expected to give it up anytime soon. This future growth can make it easy to jump into the trend and reap the benefits. However, without proper protective measures and choosing the best BNPL providers based on goals and marketing types, merchants will only risk their business models.

If you are looking for help with the development process of your BNPL app, Geniusee's professional and dedicated software development team is a great place to start.