- Short history of online banking

- Benefits of mobile banking apps

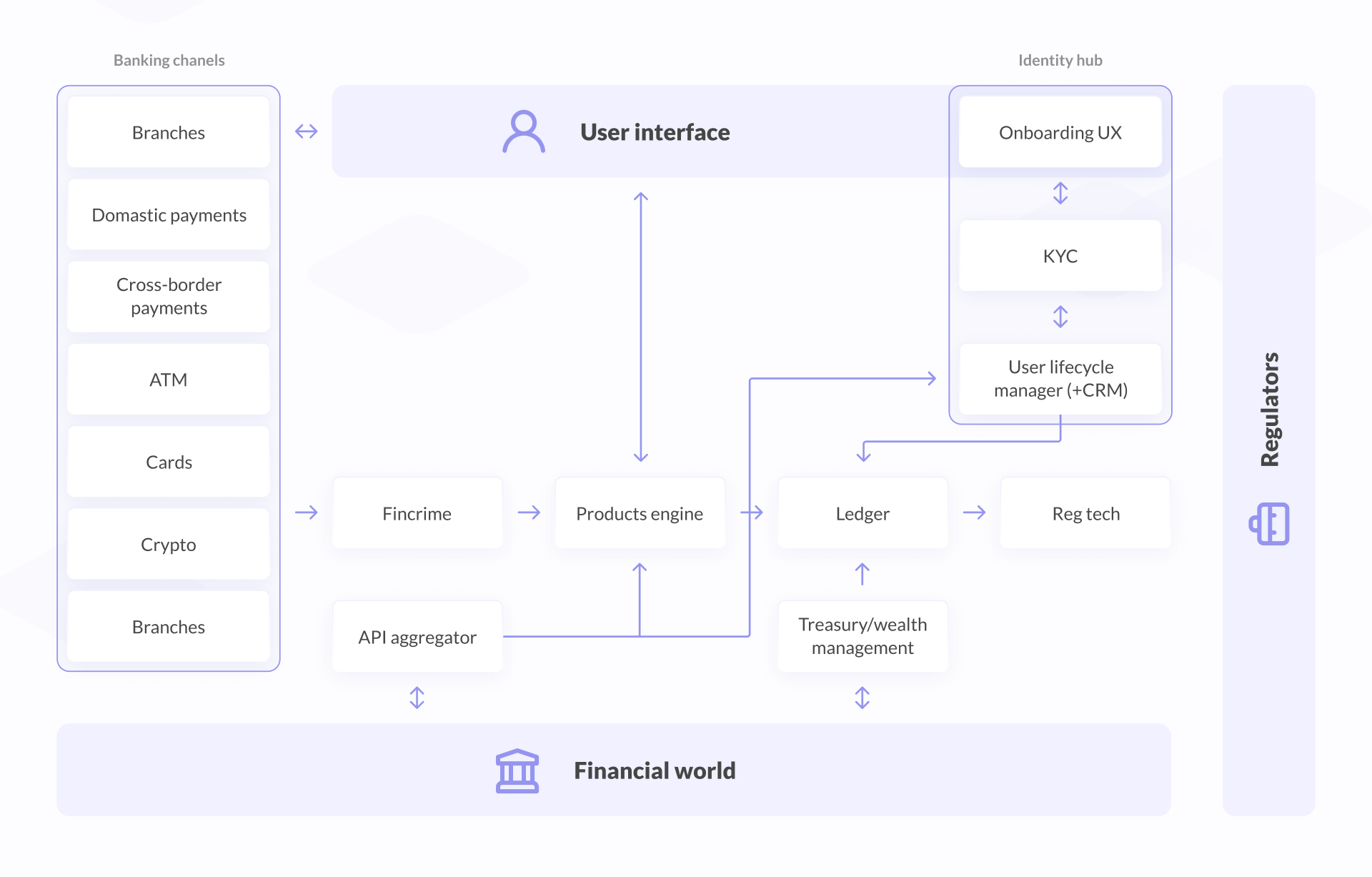

- How to choose the right banking model

- How to build a mobile banking app: features overview

- How much does banking app development cost?

- Success stories of popular mobile banking apps

- Our experience in mobile banking application development

- Conclusion

The bank's success at the beginning of the 20th century could be easily assessed by the size of the chandelier and the height of the ceiling in its headquarters in a building with monumental columns and a huge oak door with gilded handles. Nice memories, sweet approaches, but not actual anymore.

What is actual? Let’s find out together with the article by our CTO Nazar Hazdun, published on Forbes Technology Council, further expanded with some more details and examples on the topic.

We're basing this article on both research and experience. One of our most recent projects at Geniusee is the Zytara mobile banking application. Similar requests to our development team are becoming quite common these days. So, this topic should be interesting for both those looking to develop their own app and those who will be developing a mobile banking app. Let's get started.

In this article:

Short history of online banking

The Internet banking system dates back to the 80s of the last century when the Home Banking system was created in the United States. This system enabled depositors to check their accounts by connecting to the bank's computer via a telephone. Later, as the Internet technologies developed, banks began to introduce systems that allowed depositors to receive information about their accounts over the Internet.

For the first time in financial institutions, the service of transferring funds from accounts was introduced in 1994 in the United States by the Stanford Federal Credit Union, and already in 1995, the first virtual bank, Security First Network Bank, was created. But, to the disappointment of the founders of the project, it suffered a fiasco due to strong mistrust on the part of potential clients, who, at that time, did not trust such an innovation.

Bank of America was the first bank to achieve success in online banking. By 2001, it became the first among all banks to provide e-banking services, whose user base of this service exceeded 2 million customers. At that time, this figure was about 20% of all clients of the bank. Interestingly, already in October of the same year 2001, the same Bank of America carried out 3 million money transfers using online banking services for a total amount of more than $1 billion.

More on the topic

10 mobile application development trends to watch in 2024

Stay ahead of the curve and discover the key trends that are set to define the mobile landscape.

Read moreBenefits of mobile banking apps

Businesses are developing banking applications to obtain various benefits. At different times, banks can prioritize one task for implementation through their applications or several. Let's consider what they can be.

Convenience for your clients

Improving the quality of service

Communication with clients

Banks also use applications to communicate with clients, sending them notifications about account status, promotions, and offers.

These criteria above allow you to increase customer loyalty, expand their number, and therefore increase the bank’s profit.

Speeding up processes and saving time for employees and users/clients

Applications allow you to quickly and conveniently carry out financial transactions, such as transfers, paying bills, topping up your account balances, etc.

This approach makes it possible to increase work efficiency or reduce employee work time and, as a result, the financial costs of the bank.

Maintaining security

Additionally, the mobile apps ensure secure transactions as they are protected by passwords and other multi factor authentication mechanisms.

Data collection and analysis

Finally, applications allow banks to collect data on customer behavior and analyze it to improve service and guide the development of bank products.

How to choose the right banking model

Before diving into security, let's briefly compare two types of mobile banking apps: Full-Stack Mobile Applications and Front-End-Focused Neobanks.

Feature | Full-stack mobile banking app | Front-end-focused neobanks |

Banking License | Have their own banking license | Do not have a banking license |

Partnerships | Operate independently | Partner with a larger established bank |

Control of Value Chain | Keep the entire value chain from front end to back end under control | Control the front end of the value chain (customer interface) |

Approach | Use a least/asset-light approach | Operate with a focus on front-end only |

Core Banking System (CBS) | Have their own proprietary core banking system (CBS) | CBS tech systems are off the shelf or external |

Data Utilization | Leverage unsoiled data to gain customer insights/offer personalized services | Focus primarily on the customer interface |

Target Audience | General consumer base | Niche segments (millennials, SMBs, entrepreneurs) |

Support for Applications | Support a wide range of applications | Support B2C and B2B apps |

In any of these cases, your first step is to find an issuing bank, which you can cooperate with afterward based on your stack's features. After that, there's a difference.

If you stick to a full-stack banking mobile app development built on a platform model, the most important thing you should consider is the necessity of having your banking license. You will certainly need it, as you will work with a full-cycle banking service for your bank customers, providing lots of data and sensitive data. It should be secured, fraud-protected, and compliant.

If you save card data on your servers, you have to be PCI DSS compliant, which is possible but somewhat complicated and time-consuming. This stack requires a bigger team and more costly systems. If you want to test the FinTech neobank idea without getting certified, you can go with a front-end-focused neobank tech stack. Your product will be a cross-functional B2B or B2C application — which, as in the previous case, can also provide banking operation services to your target audience and customers for your issuing bank.

However, in this case, you don't apply for certification; you only choose the trusted payment platform, which is already PCI DSS compliant. There are several top platforms, and you can select which one to rely on. The main advantage of delegating this responsibility is that these platforms let you fasten your project's time-to-market. These platforms are already PCI DSS compliant. With this model, your primary task will eventually be to take good care of deep market research and then the development of the neobank application itself.

How to build a mobile banking app: features overview

Before you start a mobile banking app development process, it is important to define the key features of the application. In this section, we will share a list of basic and extra mobile banking app features.

Basic features | Advanced features |

|

|

Let's take a look at how to make a mobile banking app with a user-friendly interface.

Basic features for mobile banking app development

1. Sign up + account management

This part is very important for the development of mobile banking. This is because you need to implement security features for authentication (passwords, biometric authentication, other issues, etc.) to protect sensitive information.

Although we generally don’t recommend adding too many fields with questions via the "registration" phase, there is a difference here. You must ensure that the personal information of your customers is strictly protected. More additional questions can help you with this.

Here's an overview of the critical components to consider:

Complex passwords: Implement a requirement for users to create strong, complex passwords. This enhances security by reducing the risk of unauthorized access.

Two-factor authentication (2FA): Integrate 2FA using phone numbers or email addresses. This additional layer of security ensures that even if a password is compromised, unauthorized users cannot easily access the account.

Personal security questions: Include personal security questions as another verification step. These questions add an extra level of protection, especially during password recovery or account changes.

Confidentiality policy and terms agreement: Ensure that users explicitly agree to the Confidentiality Policy and other banking terms during registration. This legal agreement is crucial for protecting both the bank and the user, clarifying the use and protection of personal data

2. Onboarding screen

Onboarding new users is a critical step towards the success of your application. There are several factors to consider when designing an onboarding screen to make the process truly valuable to users.

Here are some best practices for creating a good onboarding screen:

Avoid lengthy tutorials. The task of the tutorial is to explain why the user needs the application.

Bring the user up to date gradually and don't expect them to instantly remember all the features.

Guide new users through the application using UI hints. Such hints should be shown to the user at the very time they require them.

Highlight important areas of the application while keeping the application screen itself visible. This way, users will be able to easily find the features they are looking for.

Showcase the app's value and main advantages using the fewest screens possible during the onboarding process.

3. Payments

Making financial transactions is a key feature of FinTech applications. The first and perhaps most significant step in developing this feature is defining the requirements. It's based on these requirements that we can determine the necessary throughput, reliability, availability, and performance of the system.

Requirements for the development of a payment system

Transaction volume: Estimating the expected transaction volume helps determine system throughput. This includes both peak and average system loads.

Payment methods: To work effectively, the system must provide support for various payment methods, including credit cards, e-wallets, bank transfers, and others.

Security: Security is the most important aspect of payment systems. Security requirements may include data encryption, authentication mechanisms, fraud protection, etc.

Reliability and resistance to failures: The payment system must be resistant to possible failures. Therefore, it is important to implement tools for data backup and replication, failure detection and recovery, and the ability to create backup copies into the system.

Compliance with standards and legislation: The payment system must comply with financial transaction laws and regulatory requirements such as PCI DSS, GDPR, and others.

It will also be convenient for a modern user if they have reminders about regular payments (regular payment for mobile services, reminder of the monthly payment on a loan, etc).

4. Transaction management

The transaction history screen is the main part of your app where your clients can follow their payments and transactions from the very beginning of their using your remittance software.

Also, the transaction feature ought to be organized in detail and include:

Transaction currency and transaction amount;

Recipient (name of individual or organization + card / account number);

Date and time of transaction;

Geolocation where the transaction took place.

Another cool feature for your sending money software is the daily, weekly, and monthly expense filter. These categories can be different: by class (food, medical services, traveling, gaming), by date, by the measure of cash (up to $50, $100, more than $250, ect.), etc.

5. Branches and ATM map

An ATM and branch map may seem like a very basic feature, but you shouldn’t neglect it. The small details show your care for clients. It will be an excellent additional service for your customers.

You can also gamify your mobile banking by involving your user in an exciting game to get cashback. For example, you can suggest "Withdraw money from an ATM on street X" or "Get a new card at branch X".

As an addition, you can also create a feature that allows your user to take the line in a bank branch using the application.

6. Support Page

Providing the most personalized approach to your clients is the key to your business success. You need to make sure that your customers have 24/7 technical support and can get professional consultation or advice anytime they need it. We’re sure that developing a great customer support system is one of the best ways to become the very bank that clients love and are willing to be part of.

Here are a few key items to make your client's support as user-friendly as possible:

Make support easy to find. When a user contacts technical support, they are already at a loss. In most cases, they try to understand a service or application but can’t do it intuitively. If they can’t find how to contact technical support within 5-10 seconds, there is a high probability that the user will leave your app.

Keep a history of communication with each user. Now support is more like a conversation with a friend or acquaintance: the user writes a message, closes the chat, receives a notification about the reply to the mail, reads it, answers it, and so on. All this becomes possible only if the context of the conversation and all data about the client are preserved.

Make sure the FAQ or knowledge base helps users. Most users try to solve problems using FAQ sections and Knowledge Base on their own within 5 minutes. You need to continuously explore the most common questions in technical support to eliminate their possible causes.

Use knowledge of user behavior. Collecting data about the user in the application helps to track when they are having difficulties and send them a trigger message in time with an offer to help.

7. Push notifications

94% of iOS mobile devices support sending mobile push notifications, while among Android devices, this figure reaches 99.4%. According to Leanplum, mobile notifications drive 9.6x more users to make in-app purchases.

In addition, customers who receive notifications spend 16% more time inside the app than those who don’t receive any notifications on their phones. With the help of mobile notifications, customers can get important here-and-now information such as:

Information about payments and expenses in real-time;

Reminders for recurring or scheduled payments;

What's new in-app updates and marketing notifications.

Coupled with account aggregation technology, notifications can become smarter, leveraging a user’s financial behavior. This allows your remittance software to transform its existing alerts and notifications feature from a reactive, event-driven service to a proactive personal financial management tool.

Thank you for Subscription!

Advanced mobile banking features

1. Cashback

Your user can be rewarded for a wide variety of card spending. You can set the conditions by which you can get a good percentage back.

The benefits of cashback include efficiency, the ability to dispose of the return at your own discretion, and the ability to form a loyal attitude of consumers towards the company.

The advantages of cash back include:

Creating a strong motivation for consumers to make purchases using your service.

Psychological aspect — clients get a chance to independently dispose of the returned amounts, which also increases their loyalty.

This service is beneficial because it provides a stable profit and is not too expensive.

Cooperation with cashback platforms allows you to reduce your marketing and advertising budget.

Cashback is available in a wide variety of locations and for a wide variety of purchases. With a competent approach, it is possible to save significant amounts per year, and then spend them in partner stores or on any other purchases.

2. QR code payments

QR payments have several advantages over other payment methods for purchases. First of all, they allow you not to carry cash and bank cards with you. All data required for the transaction is available from the payment application.

Implementation of such a feature is not a matter of one day. It is necessary to work out the step-by-step placement of application screens for both users and merchants, to carry out serious work with the backend and UI/UX specialists to get a simple flow with minimal steps and maximum benefits. But the costs are justified by the new features.

3. Trading & investing

In the banking industry, investments and trading are getting more and more popular every day. If you allow your customers to do it with the help of your app, you can improve the user’s experience and create some extra reasons why users should choose you and not other banks.

4. Cardless ATM withdrawals

Cardless ATM withdrawals offer a secure and convenient way for users to access cash directly from their mobile banking app. This advanced feature generates a unique code that the user enters into the ATM, eliminating the need for a physical card. With just a few taps on your smartphone, you can withdraw money and get cash from the nearest ATM anytime, anywhere.

This feature not only enhances security by reducing the risk of card skimming and loss but also provides added convenience for users who may have forgotten their cards.

5. Personal financial management

Modern mobile banking apps now feature advanced financial management tools that allow users to track expenses, create budgets, and analyze spending patterns. Whether you're saving to pay off debts or building a retirement fund, these tools are essential for efficient financial management. By setting SMART goals, users can create a clear roadmap to achieve their financial objectives, ensuring better control over their finances and a more secure financial future.

6. Expense categorization and insights

Understanding spending habits is paramount for effective budgeting and financial strategizing. Mobile banking apps leverage transaction data to autonomously categorize expenses, providing users with insightful visualizations and comprehensive reports.

For businesses venturing into financial planning, spending classification and analytics become indispensable tools, fostering improved planning, heightened profitability, and enhanced financial performance overall.

This feature within mobile banking apps offers a more streamlined and accessible platform, ultimately augmenting accuracy and efficiency in financial management.

Some insights for you

Strategic mobile banking benefits and risks

Explore the strategic advantages and potential risks of mobile banking with our insightful article.

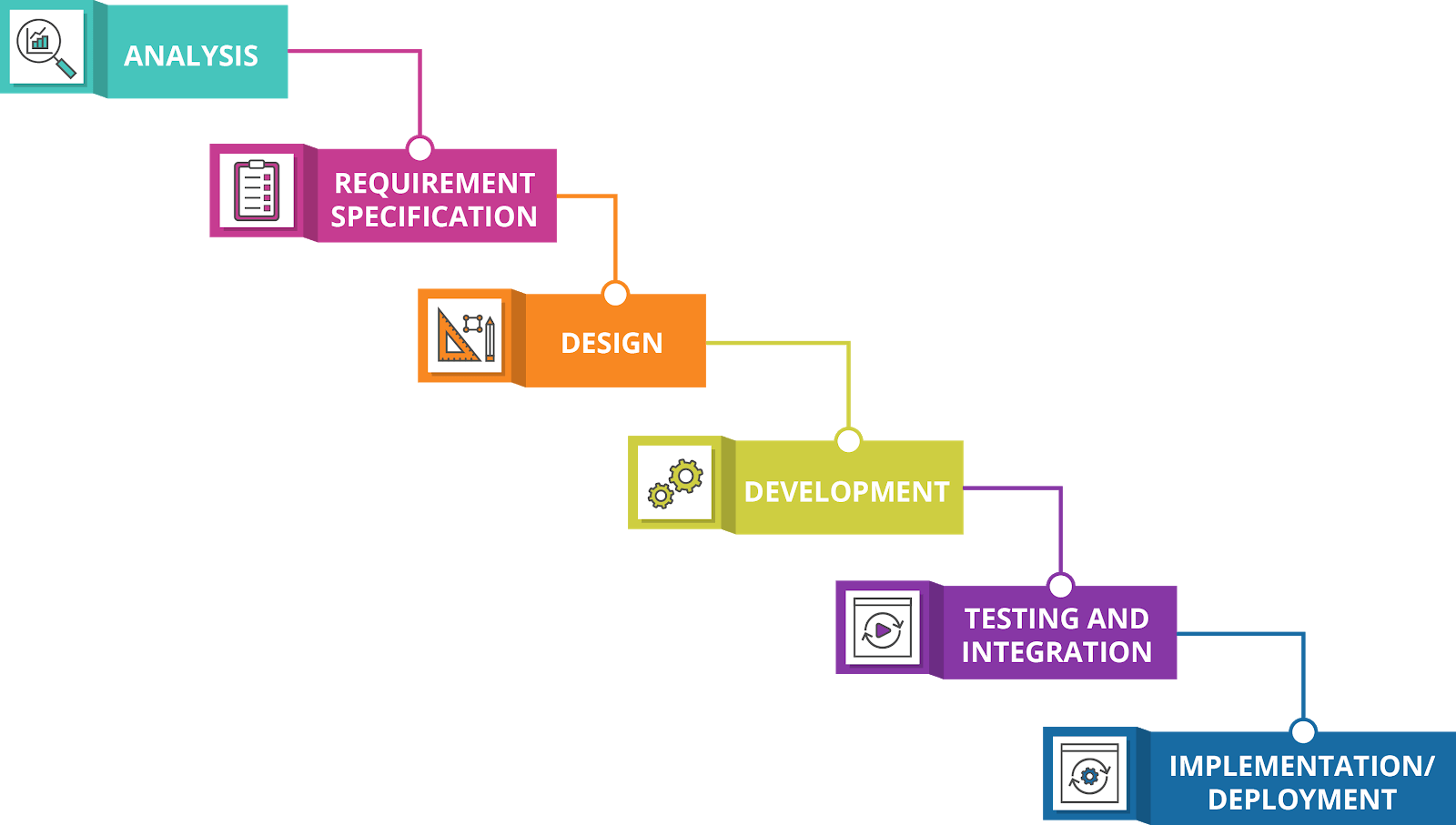

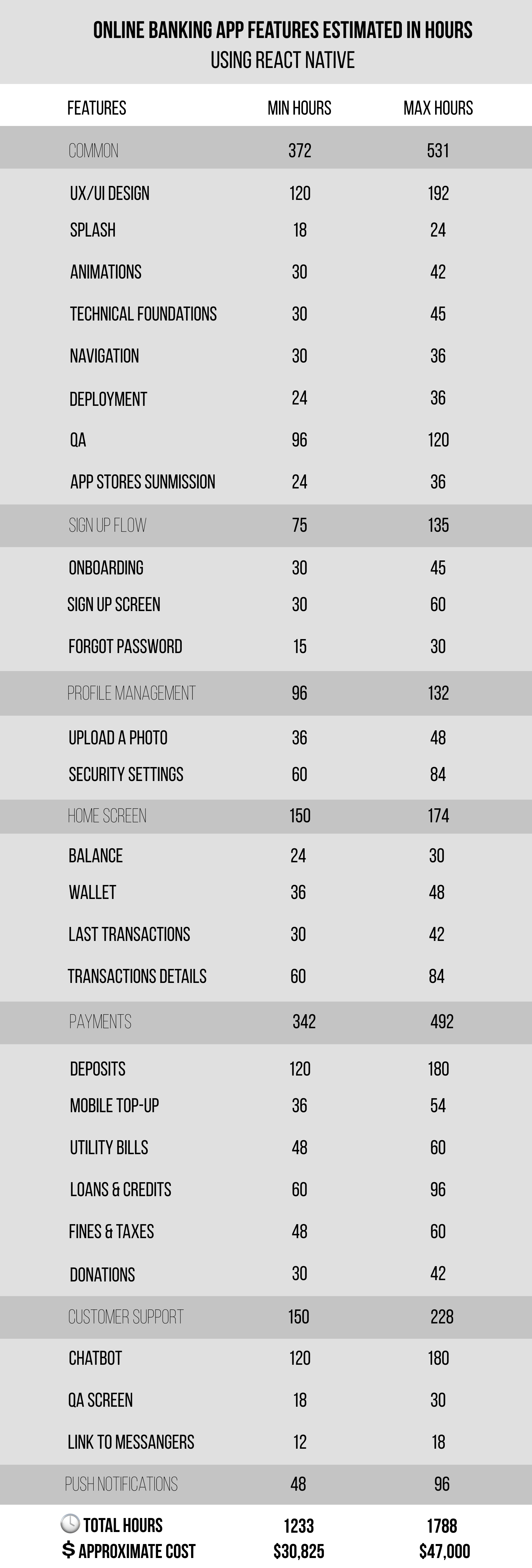

Continue readingHow much does banking app development cost?

To build a banking app that stands out from a large number of competitors, it is important to make it technically sound and really helpful when it comes to solving the problems of your consumers. But what is the cost of developing a mobile banking app?

Banking app development cost for iOS or Android is determined by two main criteria.

The first criterion is the performer. For example, if you live in the United States and order an application from local banking app developers, then its cost will be 2-3 times higher than if specialists from Eastern Europe were engaged in it.

Estimating the volume at each stage, which means calculating how much it costs to develop a mobile banking application, is a difficult task. To do this, you need to have a good idea of the end result and be tech-savvy to estimate the labor costs for each function. Therefore, as a rule, the most experienced specialists are involved in this process.

The assessment takes place in two stages:

1. Preliminary, free cost estimate. Although the preliminary estimate is called rough, it allows you to accurately find out the required amount of investment required to create an application before signing any contracts. That is, you can get it within 1-2 days, for free.

2. The exact price for the application development. An agreement that fixes the terms and stages of work and describes the final result supports a more accurate price assessment of mobile banking development.

There are also cases when, during the development process, with an increase in the depth of understanding, a rethinking of the original task occurs, which can affect the final cost. That is, nuances arise that could not be foreseen before, and decisions are made to remove something from the primary list as unnecessary or add something to it, especially when unique applications are created that have no analogs.

It's good if the company has already built mobile apps with similar functionality. In this case, the answer to the question "What is banking app development cost?" will be more accurate than if the developers had no experience in such applications.

Below you can see the price table for building a banking app MVP based on the average hourly rate in Eastern Europe:

You can make a more detailed calculation for creating a mobile banking app using our Estimator.

Success stories of popular mobile banking apps

Let's take a closer look at some inspiring mobile banking apps that really rocked the modern FinTech market.

Revolut

The story of the UK fintech project Revolut clearly shows how important it is for the founders of a startup to grasp the needs of the consumer and offer the product or solution they need. Revolut has become the tool that has helped solve the problem of commissions in foreign exchange transactions, including an application and a multi-currency debit card. This allows the cardholder to pay abroad in the desired currency, and not pay commission for conversion.

Revolut's key features:

- Spending analytics: It creates weekly insights into user spending habits with advanced categorization features.

- Financial management: Users can connect all their bank accounts using open banking to efficiently track their finances from one place.

- Instant transaction alerts: The app sends immediate notifications for all transactions, ensuring users are always aware of account activity.

- Subscription management: Users can easily organize recurring payments and receive alerts for upcoming subscription renewals.

- International money transfers: It allows users to send money abroad in over 30 currencies at the Interbank Exchange Rate.

- Fee-free global spending: Customers can enjoy fee-free spending abroad with competitive exchange rates.

- Cashback rewards: Revolut mobile banking application supports earning cashback and rewards from exclusive retailers.

- Virtual card: Users can shop online securely with a virtual card that changes its number for each transaction.

- Revolut <18 Accounts: You can open a Revolut account for children aged 6-17 with specific features.

Monzo

Monzo is one of the largest fintech players in the UK market. The company was founded in 2015 by Oxford graduate Tom Blomfield. It has managed to become one of the leading challenger banks. The main features of which are the absence of physical branches and an emphasis on communication with the user through a mobile application.

Thanks to a client-oriented approach, their convenient mobile banking applications, and competent work with the community, the startup was able to attract more than 7.4 million customers who use mobile banking in 2023 and become the main competitor to Revolut.

Monzo's key features:

- Accounts for young clients: If the client is 16-17 years old, he can use Monzo;

- Joint bank accounts: Monzo clients can create Bank accounts for 2 users;

- Customization with IFTTT: Customers can automate almost any control function;

- Capital Management: A budgeting tool from Monzo called Summary allows clients to control their budgets.

- Personal loans. Monzo offers personal loans of up to £25,000.

- Track your mortgage. Users can see the monthly payment amount and the total they owe.

Starling Bank

Back in 2014, Starling Bank was born from the ground up as a startup to make banking easier for people. At the moment, the number of open accounts has exceeded 3.6 million, the bank manages deposits for £143 billion and for 2 consecutive years has been recognized as the "Best UK Bank".

This Fintech project is also interesting because it is the first project founded by a woman — Anne Boden. 30 years of banking experience helped her understand how to start a mobile banking business.

Boden calls Starling “the bank for people who live their lives on a smartphone.” After a year of traveling the world and exploring the latest developments in technology, the woman realized that customers are used to living in real-time, and tried to implement this in her startup. Boden came up with the idea of creating an online bank, for which she raised £272 million for her project.

Key Starling's bank features:

Disable/Restrict and block payments: Users can disable chip and pin or contactless payments (Google Pay, Apple Pay), restrict online spending, and block transactions such as gambling

Set up savings space: The app allows earning interest whilst saving towards personal goals

Bill payments from saving spaces: Customers can automatically pay any direct debits and standing orders from saving space

Free virtual cards: Personal and joint current account holders can use up to 5 virtual cards to spend from linked saving spaces and to pay for subscriptions

Categorized spending: Transactions are automatically sorted into a vast range of spending categories to keep track of your spending

Round-up spending: The app allows rounding up transactions to the nearest pound to save money

Our experience in mobile banking application development

Geniusee banking software development expertise began with the development of online wallets. Then blockchain technologies were added to projects for the development of cryptocurrency exchanges, investments, and trading. Now we are focused on banking services, payment systems, and cryptocurrency exchanges. In development, we use NoSQL, relational databases, and mat systems' analysis. The production environment is built using firewalls, web server load balancing, and database replication to ensure fault tolerance and performance. You can find our successful fintech software projects in our Portfolio.

What do we offer

Digital banking portals: Our expertise ensures the creation of cutting-edge portals that enable seamless electronic document management, online customer service, and robust data security measures.

Mobile banking software solutions: We prioritize innovation, personalization, security, and 24/7 support, ensuring a seamless and secure user experience that surpasses competitors in speed and transparency.

Core banking solutions: We specialize in crafting robust and scalable solutions that streamline operations, enhance customer experiences, and drive growth in today's dynamic banking landscape. We don’t make it easy for Wise, Payoneer, or Genome to steal your customers who need multi-currency accounts.

Lending software solutions: Our software development services empower financial institutions to automate processes, optimize risk management, and deliver exceptional borrower experiences, driving success in the competitive lending market.

Conclusion

Mobile banking app development is a huge topic with many pitfalls. Moreover, each idea is unique and requires careful study and evaluation.

You can fill out a contact form and get a free consultation with Geniusee specialists to learn how to create a banking app for Android and iOS. We will help you more accurately determine the tech stack, amount of time, and cost required for mobile app development in banking.

And remember — the more often a customer uses your bank, the more you earn. And mobile application development for banking is the shortest way to a modern client's heart.