Even 7-9 years ago, mobile banking represented several additional options for the owners of cards and bank accounts. They could be used by SMS or by calling a special support line. There was a separate Internet banking with a very limited list of options and a complex system of use.

Today, remote services of financial institutions are in a kind of symbiosis. You can download the application of your bank to your smartphone and perform almost any operations with your accounts, having access to the Internet. In rare cases, when using the application, you will need to verify your identity by phone. As for the rest, banking applications are simple, multifunctional, and have quick feedback. Their advantage is that they save the potential client's time - they do not need to stand in lines to transfer money from account to account, pay bills, or carry out other transactions with their money.

At the same time, the client has someone who has got their back. It is a bank branch, where you can communicate with a "living person", get advice, issue new cards, or make exchanges or other banking activities in a safe place.

We have collected vital statistics about online banks:

- 79% of smartphone owners have used their devices for online purchases in the past six months.

- More than three-quarters of Americans used a mobile device to check account balances in 2019.

- The total value of digital payments made using mobile devices reached $503 billion in 2020.

- By 2021, there will be roughly 7 billion mobile users worldwide.

- 69% of millennials used mobile banking in 2020 for shopping.

- Bank of America continues to be an industry leader with 25 million mobile active users.

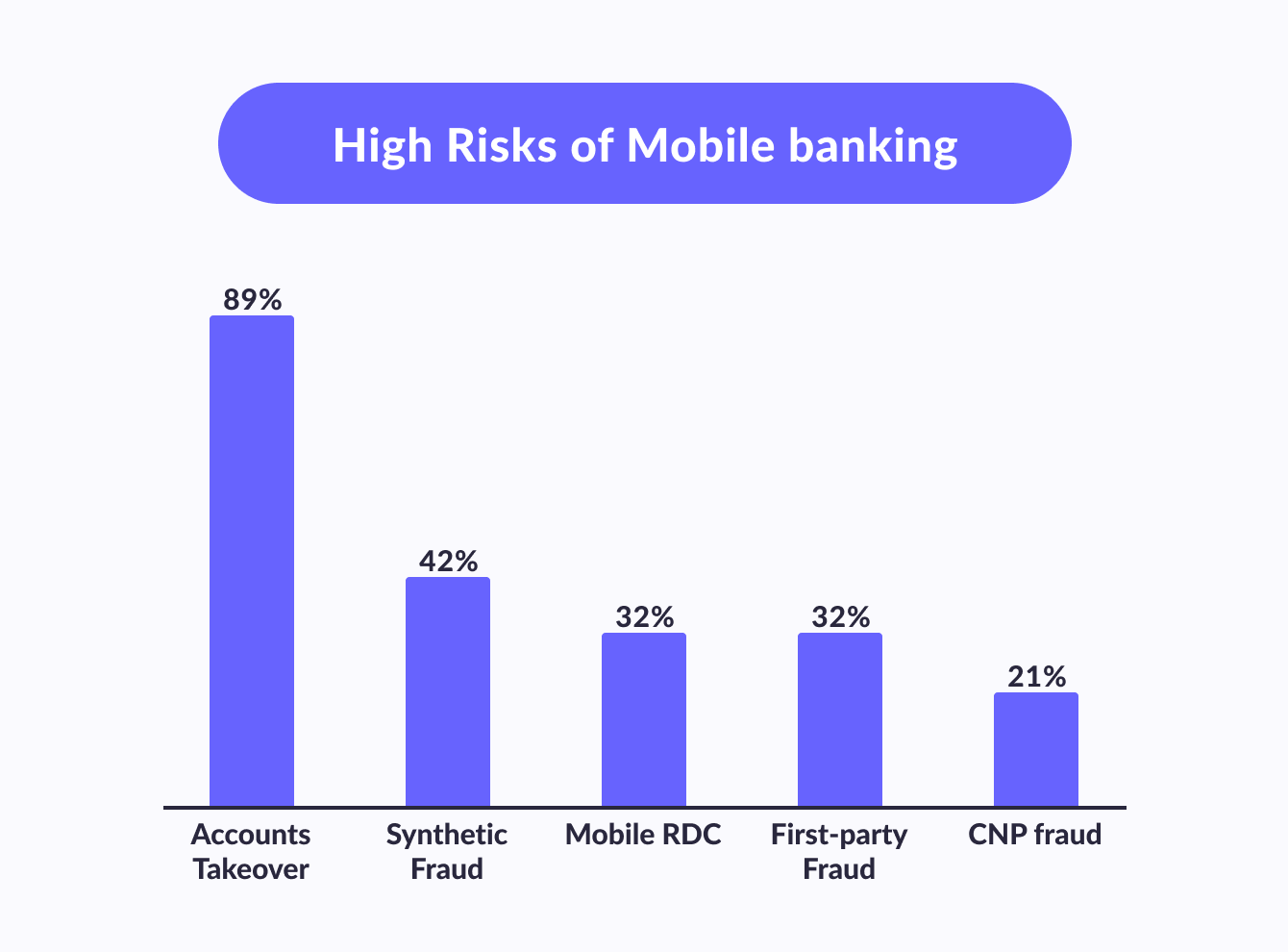

- 89% of digital payment fraud losses are due to account takeovers.

In this article, we will share the advantages and disadvantages of mobile banking development for customers and the main risks of mobile online banking.

In this article:

What is mobile banking?

Mobile Banking is an Internet bank with reduced functionality and an interface adapted to the screens of gadgets. To use the application, you need to download and install it on your device. At first, the system will prompt you to enter your login and password (or otherwise confirm your identity), after which access to your account will open.

Internet banking first appeared in the late 90s, and ten years later users could manage their finances through the bank's website, enter conversations with support, block credit and debit cards, and make transfers and payments.

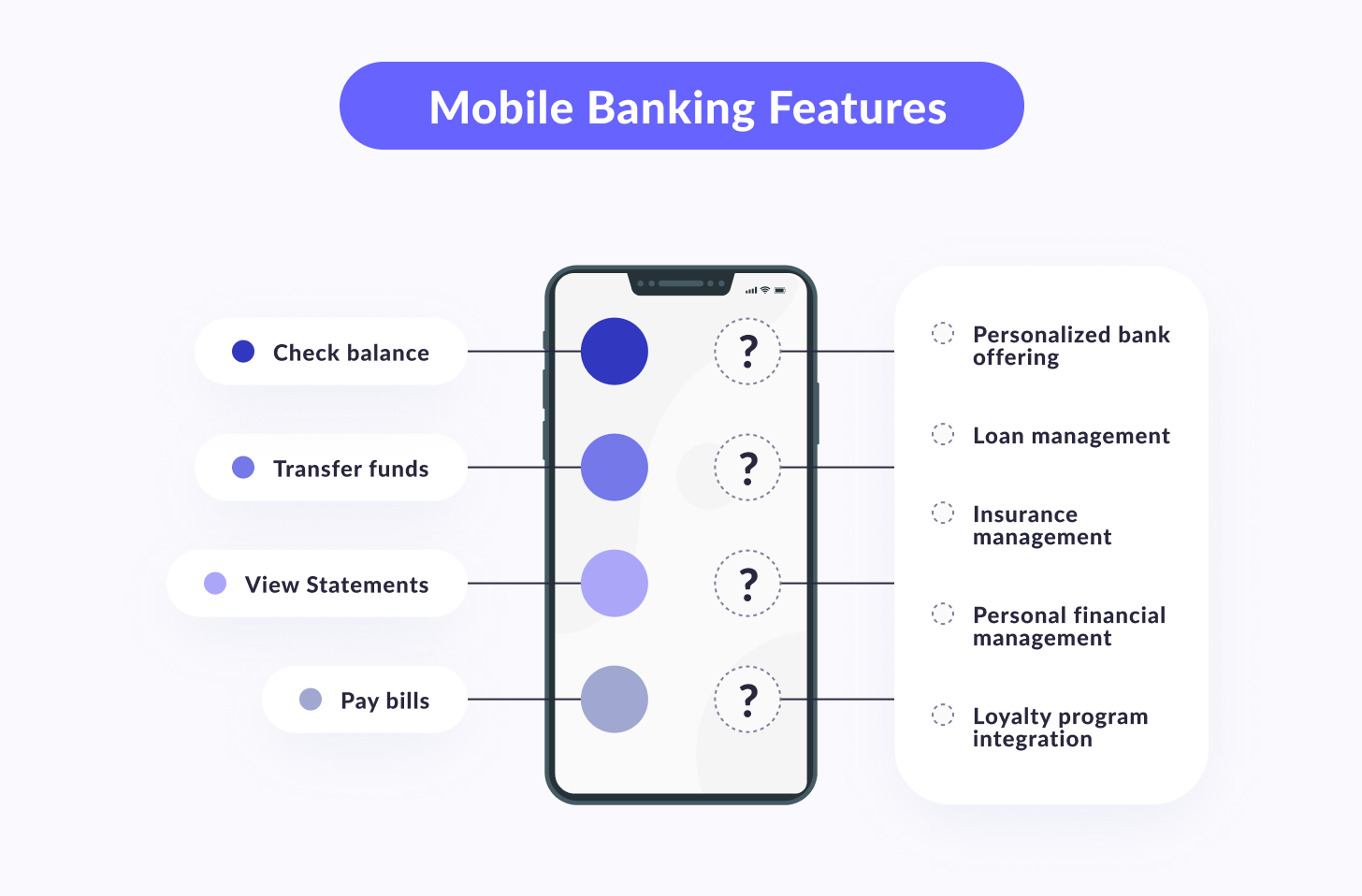

Today the mobile bank provides access to investments, insurance, discounts, mobile check deposit, and bonus programs. From the gadget's screen, you can control paying bills, send reports to the Tax Service and other regulatory structures, pay bills, and even send money abroad.

With the help of banking CRM software, institutions can better manage customer data and optimize cross-channel engagement, enhancing competitiveness in the digital era.

You may be interested to know what is the difference between mobile banking and online banking. As the name suggests, mobile banking apps are run on a mobile phone, that is, on a smartphone. Usually, you need to download the mobile banking application of the respective bank. You need to register and log into the application that provides a list of actions and transactions that a person can perform. This type of banking requires access to the Internet connection, either via a Wi-Fi network or mobile data.

More on the topic

Humanizing The Digital Banking Experience: Strategies For Customer Success

Explore innovative approaches to create meaningful connections in the world of online finance.

Continue readingUses of mobile banking, from the other point of view, are usually done through a computer. Mobile banking can be accessed through the bank's website in a browser. You can also enter the bank account via a mobile phone using a browser on the phone. However, if you are using mobile apps, then it will already be mobile banking.

The operations available through mobile banking and Internet banking are more or less the same, but this depends primarily on the bank. Both allow customers to check their bank account balances, view and request statements and mobile deposit checks, and more. Nowadays, online payments, bill payments, and money transfers can also be made using mobile banking. However, there are some limitations of mobile banking compared to Internet banking. This again depends on the bank and their applications, but the gap is rapidly closing.

Pros and cons of mobile banking for business

Main advantages

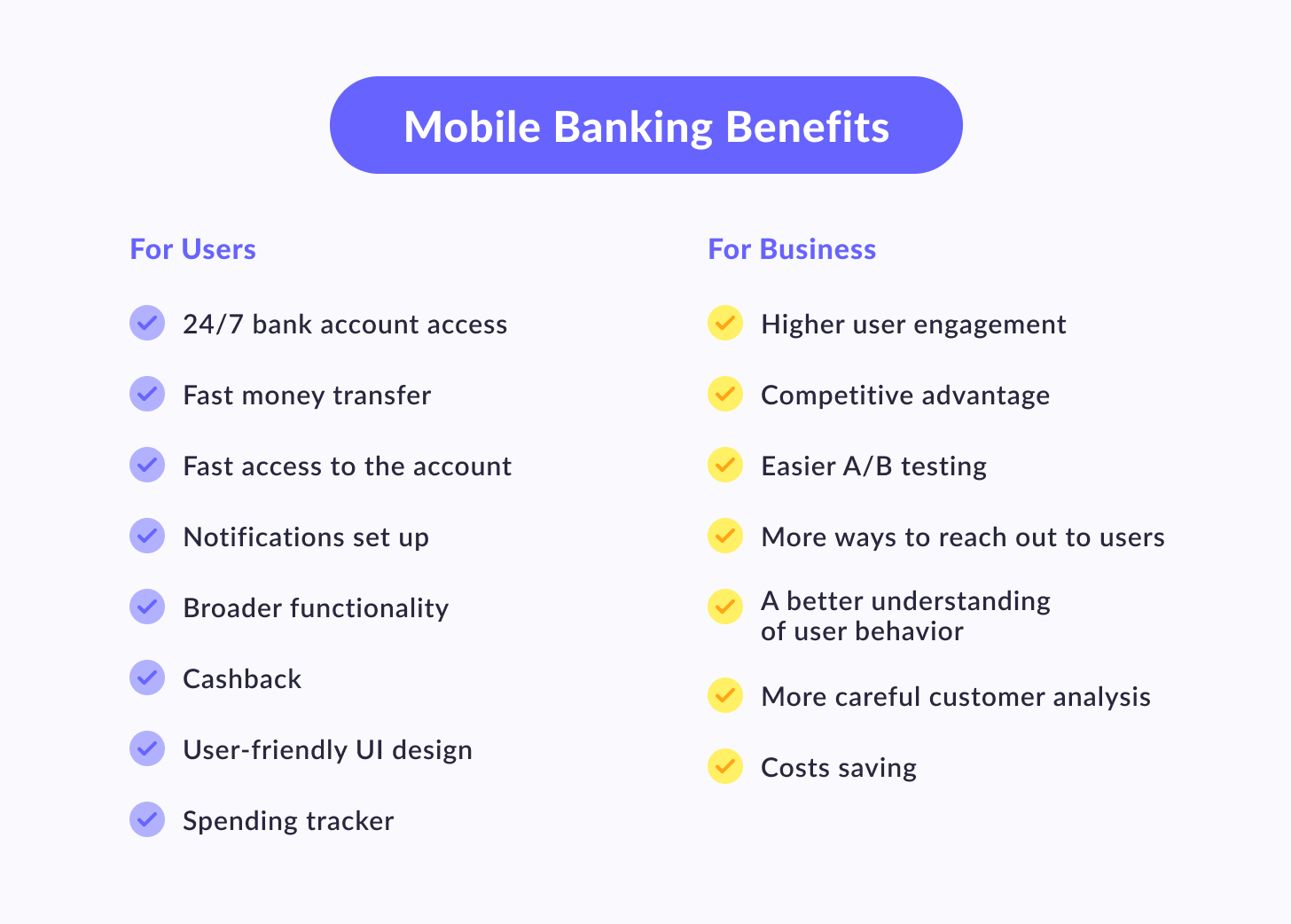

The importance of technology to financial services has never been greater. 17.4% of American bank customers, according to the GOBankingRates company, believe that mobile services are more important than low-cost services, quality of service, and high-interest rates. There are some advantages of online and mobile banking apps that were created in accordance with the best practices of digital banking.

1. High speed of customer service

Data on all transactions, changes, and other actions of the client are read automatically, operations are carried out within the system.

2. Large service coverage area

This is due to the lack of binding to branches, regional centers, etc.

3. High download volume

When processing user requests involves the human factor, there are restrictions on the production capacity of the resource, in contrast to the automated approach that is achieved using a mobile application.

4. The number of mistakes made decreases

The elimination of the human factor significantly reduces the variation in process execution, which leads to a decrease in the number of errors and, accordingly, increases the stability and quality of the process.

5. The speed of performing repetitive tasks increases

One of the most important benefits of a mobile app for banking is that with the help of it the same tasks can be completed faster because automated systems are more accurate in their actions and are not subject to a decrease in performance from time to time.

6. The control accuracy is improved

Due to the use of mobile banking services in automated systems, it becomes possible to store and take into bank account more data about the process than with manual control.

7. Fast decision-making

In automated online banking systems, decisions related to typical situations are made much faster than with manual control. This improves process performance and avoids inconsistencies in subsequent stages.

8. Higher competitiveness

Bank services can be quickly scaled up and integrated with other services.

9. Reducing marketing costs

Information and marketing channels are embedded in the mobile application. This reduces the cost of informing customers, personalized AdWords, and clients’ push notifications.

Mobile banking advantages and disadvantages

Advantages of mobile banking for clients

It is no longer possible to stop the processes of financial mobilization. Especially if you consider that the degree of involvement of bank clients in these processes is very high and is constantly growing. You will ask, what are the benefits of mobile banking? There are many advantages of mobile banking strategy, as well as technologies for remote banking services. What are the main benefits of online and mobile banking apps?

1. Easy to start

You do not need to have any special knowledge and skills in order to connect to a mobile bank. You just need to download and install the required software, register and ... that's the main pros of mobile banking!

2. Availability

Everyone has mobile phones, we have already talked about this. Mobile networks are present even in the most remote corners of the world. This means that a person can use mobile banking in any condition, wherever they are, and at any time of the day.

3. Cost reduction

One of the main benefits of mobile banking apps is low tariffs for using mobile banks. The cost of services is so insignificant that a person is unlikely to feel that he has spent something when connecting to a bank. And if you calculate: a visit to traditional banks in terms of time costs, the cost of gasoline or travel by public transport is much higher. The mobile bank allows you to save money.

4. The more you know, the better

Clients use the Mobile Bank also for the reason that they can always control the movement of funds in their bank accounts, monitor their safety, use information services and have their own personal assistant. On the one hand, it is much easier to make mobile banking transactions with a mobile phone, on the other hand, not a single penny will be lost from your savings account so you do not know where it went and for what reason.

5. Safety

It is an ability to quickly block the credit or debit card if the client notices its loss. To do this, just go to the "card blocking" section, press the button and the card instantly stops functioning. This feature helps those customers who are at risk of being used by other people who know the PIN if the card is lost.

Thank you for Subscription!

Disadvantages of mobile banking services for clients

The biggest disadvantage of mobile banking platform for cooperation with online services is additional risks. This concerns the penetration into the channel of communication between the client and the bank assistant, as well as the penetration of intruders and making payments from account holders. The main cons of mobile banking are:

1. Threat of fraud

The main security concerns in mobile banking are the unencrypted servers of cell phone providers. An expert hacker will be able to obtain information about the account activity and debit/credit cards of users relatively easily. Also, messages received from banks are not encrypted. This means that there won’t be a problem to intercept the information when it is transmitted through the mobile operator. If the mobile is stolen, the sensitive financial information stored in the messages can be used by another person.

2. Limits of financial transactions

Some banks impose a limit on the number of financial transactions; the bank can also completely prohibit transactions which in its opinion can be dangerous. Remote management of customer deposits and credit accounts is a high risk for the bank. Most often, these functions are not available in the mobile banking system or are severely limited. Limitations can apply to both the number of transactions per day and the amount of funds in one transaction.

3. Payment processing speed

Interbank payments can be in limbo for up to 3 business days, that is, if you require transferring funds on Friday, then the recipient will receive the money only next week, Monday evening.

4. Bugs and tech issues

During the development of mobile banking applications, it is important to comply with all requirements, keep abreast of new technologies, and test the product in practice. It is testing that helps to find and fix all the flaws in the program so that the user is ultimately satisfied.

Risks of mobile banking

Applications for mobile platforms are susceptible to both old well-known threats and new ones that have not yet been fully explored. The spread of malicious applications for Android is growing.

Threats to the security of mobile banks pose the risk of compromising sensitive user financial data, transferring money, and damaging the bank's reputation. Developers of mobile bank clients do not pay sufficient attention to application security precautions and do not follow the guidelines for secure development (such as multi factor authentication, code review, etc.) Developers often lack processes for developing secure code and architecture.

The study, based on static code analysis, shows that mobile banks contain vulnerabilities and flaws that can lead to funds theft. The level of protection of mobile banks in most cases does not exceed the level of protection of the conventional bank's mobile app, while the risks of mobile banking apps associated with them imply increased security requirements.

It was assumed that the number of specific vulnerabilities for the mobile platform would significantly outnumber the well-known ones. But as a result, you can see approximately the same number of vulnerabilities in both classes. This means that it is possible to carry out well-known attacks on mobile banking applications without knowing their specifics.

Attackers have many ways to execute attacks. At the same time, the cost of carrying out an attack in a real environment can be very low compared to the possible benefits.

Attackers have many ways to execute attacks. At the same time, the cost of carrying out an attack in a real environment can be very low compared to the possible benefit.

Modern security measures for mobile devices - antivirus, MDM solutions, etc. - can reduce risk, but cannot solve the full range of problems. Security should be introduced at the system design stage and be present at all stages of the program life cycle, including the development and implementation stages. It is necessary to carry out code audits, application security analysis, and penetration testing.

The risks of mobile banking are inversely proportional to the security of the application. Therefore, a comprehensive audit of the security of these applications is required.

How to reduce risks of mobile banking

1. Educate programmers about security issues

One of the big problems right now is that most developers don't have adequate financial information security training. We aren’t talking about the lack of some deep and professional knowledge, we mean basic knowledge. Programmers are tasked with creating interesting new products. At the same time, they can easily fail to see the possible directions of attack in the results of their work; they simply cannot understand how their actions by themselves create threats.

2. Build security architecture

The vulnerability of insecure interprocess communication is laid down at the stage of designing interfaces for the interaction of application components and refers to errors in the implementation of protection mechanisms. The information systems (IS) security architecture depends on the risk model and on the organizational structure of the enterprise. The task of constructing an optimal system is solved on the basis of achieving the set goals and rejecting redundancy.

3. Conduct code review

The code Review technique helps to find some errors in the early stages and get rid of incomprehensible and confusing solutions. It’s not one person who is involved in the work on the code, it’s the whole team, so a fresh look from the outside can often become useful. A programmer who knows in advance that their colleagues will check their work tends to write more accurately and in an organized manner. The output is code that is understood by several people, which means that it is much closer to quality.

4. Analyze the security of the application

Mobile app security is the first expectation of a user experience with a brand. Every day, people operate dozens of programs on smartphones. Many of them transmit confidential information that could be of interest to attackers. Therefore, when launching applications on a device, users want to be sure of their safety. Reliable bank data protection is a prerequisite for launching an application.

5. Quickly fix vulnerabilities and release updates

When analyzing the state of information security of an IT infrastructure, multiple vulnerabilities are often found, the elimination of which does not significantly affect the overall level of information security. It is not enough to eliminate the identified vulnerabilities, it is necessary to adjust the existing information security processes and implement effective control mechanisms.

Our experience

Mobile banking is not just a technology, for the implementation of which it is enough to connect a server machine, but a whole system of online interaction with clients. For this system to work efficiently and be profitable, a lot of effort and money is required, including the development of appropriate software solutions.

Mobile banking doesn’t stand still: customers ask to add an option, new technologies are periodically introduced, vulnerabilities are fixed, etc. Each of the changes requires updating the entire system and connecting new modules. And here you have to make a choice: to develop the financial institution system independently or to take advantage of the proposals of the developer companies.

In order to be guaranteed to get a professionally executed project, you can order a website for a bank from our company. We have a proven track record of building web applications across multiple niches in financial institutions. And our programmers have the necessary competencies to build a functional and secure banking site.

You may also like

Banking App UX/UI Design

Uncover the secrets of creating intuitive, user-friendly interfaces for modern banking apps. Explore best practices, trends, and tips!

ExploreFinal thoughts

With the development of technologies and a higher level of Internet connectivity, mobile apps have been added to the usual channels of banking services, which allow customers to receive information about the bank and its services anytime and anywhere. But make sure that you studied in detail all mobile banking advantages and disadvantages.

The presence of a mobile application can become one of the competitive benefits of online banking in the eyes of customers who want to be able to manage their products without visiting the bank's offices. Additionally, clients have the opportunity to get quick access to information about ATMs and bank branches.

Fill out the contact form to get more information about the development of a mobile bank.