Jumping into digital, however, requires a strong strategy that is not only sustainable but also sets in well with the current operations of the bank. Let’s discover how you can develop a successful digital banking strategy for your bank, using all the digital capabilities.

In this article:

What is digital banking?

Digital banking is the automation of all traditional banks processes and activities that occur when a customer visits a bank or credit union. This includes cash deposits, withdrawals, transfers, bill payments, loan services, investments, etc.

The advent of digital banking was a result of customers becoming tech-savvy and demanding tech-driven services. Due to this huge demand, banks started shifting to the digital-first philosophy.

As of 2023, as many as 2.3 billion consumers globally used online services for banking, and this number is expected to reach 2.5 billion by 2024.

More on the topic

Humanizing the Digital Banking Experience: Strategies for Customer Success

Learn more about upcoming digital transformations in FinTech.

Continue ReadingBenefits of digital banking

E-banking introduced many conveniences for customers. Here are some of the most important benefits it has to offer:

- Increased efficiency and accuracy: The involvement of AI in Internet banking has made operations highly efficient and accurate. The algorithms leverage real-time data to make important decisions, and the room for human error is eliminated.

- Lower costs: There is no real estate or paperwork involved, and software automates most manual tasks. This reduces operational costs and increases the bottom line.

- Agility and mobility: With cashless transactions and minimal paper processing, the virtual banking industry allows bulk cash to be processed very quickly. There is zero lag in transactions, and digital banks react to risks and opportunities quickly.

- Convenience: Remote banking services bring convenience to bankers and customers. They don’t have to carry cash or other paper documents, which makes the experience even better.

- Security: Security measures such as multifactor authentication and biometric verification make it very hard for malpractice to occur.

- Better control: E-banking makes it easier to navigate daily transactions and track all related activities. Customers can self-serve through mobile apps and are in better control of their banking operations.

The benefits listed above are substantial and prompted the digitalization shift even for those who were hesitant.

Trends in digital banking

Since the whole sphere of Internet banking is consumer-driven, it evolves with changing customer demands. Below are some of the most important trends in virtual banking that have been adopted with time.

- Artificial intelligence has automated several analytical tasks that were previously handled manually. AI-driven bots can handle complex calculations with minimal error rates.

- Mobile banking apps put customers in charge of their banking operations. This has created an ecosystem of cashless transactions, which has found applications in other industries as well.

- E-banking enabled big data monetization such that the data collection is now streamlined and more data-driven decisions are being made.

- Blockchain technology introduced a new era of banking based on cryptocurrency. It also makes transactions more secure and safeguards personal data.

- An extended banking ecosystem that is not limited to payments and investments but also includes adjacent activities such as cash flow analysis, accounting, tax management, etc., was developed.

- Banks are now better positioned to track the customer’s journey and target them better through advanced marketing strategies. Data analytics have played a huge part in making this happen.

- All digital banking experiences are being managed through smart management techniques. This involves shifting to the agile framework for managing tasks and improvising strategy as new challenges come forth.

Digital banking is continually evolving, so new trends are expected to surprise us soon.

Pillars of digital banking

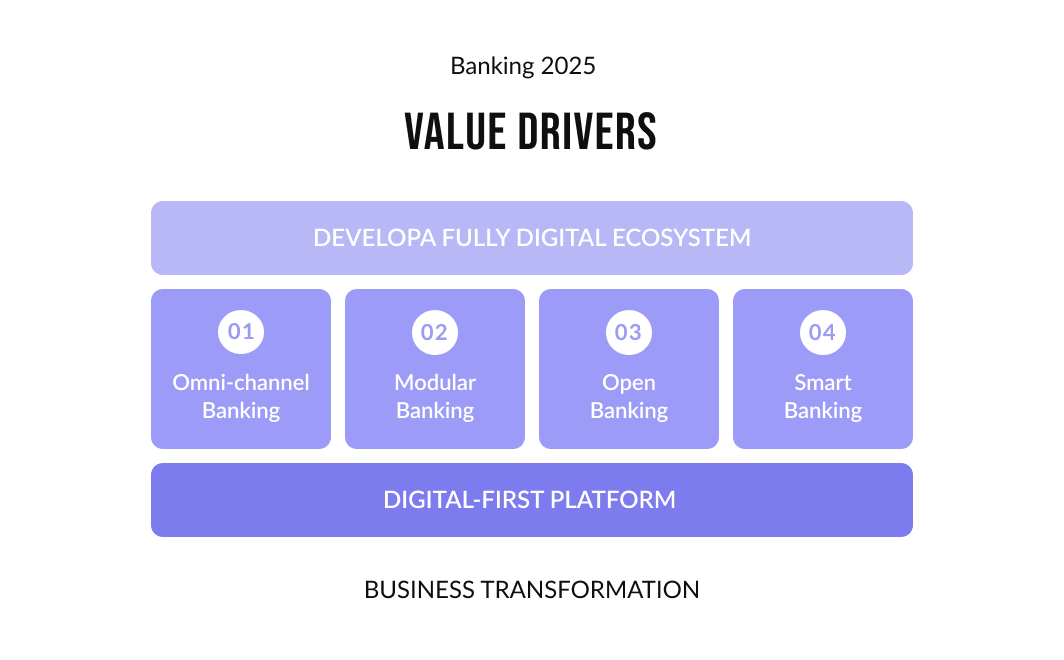

The digital banking framework is supported by four primary pillars: omnichannel banking, modular banking, open banking, and smart banking.

Omni-channel banking

Omni-channel banking involves setting up a central digital hub where all digital channels merge and then disperse for customers to use. The conventional approach was based on siloed channels where everything had to be managed separately. However, bringing everything to the same place orchestrates customer interactions across any touchpoint.

Modular banking

Modular banking architecture turns FinTech companies into marketplaces for financial tools powered by the bank’s core deposit. New services can be easily designed, offered, and scaled with minimal marginal cost, so the bank becomes more responsive to customer demands.

Open banking

Open banking is a practice where banks provide third-party financial service providers open access to their financial data to collaborate with the bank on enhancing their service offerings.

Smart banking

Smart banking allows banks to leverage technology to move expensive in-branch activities to online platforms. It allows banks to take an intelligent approach to customer service and provide multiple products from small kiosks or mobile devices.

Thank you for Subscription!

How to create a digital banking strategy

Now that we covered what e-banking is and how it has transformed the entire sphere of the financial industry, let’s discuss creating a FinTech companies strategy.

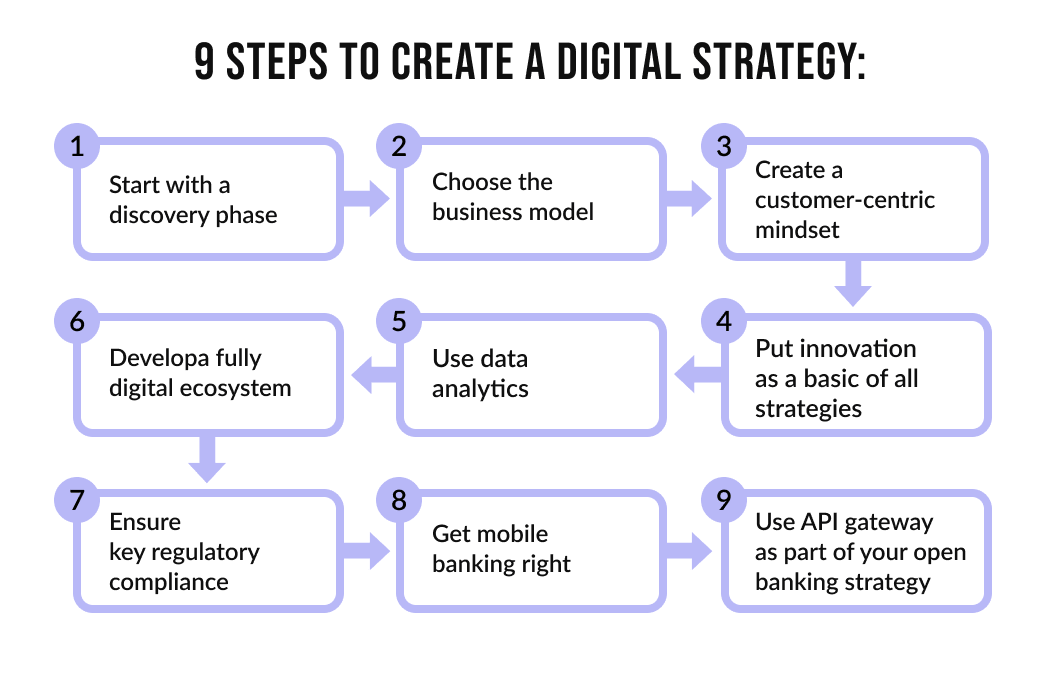

Start with a discovery phase

The discovery stage requires you to analyze your target audience and identify the right product-market fit. You may also identify important customer touch points and analyze your competitors to see how they solve the same problems.

If you skip the discovery phase and jump into product development right away, you may run the risk of making mistakes that can’t be fixed later.

Choose the business model

When starting out, you could choose a full-stack neobank model or one focused on the front end only.

Full-stack neobanks usually have a proprietary CBS and operate with a banking license. This enables them to manage everything from the front-end to the back-end and control the entire value chain.

Front-end focused neobanks rely on larger partner banks to establish a CBS. They focus solely on the tech side of things, while the financial operations are handled by the partner bank.

A full-stack digital bank allows you to handle the complete customer journey from digital account opening to monthly financial data analysis and offers a wide range of services, while the front-end model limits the scope a bit. Nevertheless, the latter allows you to specialize in one area instead of being a jack-of-all-trades.

Create a customer-centric mindset

A customer-centric mindset is essential to the implementation of digital in organizations. For banks, this works in three parts; you need to be attentive and pragmatic, embrace creativity and innovation, and redefine the role of your branches altogether. The goal should be to anticipate clients’ expectations, improve customer experience and use technology to build solutions in advance.

Put innovation as a basis of all strategies

Digital requires you to stay on your toes and keep adapting to the changes in the environment. Make sure that even the basic banking products you build have the room to absorb innovation and transform operations without disrupting older processes.

Use data analytics

When all of your systems go digital, the influx of personal data will also skyrocket. You can use this data to run different analyses and get insights about your customers, including customer behavior and the level of customer satisfaction. This data could also help make your segmentation models more effective and provide personalized services to each customer.

Develop a fully digital ecosystem

A fully digital ecosystem means that all stakeholders and third parties adopt the same strategies you do so that there can be efficient collaboration. Having everyone on the same page helps create new sources of revenue, lower process costs, and greatly enhance the speed of innovation and technology adoption.

Geniusee is here to create the best custom FinTech software for you! Find out about latest industry trends in our complete guide

Ensure key regulatory compliance

With customer data going online, the risk of breaches and other security issues increases. Thus, you need to have adequate security risk-handling frameworks in place. Make sure that the new model you implement complies with all regulatory requirements so that there is no legal interruption later on.

Get mobile banking right

Mobile-first banking is another important aspect you need to strengthen if you plan to go digital. Mobile banking needs to be very simplistic, help build client relationships, and keep up with the speed of innovation.

Focus on making the mobile interface smart and easy-to-use. You could leverage social media to develop emotional relationships with your audience and channel quality traffic to your app. Also, make sure your app keeps up with mobile OS updates. Besides, the dev-team needs to be super-efficient in identifying security risks. You could also collaborate with third parties for anti-fraud and financial crime prevention activities.

Denys Kashperskyi from Geniusee, while talking about mobile banking, said:

“The development of banking applications has its own features, which are determined by the scope for which the application is being developed. The main feature is the construction of service in terms of security of funds transfers, protection of user data, and information transfer within the service. The banking sector especially needs to implement all best practices provided by partners and services used in constructing the application. It is also necessary to have a consultant who is familiar with the laws of the country for which the team builds the application to avoid legal problems. An important role in our case is played by the partner bank that will conduct operations.”

Use API gateway as part of your open banking strategy

Using open banking APIs allows you to communicate with third parties for financial data and improve the service offering.

A simple example would be how loan processing before required considerable paperwork but with open banking, customers may obtain loans from their preferred financial institutions by consenting to share their financial data with other lenders. This way, financial brands can grow their relationship with the consumer by providing low-friction access to loans.

Digital banking strategies

1. Rediscover the customer journey

In the realm of digital banking, the customer journey encompasses every interaction a client has with your brand. Crafting an effective customer journey isn't just about providing a seamless experience — it's a strategy that can trim costs, amplify revenue, and foster lasting customer loyalty.

At each touchpoint, whether through conventional or digital avenues, customers shape their overall experience. These touchpoints span various channels: your bank's website, emails, social media, customer service calls, loyalty programs, paid advertising, and physical branches.

Pinpointing these pivotal touchpoints empowers your team to set expectations, and gauge successes and setbacks, facilitating ongoing enhancements in service quality. Ultimately, the primary goal is ensuring the customer feels content and holds a positive memory of interacting with your bank. How to achieve this pinnacle of customer satisfaction? By meticulously crafting a clear customer journey map that guides and enriches their entire experience with your online banking services.

2. Monetize data

Data monetization emerges as a pivotal strategy, leveraging internally generated and external data to yield quantifiable economic advantages—a process that unlocks genuine value from data.

As highlighted by Mordor Intelligence, the Data Monetization Market, valued at USD 3.38 billion in 2022, is projected to grow significantly, anticipating a CAGR of 19.98% and aiming to reach USD 10.41 billion by 2028.

Crafting monetization strategies isn't just an incidental endeavor; they're esteemed corporate assets. Similar to how organizations devise KPIs to gauge and manage business performance, these strategies serve as fuel for enterprise information assets, offering a competitive edge that demands continual enhancement. The potency of a monetization strategy lies in its capacity to transform good decisions into exceptional solutions.

A monetization strategy, essentially, outlines a blueprint aimed at accomplishing one or more business objectives through tangible, impactful activities. Banks must follow these strategies, that stem from a decision-making model intricately linked to corporate business levers, aligning seamlessly with overarching strategic goals.

3. Employ digital channels

Another business banking digital strategy is employing digital channels. These channels, encompassing web portals, mobile apps, and online platforms, revolutionize customer interactions with banks. Accessibility and convenience define their essence, offering clients the freedom to conduct transactions, check balances, and seek support anytime, anywhere. The seamless integration of these channels not only streamlines banking operations but also nurtures a more personalized customer digital experience, catering to individual preferences and fostering stronger customer engagement.

Furthermore, leveraging digital channels as a strategic approach allows banks to capitalize on evolving technological trends. Embracing innovations like AI-powered chatbots, biometric authentication, and predictive analytics amplifies the efficiency and security of banking services. These technologies not only enhance operational efficiency by robotic process automation of routine tasks but also fortify security measures, safeguarding sensitive financial information. By harnessing the potential of these digital tools, banks can stay at the forefront of the industry, delivering cutting-edge services that resonate with the ever-changing needs and expectations of their tech-savvy clientele.

Risks of going digital without a strategy

Going digital all at once will lead you to a plethora of problems related to security, inefficiencies in processes, and a waste of time and money.

The change is going to be uncomfortable, but you will need to find ways to adjust to it slowly but steadily. If you go all-in from day one, you will be completely lost. Instead of speeding things up, you will be wasting a lot of time in development, as there will be a lack of a timeline and a clear roadmap that defines the goals at each stage.

This situation becomes worse when you have an executive team or a team of investors to report to. There will be a lot of pressure on their end, and you won’t be able to show any results, at least in the short term.

Our experience

Zedosh is a modern digital advertising platform designed to financially empower Gen Z. Through open banking, Geniusee provided many analytical services on the platform.

We provided insights into the spending behavior of the audience, tips on how to master money, and crucially, the ability to monetize their attention through a disruptive advertising model.

The idea was to fuse FinTech and AdTech to create a highly consumer-centric solution, which was realized effectively through the collaboration of both companies.

Conclusion

The modern banking customer demands a tech-driven experience that utilizes innovative technologies yet is convenient to adapt to. Rushing into the implementation of such solutions without proper preparation can be very harmful to banks. We recommended you go in with a robust strategy that stands strong in the dynamic tech environment.

If you need help in developing a digital strategy for banks, the Geniusee team is always available to help you out via banking software development services.