Even in 2024, clients still experience tedious waiting and complicated solutions to their problems. Advanced finance companies are already leveraging their businesses by changing their service process with the introduction of artificial intelligence (AI) technologies and interactive voice banking.

Mobile apps users are increasingly looking to manage their money quickly, easily, and efficiently on a daily basis, and it is important for banks to meet these expectations.

Financial companies need to move to a new level of service and constantly improve the service in terms of personal online customer service. This is an important competitive advantage now because it builds customer loyalty.

In this article:

Banking virtual assistant use cases

Voice chatbots for digital banking read customer actions and process them to provide the most comprehensive solution from the company. After analyzing needs, behavior, and operations, the AI assistant will guide the client “in the right direction,” saving a lot of time. Interactive voice banking streamlines back-office processes, simplifies customer interactions, and enhances user security with banking service providers.

Text-to-speech voice recognition improves banking and helps banking customers:

make digital transactions, payments, and make a deposit or a loan;

check status, documents, and transaction histories;

seek information and more.

Voice assistants have tremendous potential in solving customer inquiries and managing personal banking operations through machine learning technologies, cloud computing, natural language processing, and optimized algorithms.

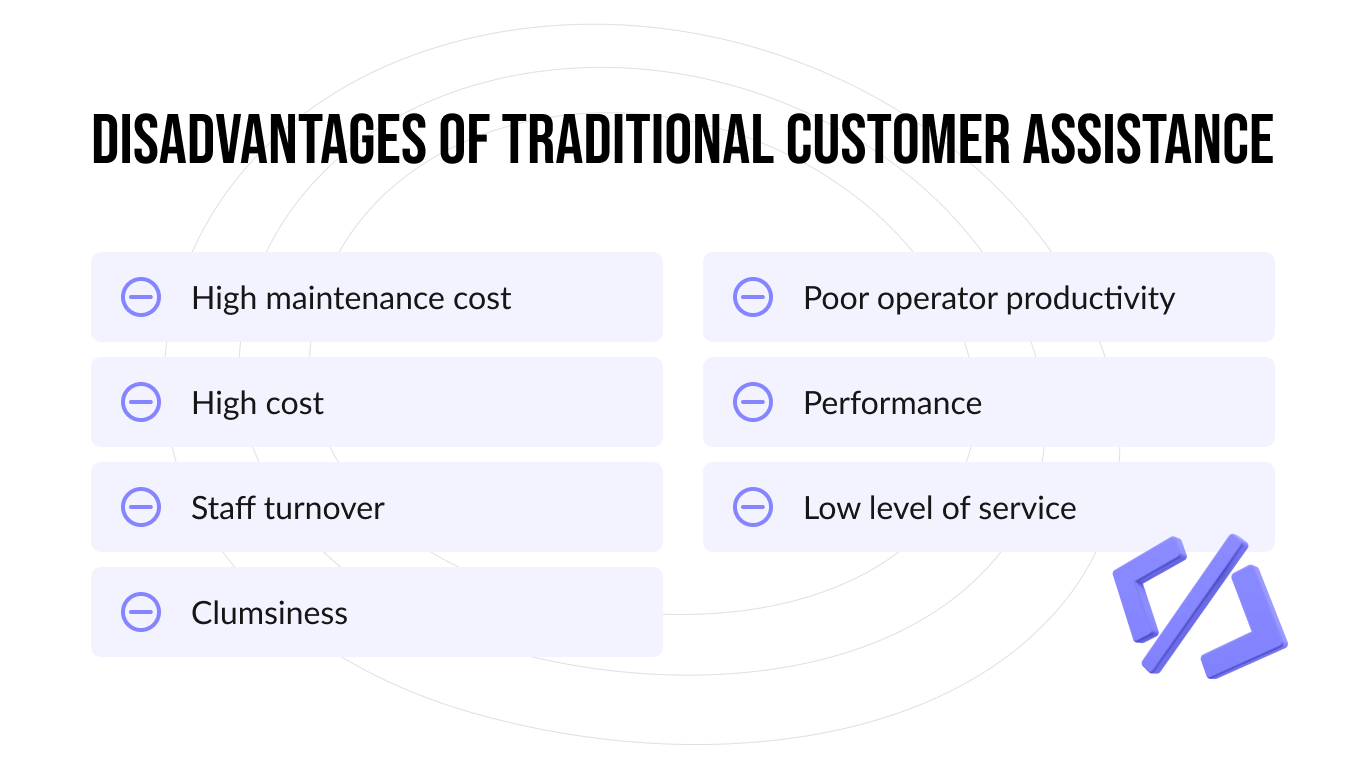

Disadvantages of traditional customer assistance

1. High maintenance cost

The more operators a business employs, the higher its payroll, taxes, hiring costs, training, and equipment. Therefore, to optimize the cost of a call center, the first thing companies look for is an opportunity to cut staff.

2. Highost

A traditional call center is considered “cheap.” This is the opinion of those who divide the operator's salary by the minutes worked. But if we take into account the associated costs, the cost of a minute of work will increase from $0.30 to $0.50.

3. Staff turnover

According to statistics, staff turnover in contact centers is about 30-45%, which is a lot. For other sectors of the economy, turnover does not exceed 15%.

High turnover is costly, as the bank continually pays for hiring, training, supervising new employees, and reworking old ones while newcomers get on board.

You may be interested

Banking App UX/UI Design

Discover how to make banking apps easy to use and visually appealing, focusing on improving the overall experience for customers.

Read more4. Sluggishness

Often, the flow of calls comes into the call center unevenly. The flow is influenced by seasonality, advertising activity, and restrictive measures. For example, during the lockdowns in the spring of 2020, the number of incoming calls to banks in the USA grew so much that it was difficult to process them. The on-hold waiting time for US call centers has increased 50%.

It is difficult for call centers to adapt to the increasing load since the increase in capacity is directly related to the expansion of the staff and the organization of jobs. Because of this sluggishness, banks are losing the quality of their services and customer loyalty.

5. Poor operator productivity

No employee is on the line for eight hours without a break. According to the standards for call center operators, the time in a conversation should not exceed 40 minutes from each hour for an incoming line; for an outgoing line, it’s 50% of work time.

6. Performance

Call center operators have low productivity. This is due to the human factor: the work is difficult and stressful, so you need to rest.

7. Low level of service

Even the best call center employees get tired and stressed from dealing with unhappy customers. As a result, they are distracted from their scripts, and this negatively affects the conversion. Human error increases the customer's cost to the company and reduces profits.

All these complexities make call center operations uneven and unpredictable. To reduce cost and improve contact center efficiency, companies are switching to robotic banking virtual assistants: voice and chatbots.

Let's build your custom intelligent virtual assistant!

mprove customer interactions and simplify tasks using our AI chatbot development services.

6 tips for successful digital custody

1. The salary of all bank employees depends on the satisfaction of the client, from the economist to the chairman of the board. The bank’s existence depends on the client's desire to use its services.

2. Each loss of a client means a reduction in the bank's income and, accordingly, in the wages of employees. A loss can also result from a refusal of an employee to cooperate with a potential client who is interested in the bank, but for some reason, decided not to contact it.

3. Competition in the banking market is constantly increasing, and it is the client who chooses the bank and not vice versa. Considering that in most cases, banks offer similar products and services, clients often choose the bank where they are comfortable and that is convenient. It is the quality of service that comes to the forefront of banking industry competition, which can become a competitive advantage.

4. Everyone who comes into the bank is a potential client, even if they made a wrong turn. If they encounter employees with a positive attitude, the next time they come to the bank, it will be on purpose.

5. Attracting a new client is many times more expensive for a bank than retaining an existing one. Retaining existing customers is no less important than attracting new ones, but at the same time, it is much cheaper for the bank.

6. An employee of the bank is its face; that is, through the actions of employees, the client "rates" the entire organization. The bank can have excellent automation management, the most professional accounting, and the most creative PR department, but if an unfriendly and incompetent employee in the call center answers the client’s call, then the entire bank will receive a negative assessment.

Top 10 AI-powered banking virtual assistants

As we mentioned above, the development of artificial intelligence has opened up new opportunities for the banking industry, and the merger of AI and online banking has led banks to improve their offerings and services. The growth trends in the popularity of digital banking have coincided with trends in the development and penetration of AI. While their progress is unrelated, it has certainly led to a merger as more banking financial institutions are exploring AI applications to improve their services.

While enterprise automation solutions have hit the market, many organizations have researched client-centric AI applications. The most widespread of these are chatbots. They have come a very long way in their development: advances in machine learning and natural language processing have allowed them to learn from their interactions and have a conversation in natural language. Take Google Assistant, for example; until a few years ago, no one could have imagined such an assistant!

According to the SemRush report, the forecasted AI annual growth rate between 2020 and 2027 is 33.2%. Online banking is growing by leaps and bounds, reaching millions of devices. Integration of virtual assistants into banking chat is the next step towards making these interactions smoother and more natural.

While today's AI banking assistants lack the digital capabilities of Google Assistant, they are still the foremost AI applications in the banking sector. Below are the top 10 banking chatbots.

Thank you for Subscription!

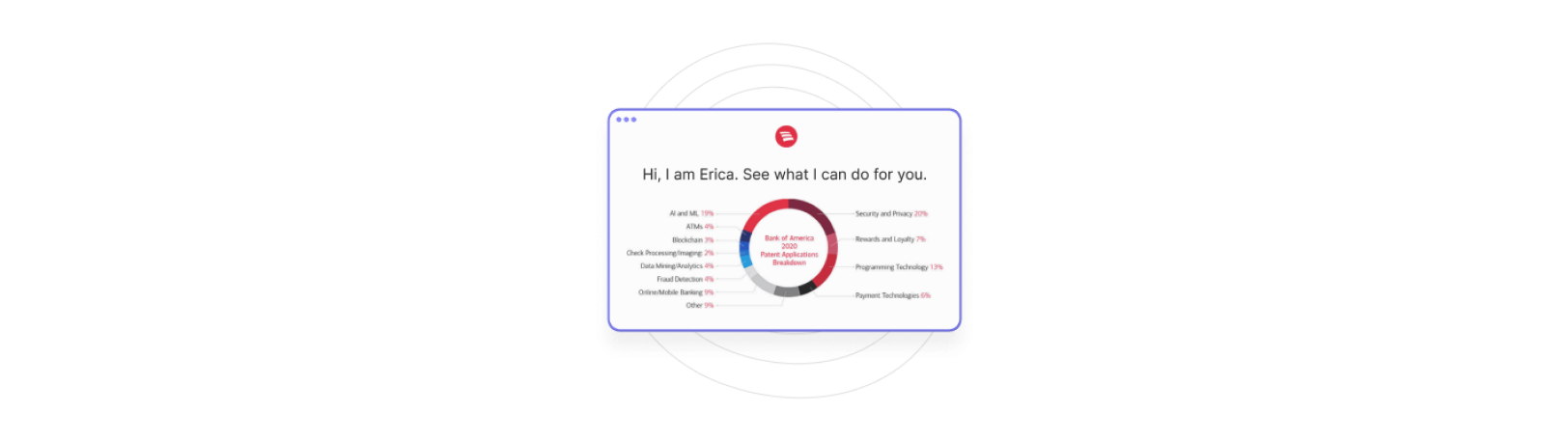

1. Erica | Bank of America

Bank of America is one of the largest banks in the world but one of the last to join the chatbot trend. Now, 25 million clients of the bank are assisted by the Erica chatbot. She will help you find the right transaction, raise your awareness about your credit history, and tell you how you can improve your financial situation on your own with better money habits. Also, customers will be able to get access to basic information such as the nearest ATM or financial center. You can schedule a personal meeting with a finance professional or one of the credit unions right in the app, block and unblock debit cards, transfer money between accounts, and send funds using Zelle.

2. Eno | Capital One (USA)

Banking holding Capital One launched Eno in early 2018. This is a text-based virtual financial assistant that will help the bank's clients understand basic queries. Executives claim their chatbot is trainable and will therefore adapt over time to the needs of each user. With Eno, you can get information about account balances, transaction history, and credit limit. The chatbot understands emoji, which is quite unusual for a bank text chatbot.

3. Ally Assist | Ally Bank (USA)

New York-based Ally Bank was one of the first international banks to start working with chatbots back in 2015. The assistant responds to text and voice messages for payments, sending money, P2P transactions, and deposits. Also, the client can request summary information about their account or even transaction history and track the parameters of savings and expenses. Ally Bank claims its chatbot can predict customer needs by analyzing their bills and transactions using natural language processing to understand and resolve common customer service issues.

4. Amy | HSBC (Hong Kong)

The HSBC Corporate Banking Virtual Chatbot is ready to help you around the clock! Amy understands English and Chinese, and thanks to machine learning, she is getting better every day. The bank plans to gradually integrate the capabilities of the AI assistant for more complex queries while continuing to improve the functionality of the AI platform.

5. HARO & DORI | Hang Seng Bank (Hong Kong)

At the beginning of the year, Hang Seng Bank introduced two chatbots—HARO and DORI. The first one is designed to answer basic questions about banking products: mortgages, personal loans, and insurance. DORI is built into Facebook's Messenger and allows customers to search for discounts and make recommendations based on consumer preferences. Both chatbots understand Chinese, English, and a mixture of both.

6. Aida | SEB (Sweden)

The Aida chatbot has been operating since 2017 and solves about 13% of issues related to the bank's IT support, and helps bank customers with credit or debit cards problems, account inquiries, and reservations. SEB acknowledged that Aida faced processing difficulties due to the complexity of the Nordic languages, but the bank hopes to fix this in the future.

7. Ceba | Commonwealth Bank (Australia)

In January 2018, Australia's Commonwealth Bank showcased its Ceba chatbot, which is ready to simplify over 200 banking tasks, including card activation, account balance inquiry, payments, cardless withdrawals, etc., using machine learning, natural language processing, and AI. CBA aims for Ceba to be able to respond to 500,000 general consumer inquiries for more than 500 banking transactions by the end of the year.

8. SIA | State Bank of India (India)

The State Bank of India began working with an AI-powered chatbot back in September 2017. Developed by Payjo, SIA aims to help the bank's clients in their daily banking business and answer their questions. According to Payjo, SIA can handle up to 10,000 requests per second, or nearly 864 million requests per day. With machine learning and a large set of FAQs, SIA is one of the largest AI banking apps.

9. Eva | HDFC (India)

HDFC partnered with Senseforth AI Research to launch the Eva chatbot in March 2018. Since its launch, Eva (Electronic Virtual Assistant) has processed over 2.7 million customer requests, conducted 1.2 million conversations, and interacted with more than 530,000 unique users in 17 countries, according to the bank.

10. iPal | ICICI (India)

In February 2018, ICICI launched its iPal chatbot, which has already interacted with 3.1 million customers, responding to 6 million requests with an accuracy of 90%. The chatbot covers three areas of action at once: answering FAQs, conducting financial transactions such as paying bills, and doing practical tasks like changing your password. The bank says its chatbot will soon be integrated into major voice assistants like Cortana, Siri, and Google Assistant.

Banking virtual assistants vs. chatbots

Advanced chatbots were able to highlight keywords and mimic human dialogue back in the ‘60s. Hippies took LSD, The Beatles sold-out stadiums, and Joseph Weizenbaum created Eliza, a psychotherapist who came before many modern bots and even psychologists.

For example, in the sentence "My father hates me," Eliza reacted to the keyword "father" and asked, "Who else in the family hates you?" But the robot-psychotherapist did not understand the essence of the questions. Modern chatbots also work keywords, linear scripts, and parodies of live dialogue.

But since the ‘60s, something has changed: now, thanks to ML digital technology and NLP, we can teach chatbots to understand natural language and context. It's still an imitation but more meaningful.

To see the difference, let's compare a chatbot and an assistant; let's imagine we need to create a virtual financer that helps customers with deposit selection.

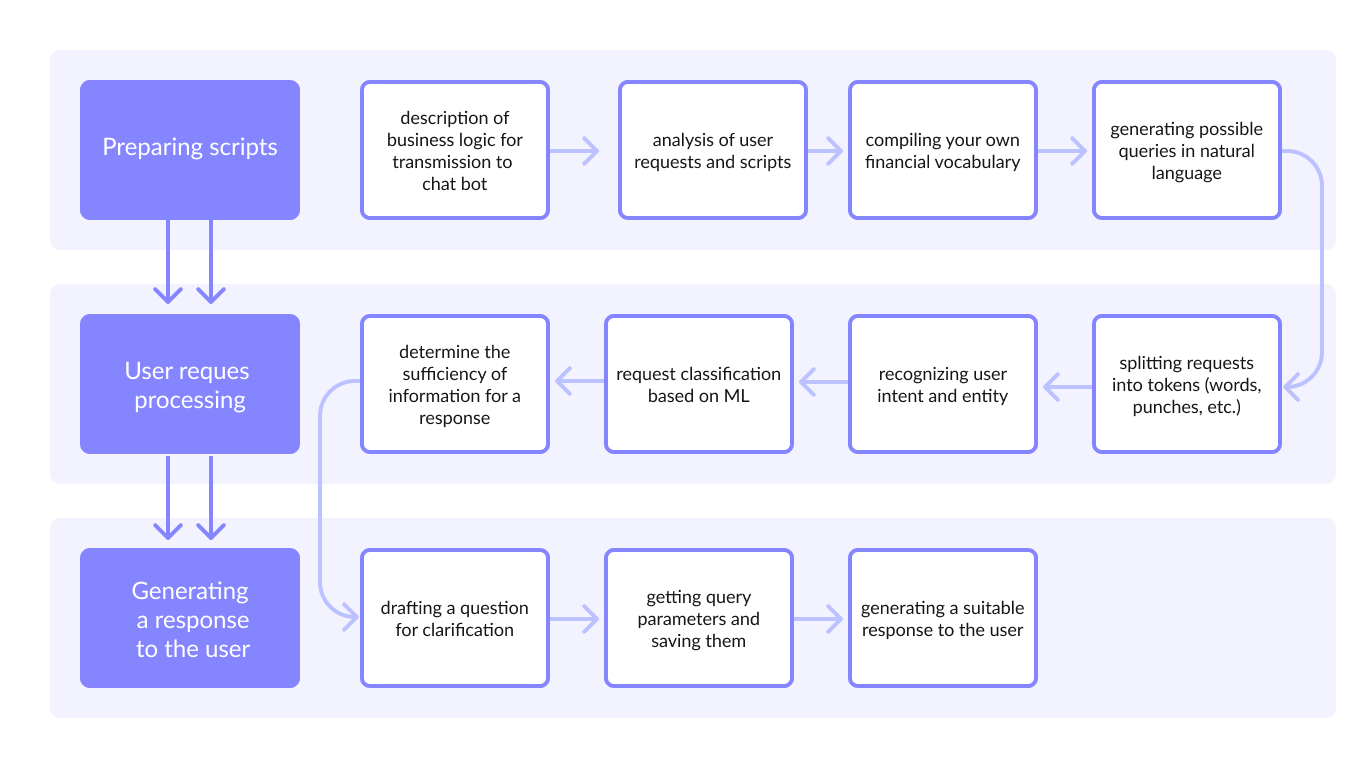

Stage #1

The first stage for a chatbot and a virtual assistant in banking is the same: we estimate user requests and come up with phrases they can write. Then we prescribe how the robot will act in response.

The basic request is clear: pick up a deposit. But this request can have many parameters such as currency, duration, percentage, or the ability to replenish the deposit and close it early. Perhaps the user will immediately write the name of the deposit that needs to be found, or he will clarify the details, "What are the opening conditions?" Maybe, out of curiosity, he will start bombarding the bot with questions: "Which bank has the most favorable deposit conditions?" Moreover, in addition to inquiries about the case, there are “Hello,” “Goodbye,” “How are you?” and other small-talk phrases that need to be asked.

You can anticipate endlessly but still not be able to predict all users' questions. When it seems that the described situations will be enough to cover 98% of requests, we stop (although then the harsh reality sinks in, and we find out that 80% will be covered at best).

Then we scatter our assumptions about user needs for specific requests—intentions. Intentions indicate what the user wants but discards information about how he wrote about it. This stage is the same for chatbots and banking virtual assistants.

Stage #2

At this stage, we start to create an algorithm from which the robot will work. This is where the similarities between chatbot and virtual assistant for banking end.

When coding a chatbot, the programmer manually defines keywords for each intent (user request), and when the user writes, the bot will search for these keywords in the phrase.

When developing an assistant, the programmer teaches the algorithm to compare the user's replicas by lexical meaning. This allows you to find the closest intention.

| Completing a deposit with a chatbot | Completing a deposit with a virtual AI assistant | What's happened |

| User: Hi! I want to complete a Euro deposit in your bank. Bot: Hello! Bot: What currency are you planning to open in? User: Euro. Bot: I can recommend the "online" deposit. The interest rate is 2% per year with the possibility of the early withdrawal of your money. | User: Hi! I want to complete a Euro deposit in your bank. Assistant: Hello! I can recommend the "online" deposit. The best interest rate in the city, the ability to open any world currency, as well as the ability to withdraw part of the money or the full amount in advance. | Bot went to complete + deposit by keywords. I did not understand what currency was and asked again. Assistant went according to the closest intention and fetched all the data about the deposit. |

How it works: a table comparing chatbots and banking virtual assistants

Chatbot | Virtual AI assistant |

| To understand the user, we take keywords. When creating a chatbot, machine learning and NLU technologies are not used. | To understand the user, we make a smart comparison and choose the closest intent. Machine learning and NLU algorithms allow us to measure the distance between replicas. For example, the phrase "spaceship" is closer to "airplane" than "scooter" and very far from "get a loan." |

Preparation: For each intention, we write out the keywords (deposit_in_euro: deposit, euro, open + deposit, euro + deposit) Algorithm:

| Preparation: Train the Model for Smart Comparison Algorithm:

|

How to improve: To reduce errors, you need to add commands and buttons. Then users will stop communicating in the language altogether but will simply click on the buttons. Such improvements lead to the degradation of spoken intelligence. | How to improve: After users chat with the robot, we will have new examples of phrases, and we will distribute them by intent. Over time, the percentage of coverage will increase, and the assistant will begin to better cope with communication. These improvements lead to better conversational intelligence. |

Digital custody in the banking industry

It is quite understandable that in such a tough, competitive environment, one of a bank's greatest values is the database of its customers.

When speaking about the trends in the development of the modern banking business, one cannot fail to note the rapid integration of the banking sector with telecommunications. By explaining this thesis, let us remember that today the consumer values his time, which means that all other forms of banking services are increasingly preferred to be remote banking. The ability to use banking services anytime, anywhere is no longer a privilege of the elite but a growing need of the masses. It is clear that in such a situation, the internet and mobile communications are becoming the most promising methods of sales, which means that completely new approaches are increasingly invading the banking business. They not only cause the need to "reconfigure" all technologies but also change the principles — the account manager may no longer see the "face" of his client, which means that other methods can convey information with "high-precision" to the consumer exactly at the moment he needs it.

As a result, the active use of internet sales technologies, smart devices, and banking agents is changing the entire sales system at a commercial bank. The old schemes for organizing the work of departments and services are no longer effective.

The importance of customer service and focus from front-office employees for the success of a retail project for any organization, not just a bank, is great. There are cases where the most successful concept on paper does not stand up to the test in practice due to mistakes in the selection and training of personnel, and even more often, due to the fact that employees who directly serve customers, for some reason, ignore the ideas promoted by management.

In order to avoid such a problem, it is necessary to purposefully approach the issue of the selection and training of workers, and it should be remembered that not everyone will be able to train, and some will have to be let. If a person is not ready to work in the service sector, which undoubtedly includes the bank's retail division, then he will hardly be able to break himself, and if he succeeds for a short period of time, then in any case, he will start working without pleasure, which will always be obvious Customers can feel when the friendliness of the employee is sincere, and when he is only trying to play a role.

Practice shows that experienced cashiers and tellers with a long banking customer experience, during their work in classical banks, have not learned to be customer-oriented. They know how to count money quickly, and without errors, and they know how to draw up banking transactions, many of them are even familiar with the basic regulatory documents, but, unfortunately, if not all, then many of them are not ready to serve clients.

That is why, when it is necessary to select a large number of front-office personnel, when the staff goes over hundreds of employees, the only way out is to look for people without banking experience but have a natural disposition to serve clients and train them in banking procedures. It is possible to teach a customer-oriented shop assistant about banking operations, but it can be impossible to make a gloomy cashier smile at customers.

Some insights for you

Strategic Mobile Banking Benefits And Risks

Explore the benefits and risks that banks may encounter in the changing world of mobile financial services.

Read the whole thingToday, all banks offer the same services at the same price, so customers do not go to the bank where it is cheaper, but to the one they like best. We sell our clients not so much banking products in a good mood.

All contacts with clients begin with the first impression of the bank employee and, at the same time, of the bank itself. Unfortunately, you cannot make a first impression twice. An operator is usually the person with whom clients most often communicate. Clients do not know or see any other employees or managers. The professionalism and quality of service of the entire bank are assessed by the work of the operator, and if he works poorly, then the whole bank is bad for the client.

Even if the operation performs quickly and accurately, this, surprisingly, is only half the battle. It is important for clients to feel their value and individuality.

Advantages of virtual assistants for banking

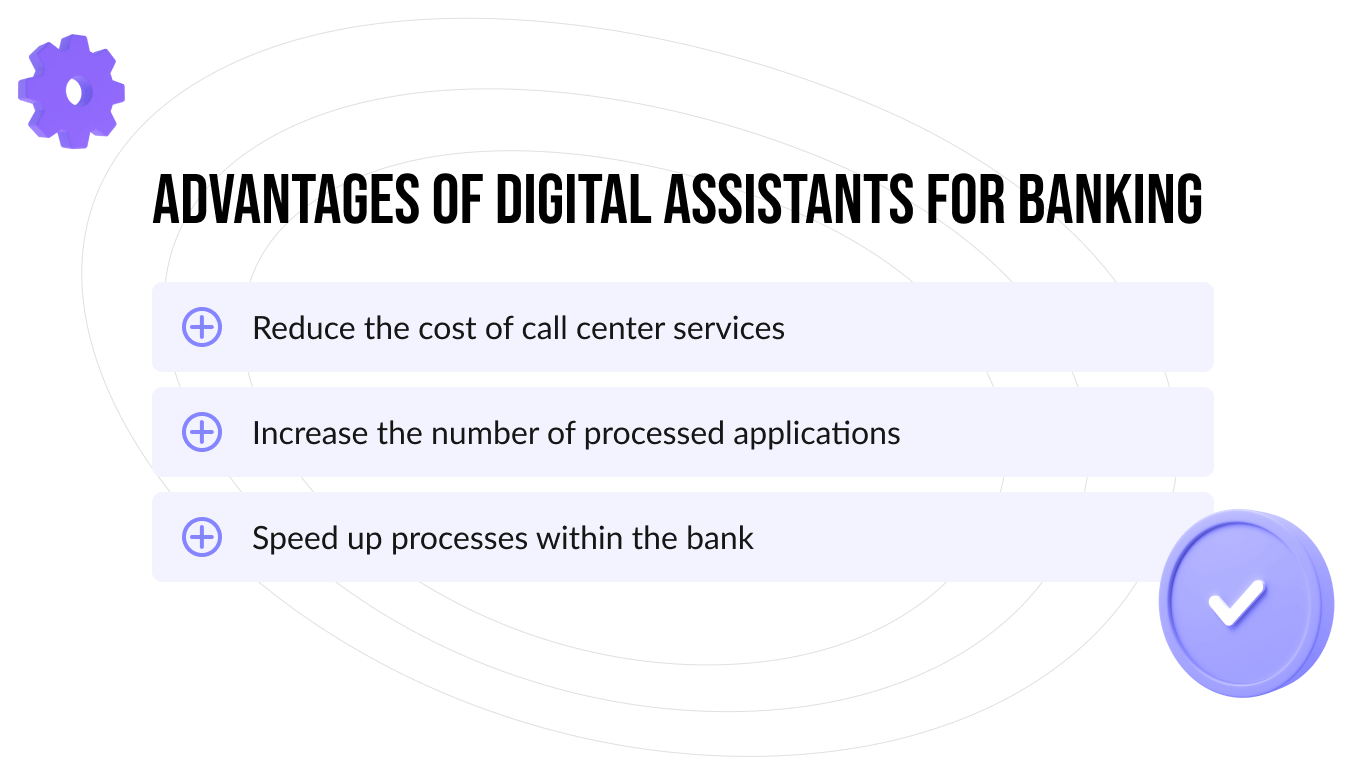

1. Reduce the cost of call center services

Traditional call centers are costly and cumbersome. They cannot quickly adjust to the growth of the load or changes in the sales script. Training takes time, and the growing number of calls requires an increase in the number of operators and the cost of the payroll. Smart banking virtual assistants based on artificial intelligence, natural language processing, and machine learning evolve over time: they process the information received, learn and become smarter, joke, and understand emotions. This makes it possible to reduce the labor cost while providing the same level of service.

2. Increase the number of processed applications

Artificial intelligence and machine learning allow the virtual banking assistant to provide better and faster customer support to users than the operator. The robot finds the necessary information faster and does not make the client hang on the line for a long time, thereby processing more requests.

3. Speed up processes within the bank

The banking virtual assistant doesn’t get sick, makes mistakes, deviates from the script, needs a workplace, works 24/7, and automatically provides analytics. Also, robotic bots can unload the contact center.

The future of virtual assistants in banking

In the financial industry, chatbots and bank virtual assistants have coexisted successfully, yet the trajectory suggests that virtual banking assistants will experience heightened development between 2024 and 2025.

Firstly, these assistants employ algorithms that go beyond merely answering queries; they actively assist clients in tasks like scheduling services, guiding product selection, or facilitating order placements. These 'smart' virtual banking assistants also extend their support post-sale, enhancing buyer loyalty while trimming operational costs for financial institutions.

Secondly, bank virtual assistant versatility shines in various financial niches, excelling in areas such as wealth management, customer service, or investment advisory services.

Thirdly, integrating these services with generative models enhances their capabilities. Trained on extensive financial customer data, these models offer more comprehensive insights and solutions across domains like risk assessment, investment portfolio analysis, compliance reporting, and financial education.

For example, bank virtual assistants can assist clients in portfolio optimization, provide real-time market insights, and guide investment decisions. Moreover, AI powered technology assistants can navigate complex regulatory frameworks, ensuring adherence and providing actionable insights to compliance officers.

These advancements lead to personalized banking experience, fostering stronger client relationships and increasing customer loyalty in the financial institutions landscape

Virtual assistant development

A virtual assistant for banking is not just a classifier or orchestration logic. In a similar vein, a graphical user interface is more than just lines and style. A banking virtual assistant is a complete channel of product experience. It requires careful and thoughtful design in order to meet the requirements of the end-users. The quality of the design determines how successful the bank smart assistant will be.

Regardless of the channel, it's important to develop a useful virtual assistant in banking that doesn't try to embrace the immense. You should brainstorm all the actions the assistant will perform and then develop an iterative plan for their implementation. High frequency and uncomplicated queries are the first aspects to cover. For example, "What time do you close?" is a high-frequency, low complexity question in banking. The strategy should also take into account changes in the frequency and complexity of the request.

Conclusion

Chatbots have become an integral part of our daily lives, and imagining a day without them seems implausible. As we increasingly prioritize security in financial and personal banking transactions, the rise of voice banking virtual assistants is inevitable, potentially achieving the popularity akin to Siri or Google Assistant. Numerous financial entities have begun exploring this sector's potential, some even venturing to create their own solutions. However, the future promises a wealth of innovative features. The key is embracing these advancements fearlessly!

Ready to explore the next level in financial technology? Discover the potential of custom Fintech software development to revolutionize your services and enhance customer experiences.