-

Mykhailo

.Net/Node Engineer

It was an amazing experience to work on a Fintech project. This domain was completely new for me. The project started as refactoring of existing solution with migration to .Net Core from .Net Framework. But after month of refactoring we decided to rewrite it completely. The main reason of this decision was a lot of deprecated libraries that couldn't be migrated to .Net Core. We did our best to investigate deeper into this new Fintech domain and as a result we managed to meet deadlines.

-

Pavlo

Project manager

As a project manager, I want to work with exciting and engaging projects, and this was one of them. Delivery of a white-label platform required a specific approach and attention to details. Another great thing regarding this project was that our client listened carefully to us and our recommendations, leaving room for creativity. Close collaboration and transparency throughout the development process became a solid foundation for a successful result.

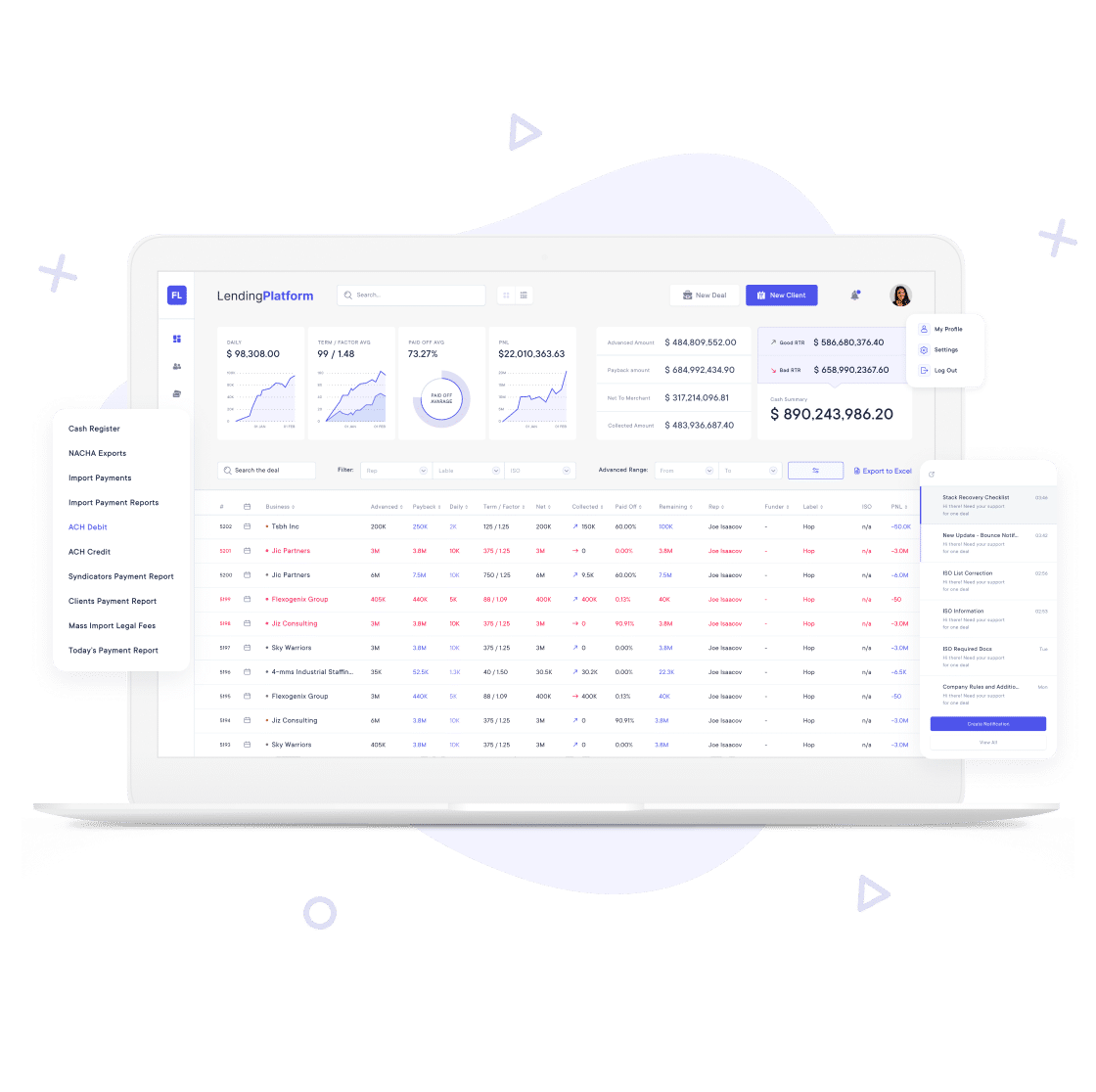

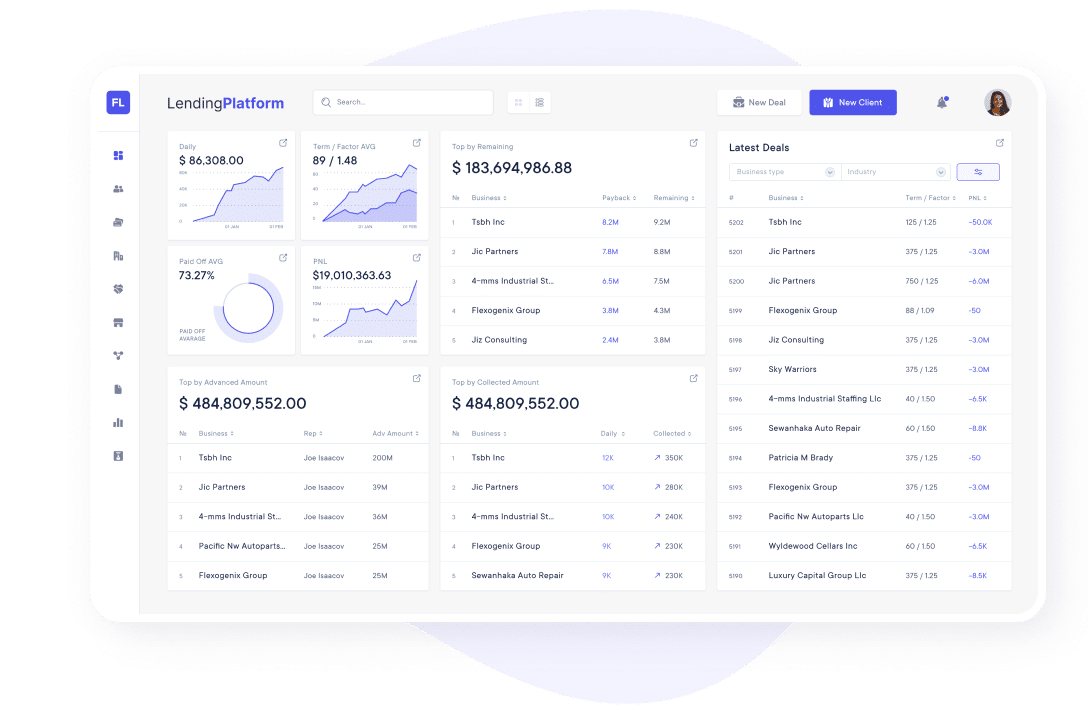

White label lending platform

Geniusee delivered a fully automated tool to match lenders and businesses. We created a secure, automated white label lending platform for our client that streamlines the merchant cash advance process and enables ISOs (Independent Sales Organizations) and lenders to manage their businesses from one centralized, convenient place. Combining innovative cloud software, leading-edge privacy technology, and deep industry experience, Geniusee created a financial platform that matches merchant applications to the optimal lender through a seamless, efficient, and private process.

Business context

The client came to us with the request to develop a white label lending platform for a company in a niche financing sector in about three to five months. Geniusee tailored the all-inclusive lending solution that financial institutions as ISOs, lenders, and merchants have been waiting for.

The challenge involved building a fully functional web loan application to bring all the company’s operations into an automated system.

Key challenges:

- Rethink and update an application design, making it more intuitive and functional

- Transfer the company’s offline operations online into an automated system with banking integrations and other services

- Develop a fast and well-performing digital lending platform

- Deliver an app under multiple FinTech legal and regulatory requirements

Work approach

-

Fit the legal requirements

Development of FinTech solutions always goes along with hitting the bull’s eye in regulatory requirements. Geniusee has our clients’ backs, mastering it for over five years.

-

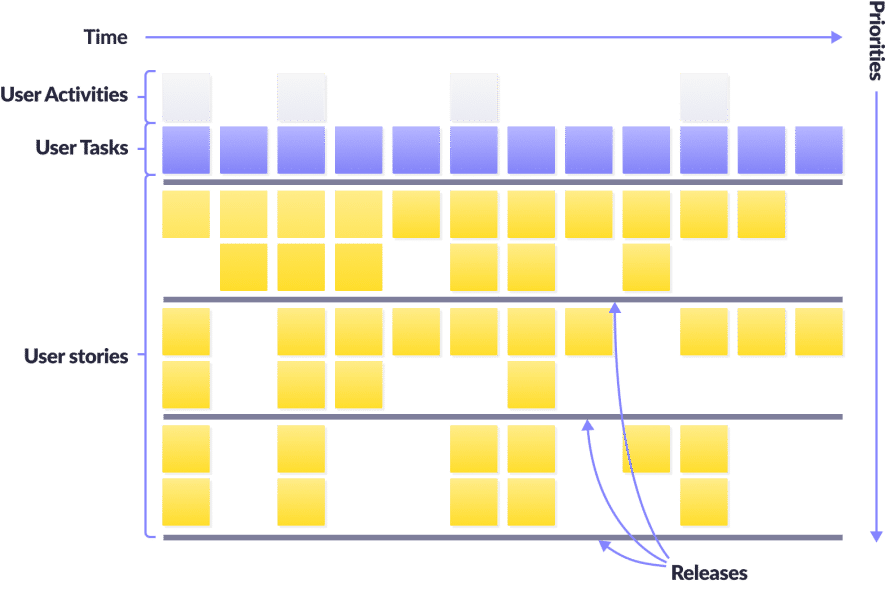

MVP-based process

MVP empowers us with direct customer feedback so we can make improvements in the following iterations. This is the best way to test solutions on real customers.

-

White-label solution

Accommodating clients’ needs and changing the work approach to align our processes with customers’ business goals is an inherent part of our job. So we successfully rebuilt a custom solution into the white-label platform.

-

High-level security

Protection of personal data and financial information is vital not only due to legal requirements but crucial for the company’s reputation and customer safety and satisfaction. Over the years, Geniusee developed our ways and approaches to provide high-level security for our clients.

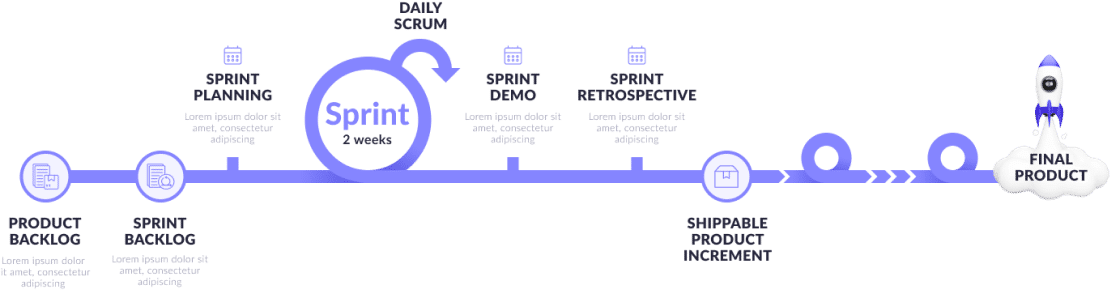

Process

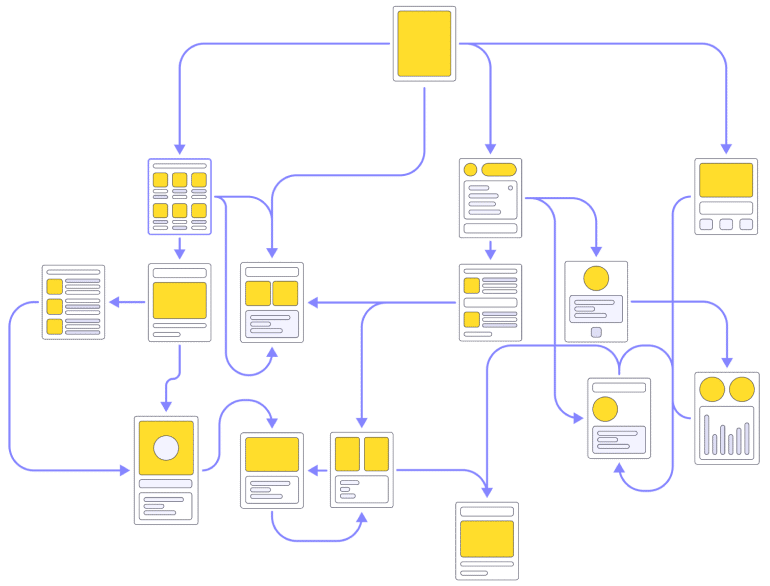

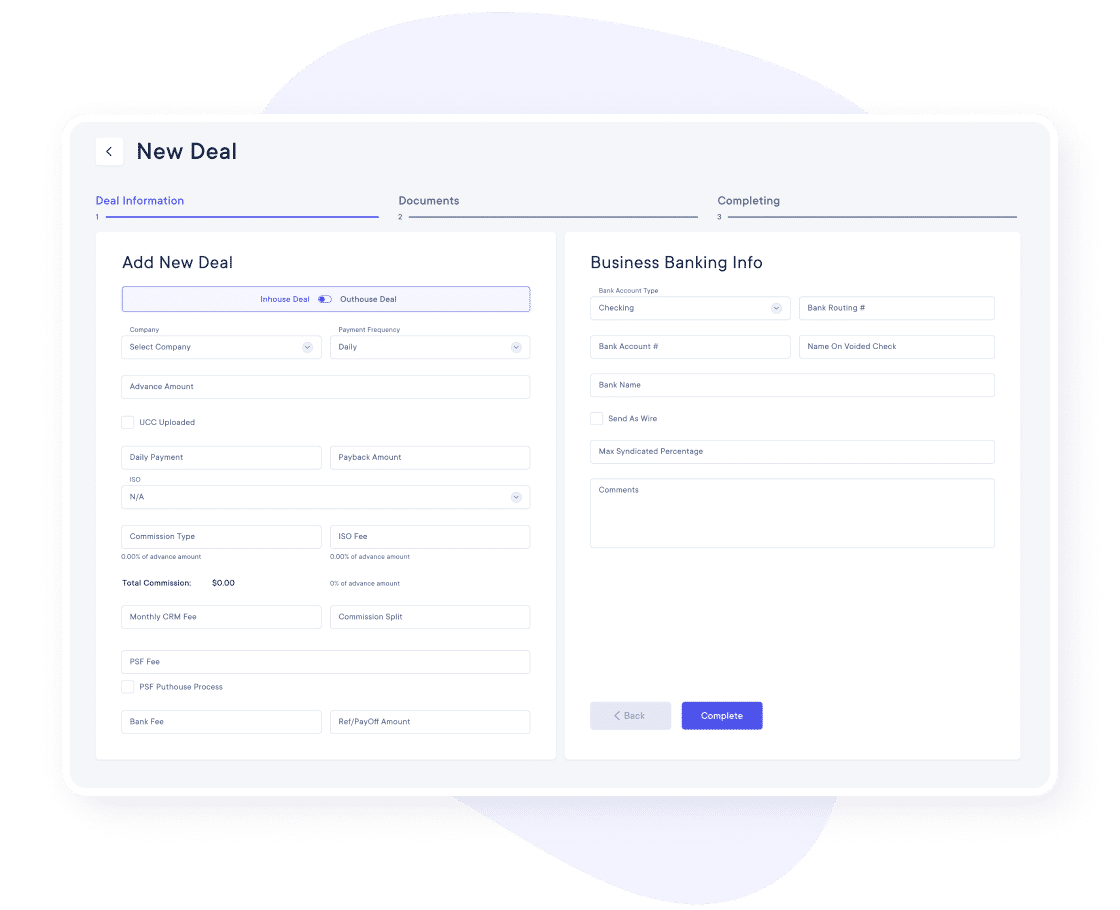

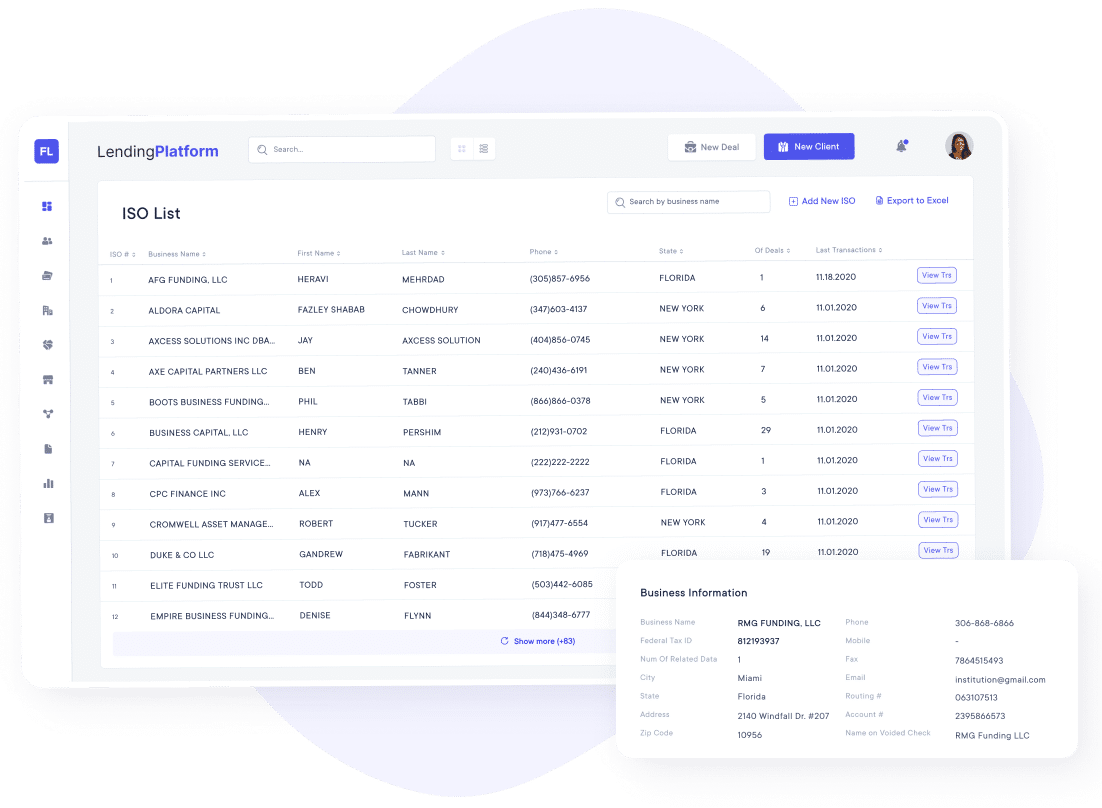

Our client's project is a complex platform with many roles and functions. The merchant applies securely online, the lender conducts a search and makes offers on deals that match their criteria, and the merchant reviews it and e-signs the final agreements online. Independent Sales Organizations (ISOs) and agents get offers from multiple lenders, keeping their deals secure and organized, helping them finish deals.

Project tech stack

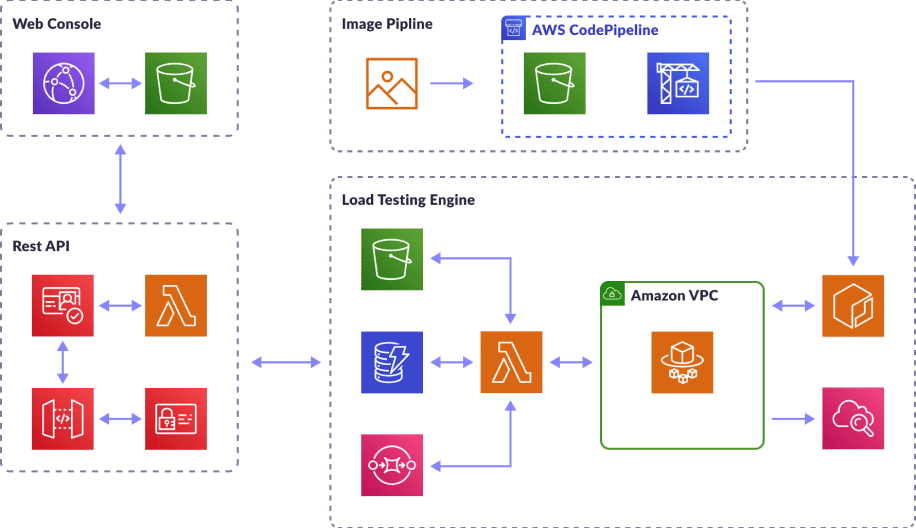

It’s always an exciting task to choose a technological stack for FinTech as it should stay up-to-date for an extended period, guarantee high-level security to protect sensitive data, and empower system scalability.

Geniusee team

Geniusee delivered a white-label lending platform with a dedicated team of eight members. It took us only five months to provide MVP and a year to tailor a full-scale project.

Product team

Development team

Are you looking for full cycle product development?

You found what you were looking for. Just fill out the contact us form.

Features

-

Lending management system

- The project matches merchant applications to the optimal lender through a seamless, efficient, utterly private process that provides actionable information while keeping sensitive information confidential.

- The lending management system checks clients according to the KYC (know your customer) model reviewing credit history, income, and spending, conducting risk assessment during application process. Lenders are also checked by the system.

- Half of the loan is paid by the company. The automation Geniusee provided for the lending platform allows calculating the daily percentage of loan contract and maximum sum end customers can get regarding personal profiles.

-

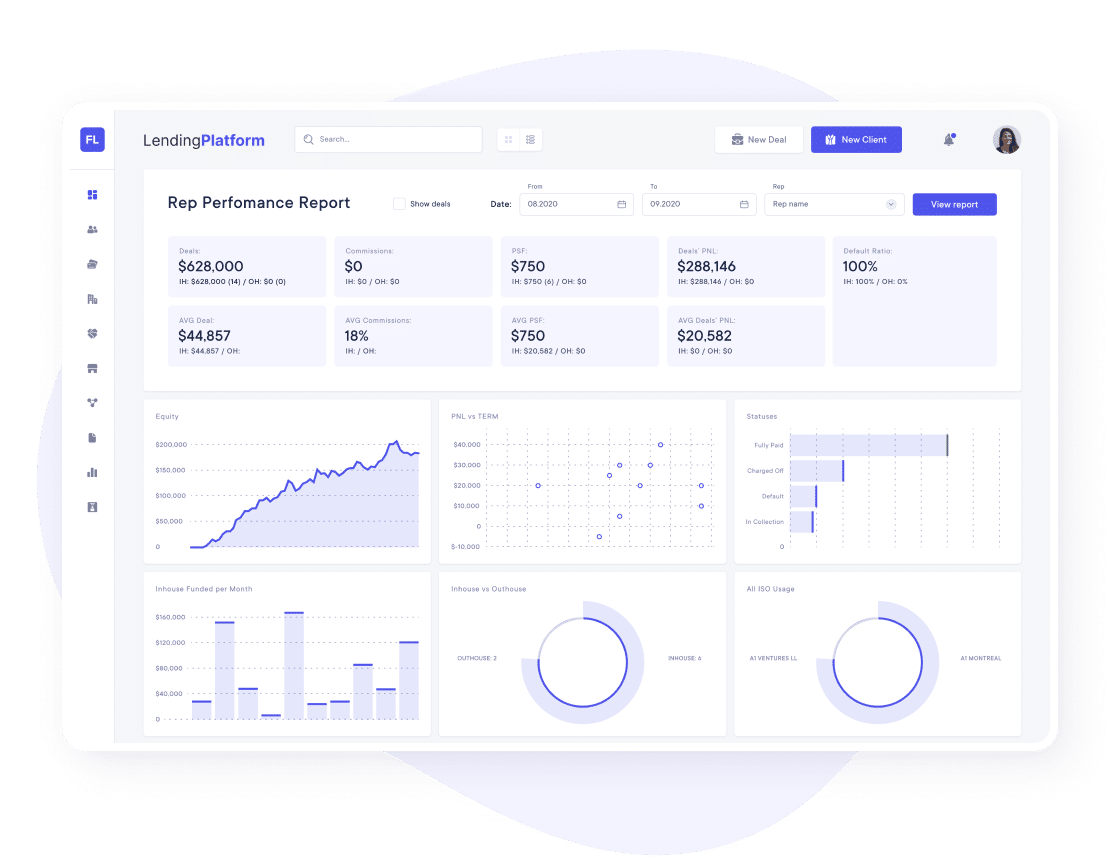

Performance dashboard

- The system tracks performance and shows each user (both borrower and creditor) a personal interactive dashboard with analytics.

- There’s also an analytics dashboard for the admin to overview company performance.

- Overall, the platform presents automatically created reports by user, time, company, and the number of borrowers and creditors.

- The performance dashboard of this digital lending solution updates automatically every hour.

-

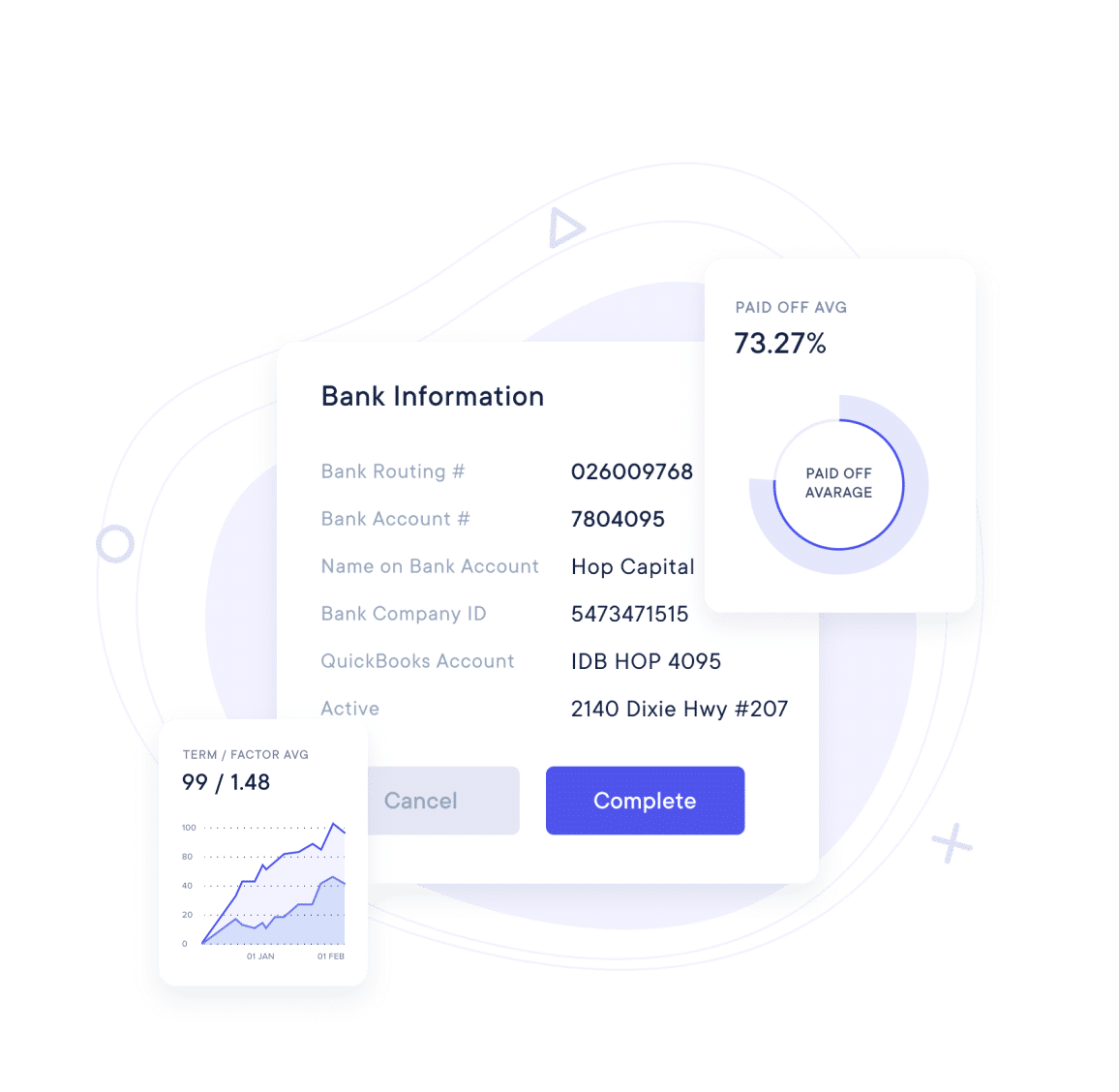

Financial analysis

- System automatically analyzes user finances before the start of a lending process. Geniusee integrated third-party services that calculate credit scores by reviewing credit history. Client scanning during application process is completed according to the know your customer model.

- The automated lending platform also connects to bank accounts to analyze spending behavior and check on payment stages.

-

Security

- A fully automated and cloud-based platform that protects all parties from risk while streamlining the deal-making process to boost productivity and profitability.

- The platform also includes an independently managed fraud detection system that compiles and tracks merchants to protect lenders against fraudulent parties.

- An important thing that allows Geniusee to satisfy clients’ needs regarding security issues is ISO 27001 — an international security standard certification. Along with ISO 9001, which regulates quality management systems, those standards allow us to deliver the best solutions, financial products and services, as we believe it’s always better to start with yourself.

-

Admin panel

- The admin panel of a lending platform allows one to manage all seven user roles starting from application process and until the loan is returned. We also provided support automated services in case of a need for human support.

- All tools and statistics are shown in the admin panel so that managers and decision-makers can analyze profit and loss reports to make data-based judgments and decisions.

-

Third-party services

- Iron PDF — library for converting and generating PDF documents

- AWS SES — email sender service

- AWS S3 — service for storing files

- Quartz — service for scheduling tasks

Results

-

Fully automated cloud-based financial platform.

-

MVP delivered in five months.

-

UI marked by experts from The Design Showcase.

-

An easily integrated platform helping lend resources quickly, safely, and effectively from one digital location, online or on mobile, 24/7.

-

Powerful deal-tracking, communication, and integrated CRM tools.

-

A complete digital transformation of lending process that reshapes the industry.