The financial services industry, a colossal powerhouse generating $12.3 trillion every year with $2.4 trillion in profits and an average 20%+ profit margin, is undergoing remarkable changes driven by current trends in fintech. The way we use financial tools and technologies is evolving fast. Consider decentralized finance, which is cutting out the middleman; AI, which is making fraud detection smarter and faster; and blockchain, which offers a level of security and transparency that once felt like science fiction.

These fintech trends aren’t just technical upgrades. They’re redefining how global trade, banking, and investments operate in our everyday lives. How will these advancements impact the way you manage, invest, or even think about your finances?

At the forefront is FinTech 4.0, a defining aspect of the Fourth Industrial Revolution. This new era introduces superapps consolidating payments, investments, and banking services into one platform. At the same time, IoT-linked devices, like smart cars, enable real-time payments for services like tolls and fuel. AI-powered tools offer hyper-personalized budgeting, credit scoring, and investment strategies, redefining how consumers interact with financial systems.

These finance industry trends reshape global payments, expand access, and drive eco-conscious investments. Read on to explore how the financial system transforms into a smarter, more inclusive ecosystem for 2025 and beyond.

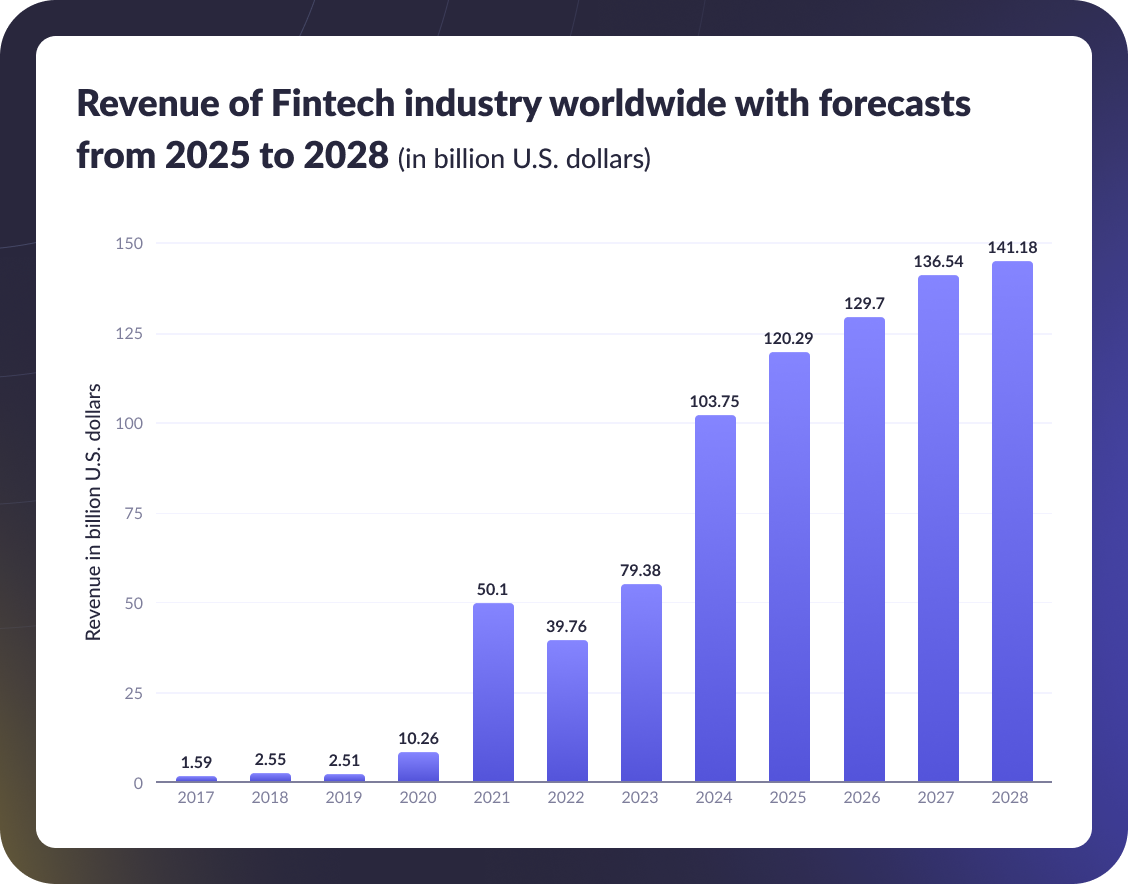

The FinTech market landscape in 2025

The underlying forces driving FinTech 4.0

Fintech trends are all about putting consumers first. FinTech 4.0 is changing how the financial industry operates by combining automation, decentralization, and AI-driven solutions as the major digital finance tendencies. It’s driving the future of the finance industry, where improved operational workflows, cost savings, and time optimization go hand in hand with personalization, such as crafting customized credit or investment plans based on individual spending patterns and life circumstances.

Intelligent automation plays a key role in accelerating processes like invoicing and reconciliation, improving precision, and cutting commissions or overhead per transaction. AI enhances fraud detection, provides real-time financial insights, and tailors customer experiences, making these fintech technology trends essential to staying competitive.

Blockchain ensures secure, transparent global transactions, while decentralized finance (DeFi) removes intermediaries in financial markets, giving users more direct control over their assets through solutions like custom banking app development that provides precise financial tools for businesses and individuals. Together, these trends in fintech are leading to a more intelligent, faster, and more adaptive financial ecosystem.

Check out our service

Banking Software Development Services

Let's see how you can benefit from our banking offerings

Contact usTop FinTech companies to watch in 2025

In the U.S. and Europe, platforms like PayPal and Google Pay lead digital payments by offering secure, user-friendly services. Neobanks, such as Revolut, simplify banking with reduced fees and intuitive interfaces. The Buy Now, Pay Later (BNPL) solution sector, powered by companies like Klarna and Afterpay, makes flexible payment options a standard feature in e-commerce.

Across Asia, WeChat Pay integrates payments with everyday activities, while M-Pesa remains vital in Africa, offering banking access to underserved communities. Blockchain-powered platforms like Aave and Uniswap are simplifying asset trading and lending by removing mediators, while Aspiration combines financial services with eco-conscious investments, emphasizing sustainability in the future of the finance industry.

Emerging trends shaping the FinTech industry

Automation continues to streamline financial operations, enabling tasks to run continuously faster and more precisely. AI-driven technologies now dominate fraud detection, credit scoring, and personalized financial management, making them integral to the latest trends in fintech. Blockchain has become a trusted tool for tokenizing assets, offering more liquidity and accessibility to investments like real estate. Some key fintech trends and predictions for 2025 and beyond include:

AI-powered advisory and asset management: Personalized financial advice and investment strategies tailored using AI to analyze individual financial behaviors.

Central bank digital currencies (CBDCs): These digital currencies are expected to gain significant traction, with central banks introducing secure, government-backed alternatives to traditional money.

Quantum computing for financial modeling: Advanced computational power will allow highly accurate financial simulations and risk assessments.

Embedded financial solutions: Financial services like payments and lending will become standard features in non-financial platforms such as custom e-commerce and ride-hailing apps.

Customer behavior shifts: Consumers will increasingly adopt multiple fintech apps, relying on them for everyday transactions and financial planning.

Alternative lending: Credit score alternatives will redefine consumer credit, offering more equitable access to loans by leveraging new data points like rent and utility payments, employment history, and behavioral spending patterns to create fairer lending opportunities.

Superapps like Google Pay in the West and WeChat Pay in China are bringing brand new standards of fintech convenience by consolidating multiple services into one platform. RegTech solutions automate compliance processes, reducing risks and ensuring adherence to global regulations.

These fintech technology trends highlight how automation, AI, and decentralized tools are setting new standards in the finance industry’s future, where innovation meets accessibility and cybersecurity. In the next section, we’ll explore specific fintech development solutions and technologies you can implement to surprise and satisfy your user base with high-quality, agile, and cyber-secure financial services.

Top 10 FinTech trends and opportunities in 2025

The fintech industry trends for 2025 reveal a market filled with democratic opportunities for businesses looking to revitalize their offerings and address specific financial hurdles such as improving cybersecurity against sophisticated threats, including risks posed by generative AI misuse, providing financial inclusivity for underserved populations, and streamlining cross-border payment inefficiencies. Exploring these latest fintech trends helps improve all key KPIs.

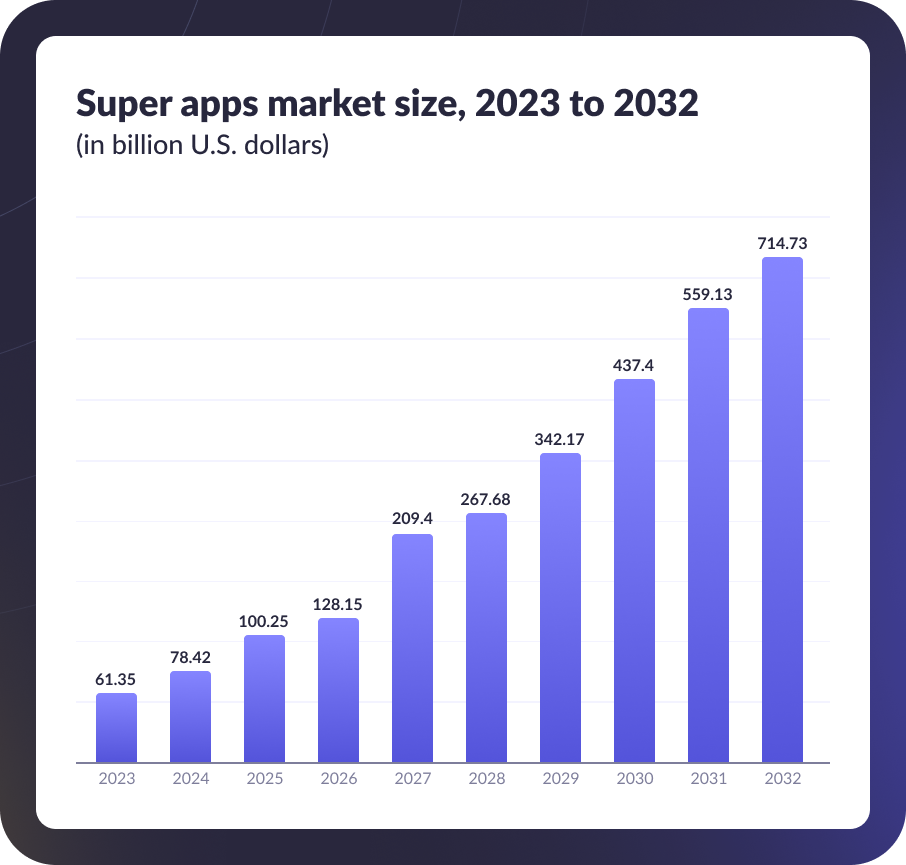

#1. Superapps

Superapps are setting a new benchmark for how users interact with financial services, blending payments, investments, and lending into cohesive platforms. The global superapp market is projected to surge to $722.4 billion by 2032. This unified approach enables users to manage bank accounts, make payments, and apply for micro-loans seamlessly without navigating multiple apps. Developing a superapp allows businesses to centralize services, expand offerings, and retain a diverse user base.

As an example of a modern superapp, Careem, based in Dubai, began as a ride-hailing service in 2012 and expanded into a multi-service platform offering transportation, delivery, and payment services. Demonstrating a trajectory similar to superapps like PayPal and Revolut, which integrate diverse financial and lifestyle services into cohesive platforms, Careem was acquired by Uber in 2019 for $3.1 billion, solidifying its position as the Middle East’s leading unicorn. Similarly, in Western markets, apps like PayPal and Revolut are evolving into superapps, offering integrated financial management, peer-to-peer payments, and marketplaces.

Genuisee case: We developed a white-label lending platform that centralizes and automates financial services. The platform securely matches businesses with optimal lenders while simplifying processes for Independent Sales Organizations (ISOs). It enables swift and reliable workflows in a single system, from merchant applications to contract signing. This solution is built with cloud technologies and digital vaults, ensuring secure and efficient fintech product processes.

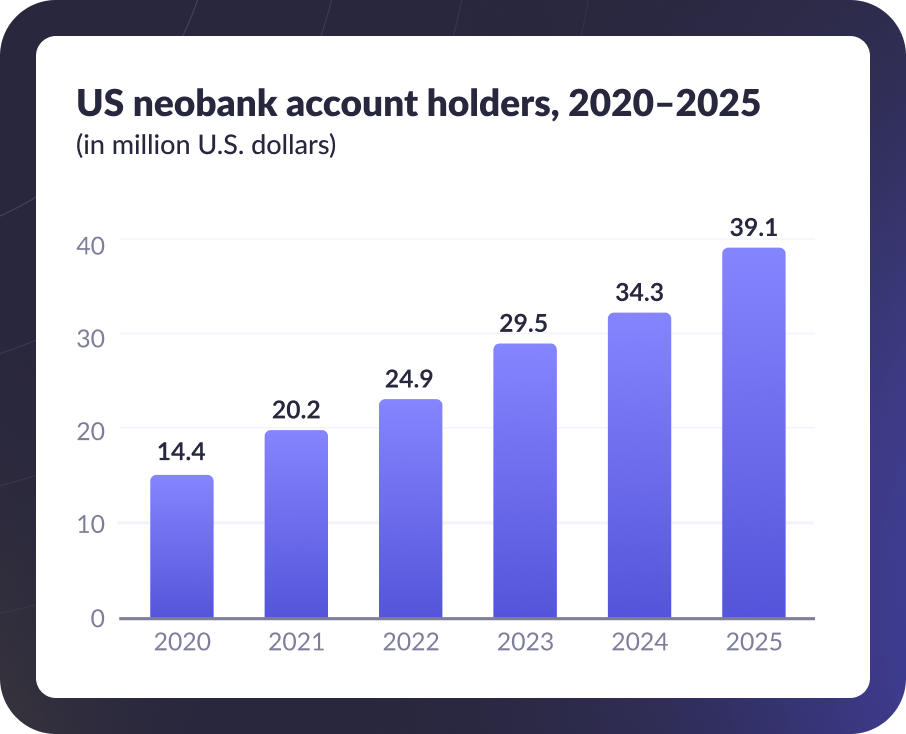

#2. Neobanks

Digital-only banks upgrade the concept of traditional banking with their user-friendly interfaces, reduced fees, and mobile-first design. Neobanks cater to tech-savvy users seeking instant access to financial services without the complexity of legacy banking systems. With 39.1 million users expected to have at least one neobank account by 2025, neobank solutions present a promising opportunity for tech-driven businesses in financial services, attracting users focused on efficiency, mobility, and next-level digital solutions. Nobank examples include Revolut, Nubank, Varo Bank, and N26, which cater to global user bases.

Geniusee case: We partnered with Zytara to craft a dynamic neobank tailored for Generation Z, blending financial education with gamification. This blockchain-based app empowers users with features like customizable card designs, management of digital assets, including NFTs, and parental controls for monitoring and guiding spending. Designed to foster financial accountability among young users, Zytara combines engaging functionalities with robust security, redefining what a digital banking app can offer in today’s fintech-driven landscape.

#3. BNPL (Buy Now, Pay Later)

The BNPL model is set to modify consumer credit by enabling installment-based purchases with minimal friction. As one of the emerging fintech trends, this approach appeals to consumers who prefer flexibility over traditional credit cards. Companies implementing BNPL solutions tend to get more checkout dialog sessions completed end-to-end, meaning higher numbers of clients converted and satisfying a younger audience that favors unusual payment options.

For example, high-end makeup brand Charlotte Tilbury prominently brings attention to Klarna-provided sub-services on its product pages, meaning that their customers are granted a privileged option to split online purchases into three payments with no fees, integrating BNPL seamlessly into the shopping experience. This model is already adopted by many traditional banks like HSBC, Citi, Natwest, and JPMorgan Chase through partnering with specialized BNPL solution providers.

#4. Sustainability and green finance

Consumers in the U.S. and other Western countries increasingly expect that brands, manufacturers, and vendors demonstrate their ability to offer eco-conscious and socially responsible financial solutions. This is where green finance initiatives come into play, aligning financial services with environmental and social goals, like funding solar and wind energy farms, financing the construction of energy-efficient public transport systems, and investing in green bonds for climate resilience projects. This also involves modern financial platforms incorporating features like carbon tracking, green investment portfolios, or eco-conscious lending that meet the growing user expectations.

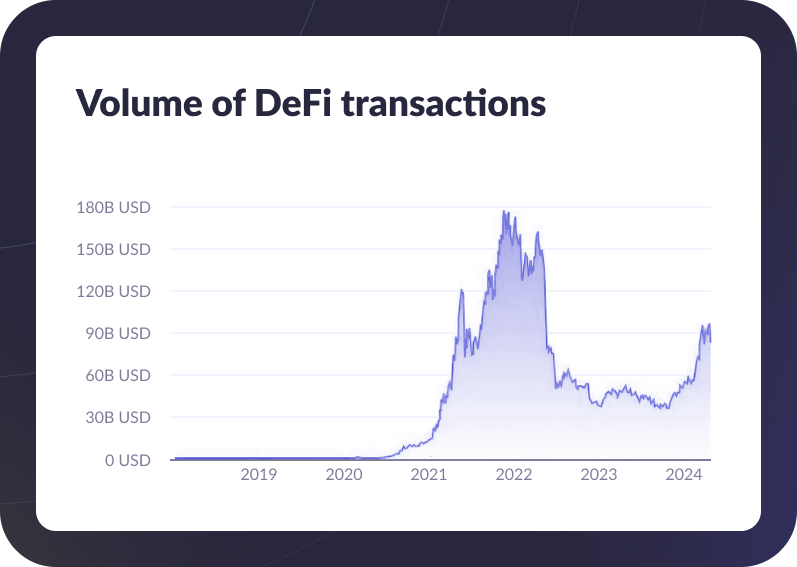

#5. Decentralized finance (DeFi)

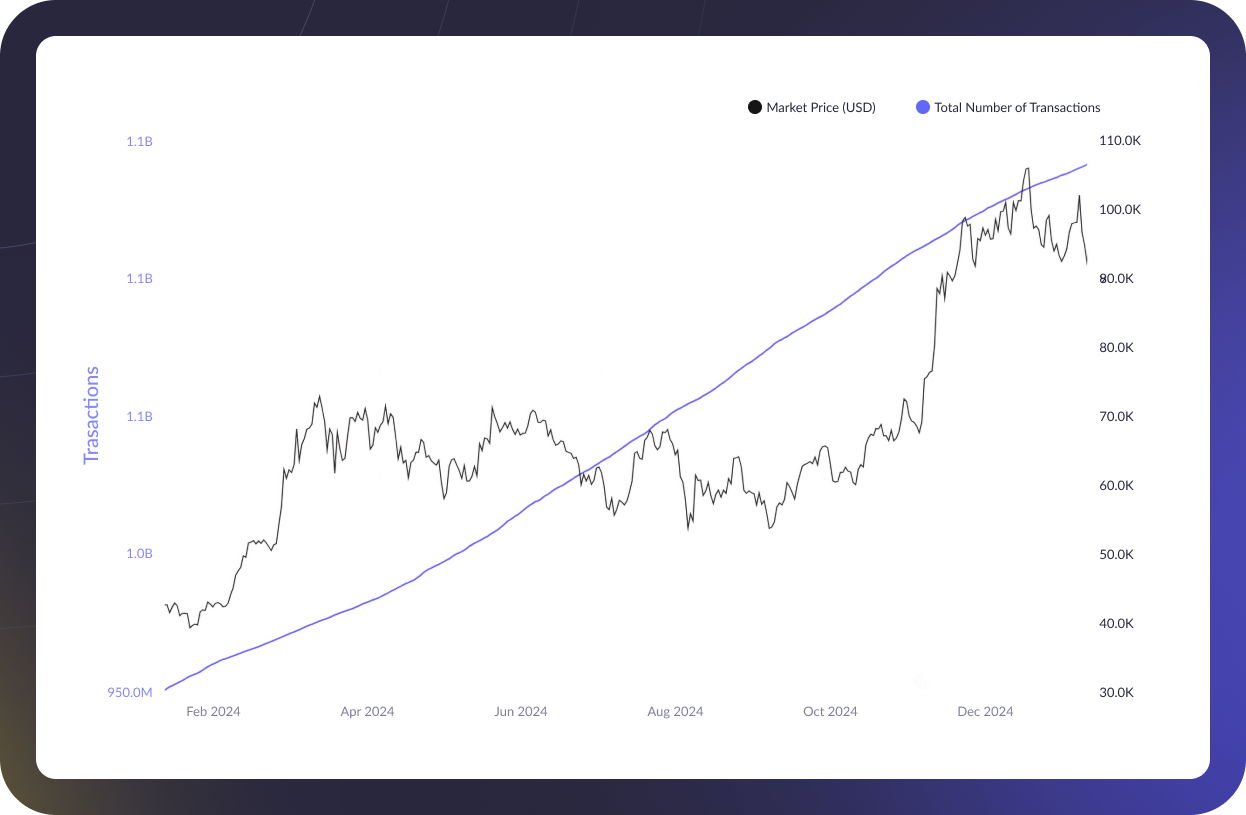

DeFi uses blockchain technology to remove intermediaries in financial transactions. This enables so-called peer-to-peer lending, trading, and investment practices executed without higher controllers like banks or governing bodies. In 2024, DeFi transactions surged above $90 billion, marking a sharp recovery from 2023’s decline, when decentralized operations fell below $52 billion.

This rebound signals a growing demand for transparent, borderless financial services. For businesses, adopting DeFi frameworks means offering transparent, efficient, and borderless financial deals and services based on a technical conception of trust. DeFi solutions work best with a tech-forward audience eager for more control over their new-age digital assets, e.g., cryptocurrencies, tokenized real estate, NFTs, digital collectibles, and peer-to-peer lending portfolios.

Geniusee case: We partnered on the KLAUS Project, a platform combining music creation with NFT ownership. The project introduced an interactive music stem player and sound engine, enabling users to explore and own unique musical experiences as NFTs. Built with a focus on scalability and user engagement, the platform utilizes advanced tools and systems to stand out in the competitive NFT music industry.

#6. Embedded finance

Embedded finance integrates financial services (like immediate payment options) contextually into non-financial apps/platforms, creating frictionless user scenarios where people get service offerings exactly when and where they need them. For instance, payments, loans, or insurance can be offered directly through e-commerce, ride-hailing, or other digital services.

This trend allows businesses to enhance their value propositions by providing organically embedded financial solutions tied to what they see or experience within virtual environments. The embedded finance market is projected to reach $7.2 trillion by 2030.

Examples include JustiFi in the USA, which provides embedded finance infrastructure enabling businesses to integrate banking services directly into their platforms, and Sunday in France, a fintech app for the restaurant industry that facilitates payments through QR code technology.

#7. Cross-border payment innovations

Cross-border payments have evolved to include a variety of legal options beyond cryptocurrencies, such as SWIFT payments, SEPA transfers, wire transfers, and payment processors like PayPal or Stripe. Mobile money systems and blockchain also enable faster, more transparent transactions. These solutions address global demands for efficient, real-time international payments.

Geniusee case: We helped Payguard to enhance its secure card payment platform. The upgraded system ensures compliance with industry standards and offers seamless payment options by integrating multiple payment gateways and implementing robust security measures like multi-factor authentication. The platform is built with modern tools and addresses evolving customer needs while safeguarding sensitive data.

#8. Tokenization in finance

Tokenization is converting physical assets like fine arts or luxury real estate into digital tokens, which enables fractional ownership and expands investment opportunities for wider audiences interested in owning a share of elite commodities. This trend democratizes access to high-value assets that were inaccessible to wider audiences before. Businesses integrating tokenization into their offerings can attract investors seeking innovative ways to diversify their portfolios, including micro-investments.

An example of tokenization is Masterworks, a platform that allows users to invest in fractional ownership of fine art as their values grow, making this traditionally exclusive market accessible to literally everyone out there.

#9. Financial wellness tools

AI-powered financial wellness tools are empowering users to operate their personal funds and family finances more effectively. Platforms such as Intuit Mint provide real-time tracking of income and expenses, while Betterment offers individualized investment recommendations using AI-aided financial wisdom. These tools transform budgeting and investment guidance into deeply personalized experiences by delivering insights attuned to unique financial situations. Offering features that promote financial wellness enables businesses to foster lasting relationships with users grounded in trust and meaningful interaction.

Fluz is an innovative cashback platform created with the help of the Geniusee team, enabling users to earn real-time rewards on everyday purchases. With over $40 million in cashback already distributed to its users, this personalized finance app supports seamless transactions through virtual cards that integrate with Apple Pay and Google Pay. The platform features a gamified referral system, allowing users to earn a percentage of their network’s cashback for life. Fluz also enables users to stack discounts, coupons, and store rewards, amplifying savings. Offering robust security measures like Face ID and two-factor authentication, Fluz delivers a high-impact, user-friendly solution for saving while spending.

#10. Gaming and gamification in finance

Gamification is transforming financial services by making them more engaging and interactive. Features like rewards, milestones, and leaderboards motivate users to achieve financial goals while creating a more enjoyable experience. For example,

Monobank in Ukraine introduced a gamification program where users complete tasks such as profile updates or ApplePay transactions to earn up to 51 badges, with exclusive prizes for early achievers. Incorporating gamification into financial platforms can boost user retention and encourage positive financial habits.

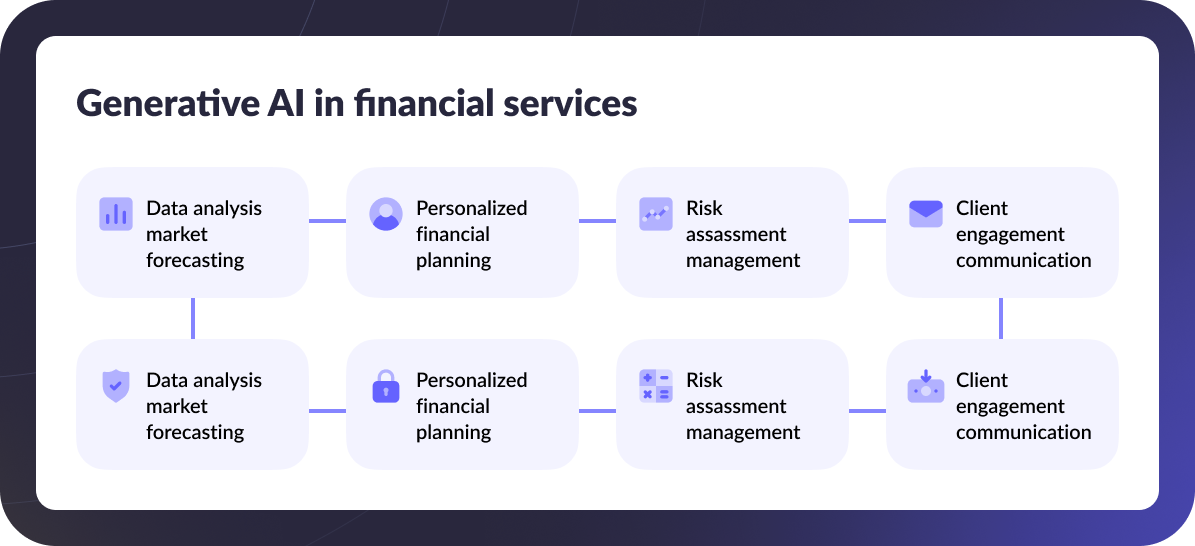

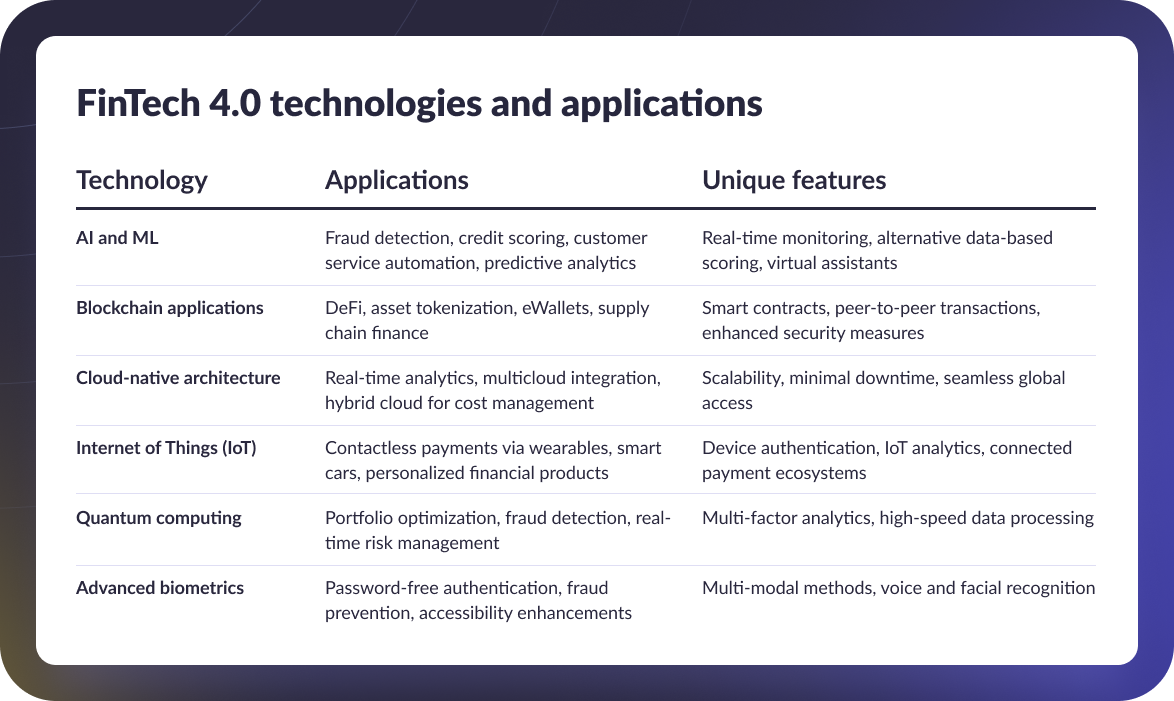

Technologies to integrate into your app for FinTech 4.0 compliance

Integrating the following technologies in FinTech 4.0 enables high-capacity fintech apps and customized lending solutions that are efficient, secure, and deeply user-centric by their architecture. By adopting these advancements in finance and accounting, businesses can stay competitive and aligned with the most important fintech trends for 2025.

AI and Machine Learning

AI and ML drive efficiency and innovation in financial services, making them central to trends in fintech. AI-powered tools offered by providers like IBM Watson, Google AI, and Microsoft Azure AI are used for fraud detection, customer service automation, and real-time risk assessment. Geniusee’s AI integration services further enhance fintech solutions by delivering tailored analytics and predictive modeling. Key applications include:

fraud detection and prevention through real-time monitoring

personalized investment recommendations using predictive models

enhanced customer service with chatbots and virtual assistants

credit scoring based on alternative data for better lending decisions

Genuisee case: The Attention Exchange Wallet is an innovative digital advertising product combining FinTech and AdTech to empower Gen Z. Applying AI mechanisms, it accurately connects to users’ bank accounts, analyzes spending behavior and delivers tailored ad recommendations for maximum engagement. Users earn coins for viewing ads, which can be converted into real money, thanks to its AI-driven reward system. Built with a secure and scalable tech stack, the platform ensures a user-centric, efficient, and rewarding experience.

Blockchain applications

Blockchain technology ensures secure, transparent, and tamper-proof transactions. It underpins decentralized finance (DeFi), digital asset tokenization, smart contracts, and custom eWallet applications, enabling users to store, transfer, and manage digital assets securely, with many additional layers of security measures. Key features include:

secure peer-to-peer transactions, eliminating intermediaries

smart contracts for automated, trustless agreements

tokenization of assets like real estate or art

improved traceability in supply chain finance

Cloud-native architecture

Cloud-native solutions provide scalability and cost-efficiency for fintech by processing sensitive data across any location and device. Managing these solutions requires careful cost monitoring, often through multi-cloud or hybrid strategies, as our cloud optimization services offer. Platforms such as AWS, Azure, or Google Cloud enable rapid deployment and seamless integration. Key benefits include:

rapid scalability to handle growing user bases

integration with real-time analytics and payment systems

high availability with minimized downtime

cost efficiency by reducing on-premises infrastructure needs

Internet of Things (IoT)

IoT devices impact the creation of new financial use cases by linking everyday objects to payment gateways. Geniusee's IoT development services facilitate IoT-driven financial solutions by integrating payment systems across devices like smartwatches or smartphones while ensuring data processing globally. Examples include:

wearables like smartwatches with contactless payment apps

IoT-backed data analytics for personalized financial products

enhanced security through device authentication using unique device identifiers or cryptographic keys to verify authorized access

Quantum computing

Quantum computing, offered by providers such as IBM Quantum, Google Quantum AI, and AWS Braket, reforms financial modeling and risk analysis, enabling rich, multi-factor analytical scenarios for fintech companies. By processing massive datasets and solving complex equations at unprecedented speeds, quantum computing is among the biggest emerging fintech trends, enabling:

precise investment strategy modeling

advanced fraud detection using complex data patterns

portfolio optimization for high-value assets

real-time risk management in volatile markets

Advanced biometrics

Biometric technologies, such as fingerprint scanning, facial recognition, and voice authentication, enhance consumer financial protection and user convenience. Key implementations of these in the finance world include:

password-free authentication for seamless user access

enhanced fraud prevention by verifying user identities

multi-modal biometrics combining multiple methods for added security

accessibility improvements for diverse user groups

Personalized finances

Personalized finance solutions harness the power of AI and machine learning to craft highly individualized financial experiences. These tools meticulously analyze earning and spending habits, empowering users to take control of their money like never before. Here’s how they elevate financial management:

granular spending insights that classify expenses with precision and reveal overlooked cost-saving opportunities

intelligent, hands-free savings systems that channel unused funds into savings or investments tailored to your unique financial behavior

custom investment blueprints designed to align with your ambitions and risk appetite

interactive, real-time budgeting tools that integrate seamlessly with your bank accounts, offering a vivid snapshot of financial habits

strategic debt prioritization frameworks that focus on minimizing interest and accelerating financial freedom

Genuisee case: The MaxRewards platform is a sophisticated credit card and benefits manager built using Swift, Kotlin, Node.js, AWS, and GraphQL. AI-powered algorithms that we integrated into the application help efficiently analyze credit card portfolios, providing users with innovative, personalized recommendations to maximize rewards and cashback. It combines automated rewards systems, cashback features, and third-party financial services while ensuring a secure, scalable infrastructure. This personalized finance management app delivers all-inclusive functionality, enabling users to optimize their savings on the fly with advanced technology.

Thank you for Subscription!

FinTech 4.0 technologies and applications

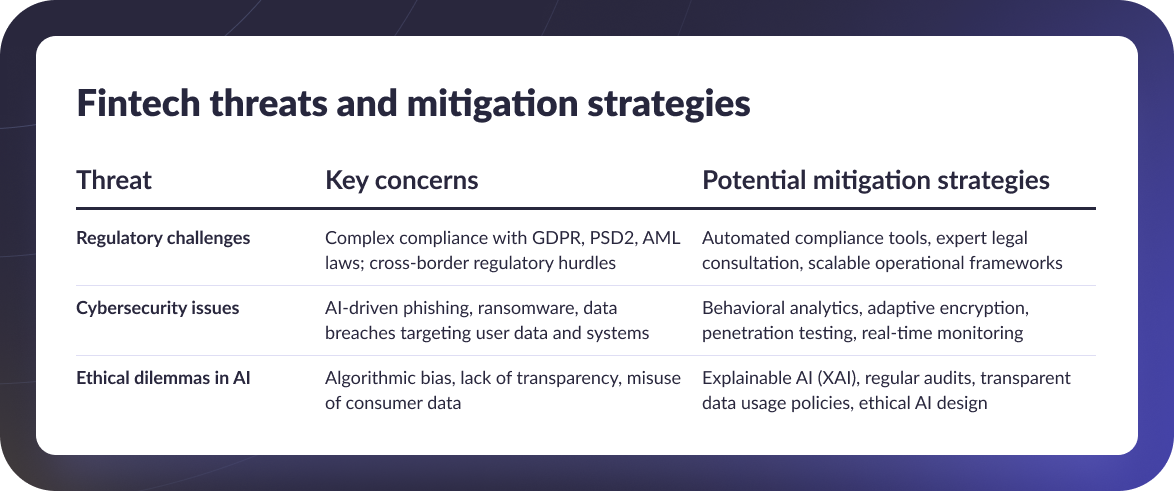

Threats to watch out for in FinTech industry in 2025

Regulatory challenges

Navigating fintech regulations like GDPR, PSD2, and AML laws is becoming increasingly complex. Cross-border operations add further hurdles as businesses balance regional standards while scaling globally. For instance, U.S. neobanks entering Europe must meet PSD2’s strong customer authentication (SCA) requirements. Non-compliance risks fines and damages user trust, jeopardizing alignment with the future of finance industry goals.

Cybersecurity threats

The shift to digital finance has escalated risks like phishing, ransomware, and AI-powered attacks targeting user data and infrastructure. Generative AI tools can bypass biometric systems, intensifying threats. Adaptive security, including behavioral analytics and evolving encryption, is vital to address these challenges. These measures are critical to keeping pace with the future of the finance industry and maintaining user confidence.

Ethical dilemmas in AI

AI’s rapid adoption raises issues of fairness, transparency, and data ethics. Biased credit scoring algorithms or opaque data use can undermine trust and violate anti-discrimination laws. Techniques like explainable AI (XAI) and regular audits ensure algorithms align with user expectations and finance industry trends for responsible innovation. By addressing these concerns, companies can give ethical AI a competitive edge.

Fintech threats and mitigation strategies

How Genuisee helps FinTech companies scale and secure their business in digital finance

Here are our success stories across different niches:

Revolutionizing digital advertising with fintech

Zedosh, the first regulated Attention Exchange®, partnered with Geniusee to create a cross-platform mobile app connecting end customers with marketing agencies through innovative advertising videos. The app offers users relevant ads based on deep insights into their financial and social behaviors, allowing them to earn money while discovering products and services tailored to their interests. This disruptive approach combines fintech and edtech, empowering Gen Z with financial tools and valuable rewards for their attention. Delivered within a year and a half, the app’s MVP was built in just three months, setting the foundation for Zedosh’s continued growth:

developed a secure and scalable cloud-based architecture

integrated third-party services like Moneyhub for bank connections and AdMob for ad campaigns

delivered a user-friendly interface with advanced personalization and in-app rewards

established payment solutions, ensuring secure transactions and real-time payouts

implemented robust data analysis tools to enhance targeting and campaign efficiency

Transforming healthcare financial management

Anatomy Financial collaborated with Geniusee to overcome intricate financial hurdles faced by private healthcare providers, including reconciling insurance reimbursements with clinic deposits, automating the processing of Explanation of Benefits (EOB) documents, and streamlining banking transactions to enhance operational efficiency. By developing robust financial management software, the solution helps clinics reconcile insurance reimbursements with deposits, automate document processing, and efficiently manage banking transactions.

By integrating technologies such as Python for backend logic, AWS for secure cloud hosting, and React.js for an intuitive user interface, the platform guarantees operational efficiency, data accuracy, and comprehensive financial oversight for healthcare providers. The MVP was successfully delivered in a matter of months, enabling swift deployment and real-world testing:

designed a scalable and secure digital infrastructure tailored for healthcare

integrated AI-powered tools like Google Document AI for automated EOB processing

built Smart Recon to track reimbursements and identify discrepancies

developed comprehensive bank dashboards with visual analytics and financial metrics

implemented seamless handling of banking transactions, including physical checks

Keep: Empowering employee retention with innovative solutions

Keep partnered with Geniusee to develop a cutting-edge employee retention application designed to revolutionize bonus structures. This innovative platform allows employers to offer vesting bonuses as loans, enabling employees to receive their total bonus upfront. The employer pays the loan to Keep while the platform manages vesting schedules and repayment processes. If an employee leaves the company, any unvested portion is returned to the employer, ensuring financial transparency and mutual commitment:

delivered an MVP within six months for rapid market entry

built a secure, cloud-based platform with AWS for scalability and reliability

integrated third-party services such as Plaid for banking, Synctera for transactions, and DocuSign for digital contracts

designed a user-friendly interface for seamless navigation and enhanced user experience

incorporated advanced analytics tools like Segment and Mixpanel to monitor KPIs and optimize performance

Banxe: Offering accessive neobanking for individuals and businesses

Banxe is a neobanking solution designed to seamlessly integrate cryptocurrency and fiat transactions for both individuals and businesses in the UK, U.S., and European markets. When Geniusee stepped in, the project faced numerous challenges, including a lack of documentation, the absence of critical testing protocols (unit, E2E, integration), no monitoring mechanisms, and a host of bugs and user complaints due to previous development inconsistencies. Our team undertook the meticulous task of stabilizing and enhancing the platform, ensuring its readiness for both end-users and the ever-evolving financial landscape. Over six months, Geniusee focused on documenting workflows, optimizing the platform’s functionality, and creating a responsive support system to address user needs in real time. While the primary goal was stabilization, our proactive approach has positioned Banxe for future growth and innovation in the dynamic neobanking sector.

seamless integration of cryptocurrency and fiat services for personal and corporate clients

robust documentation and monitoring systems to ensure stability and transparency

improved operational efficiency with quick bug resolution and proactive support

compliance with financial regulations across the UK, U.S., and EU markets

scalable infrastructure prepared for future enhancements and feature additions

How to build a secure custom FinTech solution aligned with emerging trends

With a strong demand for innovative technologies, businesses must follow a methodical approach to ensure security, scalability, and alignment with the latest fintech trends. The plan below will help you build a fintech solution that users will fall in love with, whether it’s a neobank, a payment gateway app, a digital wallet, an investment platform, or an AI-driven lending solution — each tailored for exceptional user experience.

Define objectives. Identify the target audience. For example, retail investors may seek personalized tools, SMEs often need accessible lending platforms, and millennials demand seamless mobile-first experiences. Next, outline the key problems your app will solve, such as streamlining payments or improving investment tools. For instance, you could create features like automated portfolio management, real-time risk assessment dashboards, or AI-driven stock market insights tailored to individual user preferences.

Choose a tech stack. Opt for AI for predictive analytics, blockchain for secure transactions, and cloud-native platforms for scalability. For the frontend, consider React, Angular, or Vue.js for dynamic interfaces, while the backend can leverage Node.js, Python, Java, or .NET for robust functionality in fintech and banking app development.

Prioritize security. Implement multi-factor authentication, firewalls, and modern encryption methods like homomorphic encryption, quantum-resistant algorithms, and end-to-end encryption to safeguard user data.

Understand compliance. Align with regulations like GDPR, PSD2, and PCI DSS to avoid penalties and ensure trust. Additionally, IT-focused legal consulting is essential to navigate complex compliance landscapes and protect your business from unforeseen legal pitfalls.

Design for users. Develop an intuitive interface with smooth navigation, accessible features, and personalized options. App design consulting services can help you create a user interface that excels in usability, style, and elegance, ensuring a delightful experience for your users.

Integrate core functionalities. Include secure APIs, payment gateways, fraud detection systems, AI-driven chatbots, digital wallets, compliance management tools, and advanced analytics dashboards. While a single third-party vendor can provide some of these components, others may require integration from multiple specialized providers to ensure optimal performance and compatibility.

Perform rigorous testing. Conduct penetration tests, security audits, and stress tests to ensure resilience under heavy traffic and threats.

Utilize real-time analytics. Deploy tools to monitor app performance and user activity, enabling continuous improvements.

Plan scalability. Design infrastructure that can grow with demand, using multi-cloud or hybrid cloud solutions if necessary.

Incorporate feedback loops. Collect and act on user feedback to refine features and enhance customer satisfaction.

Deploy gradually. Use phased launches to identify and resolve issues early while maintaining operational stability.

Monitor continuously. Implement 24/7 monitoring systems to detect anomalies, track performance, and mitigate risks proactively.

Conclusion: The future of Fintech

The future of the finance industry is undergoing a quantum leap provoked by evolving uncertainty about the future, the spread of superb technologies, and consequent transforming regulatory paradigms. Today’s users seek financial solutions that are naturally integrated across different financial domains, such as payments, lending, wealth management, and insurance, offering exclusive, highly personalized interactions, immediate access to financial consulting, and simpler terms of service.

Promoting financial inclusion continues to be a pivotal goal. Blockchain development services are breaking barriers by enabling banking access for unbanked populations and creating pathways to equitable financial participation. Artificial intelligence is revolutionizing core processes by driving predictive analytics, enhancing fraud prevention strategies, and delivering hyper-personalized user experiences. Cryptocurrencies, increasingly legitimized through central bank digital currencies, are reshaping financial frameworks into decentralized and innovative ecosystems.

At Geniusee, we deliver state-of-the-art fintech solutions, from AI-powered analytics and blockchain integrations to scalable, secure cloud platforms. With a track record of architecting solutions that align with industry trends, Geniusee empowers your vision to thrive in the future of the finance industry. Contact us today to get a free estimate for your projects!