Lack of timely access to data, shifting market patterns, extensive risk assessments, and time-consuming computations complicate managing financial assets for many people.

By automating critical processes like portfolio management, asset reporting, and accounting, investment management software can address these issues. However, choosing the top investment management software is not an easy task. There is a lot of efficient software available, each with its own price, deployment options, and features.

To help you decide which investment portfolio management software will work the best for you, we've created this guide to give an overview of the best software currently available, its common features, and key considerations.

In this article:

What Is Investment Management Software?

Investment management software is a category of software used by companies and organizations to manage financial investments.

This type of software can automate tasks such as portfolio management, security analysis, order management, performance measurement, and financial assets (e.g., stocks, options, and bonds) tracking.

Traditional investment management organizations, independent traders, investment advisers, and alternative investment software suppliers are all consumers of investment management software (such as hedge funds).

Every investment management platform has one common goal: to help organizations and individuals make better-informed financial decisions about their investments. Discover common features of the best investment portfolio management software.

On the topic

Recent Trends in Investment Banking Technology

To stay competitive, professionals must ride the wave and be on top of the trends in investment banking.

I want to knowFeatures of Investment Management Software

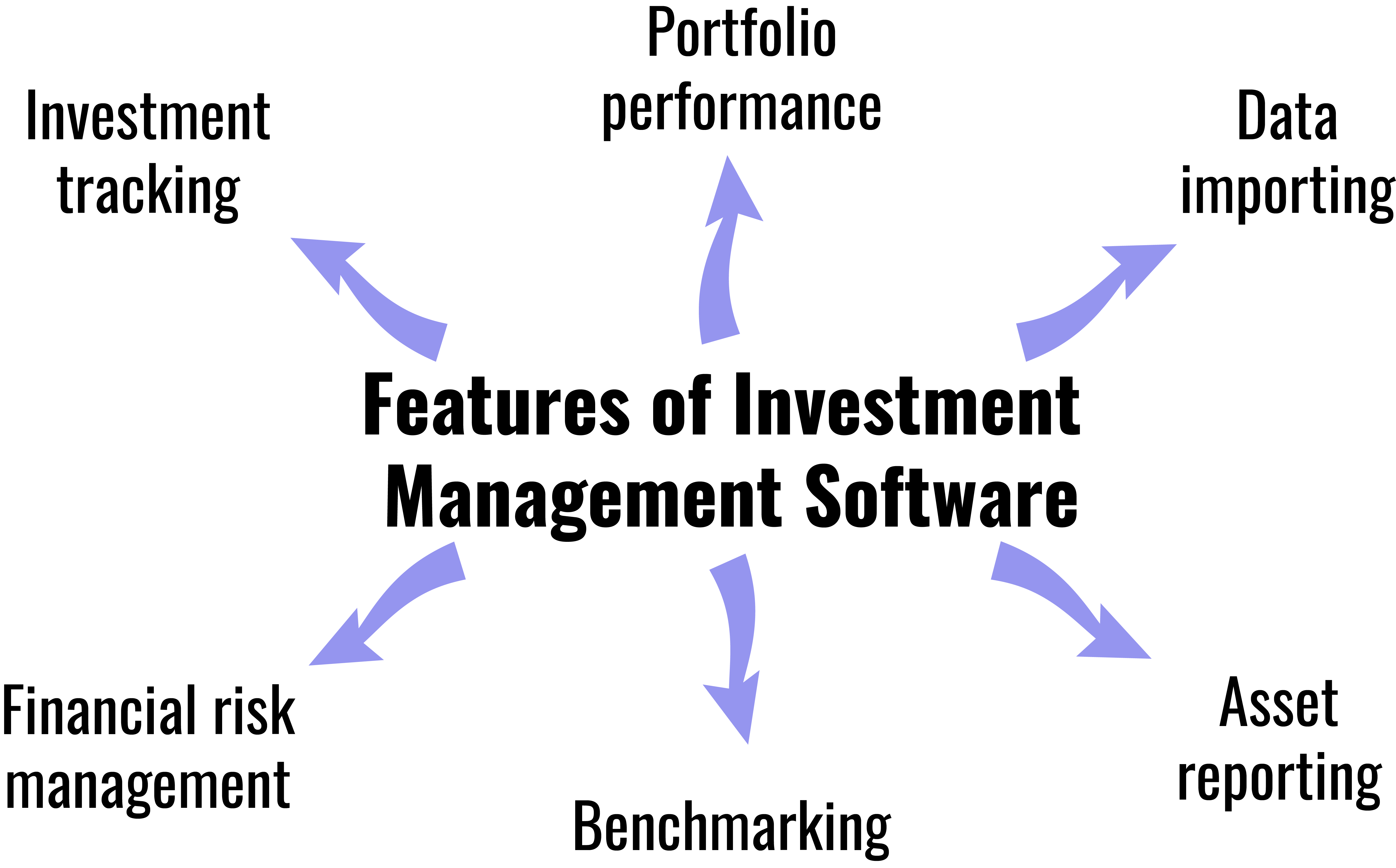

The features you should look for in investment management software will vary depending on your level of experience, the size of your portfolio, and other factors. However, most investment management software will offer features such as:

Investment tracking. Use a consolidated dashboard to track, allocate, and evaluate clients' holdings such as futures, equities, options, and entire portfolios.

Portfolio performance. Create a portfolio analysis report; then, analyze, compare, and forecast the performance of a portfolio against indices and benchmarks.

Data importing. Easily import account data, including holdings and transactions, from various sources such as CSV files, PDF, HTML, and even social media feeds, analyst reports, and news channels.

Benchmarking. Assess how a portfolio performs versus different market value segments and analyze the risks or returns based on multiple benchmarks.

Asset reporting. Generate a wide range of reports on assets, such as absolute gains, transaction reports, and even annualized return reports.

Financial risk management. Detect, measure, and monitor the risks associated with personal capital, investments, and portfolios. Utilize current and historical market data to forecast portfolio risks.

Now that you're more familiar with investment portfolio management software and its most common features, let's see how your company can benefit from this type of software.

Do you know?

The future of the money in the digital world

The spread of digital technologies and the emergence of digital platforms offering their services to tens and hundreds of millions of users are radically changing the structure of financial systems and even the very nature of money.

Find out nowBenefits of Using Investment Management Software

There are numerous benefits to using an investment performance management tool to manage your financial investments:

Improved decision-making. The system provides real-time data via reports and dashboards, allowing investment managers to make more educated investment decisions. It enables users to examine investment gaps and track the performance of parameters like the debt-equity ratio to optimize investment strategies. Users can also get price information on personal capital, mutual funds, bonds, and stocks in real-time, daily, weekly, and monthly.

Better risk management. Users can reduce risk by balancing risky investments with safer and more rewarding ones. The software uses real-time asset reporting and a variety of risk models to identify assets that are vulnerable to risk or have low returns.

Simpler portfolio management. Thanks to the tool's ability to categorize and organize portfolios on a single platform, the entire portfolio and wealth management process is simplified. This makes it easy to find and sort through them.

Faster transactions. Many investment management platforms include order-management features that can help you speed up the transaction process.

Ease of use. Most investment management software is designed to be user-friendly, making it easy for anyone to manage their investments.

So, we've covered the basics and benefits of investment portfolio management software. The next section covers the best investment management software currently available. Keep reading to find the ideal solution for your organization.

Useful Tips

How To Choose An Online Payment System That Will Fit Your Project For Years

The most important thing to consider while selecting an online payment gateway is how well it suits your specific business needs.

Show meThe Best Investment Management Software

There is various investment portfolio management software on the market, making it difficult to determine which one is suitable the most for your organization. The list below provides an overview of some of the best portfolio management tools currently available.

Personal Capital

Personal Capital is a web-based investment portfolio management tool that offers a variety of features, including portfolio management, financial planning, and goal tracking. The software is user-friendly, with a clean and simple interface. It also integrates with over 2,000 financial institutions, so you can easily import the data from your investment accounts.

Personal Capital is free for use.

The tool features include:

A planner for savings. It assists users in achieving their retirement objectives.

Organization tool. The tool helps you organize your spending by category, merchant, or date.

Tracker for cash flow. Monitor your cash flow for 30 days.

An education planner. Establish how much money is needed to pay for education.

The Investment Checkup tool. Use this tool to avoid risk and optimize profits.

Quicken Premier 2022

Quicken is a well-known brand in the stock portfolio management software market. Quicken Premier is a desktop application that allows users to manage their investments, track their expenses, and create budgets. It also includes features for tracking mortgages, loans, and credit card information. This tool stands out because it allows users to manage their finances on the go across computers and smartphones.

Quicken Premier is a paid tool, and it costs $77.99 per year.

The software offers the following features:

Stock watch lists. Create stock watch lists quickly and easily to stay in the loop with prospective opportunities.

Investment costs preview. Examine all investment costs together to understand genuine market returns better.

Export transactions. Easily export all your transactions from the register to Excel.

Quicken reports. Insightful reports that can be emailed directly.

Bills dashboard. It displays all of your reminders.

Expand your expertise

Embedded finance: what it is and how to use it?

Embedded finance is a new trend in modern financial technologies that integrates loans, insurance, debit cards, and investment instruments with almost any non-financial product.

Examine the topicMorningstar Portfolio Manager

Morningstar Portfolio Manager is a web-based investment management tool that offers a variety of features, including portfolio analysis, asset allocation, and risk assessment. It also includes a retirement planner to help you create a savings plan. The software is designed for both personal and professional use, making it a versatile option for individuals and businesses.

When it comes to the price, you can use either the free version or the paid version, which costs $29.95 per month or $199 per year.

Morningstar Portfolio Manager offers the following features:

Detailed assets overview. All stocks, bonds, and cash investments are tracked and include a detailed overview such as the price, market value, asset allocation percent, etc.

The Morningstar X-Ray tool. It displays the overall status of your investments, including asset allocation and information about stocks.

Advanced tools with Premium package. Fund and stock screening, fundamental analysis ratios, portfolio X-Ray interpretation with style, financial ratio, and expense analysis are all included in the Premium subscription.

Mint

Mint is a web-based personal finance management tool that allows you to track your spending, create budgets, and monitor your investments. The software is user-friendly, with a simple and clean interface. Mint also integrates with over 2,000 financial institutions, so you can easily import the data from your investment accounts.

Mint is free for use.

The tool features include:

Personalized MintsightsTM. Notifications that alert you about the savings you've been missing.

Budget planner. To enhance your savings, use a budget planner with custom goals.

Credit score. Your credit score is available for free 24 hours a day, seven days a week.

Multiple device compatibility. The software is free to use and is available on desktop and mobile devices.

Kubera

Kubera is a web-based investment management tool that offers a variety of features, including portfolio analysis, asset allocation, and risk assessment. Because it's as simple to use as a spreadsheet, this portfolio manager covers global banks, brokerages, equities, and currencies. It also includes a retirement planner to help you create a savings plan. Kubera's crypto component is what makes it "contemporary," as it allows you to track and verify the current value of your crypto and traditional assets.

Kubera is a premium tool, and you can obtain it for $15 per month or $150 per year.

The tool comes with the following features:

Asset values. Connect your online brokerage accounts or add stock tickers to see their current values with this stock portfolio tracker.

Asset tracker for cryptocurrencies. This feature allows you to stay up to date with recent changes.

Accounts tracker. An advanced tracker with over 20,000 bank connections worldwide.

Recent insights. Access the most recent market data and track the value of your residential lot, vehicles, domains, and metals.

You might be interested

Stablecoin: smart investment or stupid waste?

The primary purpose is to connect the world of cryptocurrencies with the material world.

I want to see itStockRover

The StockRover Portfolio Manager's advanced analysis tools make it a good alternative for people who need a more thorough and deep study of their investment portfolio. You can connect your brokerage data, manually enter it, or utilize a spreadsheet to examine your portfolio.

When it comes to the price, there are multiple options available. StockRover offers a free plan and also premium plans that range in price from $79.99 to $279.99 per year.

The tool comes with the following features:

Portfolio performance. To make investing decisions, compare portfolio performance to certain benchmarks.

Fast and secure brokerage connection. With over 1,000 brokerages available, brokerage connection is quick, simple, and secure.

Automatic reports. Detailed reports regarding the performance of your portfolio or watchlists.

A tool that predicts your portfolio dividend income. Predictions are made one month in advance of the present date.

This was our overview of the top investment management software currently available. Even though all of these tools are excellent and come with various helpful features, they may not have all the features you are seeking.

If that is the case, we have one last solution for you—custom investment portfolio management software.

The Geniusee Experience

Geniusee is a custom software and product development company aimed to help FinTech, EdTech, and other businesses worldwide thrive through tech partnerships. Our team has completed more than 100 projects on time and within budget in different domains.

The Geniusee team can help you empower your business by finding and implementing the most efficient solution for your bank, lending, or financial company that personalizes the services you offer.

With 64 actively used technologies, the Geniusee team tailors relevant tech stacks for your investment management needs. And, unlike many other companies, we don’t rely on templates. Instead, we create customized investment management software for every client from scratch.

Here are the main qualities of the Geniusee team:

- Geniusee uses a holistic method, as in rugby, when the ball is passed inside the team while the team moves across the field as a unit.

- We noted that it’s not enough to provide basic rules—high quality, low cost, and differentiation—to succeed in a competitive market. We also use speed and flexibility.

- The transition from one phase to another occurs after all the requirements of the previous phase are fulfilled. These checkpoints control risks.

- We cultivate active interaction not only between project participants but also with suppliers. This exchange and openness within the team and suppliers increase speed and flexibility.

- Our specialists are close to external sources of information, so they quickly respond to changing market conditions. Key features of our teams in development are autonomy, self-improvement ability, and mutual development of team members.

- We regularly provide transfer of knowledge to other projects that develop new products or to other departments in the organization.

A full-cycle fintech software development service should be entrusted to experienced practitioners. The Geniusee experts brought to life successful cases in blockchain solutions, payment systems, and neobank applications.

If you're looking for custom investment management software for your organization, the Geniusee team is there to help!

Stay tuned

Top digital banking trends

Visibly or not, Covid-19 has disrupted almost every industry globally and transformed existing ways of doing business for enterprises. The banking industry is no exception to this shift.

Show meConclusion

The finest portfolio management software is determined by your circumstances and objectives. Before making any purchases, make sure to research each choice to learn more about it.

No matter what your financial management needs are, there is investment management software that can help you meet them. There is something for everyone, from comprehensive and in-depth analysis tools to more simplistic portfolio trackers.

And if you don't find exactly what you're looking for in one of the software options we've outlined here, don't worry—custom software solutions are always available.

Still have questions? Ask our professionals. At Geniusee, we ensure the stability and consistency of our performance by working with people who share our four core values.