Technology is changing the structure of the financial system and the very nature of money. Digitization and the growth of technology platforms can lead to the ''repackaging'' of the functions of money, the emergence of currency zones that go beyond national borders, and cause turmoil in the international financial system. Let's see what the future of money is?

In this article:

"Repackaging" the functions of money

The spread of digital technologies and the emergence of digital platforms offering their services to tens and hundreds of millions of users are radically changing the structure of financial systems and even the very nature of money. The digitalization of money itself is not new because, for example, bank accounts and payments with their help already exist in electronic form. But new digital currencies can underpin large technology platforms that transcend national borders. The emergence of such money could change the nature of currency competition, the architecture of the international monetary system, and the role of money issued by states. We are talking about a change in the nature of money, its new forms, and the fact that among the consequences of these changes may be the separation and reorientation of the main functions of money, a "platform-centric" payment system, digital "dollarization," says Markus Brunnermeier, professor at Princeton University.

Digital money already exists in a wide variety of contexts: WeChat and Alipay digital wallets have become dominant in China's payment system; in Africa, mobile operators have launched successful money transfer services such as M-Pesa; Facebook is hatching plans to release its stablecoin; finally, there have been thousands of private cryptocurrencies launched in recent years, Brunnermeier lists. The economist focused on the implications of digitizing money in a study he carried out with Harold James, a colleague at Princeton University, and Jean-Pierre Landau from Sciences Po in Paris, as well as his presentation at the Future of Money webinar at the annual conference of the Bank for International Settlements (BIS).

Digitalization, which has significantly reduced the costs of currency exchange, can lead to the separation of the three main functions in the future of money — as a unit of calculation, as a means of payment, and as a means of accumulation. Any national currency today performs all three functions. But suppose the costs associated with the transition from one digital currency to another become small. In that case, there is no need to use the same currency as a means of payment, accumulation, and as a unit of calculation, Brunnermeier said. The user may well use one digital currency to make savings and the other for payments. As a result, the specialization and differentiation of digital currencies will intensify: each can perform a certain function and compete with others exclusively as, for example, a means of calculation or only as a means of accumulation.

Moving away from bank-centricity

Digital technologies are changing the structure of financial activity and FinTech software development services: digitalization is leading to a departure from the traditional bank-centered model, that is, from a bank-centric model, where all payments are made through a bank, to a payment-centric model focused on payments through digital platforms.

It is believed that the advantage in information about the consumer belongs to the consumer himself. However, the accumulation of a huge amount of data about customers (not only about their purchases but, for example, about the content of their accounts on social networks) on the platforms leads to a "transition of power." The information advantage is given to platforms serving consumers. As a result, the insurance company may know more about the client than he does. If he likes red cars, he will have to pay a higher premium when buying an insurance policy, as insurance companies have a lot of data that drivers of red cars drive more aggressively and have more frequent accidents.

It should be remembered that platforms have more control over digital payments than central banks because platforms know more about their users and are better equipped to track, incentivize, or restrict user activity. As a rule, the cost of entering the one is extremely low, which helps to attract users, while leaving the platform may be too expensive and become a kind of "Berlin wall" for users. In a way, some of them are reminiscent of the California Hotel, which is easy to get into but very difficult to get off.

Monopoly on the economy: corporations vs. states

The planet's population is growing, the ecological situation is becoming critical, and resources are drying up — it becomes cramped. A ‘war of all against all’ is natural in such a situation, and the world economy becomes a bone of contention.

Money issued by corporations will become more reliable than money from countries outside the top 30 in terms of budget size. As a result of the merger of corporations, a mega-corporation can become a monopoly of the economy — of course, not without friction with states pursuing an antimonopoly policy.

A strong leader may appear on the world stage in the future of money. As a result, one of the existing currencies will become a single currency. Many open military conflicts will not necessarily accompany this. It is, instead, about an information war with the use of the latest technologies and various sanctions.

The emergence of world money can occur based on the transition to the euro in the EU. First, continental money will emerge, which in the future will unite into a single currency. According to the Minister of Economy of Brazil, Paulo Guedes, by 2040, there will be only five or six currencies in the world.

The emergence of world money is not a new idea. In March 2009, Timothy Geithner, then the US Treasury Secretary, let slip that he was open to the concept of a global currency. The legendary economist John Keynes was also an apologist for a single world currency.

Digital "dollarization"

Usually, when speaking of currency areas, they mean specific geographic areas. In the digital world, things will be different. This is where digital currency zones arise, within which the currency used is not tied to a specific country or geographic region but a specific digital platform. Since digital currencies are inherently international, this entails the risk of digital "dollarization" (by analogy with traditional dollarization). Only, in this case, the national currency can be replaced not by the dollar but by some "foreign" digital currency.

For example, I have several friends from China living in the US, and when they order food at a local Chinese restaurant, they pay through Alipay. Even though both the customers and the restaurant owner are located in the United States and the transaction is made in the United States, the money goes through the Chinese payment system.

In an environment where digital ones are increasingly replacing cash payments and tech giants have more influence and power, the financial system may shift towards digital platforms. The most severe consequence could be that agents begin to enter into contracts in a platform-specific accounting unit rather than a central bank's accounting unit. Digital "dollarization" can lead to the fact that the national currency will cease to function as money, the regulator will lose the ability to carry out monetary policy, and the country's monetary sovereignty will be weakened or lost.

The most vulnerable to digital "dollarization" are:

- small economies;

- economies with a large informal sector;

- countries with insufficiently effective regulatory systems;

- countries where there is no successful national electronic payment system.

Incorruptibility and transparency

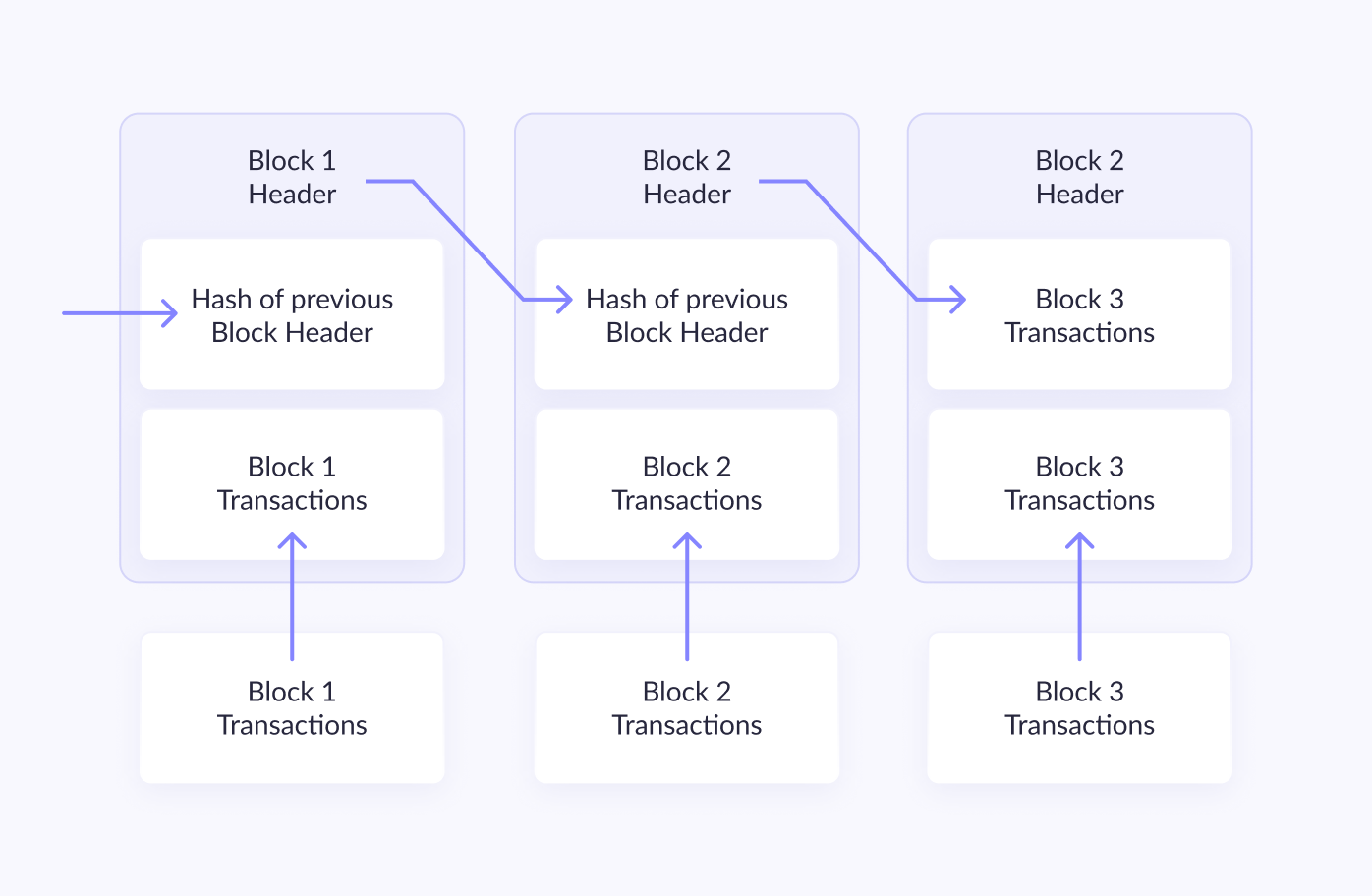

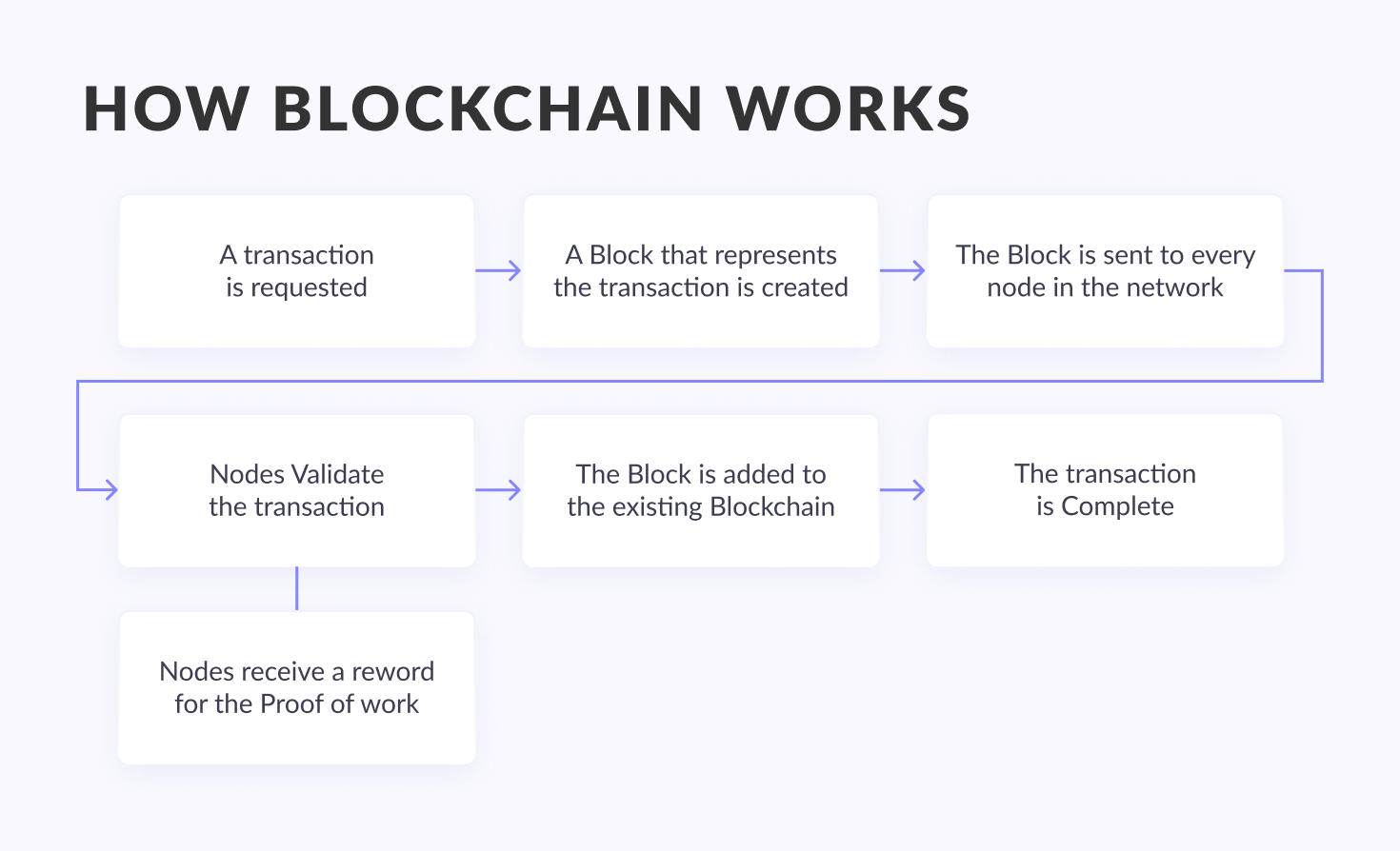

The world of technology is developing in many directions, not all of which are as popular as virtual reality or autopilot. One example of a quiet IT revolution is the blockchain system, the essence of which is reflected in its very name. We are talking about a data bank, built in the form of a simple chain of blocks, where information about the transactions performed at each step is saved and remains available for viewing by all participants.

In a recent study by the World Economic Forum, the blockchain system was identified as the centerpiece of the financial structure of the future. Experts anticipate that four of the five largest banks will use this technology as an experiment as early as next year.

The main principle of the new technology is the separation of the data bank. There is no central server where it is stored. It also lacks a central authority, as might be expected with a currency like bitcoin; any state or company does not control it. Instead, the blockchain is distributed across multiple computers and focuses on the reliability of encryption technologies.

In the case of Bitcoin, each participant has a copy of the blockchain, which also records all transactions. In the blockchain version for banks and insurance companies, the role of participants in the bitcoin system is played by various financial institutions involved in the circulation of money. At the same time, the rights of all participants and banks are equal: the blockchain does not belong to anyone and belongs to everyone at the same time. Decentralizing the data bank is important to protect it. Individual users are unable to hack it or manipulate it in any way. The integrity of the data bank will be at risk only if some hacker succeeds in hacking the accounts of more than half of the participants.

One of the strengths of blockchain is transparency. The system is under the constant control of the so-called miners — participants, whose programs and computing equipment verify all transactions block by block, ensuring their authenticity. If the block is verified, the result is recorded in the blockchain and becomes a digital brick in this system.

Nodes ValidAte the transaction (point 4 in the picture, one letter is missing)

In practice, using a blockchain such as Bitcoin does not come with high costs: the user only needs the appropriate software. The software creates a cryptographic key pair for each participant, containing private and public keys. The public key is available to all other participants, and the private key remains hidden.

Stablecoins

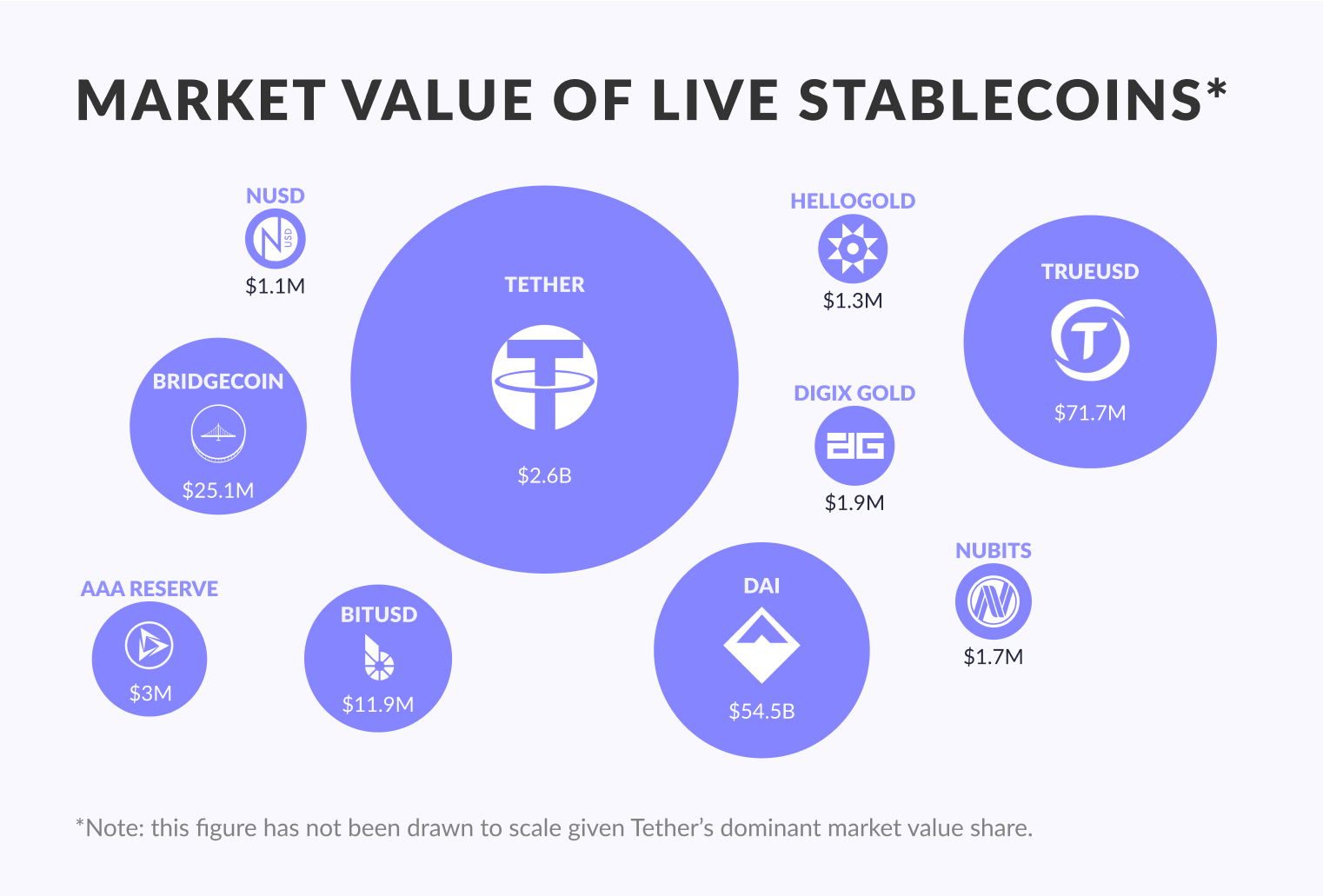

At the end of September, the Blockchain company presented a large study on the state of affairs in the world of stablecoins — cryptocurrencies that are not subject to volatility due to being tied to something stable (mainly the dollar).

Stablecoins are already an essential part of the digital asset ecosystem, with a total market value of approximately $3 billion, or 1.5% of the value of the entire crypto asset market. Stablecoins are listed on over 50 different crypto exchanges, with Tether listed on at least 46 exchanges. 43% of stablecoins in existence today are traded on one or more top exchanges. But while Tether is the absolute leader of the segment: it accounts for 93% of the total market value of all stablecoins, it is the second most actively traded cryptocurrency after Bitcoin, and the daily turnover is 60% of the Bitcoin trading turnover. Tether accounts for 98–99% of the trading volume of all stablecoins.

In addition to being able to solve the problem of volatility in the cryptocurrency market, which scares off the broad masses and thereby hinders the development of the entire industry, stablecoins can also create some competition for the largest cryptocurrencies as an alternative medium of exchange and store. Since the stablecoins themselves are built on the infrastructure already created by bitcoin and ether, such competition will not play a key role. They should be viewed rather as a basic element that can bring huge benefits to the entire digital asset ecosystem.

Central Bank digital currencies

The attitude of the world's central banks to digital money has gone from the rejection of the idea itself to pilot projects of a national digital currency (central bank digital currency, CBDC) in just the past few years.

If in 2017, two out of every three central banks surveyed by the Bank for International Settlements (BIS) showed interest in studying the potential of digital money to one degree or another, then by the beginning of 2020, the work on CBDC — from studying pre-pilot — 80%, or four out of every five central banks in countries that collectively account for three-quarters of the world's population and 90% of the global economy, were involved.

By mid-2020, at least six countries were experimenting with digital national currencies, including China, South Korea, Sweden, which was one of the first to start this work. In early October, the European Central Bank, the issuer of the second most important currency in the world, announced the possible issue of a national digital currency and the beginning of experiments with the digital euro. The possibility of issuing a digital currency is being discussed by another influential central bank of the world — the Bank of England, which previously published a discussion paper on its CBDC research. The US Federal Reserve is exploring technologies to enable digital cash, Federal Reserve Board member Lael Brainard said in August; Several Federal Reserve Banks are working on this together with the expert and scientific community — for example, the Boston Federal Reserve Bank in partnership with MIT, and the New York Federal Reserve Bank in collaboration with BIS.

In most cases, the focus of interest for central banks is retail CBDCs, a digital analog of cash. Of the 46 regulators who surveyed Central Banking in February, 70% said they are studying retail CBDCs — although earlier research on digital currencies focused primarily on infrastructure for interbank settlements (see sidebar).

Cryptocurrency

Not only is it important to understand the benefits of virtual assets, but vital to know how you can benefit from using cryptocurrency.

First, it can be used for simple payments and transferring funds. Bank transfer is usually fraught with a number of difficulties, and it is a rather long and expensive process (especially international transfer). Moreover, banks act as operators of transactions with broad powers, up to blocking funds on clients' accounts. Cryptocurrency transfers are free from such disadvantages due to decentralization.

Secondly, you can invest in cryptocurrencies to increase your assets. In this case, it is advisable to choose an investment strategy and collect a portfolio of several volatile cryptocurrencies.

So when?

It's funny that today the world's financial institutions continue to print money in record volumes (in every sense). At the same time, representatives of world banks say that we will see a completely cashless world within ten years. The coronavirus pandemic gave the impetus for this, which accelerated the development of technologies in all spheres of human life, including financial. About 70% of central banks around the world are considering issuing their digital currency.

One of the main advantages of the wonderful world of non-cash is making almost all people on the planet participate in the global financial system. Even in the United States today, about 5% of households do not use banking services. And according to the World Bank, about 1.7 billion adults worldwide do not have a bank account. Thanks to technology, the entry threshold will be virtually zero.

Eswar Prasad, an economics professor at Cornell University, explains in his book The Future of Money: How the Digital Revolution is Transforming Currencies and Finance that cash is doomed to disappear for many reasons. The main thing is that they have completely outlived their usefulness. In the modern world, they do not solve problems but create them:

- they need to be stored;

- exchange is necessary;

- separate reporting is required;

- there is a need to weed out counterfeit bills;

- they can be physically stolen.

At the same time, the main factual and legal plus of using cash in 2021 looks like this: in the face of a total coronavirus shortage of material things, it allows you to feel the pleasant weight of something tangible in your hand. But in 2021, this is no longer enough to remain meaningful.

Instead of Conclusion

In the future of money, the monetary system will have to take into account the role of the government and banks and the role of large technology companies. The big data of digital platforms is a huge advantage, but it can be used by banks as well, becoming technology companies themselves.

The state needs to maintain monetary sovereignty, which is critical for managing the economy. It requires effective regulation of technology companies, but at the same time, the solution could be the issuance of national digital currencies (central bank digital currencies, CBDC) by central banks.

Interaction between CBDC and large digital platforms will be essential. CBDC may not be attractive enough to the general public if it cannot be used on popular platforms, and at the same time, people will be more inclined to use the one where CBDC can be used for settlement.

Read also:

Best Blockchain Platforms Used by Global Companies

How to Optimize the FinTech Software Release Management Process