FinTech software development is an important area for companies operating in today's financial sector. This is due to small start-up organizations responsible for developing both innovative and technological FinTech solutions in various fields.

These areas primarily include online and mobile payments, alternative finance, big data, and most importantly, financial management. It was FinTech companies that started the revolution in the world of finance with the help of various new technologies that were appreciated by the majority of consumers.

According to experts, there are about 5,700 FinTech organizations in the FinTech industry alone in America, and all of them are growing incredibly today. In case you are in this area or just planning to enter it, know that this is the best time to enter the FinTech market.

Technology does not stand still, as shown by FinTech mobile applications, which have begun to challenge various traditional methods related to banking. And more and more banks have become interested in integrating FinTech operations with their regular offerings. Therefore, it is not surprising that the demand for FinTech requires and attracts a large number of developers.

If you are a FinTech mobile app developer, here are some simple and effective tips to keep you moving in the right direction without any confusion: benefits, types of FinTech apps, development stages, and more.

In This Article:

Benefits of FinTech Applications

Benefits for Banks. By developing a high-quality FinTech app, a banking organization can reduce the cost of doing business since a digital banking will take over part of the staff's duties. In addition, the presence of such a mobile service contributes to faster processing of financial transactions and automation of many business processes, which has a positive effect on customer loyalty.

Benefits for Users. Considering the massive spread of mobile devices in recent years, bank customers expect to manage their finances through a convenient application. With such a service, they get the ability to control their expenses and recurring payments around the clock — minimizing the need to contact banks to clarify any information. Users' lives are also simplified due to the automation of various transactions, whether it is the monthly payment of utilities, loans, etc.

Types of FinTech Applications

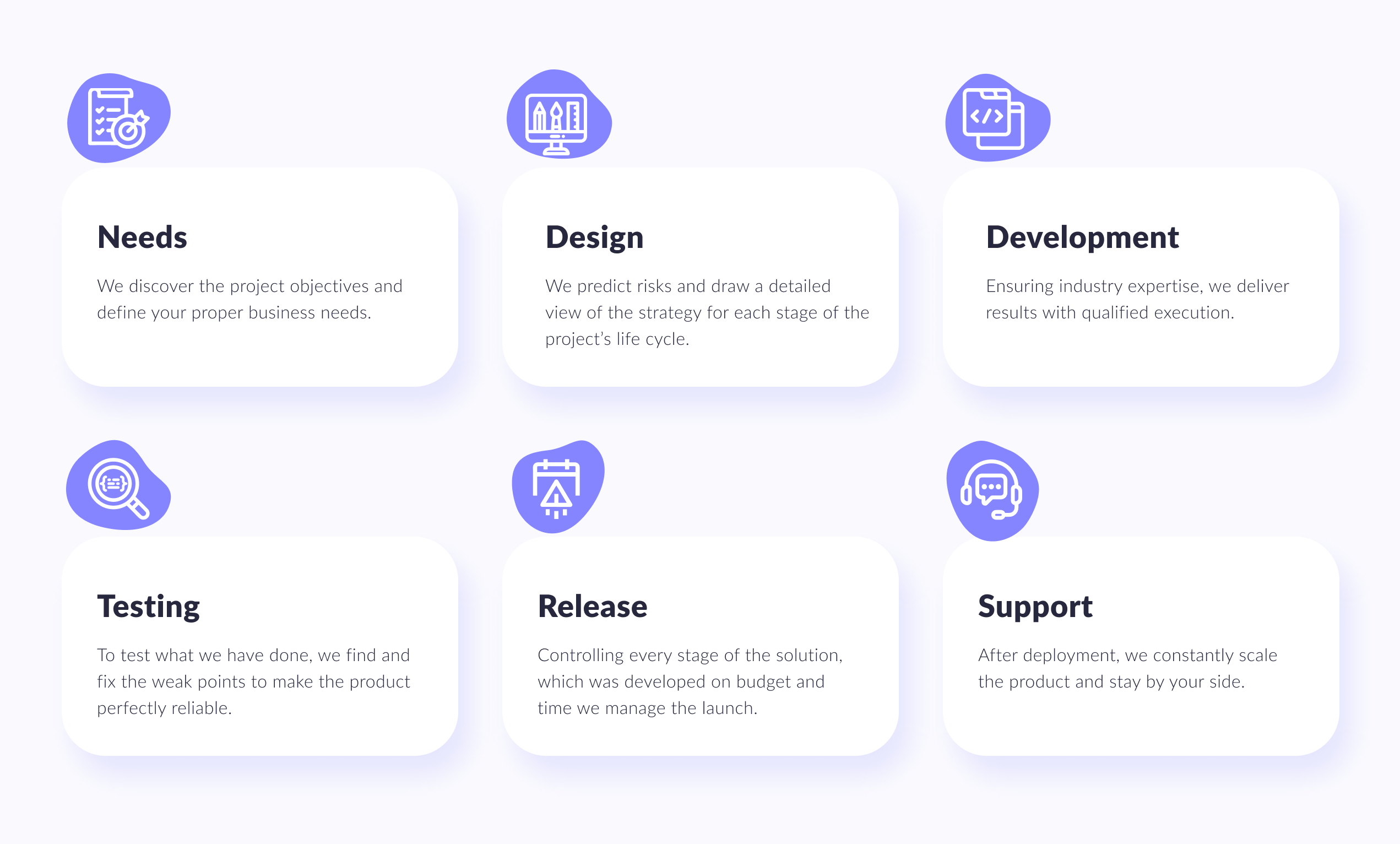

Successful FinTech App Development Stages

There are different types of FinTech apps. Most offer functionality for opening bank accounts, managing finances, digital payments, loans, investments apps, etc.

Personal finance apps

It helps users keep a detailed record of their expenses through a clear interface and tips aimed to save money. With them, people can better analyze their financial habits and, if desired, transfer part of the money to piggy banks or deposits automatically.

Applications for investment

This allows you to monitor fluctuations in the stock markets, as well as the value of currencies and cryptocurrencies. With AI-based recommendations embedded in these FInTech services, you can invest your money more efficiently by not getting stuck on one type of investment.

Lending apps

Lending apps rely on chatbots, which noticeably speed up and simplify the process of obtaining loans. Here, the creditworthiness of customers is assessed automatically — thanks to artificial intelligence — so users can apply for microloans or installments on their own — without interacting with the staff of a bank or other financial institution.

On the topic

Automation & Integrations In Lending & Underwriting

Discover how AI is transforming banking, accelerating customer access and automating internal processes.

Let's seeApplications with the possibility of transfers and payments

They provide users with enhanced options for managing their finances. Such mobile digital products can support transactions in both conventional currencies and cryptocurrencies. Through the machine learning applied here, customers can assess the riskiness of each payment. And in these services, it is possible to automate any money transfer or distribute it to several bank accounts.

Main stages of development of FinTech applications

Below we describe the development process of FinTech apps by the Geniusee team.

1. Niche selection

Before we start developing your FinTech app, you need to decide on your preferred niche. We will discuss the future project and determine what exactly it will be used for. Depending on what product you need — a service for personal finance management, a trading app, or something else — our development team will understand which functions will be the highest priority.

2. Market analytics

Our specialists will draw up a technical task after collecting information on the target market segment you are interested in, including data on the target audience and competitive FinTech apps. Based on this document, we will build a FinTech app for you.

3. Prototyping

When developing a FinTech app prototype, we focus not only on its functions and tools but also high-quality UX/UI. Since we are talking about a quite difficult product to understand, we do our best so that even users who are not financially savvy can understand its interface.

Do you know?

POC Vs MVP Vs Prototype: The Strategy For The Best Product-Market Fit

Selecting the correct strategy saves not only your time and money but also mitigates the risks of failures.

Tell me more4. Drawing design elements

At this stage, our designers draw the FinTech app interface elements in accordance with the approved visual style. Along with this, we also implement service navigation that would simplify your customers' user experience to the maximum.

5. Programming

As part of implementing the software part of the FinTech app, we consider your needs when choosing a tech stack. Our developers can create either a native financial app for a specific mobile platform (iOS and Android) or a cross platform app that supports both operating systems.

FinTech Applications development features

Now let’s explore key features commonly found in application development for FinTech. We will categorize these features into three distinct levels: basic, advanced, and complex. Each category represents a progression in functionality and sophistication, offering a comprehensive overview of the capabilities that FinTech apps can provide.

By understanding the potential features available, businesses and developers can tailor their applications to meet the specific needs of their target audience. Whether it's addressing the requirements of individual users, simplifying financial operations for businesses, or enabling seamless transactions on a global scale, the selection of appropriate features is pivotal in delivering a successful FinTech application.

Basic features

- User Registration and Authentication. This feature allows users to create accounts within the FinTech application by providing their basic information and credentials. It also includes robust authentication mechanisms to ensure secure login, protecting user data and transactions.

- Account Management. Users can view their account balances & transaction history, and perform basic account operations such as making deposits, withdrawals, and managing account settings. This feature provides users with an overview of their financial activity within the application.

- Payment Gateway Integration. Integration with popular payment gateways allows users to make secure and seamless transactions within the FinTech application. It ensures that payment processes are reliable, supporting various payment methods such as credit/debit cards, bank transfers, or digital wallets.

- Peer-to-Peer Payments. Users can transfer funds directly to other users within the application. This feature facilitates seamless and instant transactions between users, eliminating the need for third-party intermediaries for peer-to-peer payments.

- Notifications. Users receive automated notifications about important account activities or updates, such as transaction confirmations, payment reminders, or account security alerts. Notifications keep users informed and engaged with their financial transactions and activities within the application.

Advanced features

- Budgeting Apps and Expense Tracking. This wealth management feature enables users to set budgets, categorize expenses, and track their spending patterns. Users can view reports, charts, and visual representations of their expenses to better manage their finances and make adjustments as needed.

- Investment Portfolio Management. Users can manage their investment portfolios within the FinTech application. This feature includes tracking stock prices, monitoring performance, analyzing investment diversification, and receiving real-time market updates to make informed investment decisions.

- Personalized Recommendations. Based on user spending patterns, financial goals, and preferences, this feature provides personalized financial recommendations. It suggests suitable FinTech products, investment opportunities, or money-saving strategies tailored to each user's specific needs.

- Financial Calculators. Basic financial calculators help users perform common financial calculations such as loan payments, interest rates, currency conversions, or savings estimations. These calculators provide convenient tools for users to analyze their financial scenarios and make informed decisions.

- Multi-Currency Support. This feature allows users to transact in different currencies. It provides real-time exchange rate information, enabling users to convert currencies within the application and perform international transactions.

Complex features

- Risk Assessment and Management. Advanced risk assessment algorithms and tools evaluate user investment risks based on factors such as investment horizon, risk tolerance, and market conditions. This feature provides insights into risk exposure and suggests suitable investment options accordingly.

- Machine Learning-Based Fraud Detection. Machine learning techniques analyze user behavior, transaction patterns, and other relevant data to detect fraudulent activities and prevent unauthorized transactions. This feature enhances the security of the application and safeguards user funds.

- Robo-advisor Services. Robo-advisor leverages automation and algorithms to provide users with automated investment advice and portfolio management. Based on user preferences, risk tolerance, and financial goals, the feature recommends investment strategies, rebalances portfolios and tracks performance.

- Financial Data Analytics. This feature offers comprehensive data analytics capabilities to help users gain insights into their financial habits, spending patterns, investment performance, and other relevant financial metrics. It provides visualizations, reports, and data-driven insights to aid users in making informed financial decisions.

- Open Banking Integration. Open banking API facilitates integration with external financial institutions and aggregators, allowing users to access and manage their accounts from multiple institutions within the FinTech application. This feature provides users with a holistic view of their financial information and promotes seamless financial management across various accounts.

These features collectively contribute to creating a robust and comprehensive FinTech application that caters to various financial needs, promotes financial management, and enhances user experience. The specific implementation of these features may vary based on the unique requirements of each application.

The Cost of FinTech Application Development

If you want to create a FinTech app you need to require careful consideration of various factors, including cost. Whether choosing in-house development or outsourcing, the annual cost can vary based on the region, features, and team members involved. In the following table, we present approximate annual cost ranges for FinTech ecosystem development in different regions such as the USA, West Europe, East Europe, Latin America, Asia, and the Middle East. Furthermore, the table highlights the development costs associated with different feature sets, categorized as basic, advanced, and complex, while considering the team size. Please note that these ranges serve as estimates, and it is advisable to consult with experts or FinTech application development companies to obtain accurate cost assessments tailored to your specific project requirements.

Region | Team Members | Basic Features | Advanced Features | Complex Features |

USA | Small (2-5) | $200,000 - $500,000 | $400,000 - $1,000,000 | $800,000 - $2,000,000 |

Medium (6-10) | $400,000 - $800,000 | $800,000 - $2,000,000 | $1,600,000 - $4,000,000 | |

Large (11+) | $800,000 - $2,000,000 | $1,600,000 - $4,000,000 | $3,200,000 - $8,000,000 | |

West Europe | Small (2-5) | €150,000 - €400,000 | €300,000 - €800,000 | €600,000 - €1,600,000 |

Medium (6-10) | €300,000 - €600,000 | €600,000 - €1,600,000 | €1,200,000 - €3,200,000 | |

Large (11+) | €600,000 - €1,600,000 | €1,200,000 - €3,200,000 | €2,400,000 - €6,400,000 | |

East Europe | Small (2-5) | €75,000 - €200,000 | €150,000 - €400,000 | €300,000 - €800,000 |

Medium (6-10) | €150,000 - €300,000 | €300,000 - €800,000 | €600,000 - €1,600,000 | |

Large (11+) | €300,000 - €800,000 | €600,000 - €1,600,000 | €1,200,000 - €3,200,000 | |

Latin America | Small (2-5) | $50,000 - $150,000 | $100,000 - $300,000 | $200,000 - $600,000 |

Medium (6-10) | $100,000 - $250,000 | $200,000 - $600,000 | $400,000 - $1,200,000 | |

Large (11+) | $200,000 - $600,000 | $400,000 - $1,200,000 | $800,000 - $2,400,000 | |

Asia | Small (2-5) | $75,000 - $200,000 | $150,000 - $400,000 | $300,000 - $800,000 |

Medium (6-10) | $150,000 - $300,000 | $300,000 - $800,000 | $600,000 - $1,600,000 | |

Large (11+) | $300,000 - $800,000 | $600,000 - $1,600,000 | $1,200,000 - $3,200,000 | |

Middle East | Small (2-5) | $75,000 - $200,000 | $150,000 - $400,000 | $300,000 - $800,000 |

Medium (6-10) | $150,000 - $300,000 | $300,000 - $800,000 | $600,000 - $1,600,000 | |

Large (11+) | $300,000 - $800,000 | $600,000 - $1,600,000 | $1,200,000 - $3,200,000 |

5 Tips for Mobile FinTech Developers

The path to FinTech app development is clear, and the competition will only increase here. And this is undoubtedly the ideal time for the development of FinTech technologies. Make sure you follow the tips listed below and you are unlikely to experience, any difficulties with FinTech app development.

1. Know and understand FinTech

The first thing you need to do is study, analyze and, most importantly, understand FinTech. There is no doubt that you can be tech-savvy, and building mobile banking app will be easy for you. However, you cannot be unambiguously good at financial knowledge. But it is finance that is one of the most important components of FinTech, so you should study it.

The purpose of FinTech apps is to help users in financial matters with maximum ease for them. Once you align your trajectory with your clients' goals, it will be easier for you to move forward and you will not face any problem when building a FinTech app.

2. Take care of security

Given the specifics of the mobile apps, your users will be forced to trust you and provide all confidential and personal financial data. But if suddenly, such information is somehow leaked and falls into the hands of scammers, it is obvious that your mobile banking app will come to an end.

Since your FinTech app will interact with the main systems of the bank, you simply have to ensure security. And therefore, you should devote enough time to developing a back-end system with firewalls and proxies.

After completion of work, you should check the application for security, up to load testing for hacker attacks with the aim of vulnerabilities in the system. This is the only way you will understand if your FinTech app development is well protected or if it needs any improvements.

3. Listen to your users

You need to be prepared that users will speak out about your application with all sorts of suggestions or criticisms, and they will be completely right because they have their own opinion on this matter. Listen to them and be ready to implement the most necessary things.

This will save you time since it will be enough to put in extra effort during the market research so that you can protect yourself from future redesigns.

To avoid user dissatisfaction, make the application interface more comfortable for them. Make sure your FinTech app development includes the right features like gradient color transitions, motion graphics, etc. And remember that users are constantly using FinTech apps to manage their finances and control their debt situation. Therefore, you need to build a FinTech app with the appropriate features.

4. Make sure you choose the right technology

For your application to have long-term plans for the future, you must think about the technology as well as the platform on which you are interested in developing the application. After all, your users will be guided by the best technologies in applications.

However, traditional financial institutions and banks that users interact with are responsible for using traditional tech stack in their base. Therefore, you need to make a balanced choice that provides users with everything they need to make it easier to communicate with traditional institutions.

Oh, wait!

Release in 3.. 2.. 1..

Find out how to optimize the release process of FinTech web or mobile applications.

Check it out5. Use smart technology

New technologies are considered to be the backbone of FinTech apps. Various technologies that include artificial intelligence and blockchain technology are considered to be the demand of the times, and you simply have to include them in the application in some form. Blockchain can help with record-keeping, and AI should be used for personalized recommendations, financial data analysis, customer interactions, etc.

Geniusee Experience in Building Fintech Apps

With a strong focus on innovation and cutting-edge technologies, Geniusee, FinTech app development company, has successfully delivered a range of solutions that empower businesses in the financial sector.

Our expertise lies in ensuring top-notch security and compliance within FinTech apps. We employ robust encryption algorithms and implement industry best practices to protect sensitive financial data and meet regulatory requirements. Geniusee excels in seamlessly integrating payment gateways such as PayPal, Stripe, and Braintree, enabling secure and hassle-free transactions within FinTech apps.

Our user-centric approach is evident in the user experience we create. Geniusee designs intuitive interfaces and optimized navigation to enhance user engagement and satisfaction. With a strong emphasis on regulatory compliance, Geniusee team helps businesses navigate the complex landscape of financial regulations, ensuring that their FinTech apps meet industry standards.

You can discover a range of case studies and successful implementations that highlight our capabilities and experience in building FinTech apps.

Keep — employee retention application

FinTech is a prominent industry for us, and we were thrilled to leverage our expertise to empower Keep. Keep operates in the innovative space of compensation and retention services. The Geniusee team was enthusiastic about collaborating on the development of a unique service that enables companies to provide vesting bonuses to employees in the form of loans.

Through Keep, employees have the opportunity to receive their full bonus amount upfront, while the repayment of the loan is handled by the employer. The employer makes an upfront payment to Keep, and the vesting schedule determines the portion of the loan that is vested (forgiven) for the employee. In the event that an employee leaves the company, any portion of the loan that is not vested must be returned.

Our team at Geniusee was dedicated to ensuring the seamless implementation of this service, creating a robust platform that facilitated efficient loan management and accurate vesting calculations. The solution involved secure payment processing, strict data privacy measures, and user-friendly interfaces for both employers and employees.

The collaboration between Geniusee and Keep resulted in the successful realization of this innovative compensation and retention solution. By combining our expertise in FinTech development with Keep's unique concept, we were able to deliver a cutting-edge platform that revolutionizes the way companies distribute and manage vesting bonuses.

To learn more about this project and explore other examples of our work, we invite you to visit our portfolio at Keep case study.

Zedosh — digital advertising solution

Geniusee partnered with Zedosh to develop its digital advertising solution. We created a cross-platform mobile app that connects users with marketing agencies, delivering relevant advertising videos. Through extensive consumer analysis, Zedosh ensures users are presented with only pertinent ads. Users are rewarded for watching videos and gain exposure to suitable products and services. Zedosh is a groundbreaking digital advertising platform that empowers Gen Z financially.

Leveraging open banking, we provide insights into their spending behavior, financial and social analytics, money management tips, and the opportunity to monetize their attention through disruptive advertising. Our collaboration began in 2020, starting with an minimum viable product and resulting in a fully customized product within 18 months. We continue to work with Zedosh, enhancing the system to meet FinTech app development trends and challenges.

You can find full case study about our cooperation here.

Conclusion

Despite widespread digitalization, the FinTech industry is still open to new promising projects. And although the development of FinTech software has many features and risks, our FinTech mobile app development team of professionals will help you overcome these difficulties and bring a worthy product to the market.

FinTech App FAQ

What is a Fintech app?

A FinTech app, short for Financial Technology application, is a software application designed to provide financial services or facilitate financial transactions using technology. These apps leverage digital platforms and advanced technologies to offer services such as mobile banking, online payments, personal finance management, investment management, and peer-to-peer lending. FinTech apps typically prioritize convenience, speed, and user-friendly interfaces, enabling users to access financial services and manage their finances more efficiently. They often integrate with banking systems, payment gateways, and other financial institutions to securely process transactions and provide real-time financial information. With the rise of smartphones and digital transformation, FinTech apps have become increasingly popular, transforming the way individuals and businesses interact with financial services.

How can Fintech apps be monetized?

Fintech apps can be monetized through various strategies:

Transaction fees. Fintech apps can charge transaction fees for services such as payments, money transfers, or investment trades. These fees can be based on a percentage of the transaction amount or a flat fee per transaction.

Subscription model. Apps can offer premium features or enhanced functionality through a subscription-based model. Users pay a recurring fee to access advanced services, exclusive content or personalized financial insights.

Partnerships and referrals. You also can collaborate with financial institutions, insurance providers, or other businesses to offer their products or services to app users. The app earns a commission or referral fee for each successful transaction or customer acquisition.

Data monetization. Fintech apps collect valuable user data, such as spending habits, financial patterns, or demographic information. This data can be anonymized and aggregated to provide insights to third-party companies or market research firms for a fee.

White-label solutions. As a FinTech provider, you can offer white-label solutions to other businesses or financial institutions. They provide their technology infrastructure, features, or services under the partner's branding, earning revenue through licensing or customization fees.

How long does it take to create a Fintech app?

The development time to make a FinTech app can vary widely depending on the scope and complexity of the project. On average, it can take anywhere from 4 to 12 months to build a FinTech app, including planning, design, development, testing, and deployment phases. However, more complex projects with advanced features or integrations may require longer development timelines, ranging from 12 to 24 months or more.