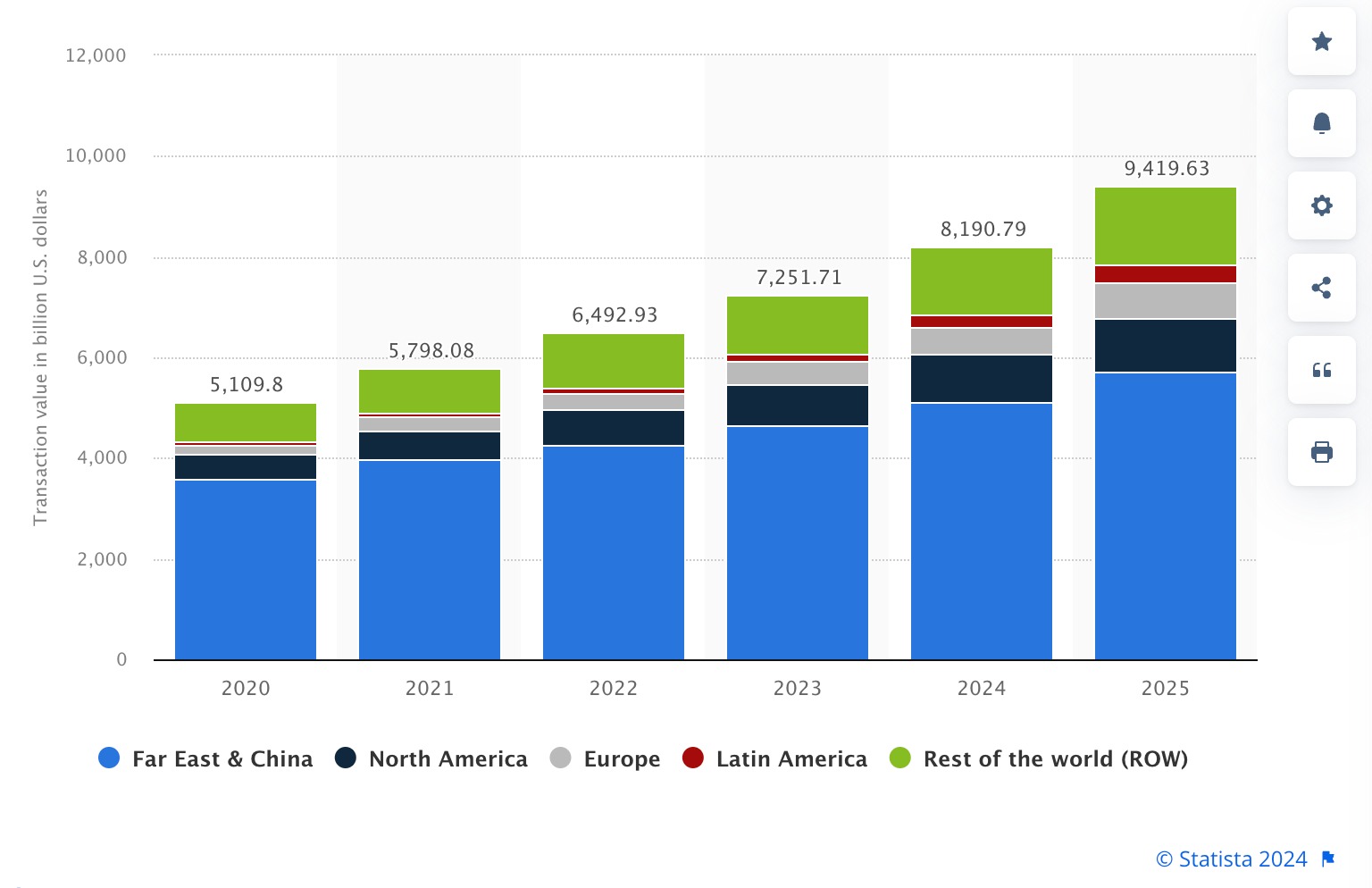

According to recent data, the global wallet mobile market is projected to double by 2025 compared to 2020. The rising demand for e-wallets plays a crucial role in the transition to a new level of the cashless society. In this article, we explore the top digital wallet apps to watch in 2025, highlighting key benefits, trends, and the evolving needs of consumers.

How does an e-wallet work?

The basic functionality of an electronic wallet usually includes the following:

non-cash payment for goods, services, fines, and other payments

transfers to other wallets, bank cards, accounts, and money transfer systems

replenishment through cards, terminals, as well as in other ways

receiving funds from external sources

linking a bank card

You can link a bank card to an electronic wallet in the payment services and/or online bank.

As for withdrawing cash from electronic wallets, only holders of plastic cards issued by the corresponding services will be able to do this without intermediate operations. If the card is virtual, then it can be “populated” in a smartphone and withdraw cash from contactless ATMs. In other cases, to withdraw cash, you will need to first transfer money from an electronic wallet to a bank card, to a bank account, or through the money transfer system.

What are the types of popular digital wallets?

Here’s a rundown of the ten main types of digital wallets, tailored to suit your needs:

1. Mobile wallets

Think of mobile wallets as your pocket-sized payment solution. Installed on your smartphone or tablet, they let you pay with a quick tap using technologies like NFC or QR codes. Apps like Apple Pay and Samsung Pay make transactions a breeze — no need to dig for cash or cards.

2. Online wallets

If you love online purchases, online wallets are your best solution. Accessible through your browser, these wallets securely store your payment information for hassle-free shopping. With options like PayPal and Skrill, you can check out in seconds, keeping your purchases quick and secure.

3. Contactless payment cards

In contrast to traditional e-wallets, contactless payment cards are all about convenience. Just tap your card at a contactless terminal, and you’re good to go. It’s an easy way to pay without fumbling with cash or entering PINs.

4. Prepaid wallets

Want to keep your spending in check? Prepaid wallets let you load money in advance. Spend what’s in your wallet, and when it’s empty, just reload. This is a great option for budgeting, so you can keep your finances on track.

5. Bank-linked wallets

Bank-linked wallets connect directly to your bank account, making transactions seamless. Whether you’re paying a bill or shopping online, the funds are deducted straight from your account, simplifying your payment process.

6. Closed wallets

If you’re loyal to certain retailers, closed wallets might be your thing. These wallets are tied to specific merchants, allowing you to earn rewards and benefits. Think of the Starbucks app, where you can earn points while enjoying your favorite coffee.

7. Open wallets

Open wallets are all about flexibility. Services like PayPal and Google Pay let you make transactions across multiple merchants and platforms, so you’re never limited. This versatility makes them incredibly popular for everyday use.

8. Cryptocurrency wallets

These wallets, whether software-based or hardware devices, help you store and manage your digital assets securely, keeping your investments safe.

9. Peer-to-Peer (P2P) wallets

Need to send money to a friend? P2P wallets like Venmo and Cash App make it easy to transfer funds directly. Whether you’re splitting a dinner bill or sending a birthday gift, these wallets facilitate quick and friendly transactions.

10. Superapp wallets

In 2025, superapp wallets are on the rise, integrating everything you need — from messaging and shopping to payments — into one convenient platform. With superapps like WeChat and Grab, you can manage your digital life effortlessly, all in one place.

What are the benefits of e-wallets?

Digital wallets transform the way consumers manage their financial transactions covering many of their preferences and requirements: convenience, security, enhanced accessibility, and integration with existing financial services. Let’s outline the main benefits that make e-wallets a preferred choice for many:

- Streamlined payments. E-wallets simplify the payment process through technologies like QR codes, NFC (Near Field Communication), and barcodes. Users can make quick transactions in-store or online with just a tap or click.

Centralized storage. Users can store multiple payment options, including credit cards, debit cards, bank accounts, and loyalty cards — all in one app, eliminating the need to carry physical cards or cash.

Enhanced security. Via encryption and tokenization, your transactions and sensitive data can be double protected, which reduces the risk of fraud and identity theft. Moreover, additional layers of security such as two-factor authentication and biometric recognition, ensure that only authorized users can access their accounts.

Seamless integration with the financial ecosystem. You can effortlessly manage all your transactions from a single point of view by integrating your digital wallet with different financial services: bank accounts, loyalty programs, etc.

Versatile functionality. You can conduct a variety of transactions such as online purchases, fund transfers, bill payments, and expense splitting. All these operations are made with just a few taps, enhancing the overall user experience.

Data security assurance. With robust security measures in place, users can transact confidently, knowing their sensitive information is protected. This fosters trust in digital wallets and encourages wider adoption among consumers.

On the topic

How to choose an online payment system?

Have you ever wondered how to choose one payment system forever, not for a year or two? Check our article to find out some useful tips.

Tell me10 best digital wallets in 2025

Let's discover the most popular digital wallets.

Apple Pay

Apple Pay is a digital payment solution designed exclusively for contactless transactions on Apple devices. Users can leverage Apple Pay to pay for a wide range of goods and services at bank terminals equipped with NFC technology, as well as at online retailers and within various applications.

For in-person payments, a mobile device — either an iPhone or Apple Watch — functions as a conventional bank card equipped with NFC capabilities. For online purchases, users access Apple Pay through the Apple Wallet application, utilizing a specialized API for seamless integration.

The Apple Pay system operates on near-field communication (NFC) technology, allowing data transmission at distances of up to 20 cm. This functionality is complemented by the Secure Element chip, which securely stores bank card information in an encrypted format. The Secure Element adheres to industry standards for digital financial transactions, running a dedicated Java application to ensure safety and efficiency.

Pros:

Convenient transactions. All operations can be conducted directly from your device, streamlining the payment process.

Expense tracking. Users can easily monitor their spending patterns, aiding in financial optimization.

High-level security. The service employs robust security measures, significantly reducing the risk of unauthorized access or intervention.

Data protection. If your device is lost or stolen, your Apple Pay information remains inaccessible to intruders, safeguarding your financial data.

Cons:

Limited to apple users. Apple Pay is only available for iPhone and other Apple device users, excluding those on different platforms.

Battery dependency. Devices require sufficient battery life for operation, which can be a limitation if your device is frequently discharged.

Compatibility issues. Users with older or refurbished models may experience performance challenges, impacting the user experience.

Terminal limitations. Not all payment terminals are equipped for contactless transactions, which may restrict usability in some locations.

Cash App

Cash App is a peer-to-peer money transfer service developed by Square Inc. that allows users to send and receive money. Cash App can help you pay bills, pay for purchases, share travel costs, or do any other money-sending tasks you want to do with other Cash App users. This digital wallet App also functions similarly to a bank account, providing users with a debit card called a “Cash Card” that allows them to make purchases using the funds in their Cash App account. The app also allows users to invest their money in stocks and buy and sell bitcoins.

Mobile payment app Cash App has reached a key milestone in the development of Bitcoin payments and has become the most popular app in the finance category on the Google Play Store in the US, surpassing PayPal in terms of downloads. Initially introduced in 2013 as Square Cash, the service has changed little since its inception.

Pros:

Bitcoin integration. Users can buy and sell Bitcoin directly from their Cash App balance, making cryptocurrency trading accessible and convenient.

Strong data protection. The app employs high-level security measures to protect user information and transactions.

Secure storage. Cash App provides encryption and offline storage for Bitcoin holdings, enhancing security for cryptocurrency assets.

Cons:

Limited transparency. Users may encounter a lack of transparency regarding other transactions made within the app, which can lead to confusion.

Instant transfer fees. If you want to access your funds instantly, there’s a 1.5% fee, which can add up over time.

No international payments. Currently, Cash App does not support international digital payments, limiting its usability for cross-border transactions.

Need custom e-wallet?

Get in touch with our tech specialists to choose the solution tailored to your specific needs.

Dwolla

Dwolla is one of the best digital wallets that attracts users due to low transaction fees, simple automation, and a high level of security. At its core, the system is an agent for both banks and individuals or entrepreneurs. Ideal for integrating bank transfers. To start using the service, you should create a personal account and then link a bank account to it. In total, this procedure will take no more than 10 minutes. Money is credited to the account within one day.

Dwolla actively cooperates with many major US banks, including Bank of America and Silicon Valley Bank, which is an indicator of reliability. The service offers three tariffs to choose from: free or trial, standard, and corporate.

Using the service will be most beneficial for residents of the United States; in other countries, it may be difficult to withdraw funds. The transaction limit is $5,000 for the standard and $10,000 for the corporate plans. The system only supports ACH payments, so it is not possible to make SEPA and SWIFT transfers. Dwolla does not plan to issue corporate or individual bank cards.

Pros:

Developer-friendly features. Dwolla provides advanced functionalities tailored for developers, making it a versatile option for integrating payment solutions.

Excellent customer support. Users benefit from first-class technical support to assist with any issues or questions.

Rapid payment processing. The platform enables fast payment processing, ensuring timely transactions.

Virtual wallet capabilities. Users can send, store, and receive funds through a virtual wallet, enhancing flexibility.

Cons:

Pricing structure. The cost of the tariff plans may be relatively high for some users, particularly for smaller businesses or individuals.

No credit card transactions. Dwolla does not support credit card transactions, which may limit payment options for some users.

Limited features for general users. The platform’s advanced features are primarily geared toward developers and businesses, leaving ordinary users with fewer options.

Related post

Cryptocurrency app development: most useful tips

Cryptocurrency and blockchain are for a long time an inevitable part of our life. But do you know everything about them?

Find out more!Google Pay

Google Pay / Android Pay is basically a mobile application for the Android operating system. The digital wallet stores credit and debit cards in one place. All user data is safe. Adding a card to the system takes only a few minutes: it will be enough to download the application to the device and select the desired card in the "Cards" tab.

Google Pay accounts work anywhere where it is possible to pay using a contactless payment terminal. Thus, residents of almost all countries can easily use the system. For each payment, Google Pay receives a small fee, but the merchant always pays it.

The company issues its own Google Wallet Card debit cards. Their owners can withdraw cash from ATMs and pay for purchases in stores. A plastic Google Wallet card is linked to the Google Pay system, and no commission is charged for maintenance and issues. The card cannot be used outside the US. The service supports all possible currencies. Google Pay is not suitable for international SWIFT payments or SEPA transfers.

Pros:

Robust security. Google Pay employs advanced measures to keep your personal data safe.

Multiple card support. Easily link several credit and debit cards for convenient transactions.

Wide compatibility. The app works with a variety of Android devices, making it accessible to many users.

Quick transactions. Enjoy fast payment processing for a seamless experience.

Cons:

Android exclusive. Google Pay is only available on Android devices, limiting access for iOS users.

Variable terminal availability. Not all locations have contactless payment terminals, which can impact usability.

ATM restrictions. Some ATMs may not accept Google Pay transactions, complicating cash withdrawals.

Device reliance. Accessing the app requires a smartphone, which may not suit everyone.

PayPal

We recommend getting a PayPal wallet if you often make purchases in foreign online stores. Almost all countries recognize it so that you can use the funds stored in your account anywhere in the world.

PayPal is an electronic wallet that allows you to make digital wallet payments. PayPal started in 1998. Until 2015, it was part of eBay, an American auction, and only from July 18, 2015, PayPal became a separate independent company.

You can use PayPal by adding your payment cards, but not only. You also have the ability to link a bank account to it and fund your PayPal account with funds directly from this account. The service also provides the ability to send money to friends. Another advantage of a PayPal account is the ease of registration, which does not even require a bank account.

Pros:

Quick registration. Sign up easily and start using your account without hassle.

Broad platform integration. PayPal partners with well-known trading platforms, enhancing your shopping options.

High security. PayPal employs robust security measures to protect user data and transactions.

Cons:

Relatively low transaction speed. Some users may experience slower transaction processing compared to other digital wallets.

Samsung wallet

Samsung is merging its two software services, Samsung Pay and Samsung Pass, into a single digital platform called Samsung Wallet. This will allow Galaxy device owners to securely and easily manage their digital keys, boarding passes, ID cards, loyalty cards, and more in one mobile app. The idea is that it "keeps everything your digital life needs" in a convenient location without sacrificing security.

This last point is obviously the key issue when you throw all your digital eggs in one basket. However, Samsung promises ‘‘defense-grade security through Samsung Knox, the company’s security and management system preinstalled on most Galaxy devices.

Pros:

Immediate activation. Get started quickly with easy setup and activation.

Fast and secure online payments. Enjoy swift transactions while keeping your financial data protected.

Rewarding application. Benefit from loyalty and rewards programs integrated within the app.

Cons:

Samsung device exclusive. Samsung wallet is only compatible with Samsung devices, limiting accessibility for users of other brands.

Limited funding options. Users cannot charge their wallet via ATMs, paychecks, or at certain retail locations, which may restrict usability.

Venmo

Venmo is part of the larger PayPal family of brands and is owned by PayPal. You can send and receive money instantly with this mobile payment app. The company advertises its service as ‘‘safe, easy, and communicative’’ when it comes to sending money. Venmo can also be used to make in-person or online purchases. It currently has a user base of 65 million people.

Venmo is a consumer-friendly digital wallet app with a social focus. It is intended to be a fast and free method for completing these transactions, whether you need to pay a friend's restaurant bill or split the rent with your roommate. Venmo is also used by some small businesses to accept digital & mobile payments.

Pros:

User-friendly transactions. Easily transfer and receive money, as well as shop online with minimal hassle.

Minimal fees. Commissions are rarely charged for standard transactions, making it cost-effective for users.

Interactive social features. Engage with friends through the app’s social feed, adding a fun element to transactions.

Debit and credit card options. Users can link debit and credit cards for added flexibility in funding their transactions.

Cons:

U.S. only availability. Venmo is currently limited to users in the United States, restricting its global reach.

Instant transfer fees. A 1.5% fee is charged for instant transfers, which can add up for frequent users.

Privacy concerns. Transactions may be visible to other app users, making it essential to navigate privacy settings carefully.

Thank you for Subscription!

Zelle

Zelle is an online platform for quickly sending and receiving money between US bank accounts.

Zelle was designed by banks and made to be secure. This wallet is a secure payment method because it uses encryption to protect your payment information. Additionally, it also has a policy that you can get your money back "if a scammer or hacker gains unauthorized access to a bank account" and that "victims can work directly with their bank for a refund."

Pros:

Free application. Zelle does not charge users for sending or receiving money, making it a cost-effective option.

Easy and fast to use. The platform offers a straightforward interface that allows for quick transactions.

High fund protection. Funds you send or receive are protected up to $250,000 per account, providing a safety net for users.

Cons:

Limited fraud protection. Zelle does not protect approved payments from fraud, which means users are responsible for verifying recipients before sending money.

Mistaken transactions. If you accidentally send money to the wrong person, recovering those funds can be challenging, as Zelle does not offer a reversal option.

Walmart Pay

Walmart Pay uses QR codes generated by its app so that any smartphone user can pay without using a new generation mobile phone with an NFC chip or their regular credit or debit card.

Walmart's new payment system, in addition to being compatible with all smartphones on the market, allows us to use any type of credit or debit card, as well as the company's prepaid and gift cards. The user just needs to install the application on their device and it is convenient to buy. When a user is about to make a payment, they just need to open the app on their mobile phone, select Walmart Pay, and scan the QR code shown by the establishment's checkout. All you need is a simple mobile phone with a camera, no NFC chips, or anything more technologically advanced.

Pros:

Compatibility with iOS and Android devices. Walmart Pay works seamlessly across all smartphone platforms, ensuring accessibility for a wide range of users.

Digital receipt storage. The app conveniently stores receipts, reducing paper waste and helping users keep track of their purchases.

Multiple layers of security. Walmart Pay employs various security measures to protect user information and transactions.

Comprehensive payment options. Users can store their credit, debit, and Walmart gift card information in one place for easy access.

Cons:

U.S. only availability. Walmart Pay is currently limited to users in the United States, restricting its use internationally.

In-store use only. The service is designed for payments made exclusively at Walmart stores, which limits its versatility for online or third-party transactions.

Amazon Pay

Amazon Pay makes it possible for partner companies to embed a button on their websites through which customers can pay for purchases and services. For stores, this service will be paid: 2.9% of the transaction amount + $0.3. For international transactions, the commission will be 3.9% + $0.3. To pay for the order, it will be enough to use the profile on amazon.com. The service guarantees complete data security.

Users of European countries can make SEPA payments — the service supports such a payment system. The same applies to SWIFT payments, which are available worldwide. Amazon issues credit cards for regular customers. The user does not need to pay a monthly commission for the use. You can get a card within a week after applying. The system allows you to make payments in the national currency, with further conversion into US dollars at the average rate.

Pros:

Low transaction fees. Competitive rates make Amazon Pay an attractive option for both merchants and customers.

Enhanced security. The service employs strong security measures to protect user information and transaction data.

Simple registration process. Getting started with Amazon Pay takes only a few minutes, making it user-friendly.

No monthly service fee. Users can enjoy the benefits of Amazon Pay without ongoing charges.

Cons:

Integration time. Implementing the service on a store's website may take some time, which can delay its availability.

No free trial. Merchants do not have the option for a free trial to test the service before committing.

Slow customer support. The customer support team may take longer than expected to process user requests, leading to potential frustration.

Neobank for Gen Z

Gamification as a new trend: modes, game-based card skins, and a built-in shop with branded merchandise. Check out how we transformed user journey for Gen Z.

Yes, I'm interested!How changing consumer behaviors reshape demands

Consumer preferences are evolving rapidly, with a notable shift towards digital payments. In 2025, we expect:

Increased need for personalization. Users will seek tailored financial solutions, pushing digital wallets to offer personalized recommendations and features. Through AI and ML algorithms, users will receive customized experiences and advanced predictive financial insights. Meanwhile, their fears about security will be dispelled thanks to fraud detection systems.

Integration with cryptocurrencies. With the growing interest in decentralized finance (DeFi), digital wallets are likely to support crypto transactions, allowing users to manage both fiat and digital currencies seamlessly. This will lead to collaboration between conventional finance institutions with crypto companies, allowing for a greater pool of payment options and investment opportunities.

Rise of superaaps. Consumers’ digital interactions go far beyond payments — they seek solutions for convenient management of multiple services from a single platform. Besides payment processing, you can message, process operations in online stores, and even optimize your financial management.

For example, the Grab app (Southeast Asia) enables users to pay for rides, order food, and shop online, all while earning rewards and cashback. This makes it a versatile financial tool for managing everyday expenses.

There are even more options to consider: our fintech software development services are tailored for progressive businesses seeking custom mobile apps, digital banking solutions, or other types of portals supported by predictive analytics.

Wrap-up

As we gear up for 2025, digital wallets are transforming the way we manage our finances, making transactions smoother and helping us embrace a cashless future.

We’re witnessing exciting digital banking trends like growing demand for personalized financial solutions, seamless integration with cryptocurrencies, and the rise of superapps that consolidate multiple services into one convenient platform. Whether it's Apple Pay, Google Pay, Cash App, or Amazon Pay, these wallets not only simplify payments and money transfers but also enhance security and streamline access to financial services.

As consumer preferences evolve, it’s essential for businesses to stay ahead by offering flexible, secure, and user-friendly payment options.

If you need a customized solution for your business and to transform your payment experience, contact our e-wallet app development specialists.