The business landscape of the banking industry has evolved into an increasingly competitive market, with institutions vying for market share for several reasons, including the digital-first experience banks provide to their customers.

Building customer loyalty in banking sectors and enhancing the overall banking experience for traditional banks or credit unions requires you to handle touchpoints customers have with your institution. Your bank should focus on digital transformation, including improvements in technological innovations, customer experience (CX), customer personalization, and more.

Bain has published an annual report on customer loyalty in the banking industry for a decade. In its 2023 report, the company shows the importance of personalization and how it boosts customer experiences.

Every customer expects easy banking. It’s no secret that traditional banks are becoming obsolete. Similarly, there are various solutions to build customer loyalty, such as:

Creating a positive customer experience

Focusing on providing a personalized customer experience

Reward and loyalty programs offering tangible rewards and customer benefits

Smooth and seamless banking system

Quickly notifying customers regarding any account activity

Secure and authorized banking system

There are many ways to achieve and increase loyalty. One is how fast bank technology can improve the customer experience. Let’s explore how to build customer loyalty in the banking sector.

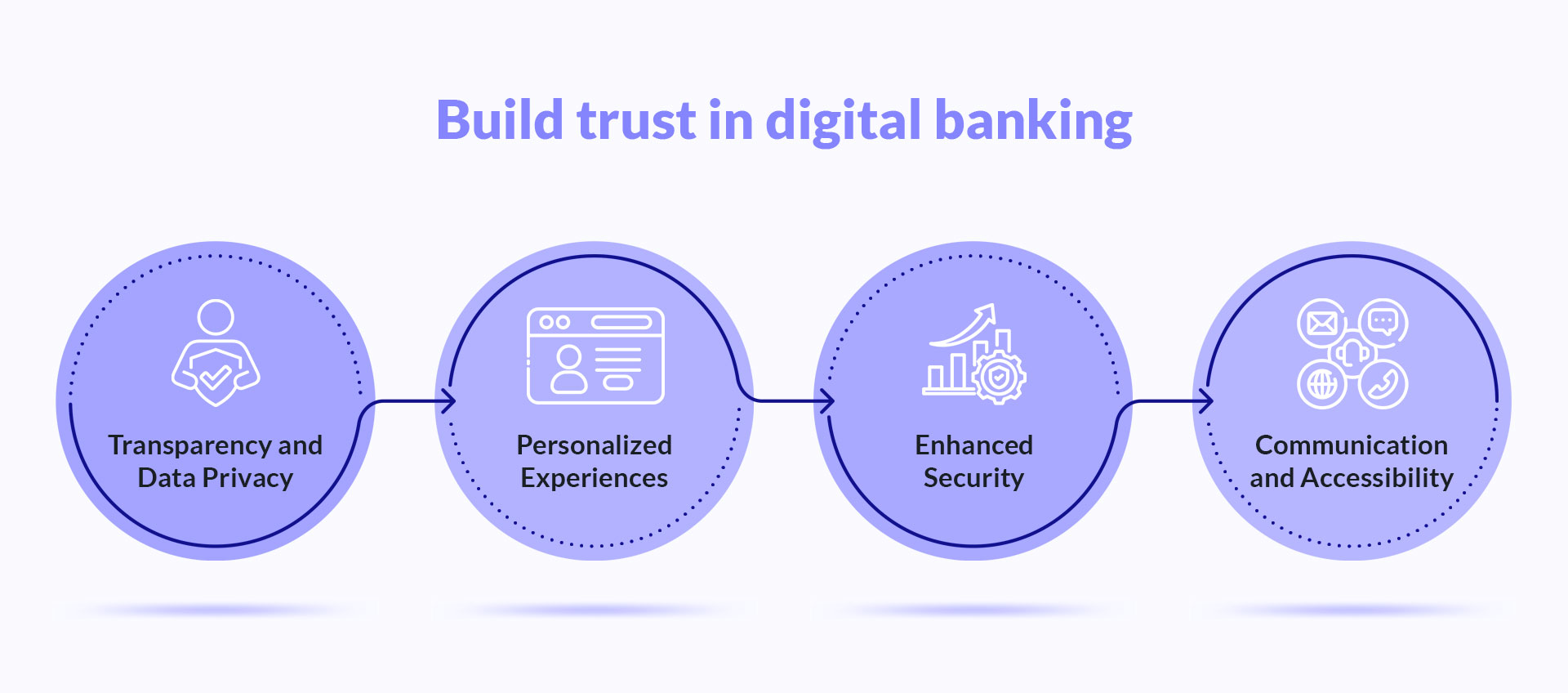

How Technology Can Build Trust in Digital Banking

Money is more than just a physical form of “cash.” It is now digital and lives in online transactions. The bank holds the transaction authority and statement. As you rely on digitalization, customer loyalty should continually increase.

Bank customers are becoming more comfortable with mobile banking apps and internet banking tools. According to Forrester, in 2022, almost 51% of UK adults with internet access researched taking out a loan on a smartphone. A notable increase from the 34% recorded in 2021. Notably, 34% of applicants completed the loan application process using their smartphones, with an additional 14% opting for the mobile app route.

Financial institutions and direct banks leverage these digital experiences to meet evolving customer needs. Many banks and credit unions are improving their financial products and services to enhance banking experiences and foster brand loyalty among new customers. As digital interactions increase, the banking industry must adapt to provide seamless experiences and personalized services to banking customers.

Learn how technology can help your financial institution build trust and banking customer loyalty.

Transparency and Data Privacy

Technology is important for building trust and customer loyalty for digital banking. For instance, the smoother your bank mobile application is, the happier your existing and new customers will be.

Your customers do not tend to trust banking or financial apps, as numerous data breaches and unauthorized activities have occurred, which falls short of customer expectations. Building trust in the banking industry means making stronger financial services that keenly focus on cybersecurity.

The features must be used securely by the customers and users. They must trust the transactions. Banks should focus on features like KYC, transaction monitoring, and risk screening. Safe banking helps a lot. It makes a better customer experience and grows the digital channels ecosystem.

Personalized Experiences

Customers' expectations have risen, considering the financial services banks provide. Digital services and personalized banking experiences for customers have increased. They also consider using AI, the cloud, and machine learning for large-scale data curation. So, to build trust with customers and create positive customer experiences, your bank must plan how to use the customer data it stores to meet customer expectations and needs.

Customers seek recommendations when they get stuck or do not understand services or features. If you provide timely, personalized solutions, it will enhance trust, which will eventually build stronger long-term customer relationships and customer loyalty.

Enhanced Security

You must also employ cybersecurity measures, which are important while building customer trust and driving customer loyalty. Protect customer accounts in ways, such as Multi-Factor Authentication (MFA), that add assurance to the security. Your customers must verify their identity using multiple methods. These can include two-way passwords, fingerprints/face IDs, and one-time codes for logging in.

Also, ensure you regularly do security audits to ensure protocol implementation, as they should be updated.

More from our blog

Banking virtual assistants for improving banking experience

Change service process with the introduction of the banking virtual assistant and AI technologies.

Read moreCommunication and Accessibility

Your customers expect clear communication from your bank, including information on schemes, transactions, and quick customer support. Accessible banking operations means addressing concerns immediately, so it is important to know what proactive customer support includes:

Anticipating customer requirements and enhancing the customer experience to make customer retention easier.

Solving the customer query before a problem arises.

Provide easy-to-use banking channels. These include mobile banking apps, online portals, and 24/7 customer service. They ensure customers’ financial services management.

Your bank will create a trustworthy environment by prioritizing customers, leading to more satisfied customers.

Examples of Technology-Driven Trust-Building Initiatives

Technology-driven banking systems increase customer trust and improve customer experiences. They make banking more reliable and accessible.

Example 1

One of the greatest examples of this is Barclays’ open banking system. Open banking allows customers to share banking data with third parties to get help with finances in more efficient ways. Barclays embraces open banking to innovate and improve the digital banking experience and customer service. It stands by this goal by introducing many industry-first features for customers.

It believes in keeping customer trust a major priority. It stresses the security of APIs and aims to be transparent with customers about data usage and the customer experience.

Barclays’ benefits and prospects:

It allows customers to manage multiple accounts in one place.

Barclays sees ongoing opportunities to improve customer finance through open banking.

Barclays’ innovation and customer-centric approach:

Commitment to innovation: Continuous innovation with open banking.

Regulatory dialogue: Ongoing dialogue with regulators to make open banking more accessible.

Customer benefits: Focus on making open banking more beneficial for customers.

Example 2

HSBC uses AI for its fraud detection capabilities and partners with AI tech startups. The goal is to improve efficiency in finding fraud. HSBC’s AI-powered system handles multiple things at once, including:

Fraud detection identifies complex fraud patterns. It reduces false positives by analyzing large volumes of data, including geolocation tagging, IP addresses, and contact numbers to gain customer loyalty for banks.

AI reduces false alerts in AML transactions and sanction screening. It uses data to detect complex crimes over various products and business lines.

AI helps know customers well. It assesses the risks of doing business with certain parties. These parties handle unstructured data and navigate negative information.

AI helps detect insider trading and corruption by analyzing many sources, including emails, phone calls, and expense reports.

Example 3

Citibank's financial wellness tools use AI and data analytics. They provide personalized financial guidance and help with budgeting. It offers customized advice that helps customers solve their problems quickly and beforehand. It is tailored to their financial needs and recommendations. Citibank aims to build trust and guide customers through their financial journey, helping them manage finances and achieve goals.

Example 4

Capital One’s customer engagement platform uses AI chatbots. They can reach customers 24/7, almost instantly. It provides instant, personalized messages to customers who interact and is available continuously, which helps customers globally and builds trust and satisfaction.

Thank you for Subscription!

Overcoming Challenges and Building a Culture of Trust

Overcoming challenges and building loyal customers should be a top priority, and maintaining data privacy is the only way. It is important to keep customers’ information and data safe and comply with the rules.

There should be regular privacy and security audits that ensure protocols align and find threats before they occur. When you safeguard your customers’ data, you forge a culture of trust and drive customer loyalty to your financial institution.

Additionally, your customers should know their invested banking schemes. You can teach about the technology your banks provide for interactions, financial products, and other operations so customers can understand them. An educated customer will feel more secure and likely to trust your banking organization more.

Once a customer becomes your loyal customer, the next focus should be customer retention strategies and nurturing relationships with customers.

Customer retention can only happen when your bank fosters customers by fulfilling their needs, as in the business strategy. Therefore, it’s important to train employees in customer retention strategies that encourage customer satisfaction. For instance, employees should always seek customer feedback timely, which will help build trust and boost loyalty. Customer feedback will also help curate further changes and identify what customers demand and expect from your banking system.

It is not easy for financial institutions to overcome these challenges. If your organization wants to leverage technology to become more customer-centric and improve customer experiences, we can help. Geniusee can help you build custom software and new-age mobile apps and improve the user experience for your customers. We also have extensive experience developing mobile banking apps specifically for fintech companies.

Conclusion

Building loyal customers involves using technology, even for traditional banks. Technology-driven bank operations help customers leverage the easy transaction process and avoid going to banks for small tasks.

Having a robust banking mobile application is not enough to build a loyal customer base. It should be highly secure so a new customer can trust their financial records with you. Keeping customer’s data private and focusing on their needs helps to retain customers and boost engagement.

Earlier, we addressed how AI tech has revolutionized banking sectors. Using AI in the banking industry, such as instantly responding to customers, personalization, data-driven information, and more, helps banking customers take their information on the go. So, leverage technology to enhance the customer journey and provide better customer experiences.

As the banking landscape continues to evolve, it's crucial to stay ahead of the curve. For more insights on how banking as a service disrupts traditional banks’ value chains, check out our in-depth analysis.