The Banking as a Service (BaaS) business model offers many advantages to incumbent banks and other financial institutions striving to make their operations more transparent, cost-efficient, and user-friendly.

Those institutions that have yet to explore emerging business models need to investigate what it will cost, what products to offer, and which partners to choose. Besides, they need to work out a thorough strategy on how to tune their legacy operations in the BaaS space.

But what is BaaS exactly? Is this model worth implementing and investing in? What are its advantages and pitfalls? This article will answer all of these questions and provide some use cases.

In this article:

What Is Banking as a Service (BaaS)?

BaaS is an end-to-end business model that allows existing banks (both digital and traditional) and non banking businesses that use embedded finance to connect directly to a bank’s system using application programming interfaces (API) and integrate payment processing into their products and offerings.

For instance, some banking services may include monetary accounts, mobile bank accounts, access to credit and loans, payment services, bills, embedded finance, and other customer-tailored financial products. This way, while not owning a banking license, these institutions become a one-stop destination where clients can manage all financial aspects of their business.

How Does Banking as a Service Work?

How the Banking as a Service model actually works can be easily explained by an exemplary hotel chain. This chain is an organization that does not own a banking license yet, with the help of BaaS platforms, can provide access to a complete suite of payment services and offerings to travelers.

Let’s illustrate this further.

The hotel chain issues plastic debit cards for its return customers. Such a card can be funded with loyalty points after each stay. Travelers can accumulate points and make card transactions in the hotels' bars or gift shops. They can even get an online loan for staying at the property.

The hotel chain's website becomes a one-stop shop where travelers book, manage, and pay for their accommodations without a personal bank account. This gives smoother customer interaction to travelers while equipping the business with analytical insights to offer even more personalized banking services.

Need a trustworthy tech partner?

Banking software development is a complicated field, so you need an experienced outsourcer to have your back.

Fundamentals of the BaaS Value Chain

With its numerous advantages and opportunities for businesses in many industries, Banking as a Service is reconfiguring the traditional value chain, enabling new banking products, opportunities, and propositions never imagined.

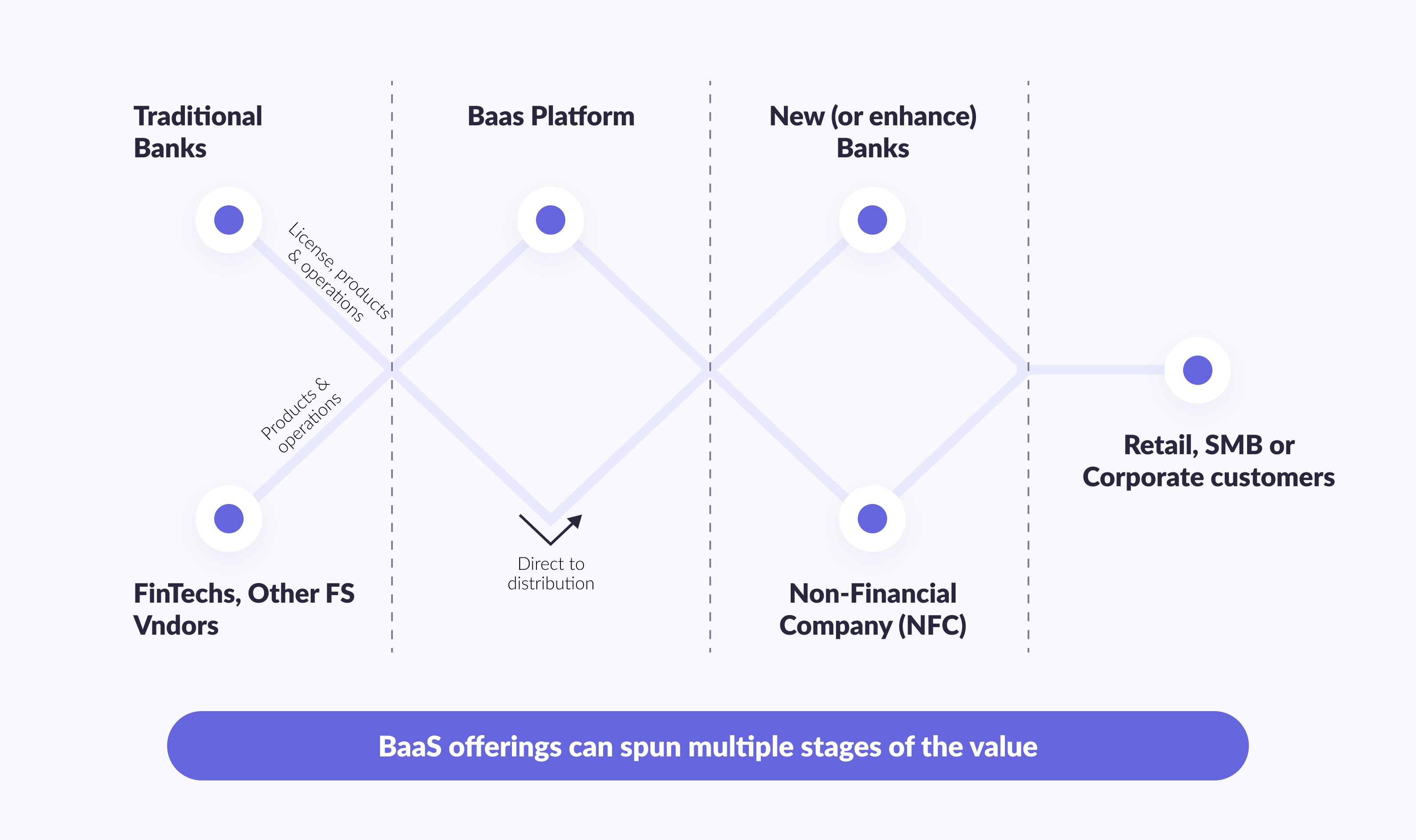

According to a recent Deloitte white paper, there are four fundamental pieces to the BaaS value chain:

- BaaS platforms provide core services that used to be offered solely by banking institutions to non-financial businesses. These include banking products, like a bank account, and operations stacks that can now be adopted by almost any company via open banking API.

- With the help of BaaS software, services can be aggregated in a single banking platform.

- The financial and banking services and offerings, which used to be offered solely by traditional banks, can be effectively distributed through many customer channels through BaaS platforms.

- With the help of BaaS tools, tech-savvy banking, and financial institutions, as well as companies not directly related to financial activities, can modernize the customer experience with embedded finance and other features.

Source: Deloitte

Thanks to the combination of multiple factors, Banking as a Service is actively gaining popularity across the globe. Some of these factors include:

Changing Customer Needs

Customers are getting used to convenient mobile applications where they can easily open a bank account and manage a complete suite of finance-related activities. They hate to switch between apps to execute this or that action. BaaS projects make a software application a one-stop shop for their operations, which provides a user-friendly experience to the customers and quiuck access to account information.

Widespread Use of APIs

Open banking APIs provided by traditional banks allow almost any third-party agents to connect to their solutions and interact with them. This ensures that almost any company—not even financial services market-related—can implement digital banking offerings into its software solution. An example is embedded finance on e-commerce websites.

Rising Popularity of Cloud Technologies

More and more companies adopt cloud technologies, looking for scalability, resiliency, and flexibility. Besides, if an application is hosted in a cloud, it can be securely accessed by trusted third-party distributors who embed financial services and offerings into their solutions.

TOP 10 Digital Banking Trends For 2023

Find out what are main trends in banking to make the right business decisions.

Fintech Industry Evolution

Even conservative industry such as banking and financial services is being disrupted by modern technologies. To comply with digital transformation and customer demand, traditional banks invest in technological excellence and become tech-savvy. This way, they let their partners benefit from BaaS services, like embedded finance, and ultimately improve the experience for end clients.

Complexity of the Banking Regulatory Base

The banking domain is regulated by various compliance and regulatory requirements— obtaining a banking license has never been easy. For a long time, the combination of these factors prevented new players from entering the market.

The BaaS model changed the rules of the game and paved the way for many fintech startups and other companies to become close to banks in terms of the services offered.

The process of using Banking as a Service by third-party companies can be schematically presented like this:

Source: Fortybites

BaaS Configurations

Most of the successful BaaS use cases align to one of the following configurations:

- BaaS providers offer banking software solutions, license, products, operations, and/or technology for aggregators, other banks, and non-financial companies (NFCs).

- Providers-aggregators act almost exactly like providers, but they also complete their capabilities with those of other vendors. As a result, the end customers can enjoy the benefits of a complete “out-of-the-box” solution.

- Distributors leverage insights about consumer behavior and end-customer relationships to present a unique suite of banking services.

- Distributor-aggregators complement the propositions they distribute with brand-new products or technology from multiple providers.

At times, choosing a Banking as a Service (BaaS) provider can be daunting because there are already many different vendors in the market. They present different offerings, so it is easy to get lost in the variety of features and benefits they offer.

So, how do you know which provider is right for your business? Let's look at the main criteria.

Things to Look for in a BaaS Provider

To implement banking software solutions into your existing business model, embed the BaaS tools into your existing banking infrastructure, or develop a white-label banking solution, you will likely need a reliable technological partner.

What are the key things to look for in BaaS providers? When choosing a partner to work with, do extensive research about their services, pricing, and already completed projects. Try to find out the following:

- What projects has the vendor completed in the past? Look for the functionality and services the company offers to its clients and explore the portfolio.

- How will the services you are interested in be priced? A complete financial analysis of the potential expenses will provide an estimate of the potential costs as well as compare the pricing with that offered by competing firms.

- What are the partner's stakes in security, privacy guarantee, and data requirements? Any digital solution accumulates a lot of data. Considering what security solutions the provider can offer is crucial.

Thank you for Subscription!

Top BaaS Platform Providers

Though BaaS is a relatively new concept, numerous companies have already successfully adopted this model. Here are some of the institutions offering embedded finance and other services in this sphere:

- Bancorp Bank. It’s a branchless bank that rocks digital financial products and services, offering services such as fintech solutions, institutional banking, commercial lending, and real estate bridge lending, among others.

- Fidor Bank. It’s a German fintech company that manages a custom operating system and a cloud-based modular system. Among the services these banks offer are digital asset exchanges and brokers, institutional digital asset traders, and crypto marketplaces.

- Solarisbank. The company built its custom platform from scratch to ease its integration with the partner network and shorten its time to market. It maintains simple open banking API documentation on how to integrate its services into the partner's infrastructure.

It’s not only about banks but also about technological companies such as Galileo or Marqeta. Despite Galileo and Marqeta's longstanding position in the banking-as-a-service sector, a number of startups are hot on their heels. In their view, startups offer more targeted, unique services than incumbents because they are built on newer technology.

- Galileo technology company. The Galileo platform offers a wide range of financial services across North America and South America on an open and connected basis. In addition to North America's leading fintech, such as Chime, KOHO, Robinhood, SoFi, Varo, and many more, Galileo lets international powerhouses operate in the U.S., including Monzo, Paysafe, Revolut, and TransferWise.

- Marqeta. Marqeta offers a platform that enables its customers to build products using the services of its bank partners. Marqeta, a fintech company focused on payments services, is launching a suite of new banking products, including BNPL solutions, lending, expenses management, crypto cards, and more. In addition to Coinbase, Uber, and DoorDash, it has been trying to deepen its relationships with its customers.

On the topic

Everything you need to know in one guide by top Geniusee experts

Zytara Neobank - What We've Learned

We developed a gamified neobank to educate Gen Z financially. We not only developed a blockchain-based banking app for parents to oversee kids' spending and savings but also added fun and joy to the financial world. There are now modes, game-based card skins, and a built-in shop with branded merchandise (e-sports teams, games, musicians, etc.). This was a thrilling project for Geniusee because it provided opportunities to manage digital assets and complete the NFT lifecycle.

This project required cooperation with different service providers as I2C and Plaid. Let us share with you some lessons we’ve learned.

Insights based on work with I2C:

We used IaC to ensure protected connection and security checks based on APIs.

- incomplete documentation that describes functionality of I2C;

- some services worked incorrectly;

- non-tested corner cases that didn’t work correctly;

- complicated communication with I2C team referring fix of APIs functionality which became a bottle neck as problem solving led to non-productiove work and took 2-3 months;

- tailoring a secure connection to communicate with I2C system inside of our infrastructure to provide a protected information exchange;

- building APIs in way that ensures display and collection of only the most necessary information from I2C that we work with so hackers wouldn’t see what’s inside the system and it would be hard for them to disrupt it. For example, I2C has banking card IDs for transactions, and if a client needs to transfer money the system puts down both IDs, yet the client does not see them because all this information is kept inside of I2C data storage and our protected communication channel. In this way, only necessary information is shown “outside” for the client to use the system. It also allows to avoid bureaucracy and additional certification and examination as I2C owes all needed allowances for these actions, and they are conducted on its side.

Insights based on work with Plaid:

We used Plaid to ensure integration with already existing banking accounts with accounts and cards from other banks via our system.

- documentation refers to real situations;

- the main and the most complicated challenge was to create a secure part of system functionality that uses only the mobile platform (operations that do not influence security) and partly goes via our backend (operations that influence security). We used SDK (software development kit as a library of different services for multiple platforms) to ensure this segmentation;

- as we created a neobank for children, US law allowed us to collect a bare minimum of data from teens and no data at all from kids below the age level, so do we need to ask parents to provide their financial information and tied their banking accounts with kids’ accounts in Zytara using Plaid APIs.

Case

Zytara Neobank and gamification to financially educate GenZ.

A digital platform built to merge traditional banking systems with new-age digital assets such as cryptocurrencies and NFTs.

Look closerFinal Thoughts

Banking as a Service (BaaS) has completely reconfigured the banking value chain by allowing third-party distributors to add banking services, such as embedded finance, into their platforms and applications.

Traditional and digital banks that now offer BaaS solutions are already obtaining a larger client base and increasing their revenue by teaming up with fintech companies as well as non banks.

If you’re considering adopting the BaaS model and partnering with a reputable technology provider, check out Geniusee’s portfolio for examples of new services implementation.