Major changes in financial technology due to the pandemic

1. Only card, only online

Fear of the Covid-19 pandemic has changed habits. More and more people have begun to abandon cash in favor of card payments, considering banknotes as a potential source of infection. Contactless payments are the most "hygienic" payment method today.

Quarantine and social isolation meant going online, which means that online commerce has started to grow at a tremendous pace. People began to avoid going to crowded places at all costs, so businesses went online as much as possible.

The pandemic has raised the borders between countries; tourism, on its usual scale, has been paused; therefore, the use of payment cards abroad has sharply decreased. Visa and Mastercard payment systems have already informed investors that their sales do not meet their expectations. Not surprisingly, payment system stocks have since plunged more than 30%. But maybe this is not the limit – Wedbush analysts say the two giants face an additional fall of 20% or more.

Both banks and fintech solutions software development companies have felt the market pressure. The massive decline in consumption and trade has affected everyone who makes money from commissions on debit card transactions. But FinTech has found itself in a slightly more advantageous position than traditional banks; most of the FinTech companies’ similar services during Covid-19 are provided remotely, and the corresponding applications are developed taking into account the convenience of the client.

2. Investment in quarantine

The coronavirus has turned the stock markets into a minefield – traders are afraid to make unnecessary moves, thinking in horror about the recession. Only daredevils can afford to make investments today. The global economy is suffering from this, and global trading platforms, such as Robinhood and eToro, have ceased to be profitable. To smooth over this moment, the US Federal Reserve made the largest cut in the federal funds rate in more than a decade. Unfortunately, the most famous commission-free trading FinTechs will not be able to reduce prices for services – most likely they will offer to invest in shares of companies that will surpass the global crisis.

3. The rise of banking applications

Oddly enough, the Covid-19 pandemic has become the engine of progress. It is already noticeable how quickly everyone is moving online and how they are trying to make their services more flexible, convenient, and rich in terms of functions. McKinsey prepared a report on "How COVID-19 has pushed companies over the technology tipping point — and transformed business forever" with detailed numbers. Innovations in mobile applications for banks and banking services are already happening, and in leaps and bounds. Competition for new technological offerings is intensifying, ranging from artificial intelligence, new services through the Open API, and creating new options for customers. The Organisation for Economic Co-operation and Development (OECD) has published a "Digital Disruption in Banking and its Impact on Competition" study, which shows the real situation between the financial and technical sectors.

You might also be interested in the following articles:

4. What about Chinese FinTech?

Investment in Chinese financial technology had declined from $1.8 billion to $298 million in 2019 (Business Insider, 2020). The Covid-19 epidemic has not made the picture any brighter, and 2021 will not be the best year for Chinese FinTech in terms of investment. Therefore, companies have begun to look for a more sustainable business model for themselves. All this affects not only China but the entire FinTech world.

Everyone has had to become socially responsible. FinTech giants such as Tencent, Baidu and Ant Financial are actively supporting local hospitals, trading companies, and scientists, thereby strengthening their country's economy. MYbank, a project of Ant Financial, helps companies in China's Hubei province by offering a one-year loan at 0% for the first three months and a 20% discount for the remaining nine (MSN, 2021). WeChat is willing to give $143.5 a day to small businesses for 30 days (Fintechnews, 2021).

The Chinese government claims that everything in the country will return to normal by the end of 2021. Already, almost 65% of residents have returned to their cities and are restoring their former lives (Forbes, 2021). In a little while, Chinese FinTech will come to life again.

5. Venture capital investments only for the best

The coronavirus has also hit venture capital investments. Most investors are looking for the safest projects to invest in, and tech venture funding has dropped significantly. True, Northzone partner Paul Morphy says that although investors have become very cautious, the really good companies will not be affected. Therefore, it makes no sense to go for investments with old ideas – venture capitalists have become more picky. You can find out about what changes have occurred in startup investing in the article, the IMPACT OF CORONAVIRUS ON STARTUP FUNDING AND ECOSYSTEM.

6. Government and regulator support

To save the economy, governments and regulators have offered a variety of measures to support the segment. For example, South Korea has temporarily proposed more flexible rules for FinTech startups. The Korean government offers special incentive schemes, mainly in the form of tax incentives for FinTech businesses, including small/medium-sized businesses. Notably, small/medium-sized businesses established in certain areas of Korea that are not located in highly populated cities can receive 50% corporate income tax relief for up to five years. Also, companies identified as “venture businesses” by the Korean government, which could include many FinTech companies, may receive 50% corporate tax relief even if they are located in highly populated cities. For certain R&D costs (including labour and material costs), an R&D tax deduction may be available as well.

In the United States, as part of the Senate’s US$2 trillion stimulus package, the Coronavirus Aid, Relief, and Economic Security Act (the CARES Act), approximately US$350 billion was initially allocated for small business loans of up to US$10 million each, to cover certain expenses for up to eight weeks. Known as the Paycheck Protection Program (PPP), this program is administered by the Small Business Administration (SBA) and involves individual banks and other financial institutions extending the credit, which is backed by an SBA guarantee.

Most European banks have offered loan deferrals for FinTech companies. Firstly, any FinTech that holds a banking license or is an insurer will be generally excluded from all the government debt financing measures. Secondly, those FinTechs that are regulated entities (for example as e-money institutions), other than banks and insurers, are also clearly excluded from the Corporate Financing Facility (under which the government purchases commercial paper issued by investment grade, non-financial corporates), which broadly excludes any regulated entity or entity in a regulated group.

We hope that these measures will be able to support FinTech during this difficult time.

Statistics about the impact of Covid-19 on the FinTech sector

In the last five years of pre-modern life, the financial technology industry has had a compound annual growth rate (CAGR) of almost 25%, making it one of the fastest growing in the world. The latest relevant statistics on the FinTech sector show that it should reach almost $310 billion by 2022 if this positive trend continues. Thus, although FinTech was not among the top 10 global sectors in terms of revenue, with the arrival of the pandemic, it will undoubtedly get there. Let's take a look at the most interesting statistics of the FinTech industry between 2019 and 2021.

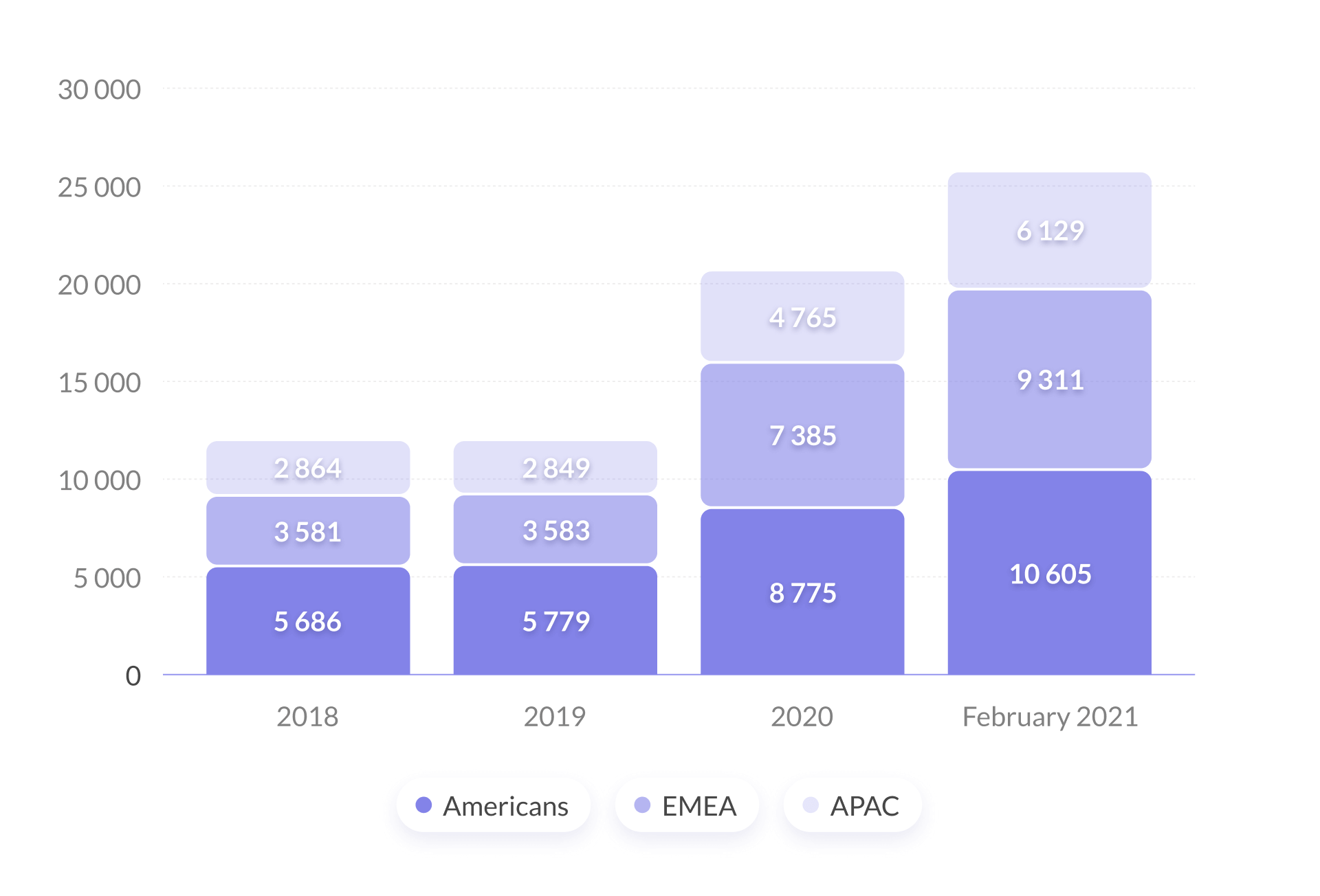

1. North America continues to lead in the number of FinTech startups.

Despite the fact that Asia is the leader in terms of revenue for FinTech companies, North America boasts the largest number of FinTech startups. According to Statista, currently in America there are 10,605 startups, which is two times more than before the start of the pandemic. In comparison, there are about 9,311 FinTech startups in the EMEA (Europe, Middle East, Africa) region and 6,129 in the APAC (Asia-Pacific) region.

2. The size of the global FinTech sector will be evaluated at $310 billion by 2022.

Based on the TopTal report in 2018, the FinTech sector attracted $128 billion in investments worldwide. Experts project the expected investments in the sector by 2022 are set at $310 billion, that means the CAGR of the industry is at 25%.

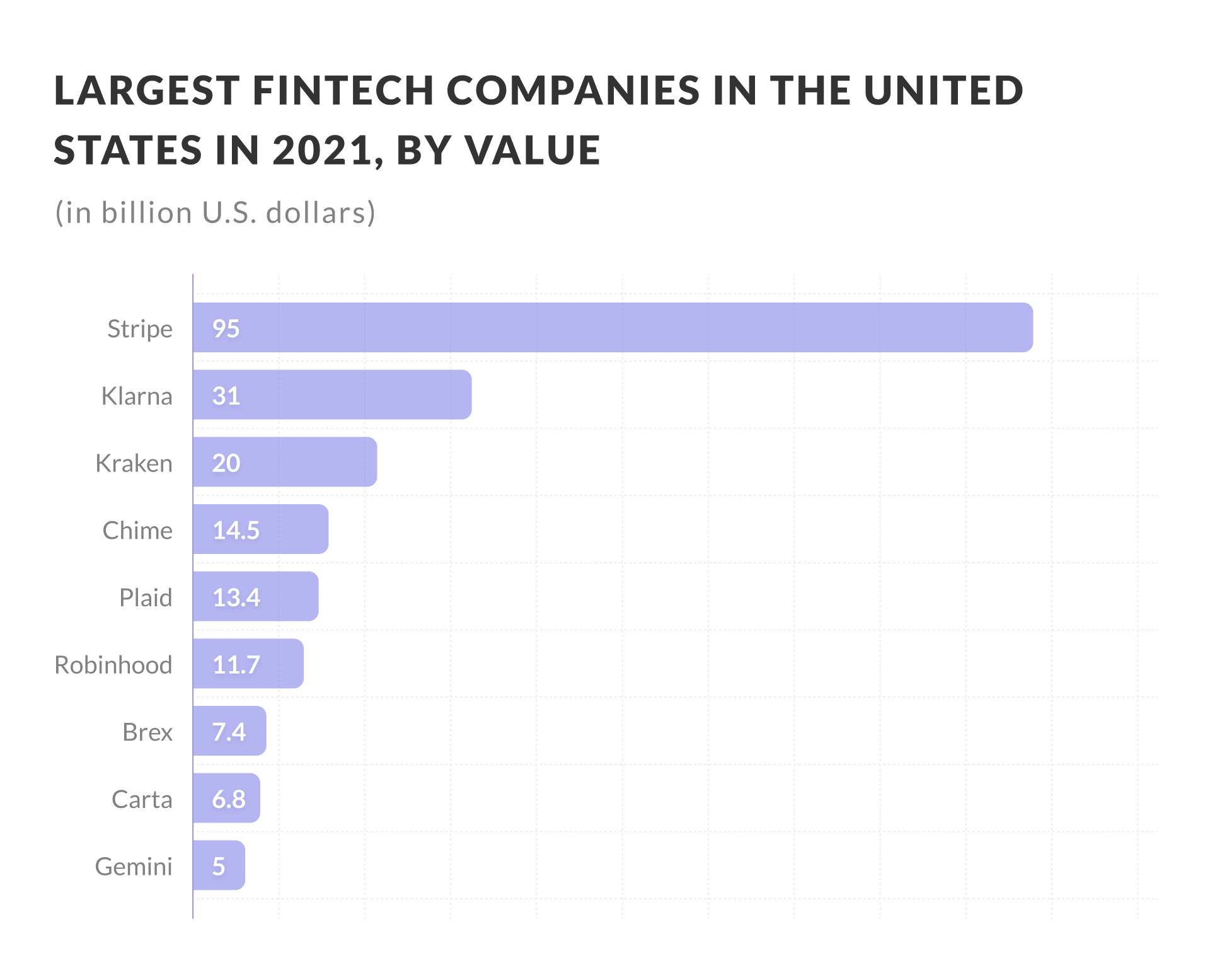

3. Stripe continues to be the largest FinTech company in the US in 2021.

Statista reported that Stripe (a payment-processing service), valued at $95 billion in 2021, was way ahead of its main competitors. Compared to the previous year, when the firm was valued at $25 billion, the company grew 270%. Klarna and Kraken were worth $31 billion and $20 billion, respectively.

4. Stripe continues to be the largest FinTech company in the US in 2021.

As of 2021, the total transaction value in the digital payments segment has already reached US $6,682,332 million1. The latest research and trends on FinTech transactions flag a total digital money transfer value of $10.52 trillion in 2025. It is interesting to note that the market's largest segment is the digital commerce industry. The total transaction value is expected to reach US $4,195,631 million in 2021 (Statista).

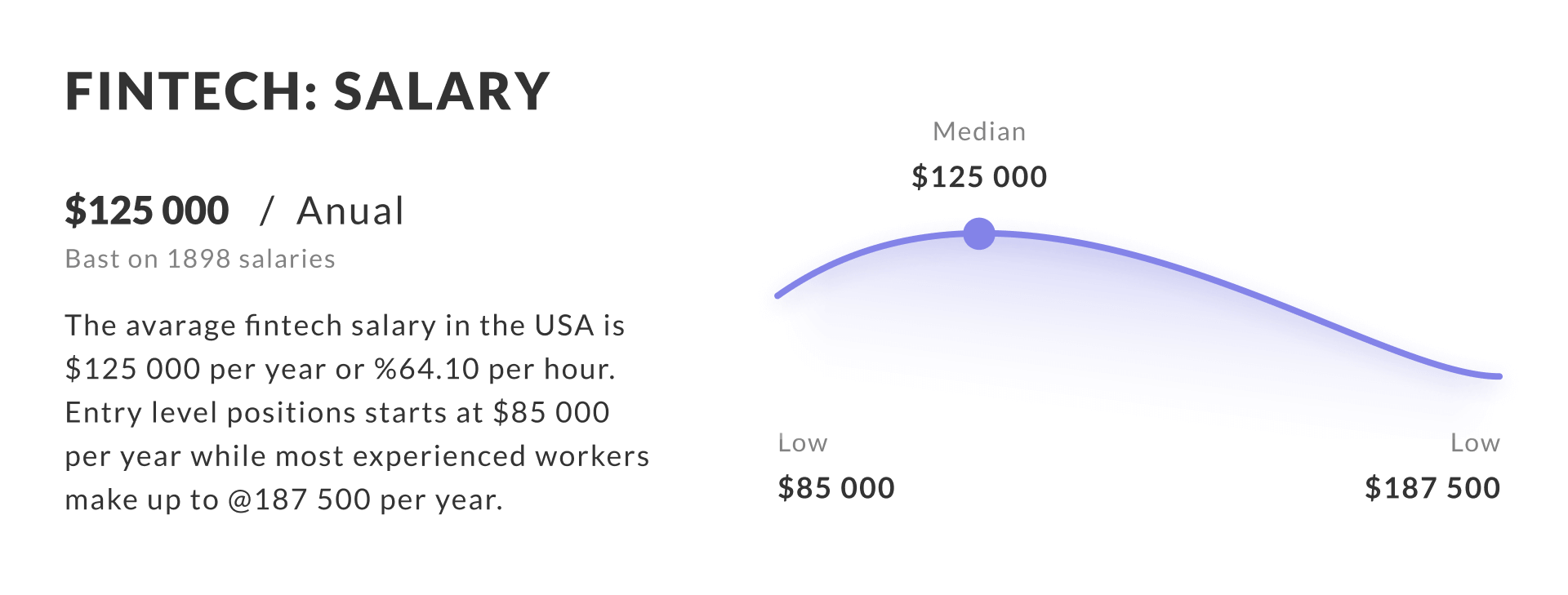

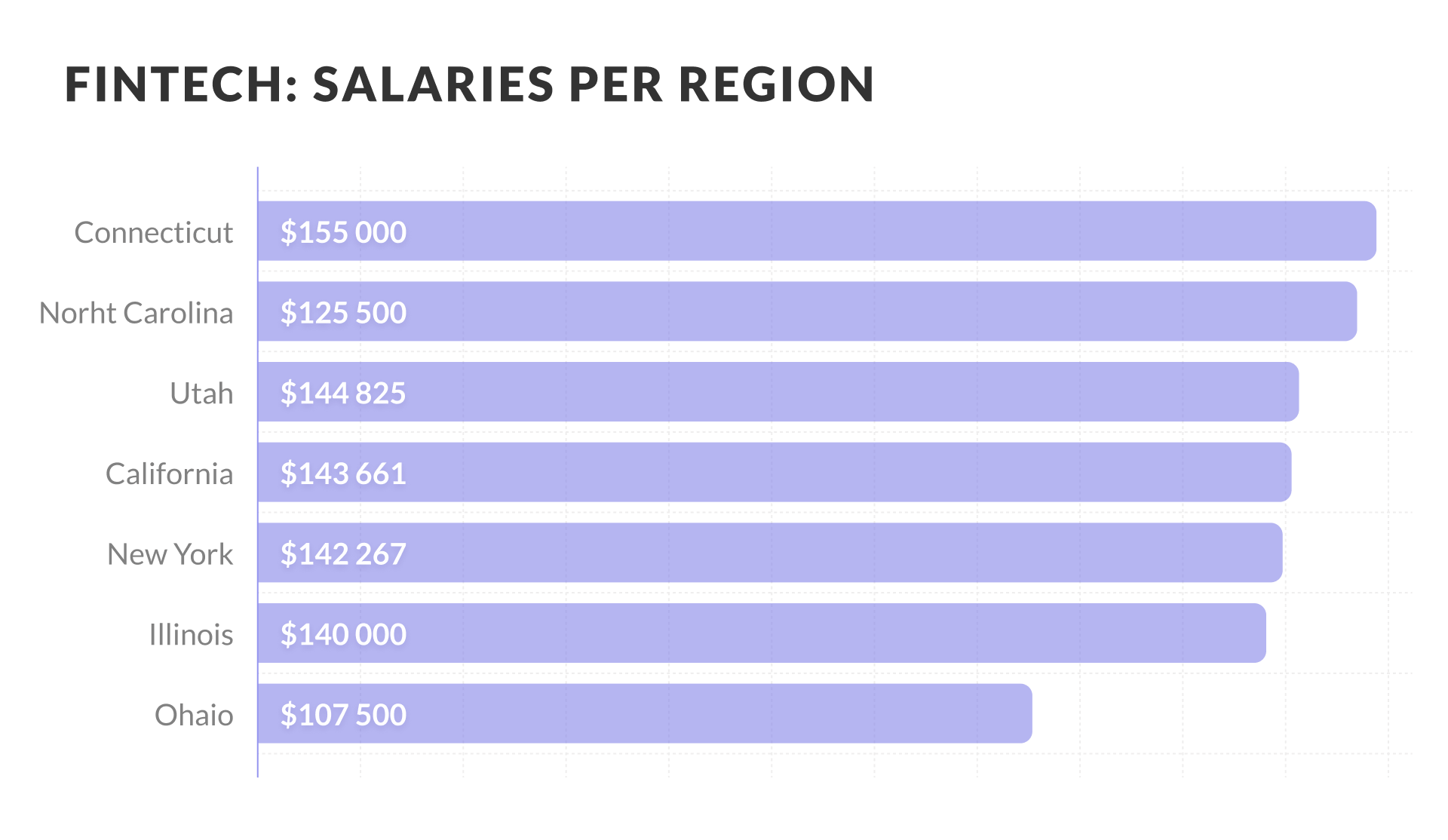

5. FinTech industry employees’ salaries range from $85 000 to $187 000 a year.

Based on Talent.com research, the average FinTech employee’s salary in the USA is $125,000 per year. It means that the hourly rate is $64.10. The entry salary starts at $85,000 per year, while most qualified and experienced workers make up to $187,500 per year.

Five new billionaires in the FinTech industry

It's no secret that online retailers and telecommuting services have benefited from home isolation and the move to online shopping. FinTech startups that process payments, provide installments, or help users trade on the exchange have also become beneficiaries of the pandemic. Geniusee team estimates that at least five entrepreneurs behind such services have become billionaires thanks to the coronavirus.

In 2015, Nick Molnar lived with his parents in Sydney and sold decorations from a desktop computer right from his children's bedroom. Promoting everything from $250 Seiko watches to $10,000 wedding rings, he was sending thousands of packages a day, and soon the 25-year-old became so successful in internet marketing that he is now one of the most successful eBay jewelry merchants in Australia.

In the same year, he began working with a former investment banker, Anthony Eisen, who is 19 years older and lived in a nearby street. Together they created the online service, Afterpay, which allows shoppers in the US, UK, Australia, New Zealand, and Canada to pay for small items like shoes and shirts in four interest-free payments within six weeks of purchase.

“I'm a millennial who grew up during the 2008 crisis and saw this shift away from loans to interest-free payments,” 30-year-old Molnar says today. Either for lack of credit cards or fear of accumulating expensive credit card debt, Molnar's generation quickly embraced this new way of buying and receiving goods right away and paying later.

Five years later, Molnar and Eisen, who each own roughly 7% of the company, became billionaires – during the pandemic. Afterpay, which went public in 2016, plummeted at the beginning of the quarantine in the spring, but then surged nearly tenfold thanks to the growth of its online-selling business. In the second quarter, the service processed transactions for $3.8 billion, which is 127% more than in the same period a year earlier.

Molnar and Eisen aren't the only ones who have grown rich by leaps and bounds over the past few months. According to our team's analysis, at least five FinTech entrepreneurs, including two Australians, have become billionaires thanks to the pandemic. Among them are the founder of the digital bank Chime, Chris Britt, and the creators of Robinhood (the application for trading without commissions), Vlad Tenev and Baiju Bhatt.

Chime reaches $600 million on an annualized basis. After raising $485 million in mid-September, Chime received a new, staggering valuation of $14.5 billion. This means that venture capitalists value the company at 24 times its revenue. Some investors question whether Chime deserves such a generous rating when Green Dot – a public FinTech company that offers checking accounts and prepaid debit cards to low-income customers – is worth double the revenue.

The forced stay at home, wild stock market swings, and government payouts have pushed some millennials and Gen Zers to become day traders and play options. In the last round of investments in September, Robinhood was valued at $11.7 billion, and its founders became billionaires. Some believe Robinhood could get a $20 billion valuation if it goes public or is sold. This assumption is based on the fact that in February, Morgan Stanley paid $13 billion for the E-Trade trading platform, and even earlier, the Charles Schwab Corporation acquired the broker TD Ameritrade for $26 billion.

Several other startups, in particular the founders of the services Klarna and Marqeta, have come close to billionaire status.

Klarna charges retail stores 3–4% of each transaction for its services. This is slightly less than the 4–5% fee charged by Afterpay. The key difference between the two companies is that Klarna is becoming a full-fledged financial services business. In 2017, the startup obtained a banking license in Sweden and began offering long-term financing for up to 24 months at interest on high-value purchases like laptops, which are sold by a limited number of retail stores. Semyatkovsky has already turned Klarna into a digital bank in Europe and has begun issuing a debit card for everyday expenses. He will probably do the same in the US soon.

The pandemic has taken Klarna's business to a whole new level. By mid-2020, its US customer base had reached nine million, an increase of 550% from the same period a year ago. Globally, 55,000 consumers install the Klarna app every day, double the number of last year. Klarna is now available in 19 countries, has 90 million users, and expects to surpass $1 billion in revenues this year. After a recent new round of funding, the company's valuation has nearly doubled from last year to $10.7 billion.

As with other sectors, FinTech has had both winners and losers from the coronavirus crisis. For example, the LendingClub service, which offers personal loans to high-risk clients, was forced to lay off 30% of its employees. And the On Deck company, which provided loans to small businesses, was urgently sold at a price several times lower than its market value at the beginning of the year.

Geniusee FinTech application development

The development of mobile and web applications targeting B2C audiences should be part of the plans of any bank or financial company in order to achieve a positive customer experience. And if it is no longer possible to retain customers with conventional financial applications and something more modern is required, then make them technological by adding the appropriate functions.

Personal finance applications

-

Personal finance management with savings training;

-

Cost accounting with tips on ways to save money;

-

Analysis of financial habits with personalized advice; and

-

Smart digital piggy banks with flexible settings and support for transfers to deposit.

Investment Applications

-

Tracking and notification of changes in prices for stocks, currencies, and cryptocurrencies;

-

Robotic advisor for investment and portfolio diversification;

-

Automatic copy trading; and

-

Asset management using artificial intelligence.

Lending-enabled applications

-

Acceleration of the loan processing procedure using a chat bot;

-

AI-based automated credit ratings;

-

P2P lending between customers and users; and

-

Automatic issue of microcredits by artificial intelligence.

Applications with the possibility of transfers and payments

-

Mobile or web wallet with support for electronic money and cryptocurrencies;

-

Risk assessment of transactions based on machine learning;

-

Support for smart auto payments (regular, irregular); and

-

Splitting the transfer into multiple recipients.

The selection of a worthy development company is an important decision on which the success of your project depends. When determining the exact cost and development time, it is better to first form detailed terms of reference. As part of the TK, you can assess the number of hours required for all stages of work and calculate the total cost. You can also use the Geniusee Estimator, which will help you find out the approximate cost of your FinTech application.

Geniusse offers innovative solutions with speedy implementation. Development of complex and high-load projects is our specialization. We create individual products for specific requests and requirements, taking into account the specifics of a particular business.

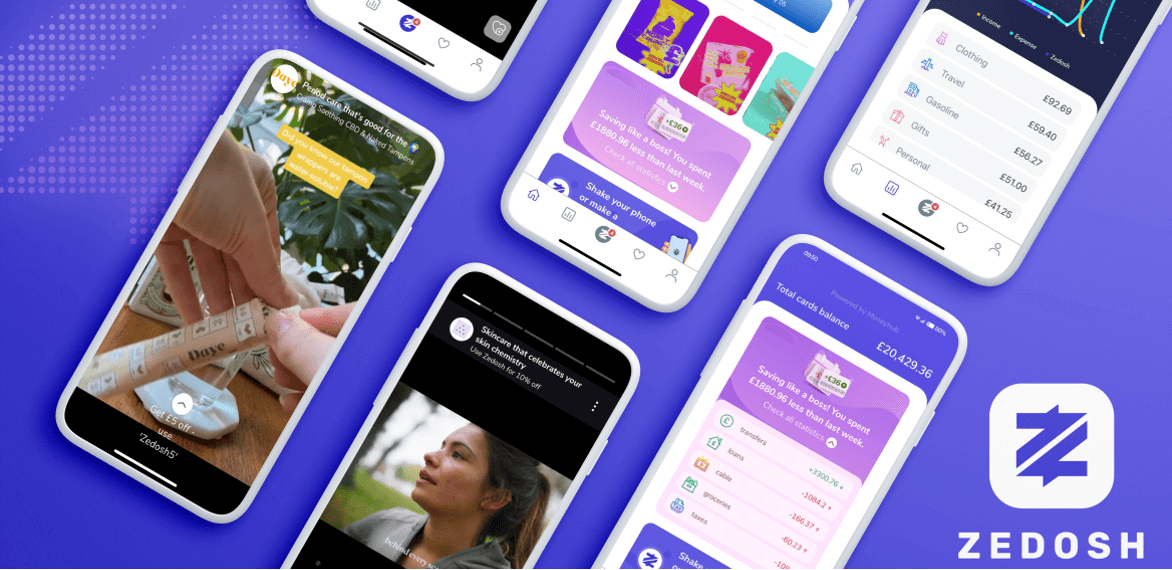

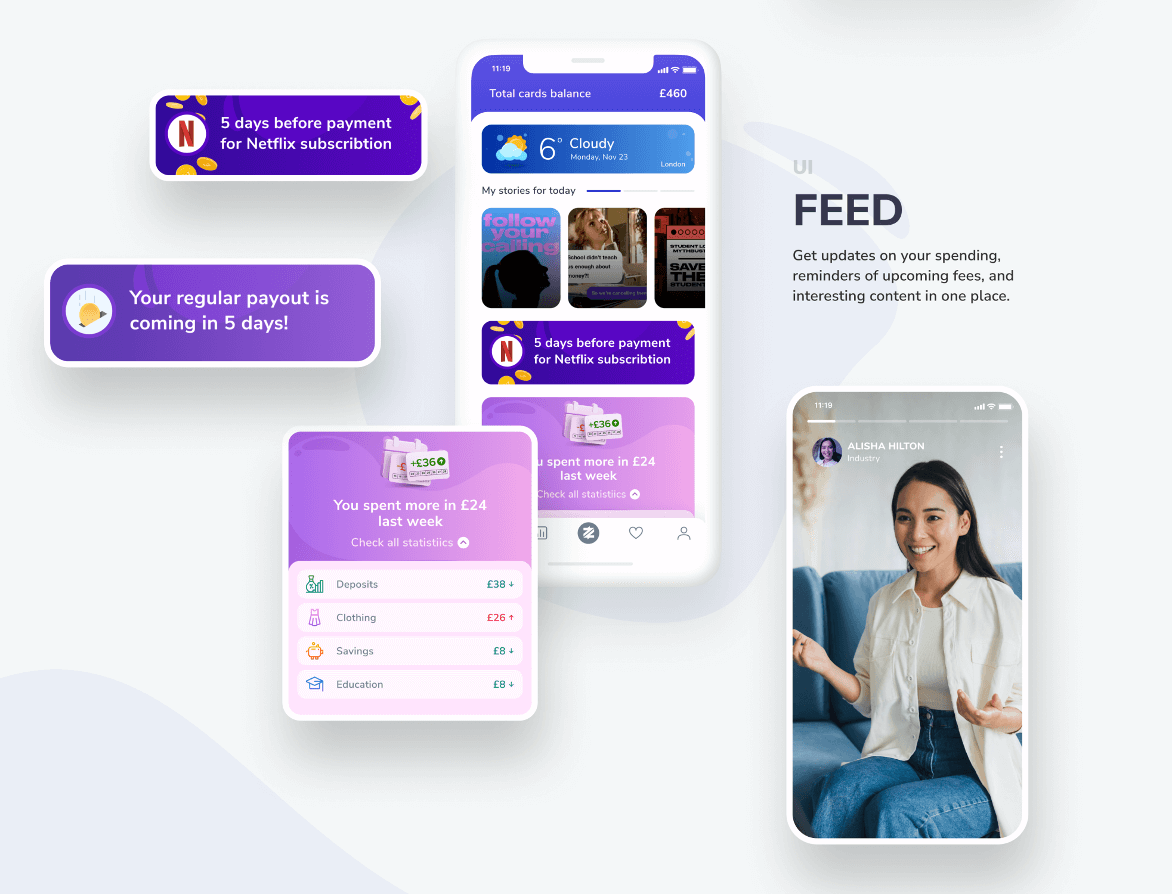

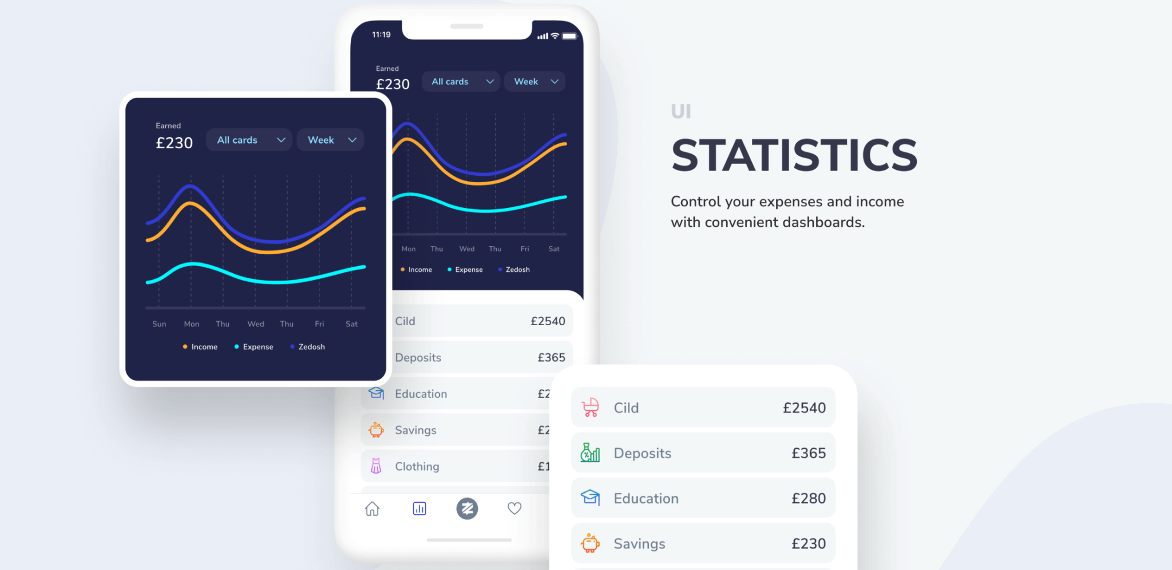

Below we will share one of our FinTech projects, Zedosh. You can find all of our projects in the Portfolio section.

Zedosh

Zedosh is a new digital advertising platform that financially empowers Gen Z. Using Open Banking, our application provides insight into their spending behavior, tips on how to master money, and, crucially, the ability to monetize their attention through a disruptive advertising model. We’re fusing FinTech andAdTec.

Our cooperation began with a two-week discovery phase that we conducted with the ReactNative technical lead and the designer. We provided the minimum viable product (MVP) scope, timeline, and application design. The client was happy with those results, and we started the development process.

After developing the MVP version we came up with new ideas on how to improve the customer experience and spent two months working on this with the team. The latest version of the application has just been launched, and we've just started to onboard users.

The most complex items were integration with the financial data provider (Moneyhub), although we had a direct channel of communication with the Moneyhub team, so they've supported and still support us. The second complex thing was to select a good payment integration. We investigated a significant amount of solutions and finally selected Revolut because it fits our business model. However, now our team has wide expertise in payments systems.

"Zedosh has built a new app which crosses traditional verticals – FinTech (including Open Banking and payments) with AdTech. Geniusee have been with us all along the way, and without them, we wouldn't have such a great app",

Guillaume Kendall, Zedosh Founder

Final Thought

The crisis has not only brought losses, but also new opportunities. It has urged companies to invest in new products and technologies that can keep them competitive. In these times of global instability caused by Covid-19, it is very important to be flexible. Remember that the flexibility of your business depends on the technical properties of your product; develop technologically, and it will be much easier for your business to rebuild in an era of change.

If your company or your FinTech product is looking for a professional team of software engineers, you can contact us and get advice on how to do it most efficiently.