Why should lenders explore modern loan origination system features? According to a Digital Banking Report, companies can use them to reduce application time to five minutes or less. This, in turn, reduces their abandonment rates from 60% to 25%. Yes, it’s true!

Automated loan origination systems can help you quickly evaluate borrowers and set up workflows for loan processing. This benefits lenders and increases customer satisfaction, reducing paperwork, review time, and manual errors.

Dive in to learn how your company can use loan origination systems to streamline operations, reduce risks, and improve the bottom line.

In this artice:

What is a loan origination system?

A loan origination system (LOS) is a software solution that helps banks and lenders automate loan applications, processing, and disbursement. It streamlines the loan process, ensures regulatory compliance, and mitigates risks.

The main components of loan origination software include:

Loan application,

Document management,

Loan eligibility,

Pricing, and

Fulfillment.

These components streamline the lending experience for borrowers, loan officers, and other stakeholders. Usually, underwriters, compliance officers, and senior managers carry the brunt of the work. But, with loan automation, their workload becomes easier to manage.

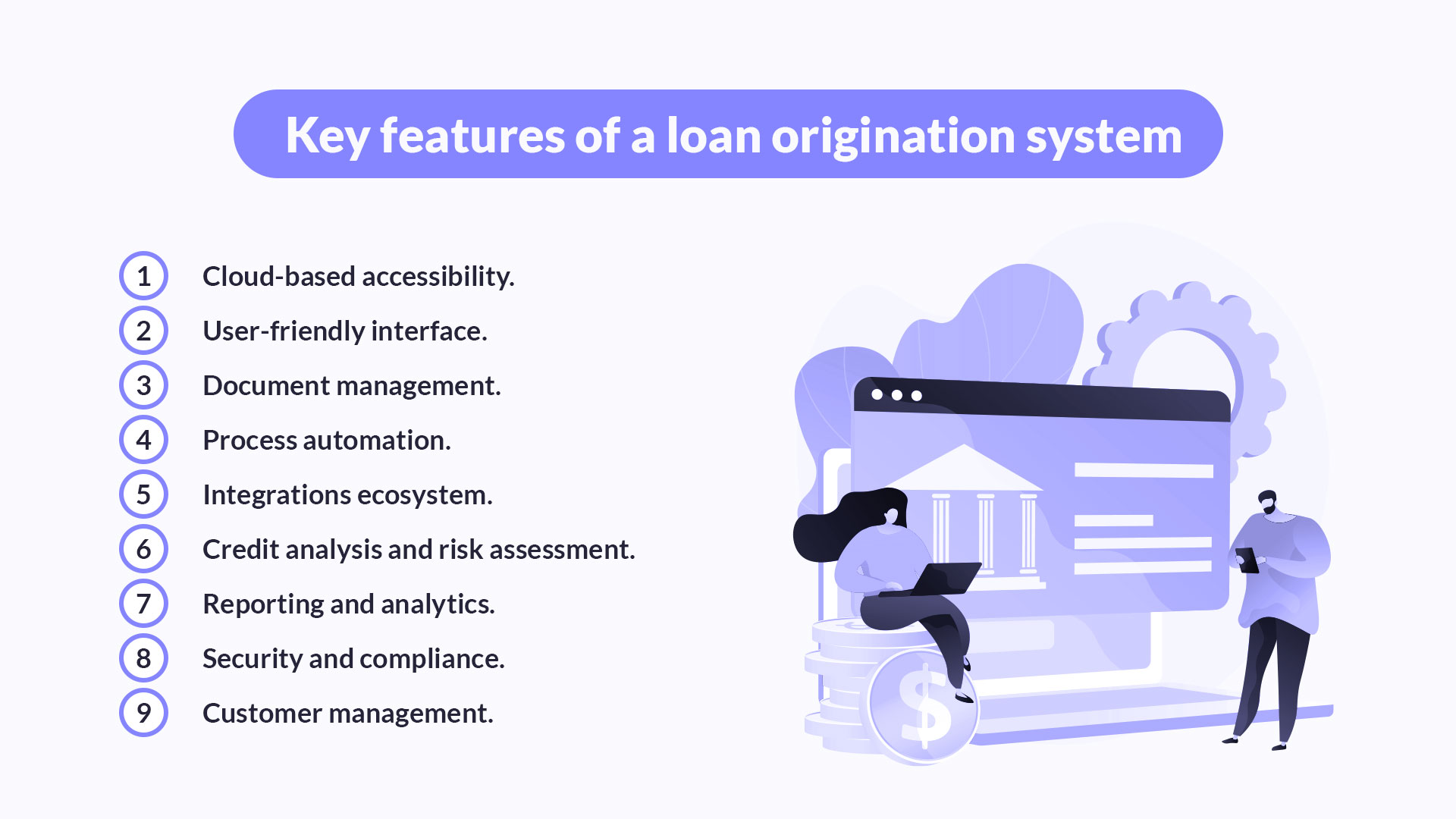

Key features of a loan origination system

A loan origination system is a sophisticated tool with several essential features. Here are the main LOS features you should look for:

Cloud-based accessibility. Cloud-based systems give you access to all the vital customer information, including their needs and credit history. Electronic records also allow for better scalability.

User-friendly interface. Providing a seamless lending experience is a leading client expectation. However, an intuitive interface and a low-code or no-code platform are also easier for your staff to use.

Document management. This feature allows lenders to collect, upload, store, and share documents related to borrowers. Some records may be vital to comply with regulations, and staff can track them through this system.

Process automation. Automating repetitive manual tasks in the lending process has several benefits. Lenders can save time and effort and eliminate human error. Setting variable underwriting criteria accounts for different scenarios in the automated system. Eliminating manual input also allows them to scale up when the number of applications increases.

Integrations ecosystem. Your loan origination system must allow a wide range of API integrations. Connecting your system with third-party services and vendors will be invaluable for credit score checks and identity verification.

Credit analysis and risk assessment. Integrations with credit bureaus will also inform credit analysis and credit risk assessments. Your loan origination software will automatically extract relevant information and organize it to make the most accurate lending decision.

Reporting and analytics. A well-oiled LOS offers advanced analytics and reporting features. You can access application trends, compliance metrics, and loan performance. With these reports, you will analyze gaps, resolve issues, and improve customer experience.

Security and compliance. Safeguarding confidential data is a key requirement for customers and regulatory bodies. All financial institutions should invest heavily in security and compliance features.

Customer (borrower) management. Key employees need to have access to correct customer data. Data can be collected from forms customers fill out or from third parties. Admins should also be able to request additional data or flag borrowers with suspicious behavior.

Let’s examine these features more closely in the loan origination process.

More on the topic:

9 recent investment banking trends in 2024

The banking industry was greatly affected by the recent technological revolution. Here are investment banking trends to look out for.

Read moreProcesses involved in loan origination

There are several steps in the loan origination process, and you can streamline it through automation.

1. Pre-qualification

During pre-qualification, lenders will verify the borrower’s identity and check if they’re eligible to apply for a loan. A loan origination system can use optical character recognition (OCR) and machine learning algorithms to authenticate documents submitted by borrowers. These documents may include:

a government-issued ID or passport,

employment and income status documents,

credit score and bank statements, and

previous loan statements.

After collecting and verifying the information, the lender may allow the borrower to continue with their application.

2. Application submission

Financial organizations are automating the application process through online application forms. This minimizes paperwork and human error. In addition, it’s much faster and more convenient for clients. They can use mobile apps or online portals to choose which loan they want to apply for. What’s best is that this means no more incomplete applications. The application won’t go through to the next phase if a document is missing.

3. Data verification

Once again, the LOS will verify and validate the borrower’s documentation to continue with the loan application process. These checks are more accurate, consistent, and fast.

4. Underwriting

The underwriting process is crucial to deciding whether the borrower can get a loan and how much they can get. Instead of manual underwriting, a loan origination system analyzes credit scores, risk scores, outstanding loans, and other relevant financial information. You can also customize it to fit your needs and include more parameters.

5. Loan approval/rejection

Based on the data from the application process and the rules you set in advance, your LOS can make a speedy and impartial loan decision. If the loan is approved, the system will devise loan terms, fees, interest rates, and the repayment schedule.

6. Compliance and quality control

The lending industry is highly regulated, so compliance is a must. Lenders need to satisfy strict legal requirements regarding cash reserves, credit ceilings, capital adequacy, and KYC processes. Quality control must happen before any loan is disbursed. During these compliance checks, the platform uses a set of rules to determine adherence to internal and external requirements.

7. Closing and funding

In this stage, the platform verifies all documents are in order and transfers the funds.

8. Post-closing activities (loan servicing)

The loan origination system plays a vital role even after closing the loan. Automated communication, repayment tracking, and refinancing requests can all be handled with little human intervention. The system can also create reports for internal and external parties to review.

Benefits of using a loan origination system

For lenders, the benefits of using a loan origination system are enhanced efficiency and profitability. Here are some real-world examples.

Streamlined and efficient loan processing

Bank Muscat, operating in the Middle East, implemented Newgen’s LOS for 42% faster processing time on its retail loans. The bank decreased its loan processing time to 23 minutes through intelligent process automation.

Ensured compliance and risk management

Geniusee built an automated white-label lending platform that matches businesses with appropriate lenders for business loans. Our client emphasized the need for privacy and compliance, and we delivered a cutting-edge solution. We paired risk assessment and mitigation strategies with digital security. This instilled confidence in lenders and borrowers. Also, it ensured compliance with FinTech legal and regulatory requirements.

Enhanced customer experience

Bancorp automated their LOS to create personalized loan packages in 5-7 minutes. Their platform, Talea, was developed in partnership with Smart Communications. It reduced their time to funding from weeks to two to four days, improving customer experience. As a result, they marked a 400% increase in loan volume and a remarkable 750% ROI. Sounds impressive, right?

Challenges and considerations

When you automate workflows, you will get many benefits. So what’s the problem?

Any lending institution that wants to automate its loan management system must also account for the risks in all stages of loan origination.

The main risks are security breaches and data leaks. So, significant considerations must be data privacy and protection measures. A PwC survey from 2022 noted that 65% of business executives believe cybercriminals pose a great threat to their business.

Another important consideration of a loan origination system is documentation. With strict record-keeping requirements, cloud-based systems offer efficient document management platforms. This is vital for complying with data privacy regulations.

If you want to implement a loan management system but aren’t sure where to start, we can help. Geniusee offers FinTech Consulting Services to meet your business goals. With seven successful years and over 150 projects behind us, our experienced engineers can help ward off issues with your loan origination platform.

Thank you for Subscription!

Future trends: AI and machine learning in LOS

With previous successes, we expect companies to continue automating the loan origination process for greater operational efficiency. The key features of LOS systems will get more refined, and new ones will emerge.

Here are some loan origination system trends and predictions:

According to a Deloitte report, the global AI lending market will grow from $5.7 billion in 2022 to $32.8 billion by 2028.

Loan origination software features will use computer vision and natural language processing (NLP) to speed up underwriting and processing loan applications.

Robotic process automation (RPA) and machine learning will help prevent fraud and detect anomalies.

Systems will evolve to collect and analyze data from multiple sources. These include social media activity, education, employment history, and spending patterns.

Virtual advisors and cross-selling will personalize loan offers and improve customer experience.

Summarizing the impact of loan origination system automation, Dmitry Lushchinsky, Head of Engineering at HES FinTech, stated: “AI has the power to revolutionize the loan management process, bringing a new level of accuracy to an industry that has long relied on manual processes.”

Conclusion

Let’s recap. If you want to develop a loan origination system for your lending organization, you’re on the right track. Statistics clearly show that automation is the trend to follow in lending. The main loan origination system features can ease applications for customers, speed up processing, mitigate risks, and ensure compliance. If you’re unsure where to start, contact experts for help.