Until recently, the concept of "Fintech" was a novelty both from the point of view of theoretical substantiation in scientific literature and practical aspects of adaptation of modern information technologies in the financial industry. However, the rapid development of digitalization processes and the associated transformation of society have provided conditions for the rapid adaptation of existing Fintech innovations. These processes also created conditions for the formation based on new directions and varieties that satisfy the consumer market's specific goals and needs. In particular, because one of the main guidelines of the modern development of society is the formation of socially responsible business models. It is reasonable to search for opportunities to achieve these goals in the Fintech segment and highlight the appropriate Fintech services and innovation.

In this article, we will share our analysis of sustainable finances in the world, define its role in achieving Fintech and sustainable development goals, classify its main areas, and consider the stories of the most successful green finance companies.

In this article:

What is sustainable Fintech?

A sustainable Fintech business or “green business” is an enterprise with a minimal negative impact on the global or local environment, community, society, or economy. It is a business that aims to satisfy triple profits. Often, these businesses have progressive environmental and human rights policies. In general, a business is described as green if it meets the following four criteria:

- It incorporates the principles of sustainability into each of its business decisions.

- It delivers organic products or services that replace the demand for illiterate products and/or services.

- It is more environmentally friendly than the traditional competition.

- He has shown a solid commitment to environmental principles in his business operations.

40 innovative opportunities for those who follow sustainable development goals

How does Fintech sustainability work?

A large Fintech company, which has its ethics and principles, is also developing a chain of its partners. Thus, this company develops small companies and the market as a whole. So in the US and Europe, the company reports not only on its performance, but also on the performance of those with whom it cooperates. If there are scandals, for example, related to corruption, it affects everyone.

Sustainable Fintech companies meet the current needs of society and do not jeopardize the existence of future generations. For business, this means that we can make a decision not only in terms of economic benefits but also consider how clear the environmental impact will be.

Issues on the agenda of every manager: defending the interests of employees, their effective maintenance, and the company's impact on the environment.

- Sustainable development benefits are income growth: new innovative products, increased market share, and high prices.

- They ensure a sustainable future — product differentiation in the market, customer loyalty, attracting and retaining talent: cost reduction — efficiency, asset utilization, insurance costs.

- Changes in the quality of income — the stability of the supply chain, reduced volatility in raw materials prices, the stability of the business as a whole. All this leads to an increase in the value of the company.

What do you think?

Can Green Fintech reduce mindless consumption?

Sustainable Fintech or ''Green Fintech'' is an enterprise that has a minimal negative or even potentially positive impact on the global or local environment, community, society, or economy.

Let's seeWhy make steps towards sustainability?

Suppose we will do nothing in a few years. In that case, we will come to the following: 4 ° C warming by the end of the century, 65% of cities and 10% of the world's population will face the problems of rising sea levels, and by 2050 52% of the total population will suffer from water shortages.

More than 10% of the world's population lives below the poverty line. Humans do not receive a salary for their work, and child labor is used. Eight people have the same incomes as 50% of the poorest half of humanity. A third of people work on $2 per day. The young population has three times fewer opportunities to get a job. Mass migration: 20 people per minute are displaced.

However responsible businesses can influence all of these metrics. Each company can work with its employees and affect the poverty rate at its level. Investing today is vital in the agricultural sector, energy, ergonomic use of resources, urban development, and health care.

Leading Fintech companies

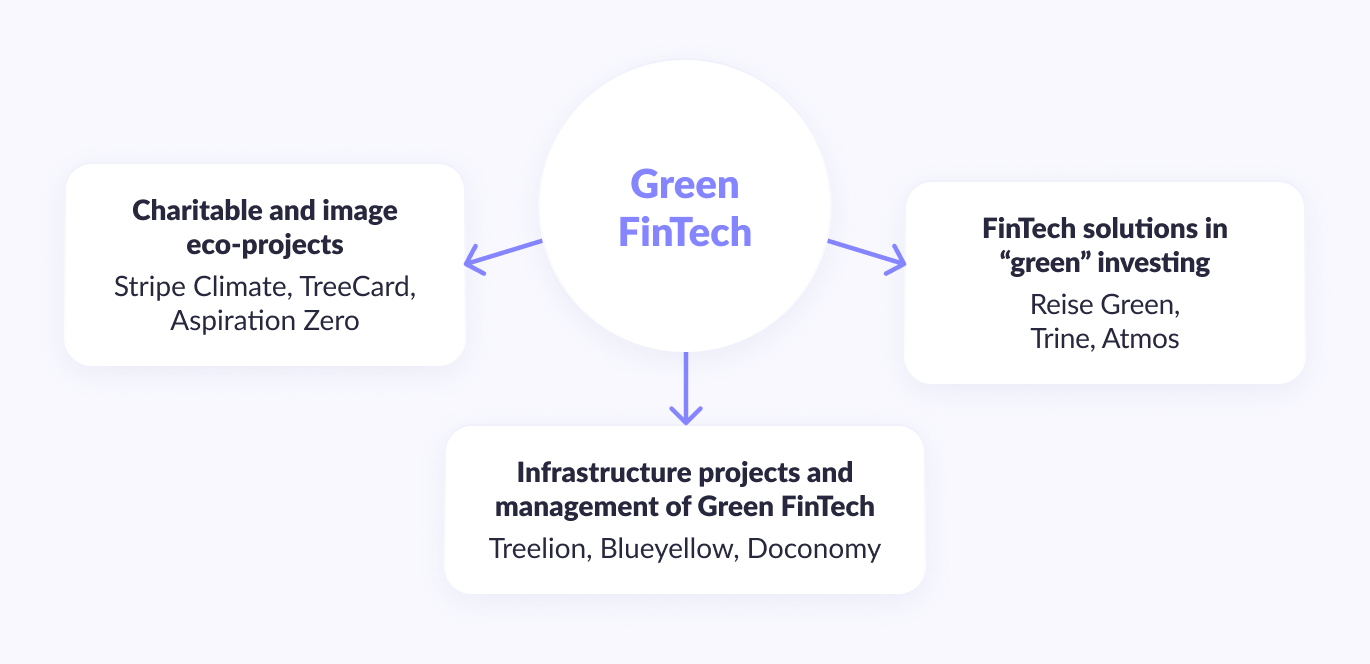

The generalization of the existing practical cases of combining elements of socially responsible business and innovation in the field of Fintech allowed us to identify three main areas of the modern development of Green Fintech in the world.

1. Use of Fintech in the image and charitable eco-projects

The first direction of the Green Fintech sector is characterized by the absence of direct financial reward for the investor (donor). It aims to achieve positive environmental effects by reducing carbon dioxide emissions, reducing the use of plastic, increasing green space on the planet, and more. Achieving the goals of this area can be achieved by financial intermediaries and Fintech companies using various tools. For example, the American technology company Stripe, which provides a wide range of financial services in the reception and processing of electronic payments, has an exciting solution. It allows corporate customers to automatically deduct a portion of their income (according to a predetermined percentage of deductions) to finance advanced technologies to reduce carbon emissions. Deduction companies receive a special green badge to create a positive company image.

Another example is using wooden payment cards, as is the case with the German investment company Ecosia which invested 1 million pounds in the British Fintech startup TreeCard. Wooden payment cards perform all the functions of traditional debit cards. However, unlike the latter, they are made exclusively from organic and recycled materials, and the commission for their use is used to finance the planting of trees in 15 different developing countries. Users of such cards can track their expenses and see how many trees they have financed.

Aspiration pursued a similar goal. In 2020 the Plant Your Change feature for current customer accounts was introduced, which consists of rounding the amount of any transaction to the nearest dollar and transferring the relevant difference to finance the planting of trees. In 2021, the company began issuing Aspiration Zero payment cards, which, through deductions from each purchase, allow their holders to recoup their carbon footprint and receive cashback when they reach the target amount of monthly deductions.

Do you know?

The future of money in the digital world

Digitalization, which has significantly reduced the costs of currency exchange, can lead to the separation of the three main functions in the future of money — as a unit of calculation, as a means of payment, and as a means of accumulation.

Find out more2. Fintech solutions in "green" investing

The following important direction of Green FinTech's development is innovative financial technologies in green investing. Unlike charitable and image eco-projects, green investing aims to make a profit for the investor, but the choice of projects is based on their compliance with sustainable development goals. Green Fintech-based investment may involve varying degrees of end-investor participation in project selection.

For example, Atmos has developed an innovative model of climate-friendly banking. By cooperating with various financial institutions, Atmos accumulates funds on deposit accounts and directs them to investments exclusively in climate-positive infrastructure to accelerate the transition to a clean, fair, and transformed green economy. In particular, the priority areas of Atmos investment are renewable energy sources, energy efficiency projects, electric transport, green building, and renewable agriculture.

An alternative, that involves the active participation of investors in the choice of green investment, is the creation of specialized investment platforms for projects on energy efficiency, renewable energy, etc., following the example of crowdfunding and online peer-to-peer platforms. A significant advantage of this approach is the ability to transfer funding to the appropriate level of projects at the regional or local level and increase the number of investors involved, including from the local community, without rising transaction costs.

Green finance companies such as Trine and Raise Green operate on the principle of online platforms.

Trine specializes in investing in solar electricity. The algorithm for participation in green investing using the platform Trine is quite simple and includes:

- Pre-registration on the site.

- Selection of the investment object among the proposed options, considering the location, size, risks, and other parameters.

- They are determining the amount of investment (minimum 25 euros).

Upon successful completion of the project, the investor receives a reward in interest.

Raise Green platform uses a similar approach in the operation of the, created as a licensed financial portal of the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) in the United States. Through the Raise Green platform, you can find and invest in any local eco-project. Participants in the forum can be accredited and non-accredited individual and institutional investors. In addition to direct financial information about investments, the platform allows you to show the expected effects of the investment, in particular the number of kilowatt-hours of clean energy created by each investor's contribution.

More on the topic

Recent Investment Trends in Banking Technology

Having access to the latest banking technology can be of great help, but what is more important is how you put it to use.

Tell me more3. Infrastructure projects and management of Green Fintech

The principle of online platforms is actively used in other areas of Green Fintech development, in particular in infrastructure projects and management. Following the example of crowdfunding platforms, it is possible to create local marketplaces for the provision and receipt of energy. In turn, artificial intelligence technologies are used to reduce energy consumption and develop networks of more efficient power distribution between users of the platform.

Green Fintech technologies allow participants to buy and sell energy in retail or wholesale markets on an equal footing and community-oriented energy systems such as micro-networks. Micro-network users can choose where they want to get power. This approach already has several examples of successful applications globally: the Vandebron Energy platform in the Netherlands, the Piclo platform in the UK, the peer-to-peer energy market in Brooklyn (New York, USA). There are also online platforms that mediate transactions with renewable energy, an example of which is the Swiss platform Blueyellow.

You should also pay attention to infrastructure projects that have a broader focus and contribute to the development of different Green Fintech products types. For example, the Treelion Foundation, established in 2019, currently implements projects in more than 30 countries and regions of the world worth more than $ 1 billion. The fund's primary goal is to create a "green" digital financial infrastructure based on blockchain technology.

The strategic guidelines of the fund are: solving the problems of pollution of land, air, soil, and biological pollution to promote the construction of ecological civilization; support for sustainable and "green" business through a combination of environment, finance, and digital technologies, creation of the largest "green" digital data ecosystem; maintaining a database on the global climate and biodiversity using blockchain technology; promoting environmental cooperation at the international, regional, national and local levels, creating ecological civilization.

Another example is the Swedish startup Doconomy, which focuses on creating an ecosystem of financial instruments for learning and stimulating positive change. Doconomy works with Finnish bank Ålandsbanken, UN, and MasterCard to raise global green awareness of climate change, using the capabilities of international banking and global payment technologies.

Sustainable Fintech trends

A growing emphasis on Fintech and sustainability has sparked innovative trends and practices aimed at reducing environmental impact and fostering a more eco-conscious approach to banking and investment. Let's take a closer look at 10 main ones.

Open banking

Embracing the concept of open banking revolutionizes the financial sector landscape, empowering customers to securely share their banking data with trusted third-party providers. This fosters an environment of innovation and personalized services while championing competition and transparency. It also empowers individuals to maintain control over their financial information, thus fostering a more interconnected and efficient financial ecosystem.

Eco-conscious green cryptocurrencies

In response to growing concerns surrounding the energy consumption associated with traditional cryptocurrencies like Bitcoin, forward-thinking Fintech leaders are exploring alternative technologies with reduced energy footprints. These environmentally-friendly cryptocurrencies, leveraging consensus mechanisms and proof-of-stake algorithms, present investors with sustainable options while aligning with eco-conscious values.

Digital wallets for sustainability

Digital wallets emerge as a sustainable payment solution, effectively reducing paper and plastic waste inherent in traditional payment methods. With an increasing number of users adopting mobile wallets, which often prioritize renewable energy sources and eco-friendly infrastructure, the trend supports environmental causes and fosters a greener way of transacting.

Contactless payments driving sustainable transportation

The widespread adoption of contactless payments in public transportation not only streamlines the commuting experience, but also significantly reduces paper usage and its environmental impact. Furthermore, these eco friendly payment alternative methods facilitate access to alternative transportation services like bike- and scooter-sharing, promoting sustainability options in urban environments.

Carbon-neutral payment processing

Embracing carbon-neutral payment processing methods entails offsetting carbon emissions through renewable energy projects or carbon offset programs, effectively achieving a net-zero carbon footprint. By leveraging energy-efficient technologies and supporting carbon offset eco-friendly initiatives, payment processors contribute to mitigating environmental issues associated with financial transactions.

Mobile payment solutions for carbon offsetting

Innovative mobile payment solutions empower users to offset carbon emissions generated from their transactions by supporting renewable energy projects or reforestation efforts. Platforms like TreeCard and Doconomy enable individuals to track their carbon footprint, make eco-friendly financial decisions, and actively participate in global climate change mitigation efforts.

Carbon tracking technology

The integration of carbon tracking technology plays a pivotal role in monitoring and managing carbon emissions, crucial for achieving overarching environmental objectives. Leveraging digital solutions, including blockchain, facilitates real-time tracking of CO2 emissions, enabling businesses to implement proactive measures aimed at reducing their environmental impact.

Sustainable investment options

Fintech companies are at the forefront of developing digital solutions to address environmental challenges, with industry leaders investing significantly in green initiatives like renewable energy. The global surge in green investments, reaching $495 billion in 2022, highlights the pivotal role of digital platforms in supporting eco-friendly endeavors and driving sustainable financial practices.

Digital payments and signatures

The proliferation of digital payments, electronic signatures, and mobile banking contributes to reducing the environmental footprint associated with conventional banking methods such as cash and paper statements. This transition toward fully digital banking not only enhances convenience but also aligns with efforts to promote sustainable financial operations and reduce paper waste.

Sustainable finance and green loans

Financial institutions are increasingly offering loan products that incentivize businesses to prioritize sustainability, thereby fostering a more environmentally conscious economy. These green loans may offer lower interest rates or other incentives for companies investing in energy-efficient technologies or sustainable agricultural practices, driving positive change toward an inclusive financial future.

One more interesting topic

Embedded finance: a new ecosystem in financial world

Embedded finance tools allow you to integrate payments, debit cards, loans, insurance, and even investment instruments into almost any non-financial product.

I want to read itChallenges to be overcome by Fintechs

As promising as an industry is, there are always challenges to be overcome. The financial industry today is experiencing the same challenges that have been the focus of attention in recent years. Among them are the following.

Outdated technology

Many traditional financial institutions still use outdated technology and business models. The competition is steadily increasing. Customers want and expect more. But many companies are trying to compete with green startups using outdated technologies that are holding back the entire industry. The pandemic has accelerated digital transformation. However, it takes time and internal changes within the company, including customer interaction models and business philosophy.

Regulations

As Fintech uses a variety of online technologies to speed up customer interactions and payments, data privacy is becoming increasingly important. A new approach to financial management requires new laws. The first Payment Services Directive laid the foundation for the rapid development of the FinTech industry in Europe back in 2007. It also created the legal basis for SEPA (Single Euro Payments Area). Since then, FinTech-related legislation has constantly been evolving and striving to increase its value to customers in order to compete with traditional institutions. The achievements of recent years are GDPR, PSD2, etc.

Safe storage of data

Safe storage of user data is another risk of modern online business. Leakage of data such as payment card numbers, passwords is simply unacceptable. Fintech companies do their best to prevent this, but failures do happen. Especially when users want to see transparency in their operations, they need a solution that combines transparency with security. Therefore, the question of secure storage and transmission of user data remains open.

User confidence

If a financial institution does not provide customers with the required level of service, threatens data security, then customers lose trust, and lack of trust leads nowhere. Banking security, for example, is one of the most important criteria for selecting clients. And as more and more data is transferred over the internet, cyberattacks have recently become more frequent. According to Security Intelligence, the average cost of a data breach in 2019 was $ 3.92 million.

Termination of funding

This challenge is related to recent events. COVID-19 has suspended funding for FinTech technology, according to CB Insights, as the total number of deals for Fintech companies has plummeted since late 2019. Funding for startups is also dwindling as traditional financial institutions that previously preferred to work with startups are now creating in-house development departments and working on their new finance solutions. Under these conditions, sustainable finance startups that have been the driving force behind Fintech development in recent years will be less likely to succeed.

How can Fintech become more sustainable?

"How can we be more resilient?" This sentence you've probably heard over the past few years, either in your office or perhaps in your head. Sustainability in Fintech is a hot topic for companies because, in general, this is the future of how we humans live. Below are some guidelines for Fintech companies planning to become sustainable.

- Conduct a feasibility study involving all stakeholders and identify the most critical issues and requirements.

- Link sustainability issues to your business model.

- Identify both risks and additional opportunities. Determine what positive things you are bringing and how you can stimulate and implement new changes to achieve the best result.

- Don't forget about smaller and simpler things. Your actions mustn't diverge from your words.

- Don't be afraid to set essential and ambitious goals.

- Don't see sustainability as the opposite of making a profit. To ensure sustainable development in the long term, the company must generate income here and now.

Conclusion

The modern development of the Fintech segment provides the financial services market with innovative solutions, helping to increase the efficiency of its operation, and the flexibility and adaptability of the Fintech segment allow you to extend successful technological developments to other areas of public life.

Fintech demonstrates significant potential in terms of its application in green finance and socially responsible business. The current results of Fintech's practical application in the image and charitable eco-projects, "green" investment, and the formation of "green" digital infrastructure testify to the prospects of this area and the possibility of using Green Fintech to build an ecological model of an economy based on sustainable development. And if you are interested — our Fintech experts are here to help you.