If you’re in the Fintech industry, you have heard of ChatGPT. It has been storming the internet. ChatGPT is a training model and a generative AI tool with Generative Adversarial Networks (GANs) algorithms that can predict real-life information based on its learning dataset.

Generative AI models have various uses for Fintech businesses, for instance, providing several Fintech solutions—from combating fraud to asset management. In this article, you’ll learn about the top five use cases for generative AI from the real world.

These examples will show you how to implement generative AI in your Fintech business and become more efficient. Read on!

In this article:

The top 7 use cases of generative AI with real-world examples

The examples below show what generative AI for Fintech can do in the future. They offer endless possibilities for how artificial intelligence technology will change how Fintech businesses and the banking industry work.

1. Generative AI for fraud detection and prevention

As per Allied Market Research, the global fraud detection and prevention market was $29.5 billion in 2022 and is expected to reach over $252 billion by 2032, and generative AI in Fintech will play a crucial role in it.

With the advancement of AI capabilities, training models can analyze enormous amounts of transaction data and find unusual patterns that may lead to fraudulent transactions.

Additionally, gen-AI can detect unusual user behavior and sketchy patterns in data and prevent fraud from happening.

Generative AI is adaptive to learning and continuously updating with new data and patterns; staying ahead of potential threats will reduce financial losses. However, companies can manually update the dataset of their generative AI tech to quicken the tool’s learning.

Overall, financial technology companies can prevent and protect their customer service from any kind of digital fraud with this tech.

Example: PayPal using AI to combat fraud

PayPal is utilizing generative AI to identify patterns and anomalies in user behavior. They are detecting fraudulent patterns that show unusual activity.

PayPal collects data such as device details, session analysis, and third-party data. It allows the financial firm to create a detailed profile of users and transactions.

It uses machine learning models to analyze device data, sessions, verification checks, IP addresses, and user behavior to ensure a safe and secure transaction.

2. Generative AI for credit scoring and risk assessment

Regarding risk, Fintech companies are leveraging AI with pomp and show. With the help of generative AI, financial services companies can analyze emerging trends in the market, transaction history, spending habits, and other relevant data to make better and more informed decisions.

Additionally, generative AI for Fintech also plays a crucial role in credit scoring assessment. It can easily analyze customer data like credit history, buying behavior, and the income of an individual via its advanced algorithm.

Additionally, Fintech companies can use it for pattern recognition, reduce biases, and calculate an overall prediction of an individual's creditworthiness.

Example: Crediture uses Gen-AI for credit scoring

Crediture leverages generative AI to generate risk management processes. They trained their systems on their extensive financial data to analyze economic conditions, industry trends, and more. The company can accurately predict bear markets, odd events, market instability, and recessions.

They also use generative AI algorithms to offer customized lending choices to business borrowers. These algorithms generate tailored credit product recommendations based on a company's financial status using Variational Auto-Encoders (VAE).

Thank you for Subscription!

3. Generative AI for algorithmic trading

Algorithmic trading in the forex market involves ordering automated and programmed trading decisions for price, time, and volume.

As per research in 2019, algorithmic trading is responsible for 92% of the total trading in the forex market.

With generative artificial intelligence, you can analyze market data trends and real-time market conditions to make future predictions. Further, you can automate the trading process for your financial products and trade based on data analytics and algorithmic pattern identification.

Example: Bridgewater Associates (the world’s largest hedge fund) uses AI

When most businesses were thinking about whether to leverage AI or not, Bridgewater Associates, the world’s largest hedge fund, had already accepted and employed it for a while. After years of analysis, they found that AI and other large language models can easily analyze data, test theories, and make a positive impact on decision-making.

Greg Jason, co-chief information officer at Bridgewater Associates, said in an interview about the potential of ChatGPT and other artificial intelligence (AI) models that with gen-AI applications, there is an increase in efficiency, a cost reduction, and improvement in the accuracy of market predictions.

More on the topic

Humanizing The Digital Banking Experience: Strategies For Customer Success

Explore the evolution of digital banking, its challenges, and the trends shaping the industry.

Read more4. Generative AI for personalized financial services

In a USA study of over 1,000 people, it was found that 77% of Americans feel anxious about financial situations, and 58% said finances control their lives.

With the assistance of generative AI solutions, financial advice such as investment decisions and financial planning are more accurate and less time-consuming. It can now analyze expenses, suggest investments, manage risks, and make customized investment plans for you.

For instance, generative AI can create investment portfolios tailored to a person's objectives and risk tolerance, modifying suggestions as needed. Additionally, it will give financial institutions an option to foster their clients with personalized services.

Example: Cleo, a personal financing app, uses ChatGPT tech

Cleo is your financial virtual assistant. It is an AI app that leverages ChatGPT to analyze your finances and give budgeting and saving suggestions. Once you link your bank account to the app, it will instantly analyze it and provide you with real-time updates and tips to make smart decisions.

Additionally, Cleo answers your financial queries inside the app with their implementation of gen-AI and natural language processing.

Are you ready for a new era in Fintech?

Check out our Fintech guide to get the latest insights from the industry!

5. Generative AI for regulatory compliance and reporting

For financial services, it is critical for Fintech bodies to follow mandatory financial regulations. Thankfully, generative AI can help you stay aligned with financial regulations and eliminate the chances of violating regulatory compliances.

Generative AI can read vast financial and legal documents and monitor changes in regulations in real-time. Leveraging this to your advantage, you can automate tasks, decrease human errors, follow important regulations, and avoid penalties.

Example: FintechOS, a cloud-based platform that helps financial institutions manage their regulatory compliance and reporting requirements

FintechOS helps banks and financial bodies deploy digital solutions. With its latest update to FintechOS 22, the company is focusing on enhancing digital transformations with its no-code or low-code approach.

Also, they regularly update their services to fulfill financial regulations. Overall, FintechOS offers customized services while adopting regulatory changes for various financial organizations.

6. Generative AI for market analysis and asset management

One of the most transformative applications of generative AI in Fintech lies in its ability to process and synthesize vast amounts of unstructured data.

Financial news, social media sentiment, and regulatory filings – all traditionally overlooked due to their sheer volume and variability – can now be ingested and analyzed by generative AI models.

This allows asset managers to glean valuable insights into market sentiment and investment strategies, identify potential risks and investment opportunities lurking beneath the surface of traditional data sets, and gain a more nuanced understanding of the ever-evolving financial market.

However, it's crucial to remember that generative AI is a tool, not a silver bullet. Human expertise remains paramount in interpreting the insights generated by AI models and making final investment decisions. The most successful integration of generative AI involves a synergistic collaboration between human intuition and predictive analysis powered by AI.

Example: A leading provider of investment research, MSCI is using generative AI to enrich its climate risk data.

The AI can analyze vast amounts of satellite imagery and other environmental data to create more comprehensive risk assessments for assets located in areas vulnerable to climate change. This empowers investors to make informed decisions about environmentally sustainable portfolios.

7. Generative AI for automated customer service

Fintech and generative AI are transforming customer service, offering a powerful new approach to automating interactions with virtual assistants and enhancing the overall customer experience.

Unlike traditional rule-based chatbots, gen AI in Fintech leverages advanced natural language processing (NLP) techniques to understand the nuances of human language and generate human-quality responses.

This enables AI-powered chatbots to handle a wider range of queries, engage in more natural conversations, and ultimately resolve customer issues faster and more effectively.

Example: The vacation rental platform Airbnb uses generative AI to streamline communication between hosts and guests.

Artificial intelligence can answer frequently asked questions about listings, amenities, booking procedures, and even translate messages between users with different languages. This fosters a smoother user experience and reduces the need for manual intervention by Airbnb support staff.

Benefits of generative AI in Fintech

By using the power of generative AI, Fintech companies can unlock a new era of financial services that are not only secure and efficient but also personalized and innovative.

Here's a closer look at its key benefits:

Improved security

Generative AI excels at pattern recognition and anomaly detection. This makes it ideal for creating robust fraud detection systems that can continuously monitor financial transactions, flag suspicious activities, and identify potential threats in real time.

Increased operational efficiency

Repetitive tasks like data entry, document processing, and loan approvals can be automated using generative AI. This frees up human resources for more strategic tasks and reduces processing times significantly.

Generative AI in Fintech can also automate report generation, creating summaries of complex financial data for easier analysis and strategic decision-making. The overall result is a leaner and more efficient operation, leading to cost savings for Fintech companies.

Personalized customer experiences

Generative AI can analyze vast datasets of customer behavior, spending habits, and financial trends. This empowers financial companies to create personalized financial experiences with the help of generative AI-powered tools.

Generative AI can also personalize marketing campaigns and product recommendations, leading to higher customer engagement and satisfaction.

Risks of generative AI

Data biases and privacy concerns

Generative AI Fintech systems are trained on vast datasets. If these datasets contain biases, the AI can perpetuate and amplify them. This could lead to discriminatory lending practices and financial operations, unfair investment recommendations, or biased algorithmic trading.

Furthermore, GenAI's ability to generate synthetic data raises privacy concerns. While synthetic data can be useful for simulations, it's crucial to ensure it doesn't inadvertently reveal information about the real-world data used to train the model.

Lack of explainability and regulatory challenges

Current regulations are designed for a world where human decision-making plays a central role. The opaque nature of GenAI models makes it difficult to establish clear accountability and compliance standards. Regulators need to develop frameworks that ensure responsible development, deployment, and use of GenAI in the financial sector.

The future of generative AI in Fintech

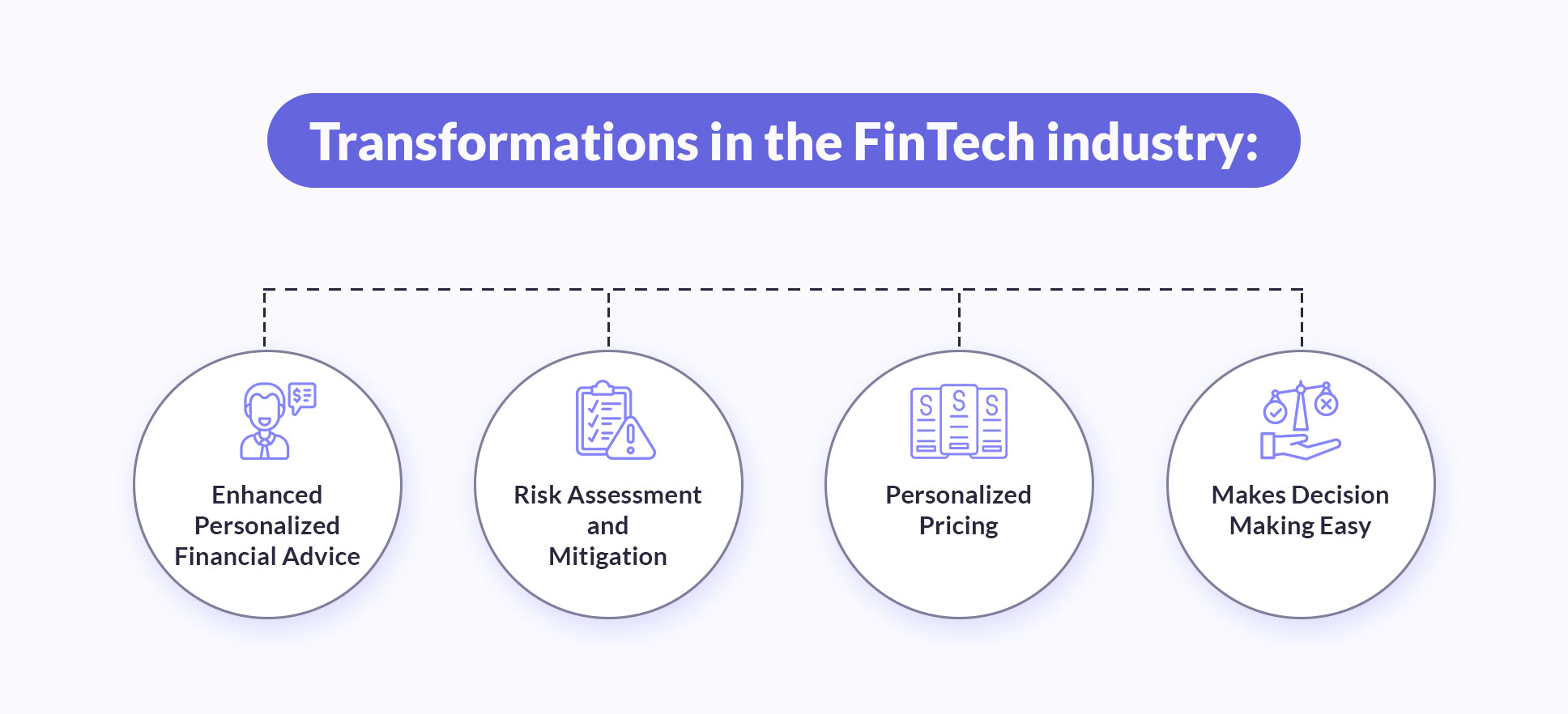

Generative AI applications are still scarce, but they will make numerous transformations in the financial industry. Let’s examine some enhancements of generative AI use cases in Fintech that you’ll see in upcoming years:

Enhanced personalized financial advice

Generative AI will change the definition of personalization by providing tailored suggestions to each customer. It will analyze individual financial conditions, such as expenses, salary, savings, and investments, and offer solutions per their needs and requirements.

Next, it will generate a wide range of personalized strategies for customers, which will further decrease the workload of financial services companies. It will be a great way to save time, ensure customer satisfaction, and enhance customer experience.

Risk assessment and mitigation

AI will continue to develop and identify potential risks with more accuracy. With its development and advancement in training datasets, it can detect fraud and notify you. Overall, AI will enhance security measures and decrease financial losses.

Personalized pricing

Currently, you have to pay high charges or standard prices for financial services and advice. But with AI, it can access your financial profile in real-time with the available requirements and information.

Additionally, financial bodies can provide embedded finance services, such as payment gateways, to other businesses to help them use personalized pricing.

Overall, AI will ensure fair financial services prices and make it more affordable to the masses.

Makes decision-making easy

By analyzing different patterns, risks, and market trends, generative AI will help you make decent and calculated financial decisions. It will help your business eliminate risk and fraud and enhance financial outcomes.

Wrap up

Now you know the top five ways generative AI and Fintech work together. From enhancing security to personalizing services, AI has the potential to transform the financial services industry for the better. You’ve only seen a few examples of what’s possible with this cutting-edge technology.

As this tech develops, we’ll witness additional uses in the Fintech sector. The companies that adapt to this tech will see growth soon. If you want to join this emerging tech, it’s the right time to jump on the bandwagon. Connect with the Geniusee, generative AI development company, that will help your Fintech business leverage the power of generative AI to improve your customer experiences.